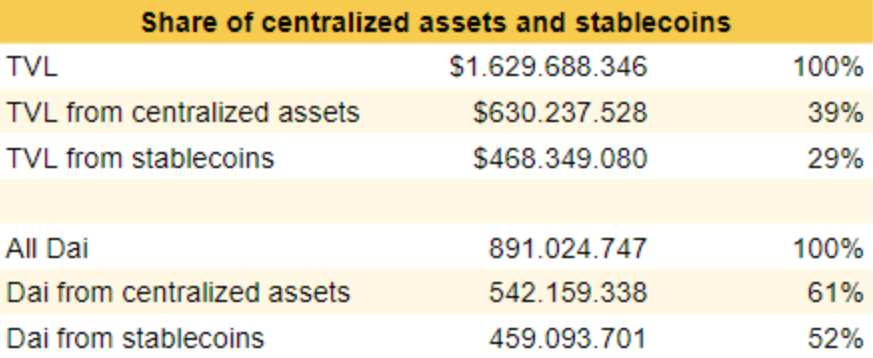

For the last days, Crypto Twitter has been abuzz with discussions about the state of Maker’s collateral.

Some users have pointed out that 40% of all collateral in Maker is now IOUs – meaning instead of digital commodities like ETH, which are no one’s liabilities – they rely on a central custodian’s compliance.

The assets in question, which have become more and more popular, are USDC ($387m), WBTC ($162m), TUSD ($50m), and PAX ($31m). These IOUs issued on Ethereum represent either a dollar in a US-based bank or a bitcoin in BitGo custody.

Snapshot: 25.09, 2020, 21:00 UTC

However, that figure understates the severity of the situation. While centralized collateral makes up 40% of collateral, not all collateral has the same collateral ratio. The ratio determines how much Dai borrowers can draw per $1 of collateral. While they need $150 of ETH or WBTC to generate 100 Dai, they need only $101 of stablecoins to generate the same 100 Dai.

As a result, 61% of all Dai is backed by these centralized assets, with 52% coming only from centralized stablecoins.

Snapshot: 25.09, 2020, 21:00 UTC

To get the obvious out of the way first: This development makes the backing of Dai partially dependent on the actions of centralized actors. For example, Circle could freeze all USDC in Maker (but not individual CDPs), in which case the system would print more MKR to cover the shortfall. In this article, we’ll explain why allowing stablecoins still makes sense and why it’s almost certainly temporary in nature.

