In this week’s edition of Option Flows, Tony Stewart is commenting on a huge Option unwind liquidation event.

May 17

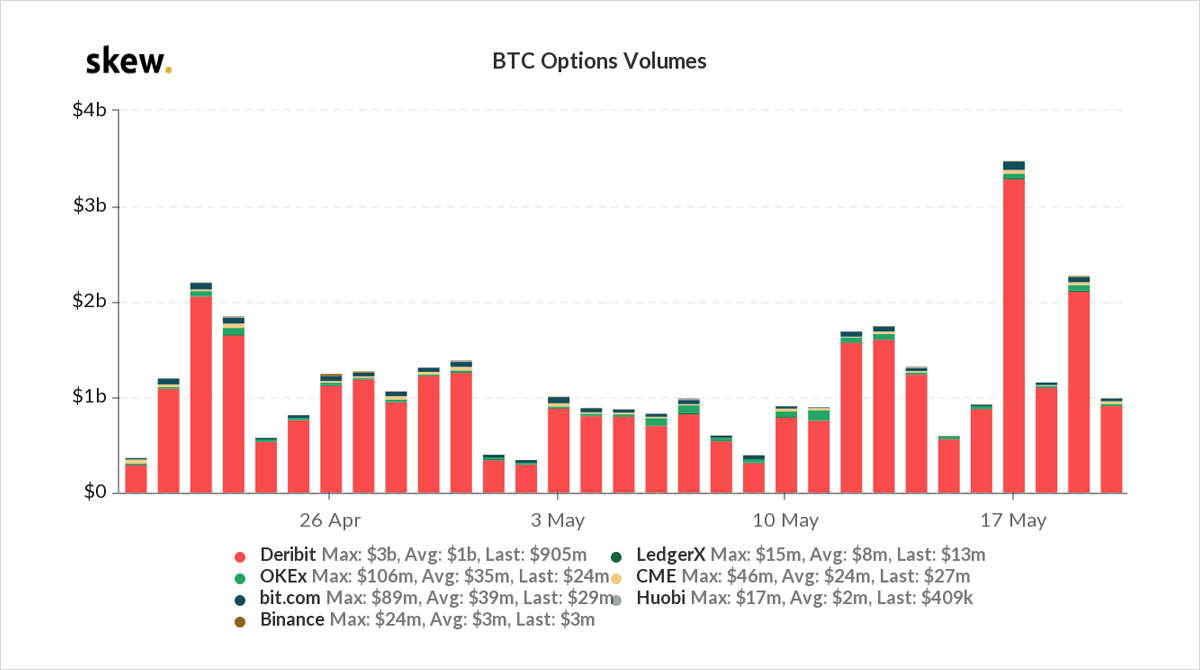

What appears to be a huge Option unwind liquidation event created disorder on illiquid + strained BTC Option markets.

Not directly linked to Friday’s Put buyer, but indirectly additive short gamma from 45-46k area + 40k area compounded lower spot BTC, forcing a nasty unwind.

