In this week’s edition of Option Flows, Tony Stewart is commenting on ETH Option flows dominating BTC.

May 10

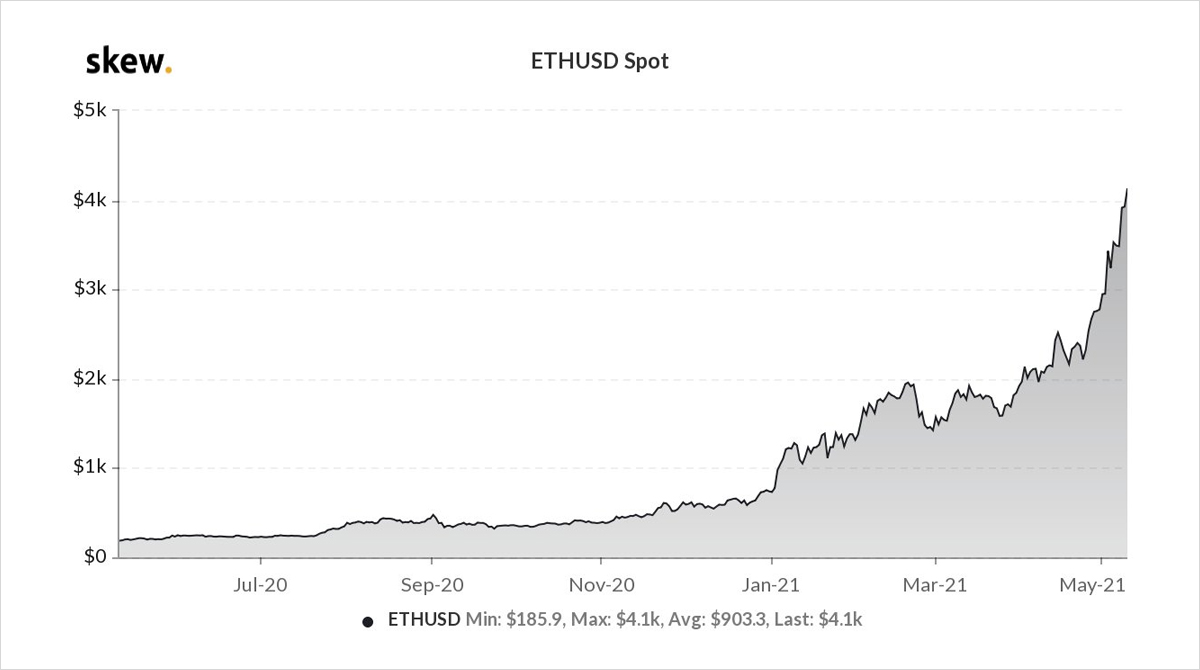

ETH Option flows now dominating BTC.

And not just Fast money.

Action across maturities, with Deribit listing the ETH Mar22 50k Call (really!), gaining immediate buy traction.

In general, Calls rolled up to keep/add exposure; decent 2-way Put action, but few reducing upside.

2) Stand-out ETH Option trades:

– Jun 8k Calls, buyer of 10k.

– Roll Sep 2240C x2500 to + Dec 5000C x 4300, ~flat premium, so increasing upside exposure.

– Roll Dec21+Mar22 25k Call to Mar22 50k Call, ratio to buy more 50k Calls x10k+, increasing upside exposure.