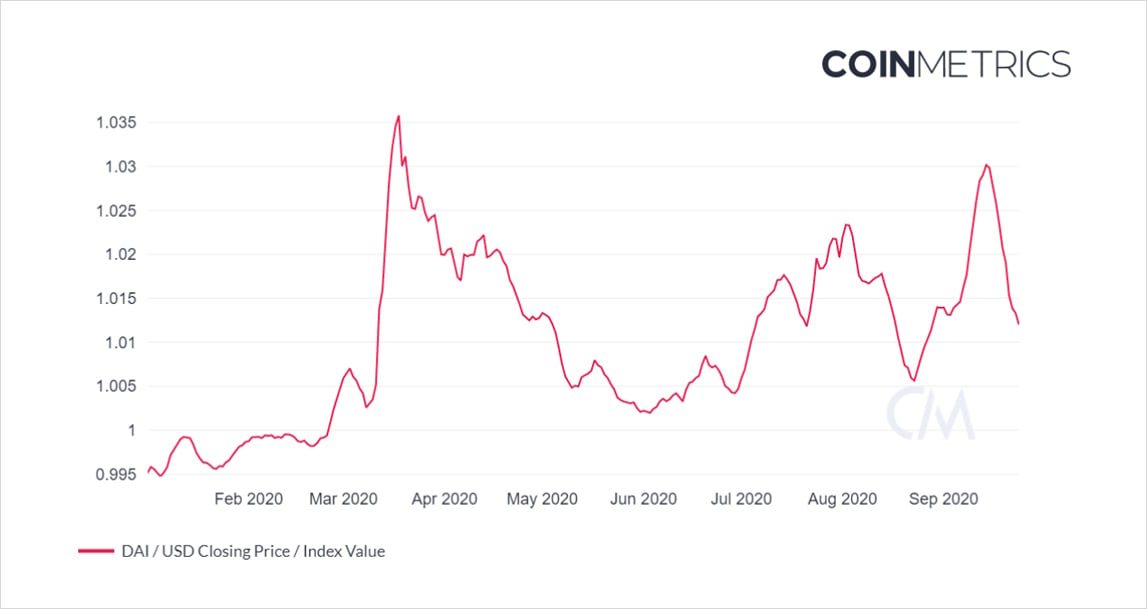

MakerDAO is a permissionless credit facility that allows users to generate DAI, a debt token, against various forms of collateral. It also manages this tokenized debt to be worth $1.00, a mission that has proven difficult for them over the last months.

Source: coinmetrics.io, 7-day moving average

Like any other asset, Dai’s price is the result of supply and demand. When it trades above $1.00, there is more demand to hold the token (go long Dai) than to create it from CDPs and sell it (go short Dai).

There are two reasons why demand has exploded: Dai’s use in yield farming and general demand for stable assets in a time of global uncertainty.

It is this persistent divergence from the peg that has forced Maker into a corner. From a high level, there are three mechanisms to stabilize a currency:

- Interest rate policy

- Open market operations

- Collateral policy

We analyzed all three options in greater detail in a previous article.

The gist is that Maker has reached its self-imposed limit in terms of interest rate policy (they are unwillig to go below zero rates, which would be the equivalent of longs paying shorts). They are also unwilling to perform any open market operations, presumably because of regulatory concerns.

So the only remaining tool in their toolkit is collateral policy. To increase the supply of Dai, Maker has to strike a balance between adding collateral that is safe for the system and that users want to borrow against. They are actively adding more trustless forms of collateral, but

there have been few high-quality collateral assets before the recent DeFi runup (LCR, COMP, and LINK will be added soon.)

So, in the absence of a faster due process and more trustless collateral types on Ethereum, the only way to meet Dai’s explosive demand has been to allow centralized assets, especially stablecoins, into the system.

Their addition creates a fantastic arbitrage opportunity for traders. For example, you can make 100,000 Dai from $101,000 of USDC – because the collateral ratio is 101%. if Dai trades at $1.02, you can sell the 100,000 Dai for $102,000 of USDC – an instant arbitrage cycle. (The lack of which was something Su and I had previously criticized in a 2019 article)

Not only did you make an instant $1,000 on your trade here, but you also retain the option to rebuy the $101,000 USDC in the CDP at a profit if Dai ever trades below $1.01. for example, when it trades at $1.00, you can buy back the $101,000 USDC for $100,000 Dai for another $1,000 profit(1).

There are three takeaways:

- This arbitrage singlehandedly explains the rise of stablecoins inside Maker.

- Dai can never go above $1.01 again as long as the collateral ratio on stablecoins is 101%. At any price higher than that, arbitrageurs would mint more Dai and sell it at an instant-profit, pushing the price back down.

- The stablecoins will naturally disappear from the system when Dai has returned to its peg.

The final point might need some unpacking. When Dai returns to $1.00, there is a double incentive for arbitrageurs to unwind their stablecoin positions. First, they still have a negative carry because of the stability fee charged on stablecoin vaults (currently 4%). Second, they should exercise their option to rebuy the collateral with the now cheaper Dai.

Dai can return to $1.00 either because the demand to hold it has decreased, and then supply would naturally follow. Remember that Dai is tokenized debt, created from CDPs. So when arbitrageurs unwind their positions, Dai is necessarily destroyed in the process. Alternatively, demand to mint Dai can increase, creating more natural supply to meet market demand.

For one, I have my eyes peeled on the upcoming release of the Yearn’s yETH v2 vault, which generates Dai from ETH collateral to farm CRV in Curve. If the v1 vault is any indication, this could create hundreds of millions of additional Dai, which – holding demand constant – should flush out many stablecoins from the system.

(1) Further, liquidations for regulated stablecoins are currently disabled. Their value of $1.00 is basically hardcoded into the oracle.

AUTHOR(S)