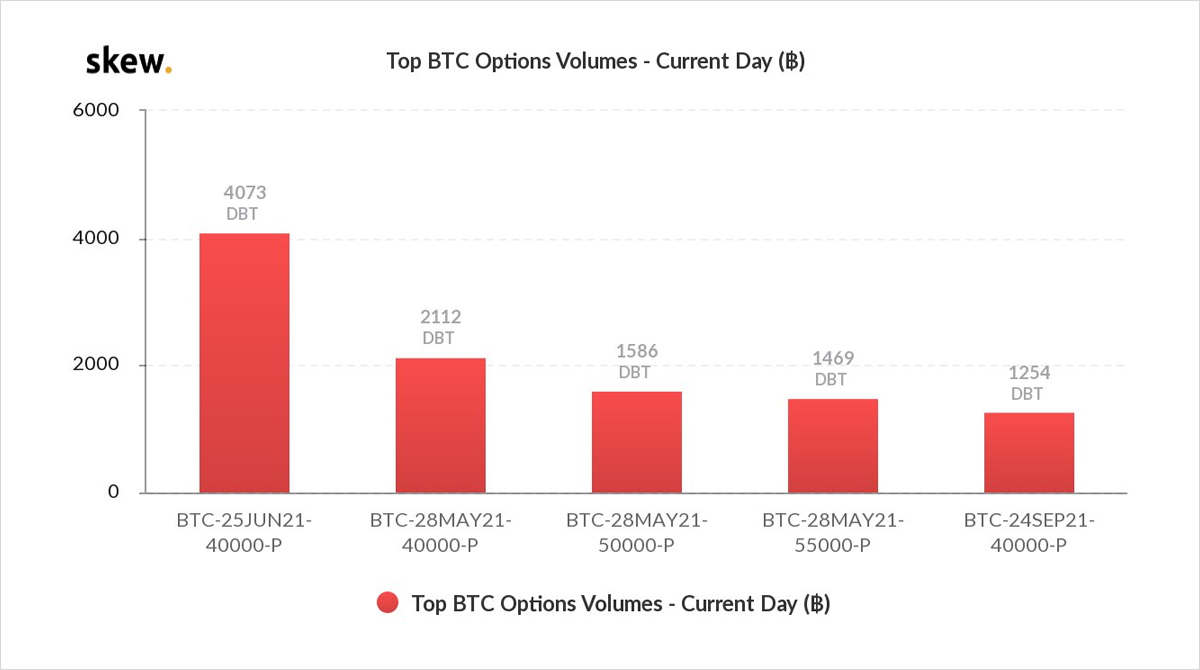

2) Observable data shows a combination of May+Dec ITM and May-Sep 40k OTM Puts were unwound, predominately short-covered.

In addition, Perp-May28 + basis-plays unwound at deep discounts.

BTC spot not materially impacted, but Elon/Tesla BTC clarification may have curtailed fall.

3) Most executed on screens in very small bot-like clips, but that execution had a massive impact during illiquid Sunday/Monday Asian/Eur hours.