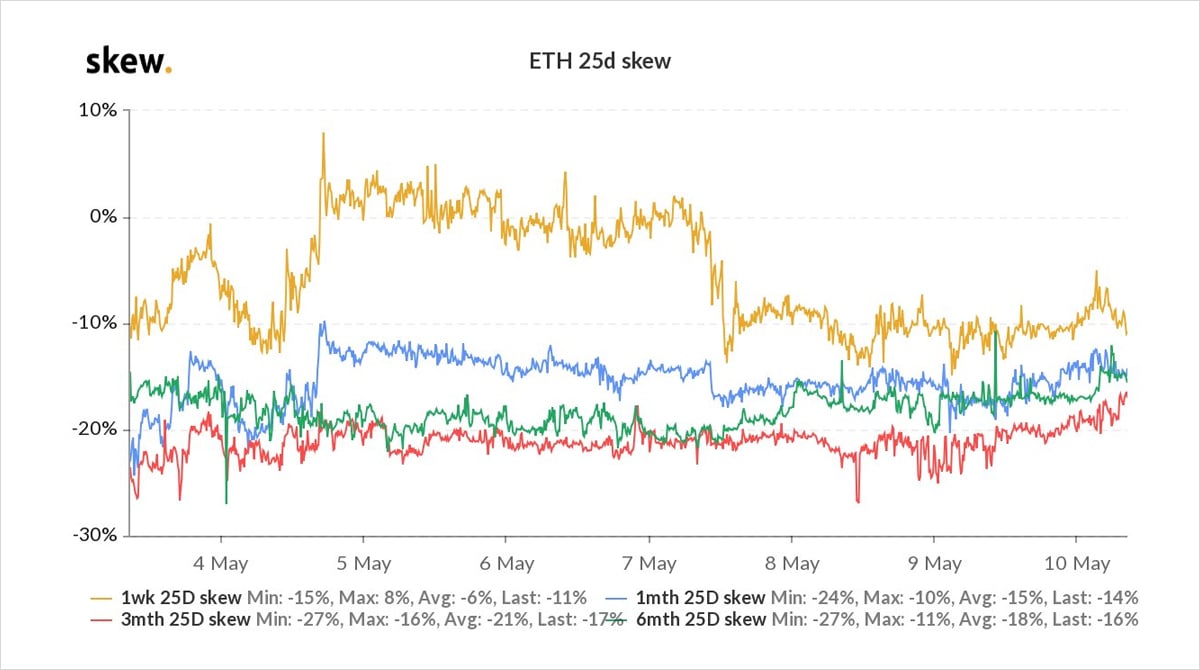

+ve Call Skew.

3) Regarding the Mar22 50k Calls, the motive is not as clear-cut as first impressions.

Volume 12k, was majority bought by what appears to be a roll from Dec+Mar 25k strikes.

Simplistically, this might just be a bullish spot play.

But also could be a technical Option greek play.

4) Interestingly there was a quote for 5k more of the Mar22 50k Calls (as an individual trade) that was not executed. Sometimes this is genuine interest, sometimes a muscle flex.