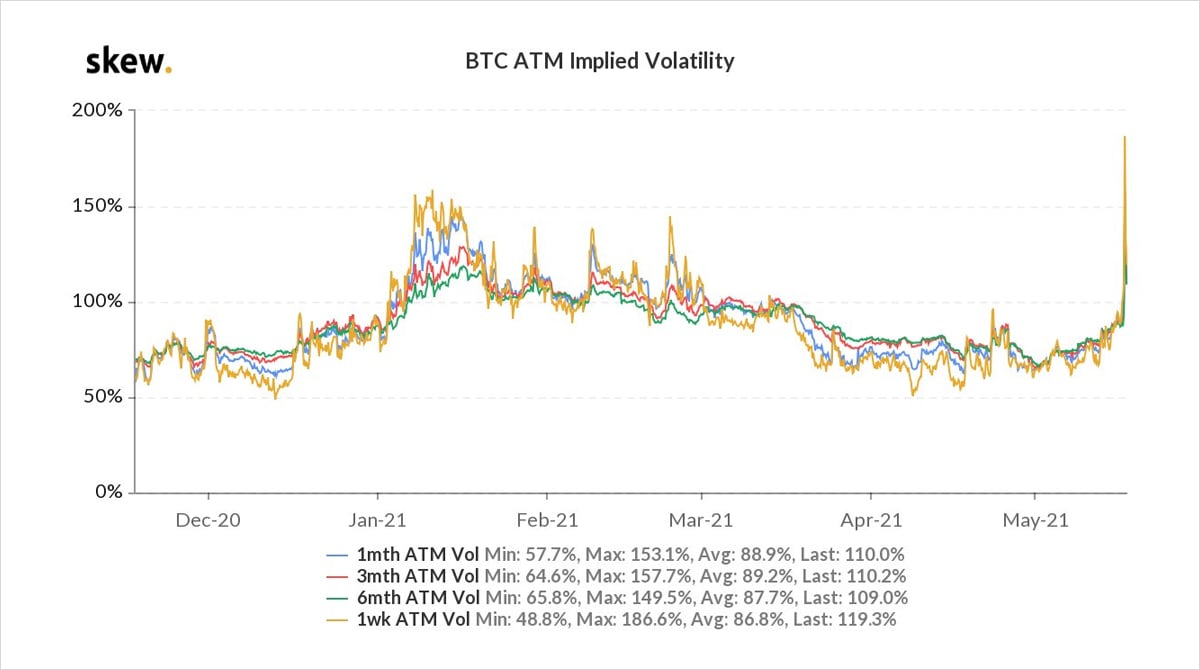

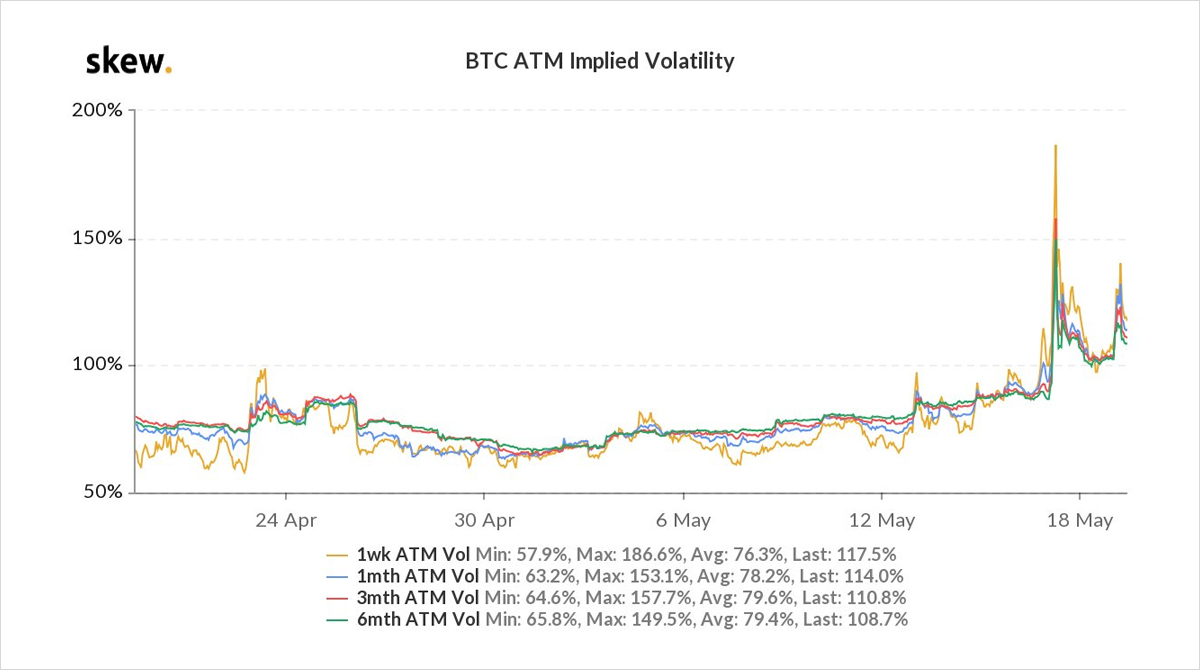

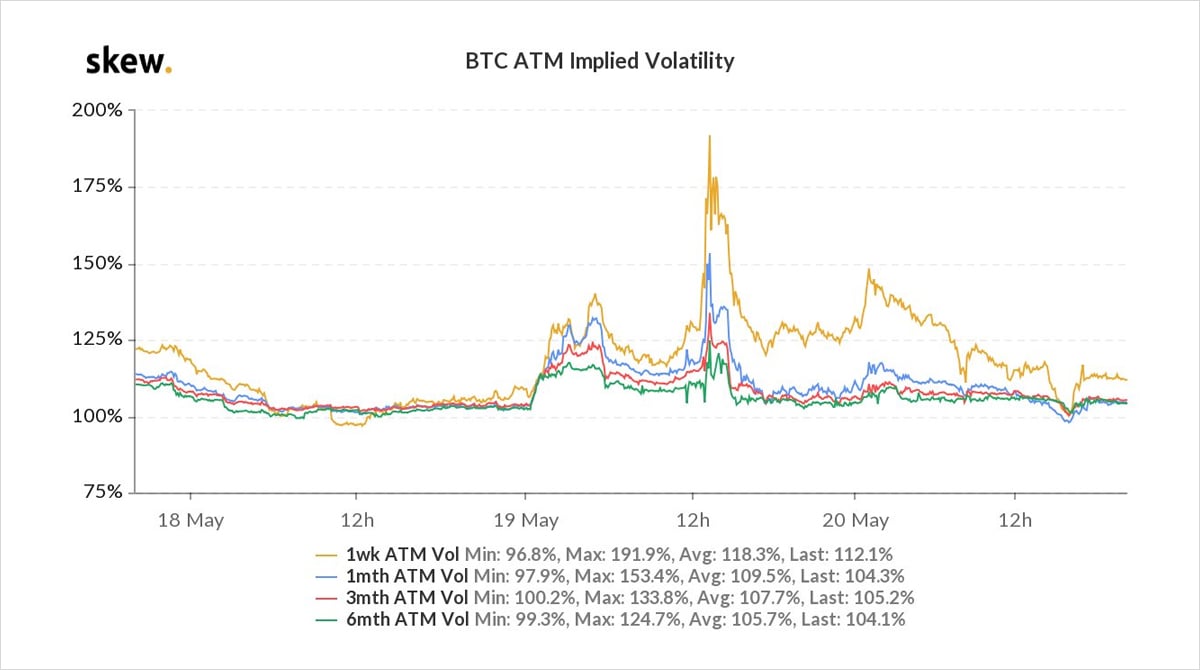

Implied Vol exploded from 100%-200% briefly, before retracing.

MMs offset.

Hot potato risk is still there, but better managed now.

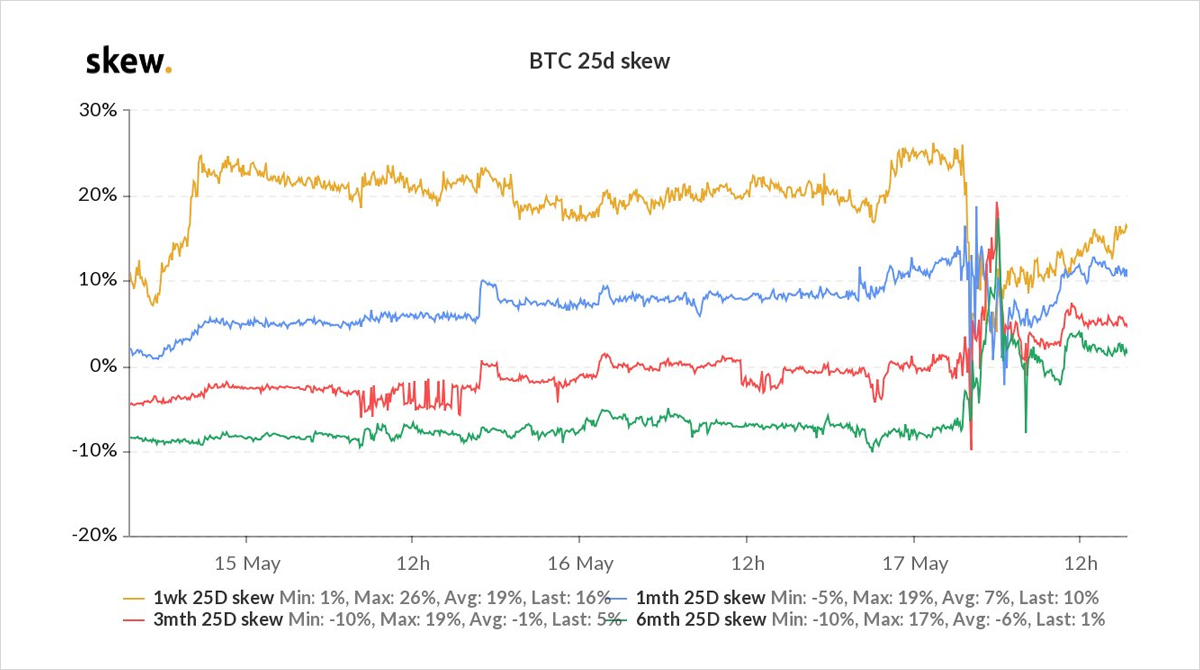

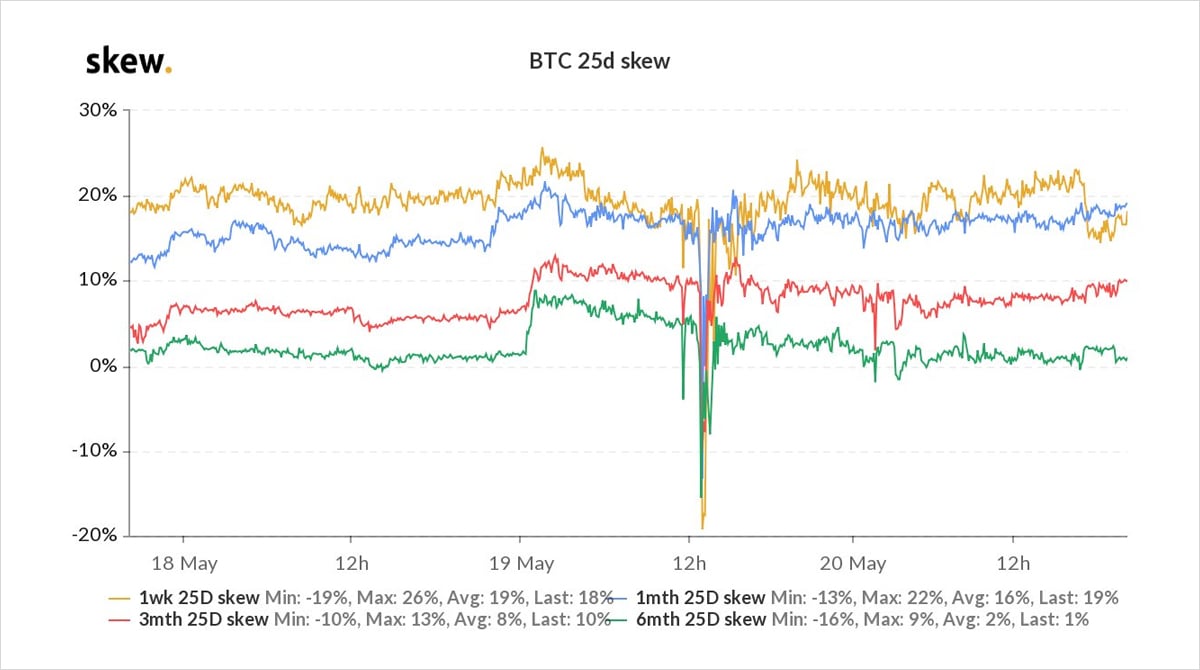

4) After an almost seismic event on Skew and Implied Vol graphs, Skew is stable, with yield players looking to sell upside (Jun 56k Calls x1k), and downside Puts 2-way action with yield+vol sellers battling buyers of protection.

Friday’s 21May 45+46k Puts still Open + active.

View Twitter thread.

May 19

As 43k was tested, a buyer of Jun28k Puts x600 financed by Jun48k Calls led a bearish move lower, reinforced by continued selling of Jun+Jul 60k+ Calls+spreads.

On approach to 40k, observed a buyer of Jun 50k Calls x1k, countering the flow.

Eerily quiet on dip <40k in Europe.

2) Blew through the May 45+46k Puts, % closed, % restructured + hedged, so gamma impact at 40k low.