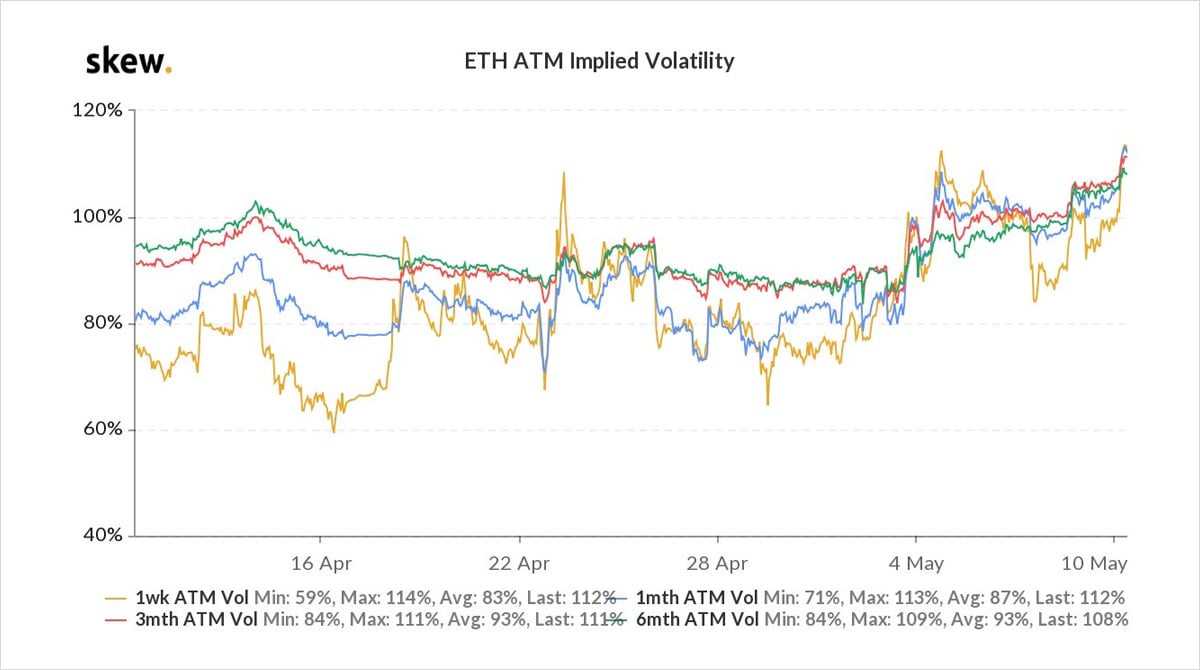

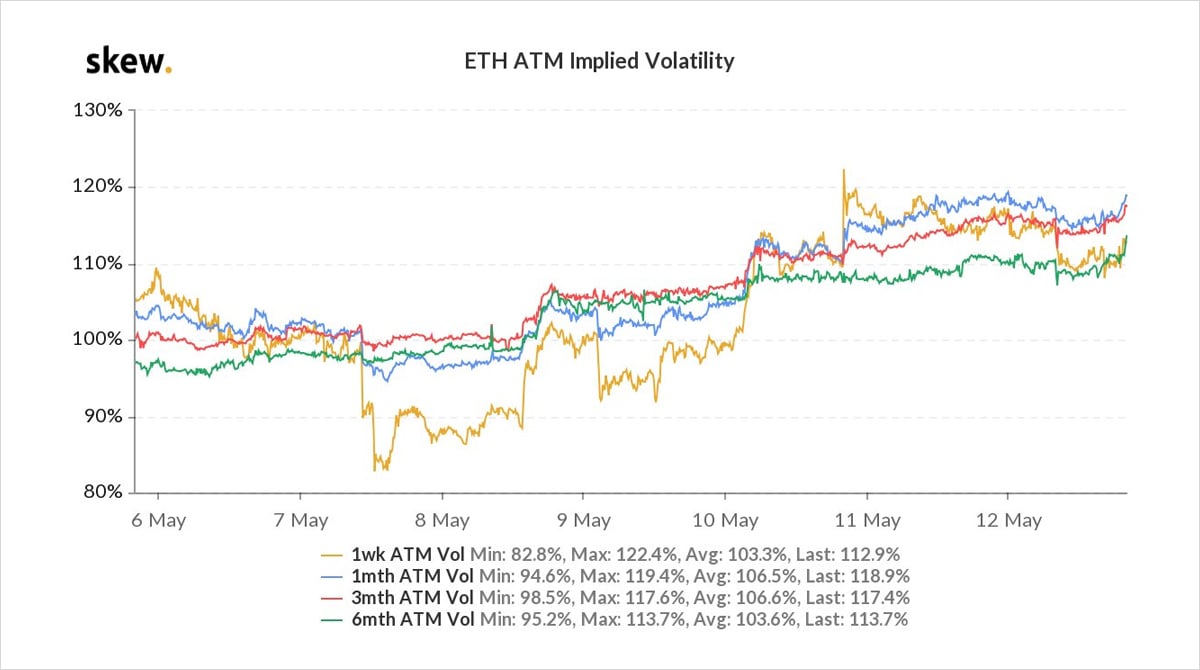

Impact of buying has been to maintain +ve Call Skew and increase Implied Vols, supported by RV>100%.