But now the 40k strike kicks in, big OI; Deribit saw a forced short cover closure Monday of 2-3k, split around MMs, so IV unsurprisingly bid, compounded by increased 10d RV>105%

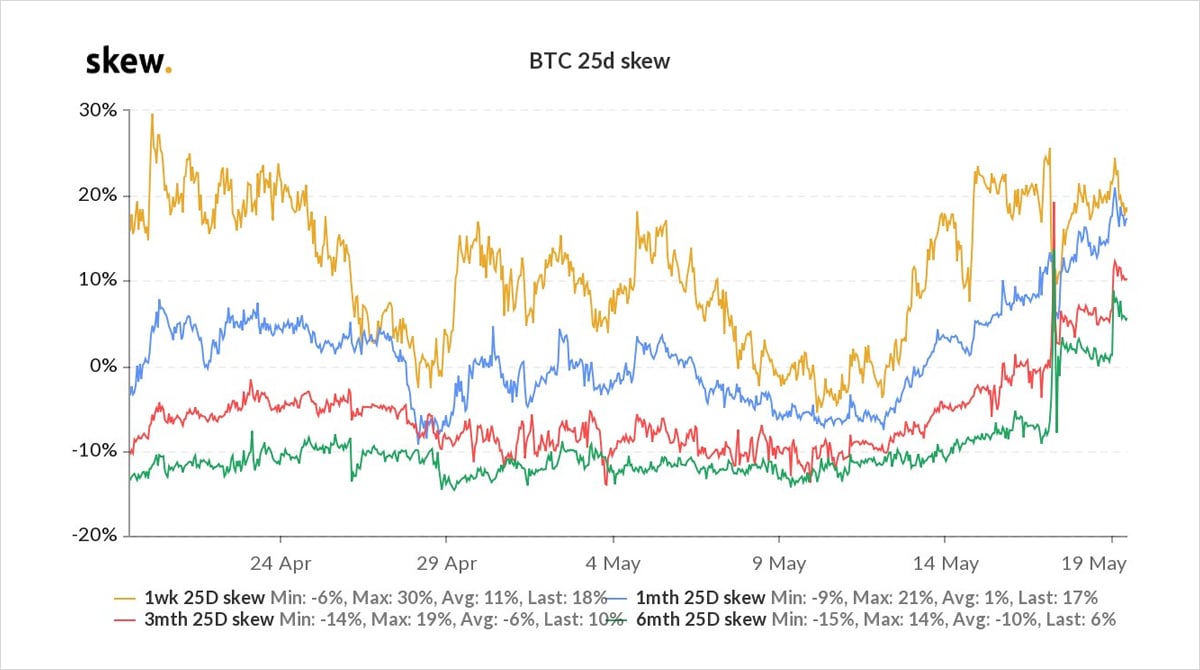

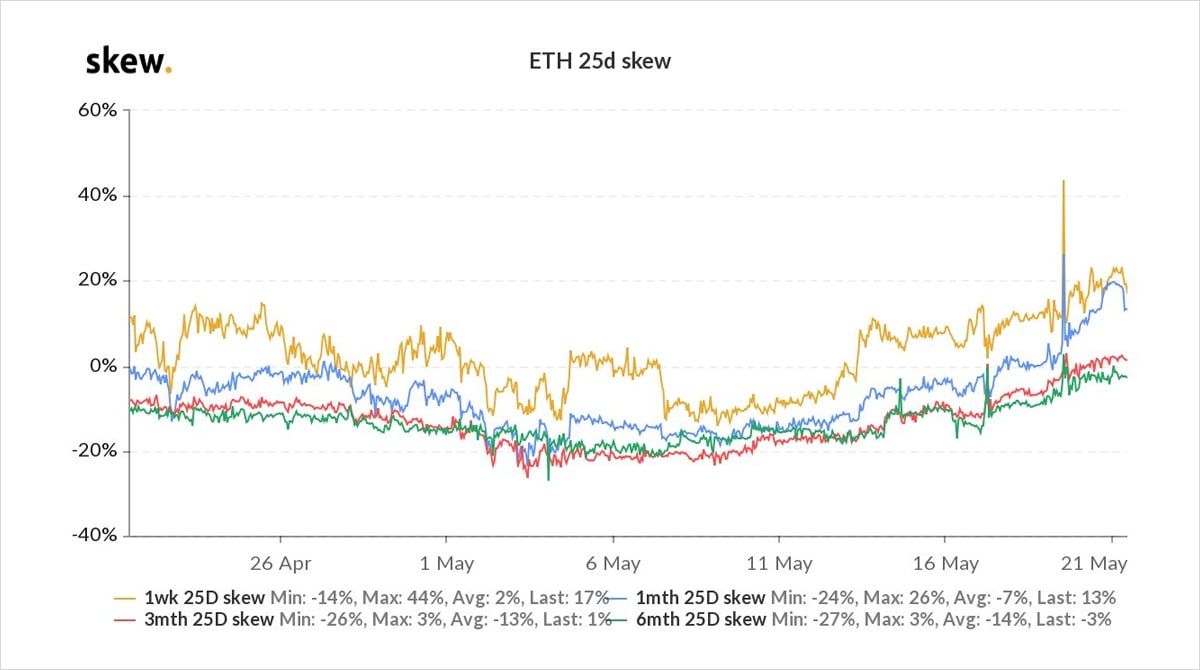

3)Skew is the critical metric to observe.

Normal to see near-dated Put skew elevated with fear, hedges + speculation in the market, but rare to see longer-dated +ve Put skew.

This represents current sentiment across different investor classes.

View Twitter thread.

May 20

This thread focuses on the BTC vol market, following 19/5 carnage.

Today has been much calmer, with ~average volume, and flow indicating a protective bias.

The next thread will focus on ETH, where significant Option activity is ongoing, after massive volatility and closures.

2) Granular Option trade forensics almost irrelevant to the big picture overview in disordered fast markets, where trades are executed out of necessity rather than indicating directional bias, and where Implied valuations are like an old road map that aids, but can still confuse.

3) The above 3day chart shows the Implied Vol spike as BTC plunged to 30k.

Put Option Shorts always first to the market, to cover out of fear or necessity.

High delta ITM & ATM Puts were closed, the hedge exacerbating the fall.

Long Option players then lock in profit; hitting IV.

4) Aside Long Puts taking profit on yesterday’s rally, observed greater flow to sell Calls, in particular 48-70k strikes, high IV, probably to yield vs long spot.

Initiating Call buyers were not materially obvious.

So both wings were hit and Skew remained elevated but flat.