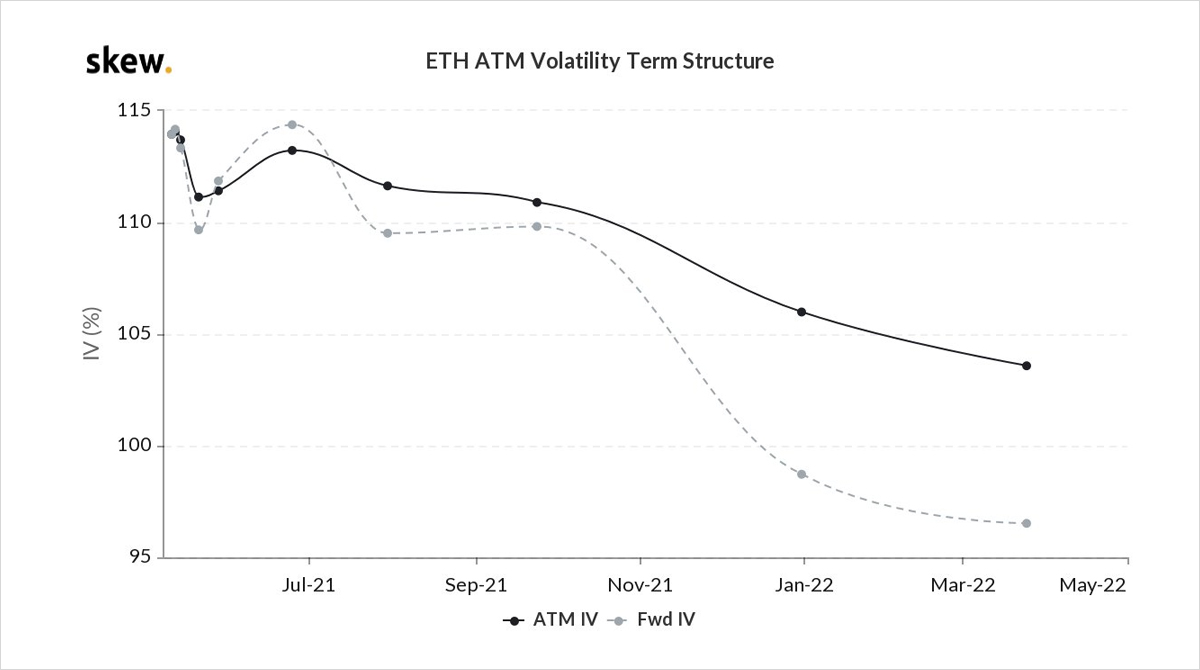

5) ETH term structure is in backwardation.

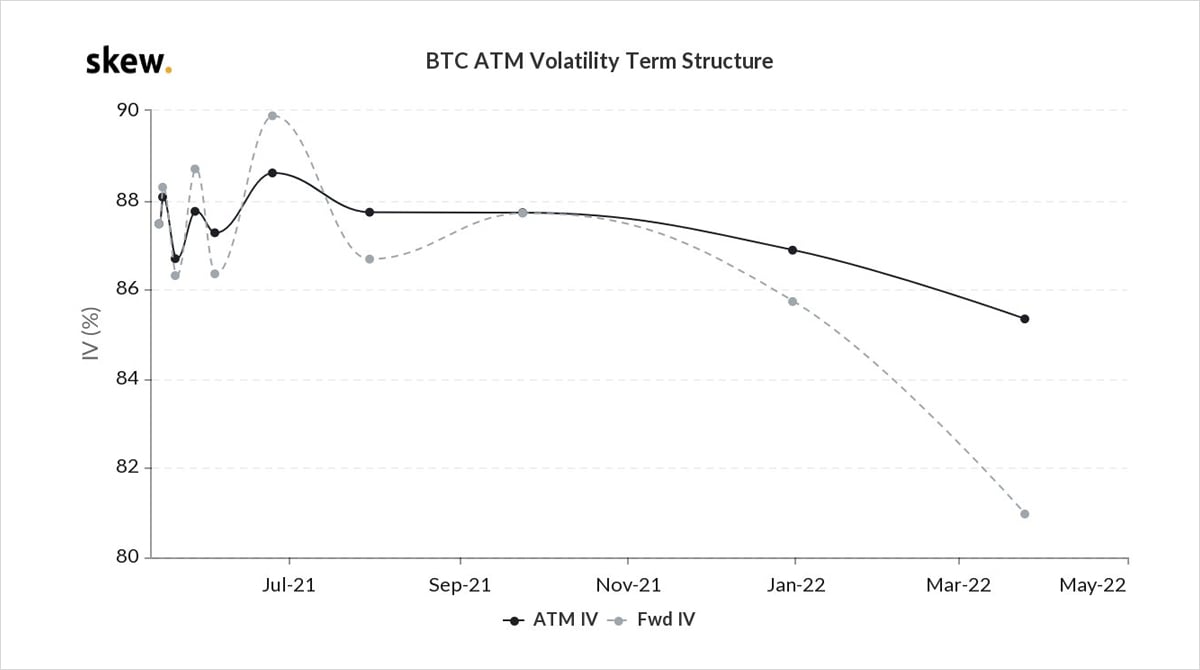

BTC term structure is in contango.

We would expect this from relative RV movement.

But BTC IV is nudging higher in sympathy with ETH, on low volumes.

Either expectation is of BTC move, or perhaps a shift of MM collateral to the action.

6) Resulting underperformance in legacy-style trades due to drop in correlation, failure of cross-product mean reversion trades and ETH Call yield structures:

ETH Call selling locked in >$, but ETH loss.

BTC/ETH IV mean reversion fail.

Defi/ETH spot +hedging fail.

Trend friend.

View Twitter thread.

May 12

So far Option’s market reaction to Vitalik charity transaction is orderly; almost business as normal.

Prior to the event, ETH Option flows balanced.

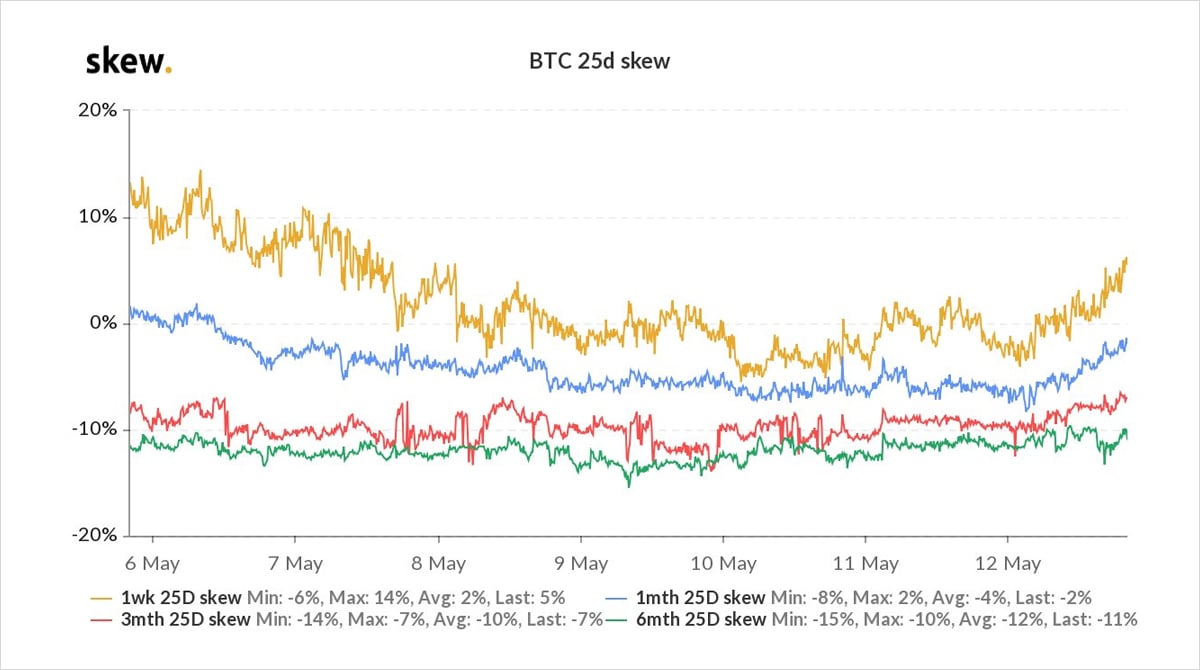

BTC small bearish as May50k Put moved to longer maturities, and noted buyer of 2day 52k Put.

ETH holding >4k now, Call buyers.

2) In ETH, buyer Dec1040p x8k, some near-dated hedging structures, but also further dated bullish Call ratios + Call rolls ups, which have continued post-event eg Sep2880C to Dec 6000C x2k, Mar 8k x2k, 10k x1, buyers, longer-term narrative considered in place.

IV chasing 135% RV.

3)

In BTC, movement of May 50k Puts to longer-dated Sep+Dec, plus a 2day 52k Put buyer x500+ outweighed buying interest in May 60k Calls.

Put Skew slightly firming on the back of this, but Implied Vol in line with Realized and Term-structure not panicky.

Still pricing rotation.

View Twitter thread.

May 15

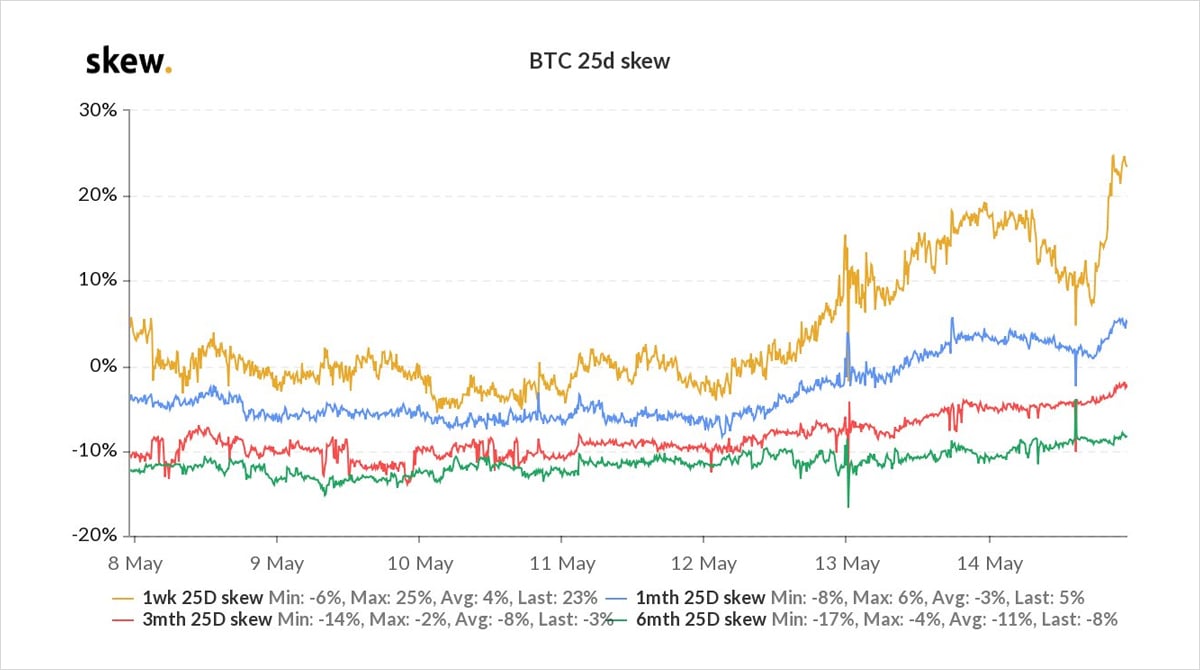

Abnormal size buying of BTC 1-2 week 45+46k Puts dominated near the US close.

~$250mn notional (~5k options) bought.

Initially, May21 46k Puts 1k blocks, smaller May28 45k Puts, then returning for more, found MM unwilling, so buyer forced to lift May21 45k Put size on screen.

2) When the buyer was forced to complete size in full view, IV and Put Skew surged, as sellers were unsure on full order total.

As the buyer did not want to exchange futures with the Put purchase, he is likely either protecting an existing position or speculating on BTC to fall.

3) Of note, there was no such activity on ETH options, despite recent significant engagement. This bearish BTC flow further confirmed the separate narratives in play. The BTC term-structure, recently in contango, levelled out.

Expect shorts to pressure IV over weekend, cet-par.

View Twitter thread.

AUTHOR(S)