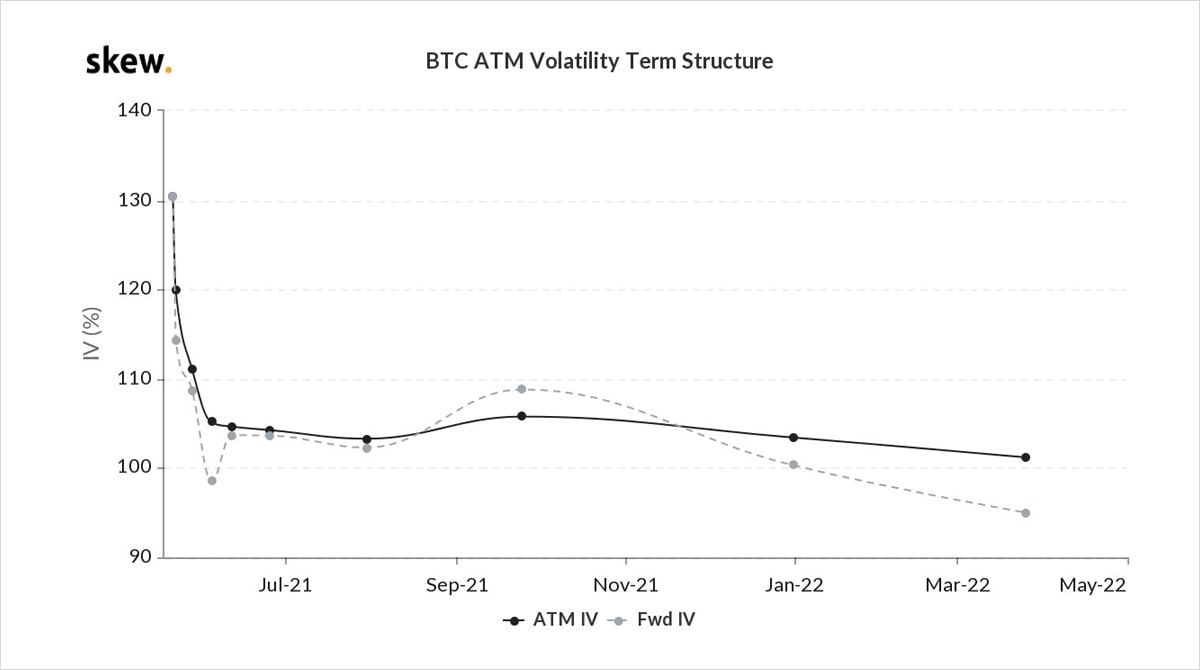

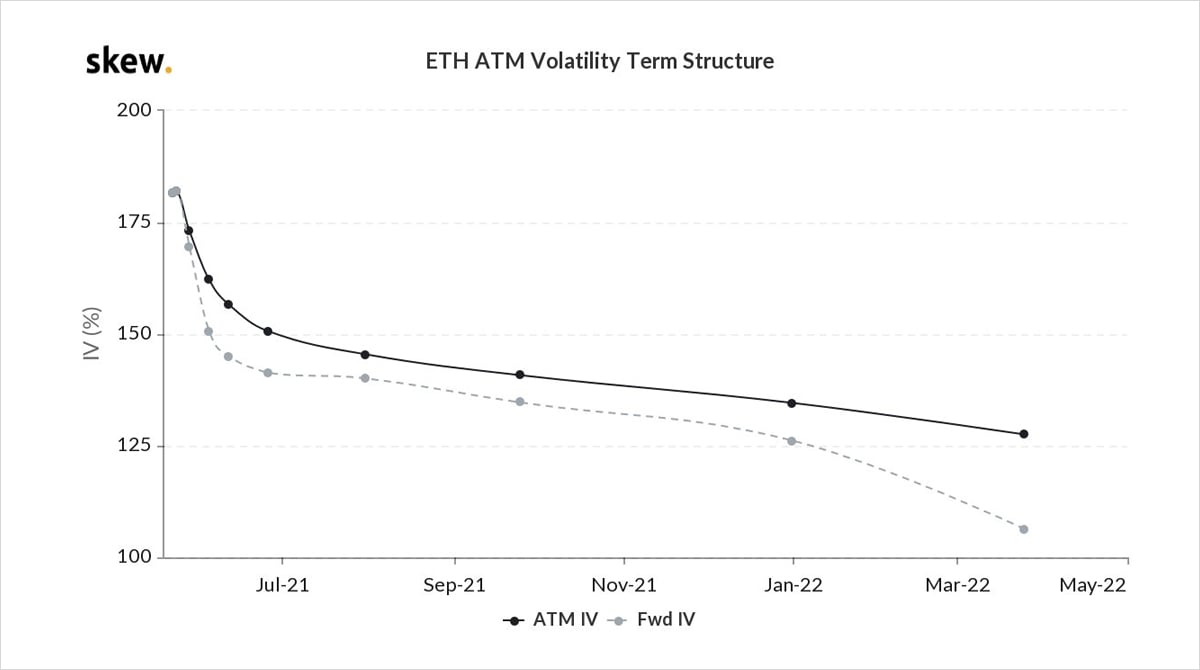

5) Term-structure above shows live (21:00 UTC) IV across maturities.

IV >100% and near-term backwardation due to elevated concern/expectation of imminent movement.

Flow protective today; buyers of Puts, particularly <36k, speculation/risk mitigation/hedge/fear, often Call funded.

View Twitter thread.

May 21

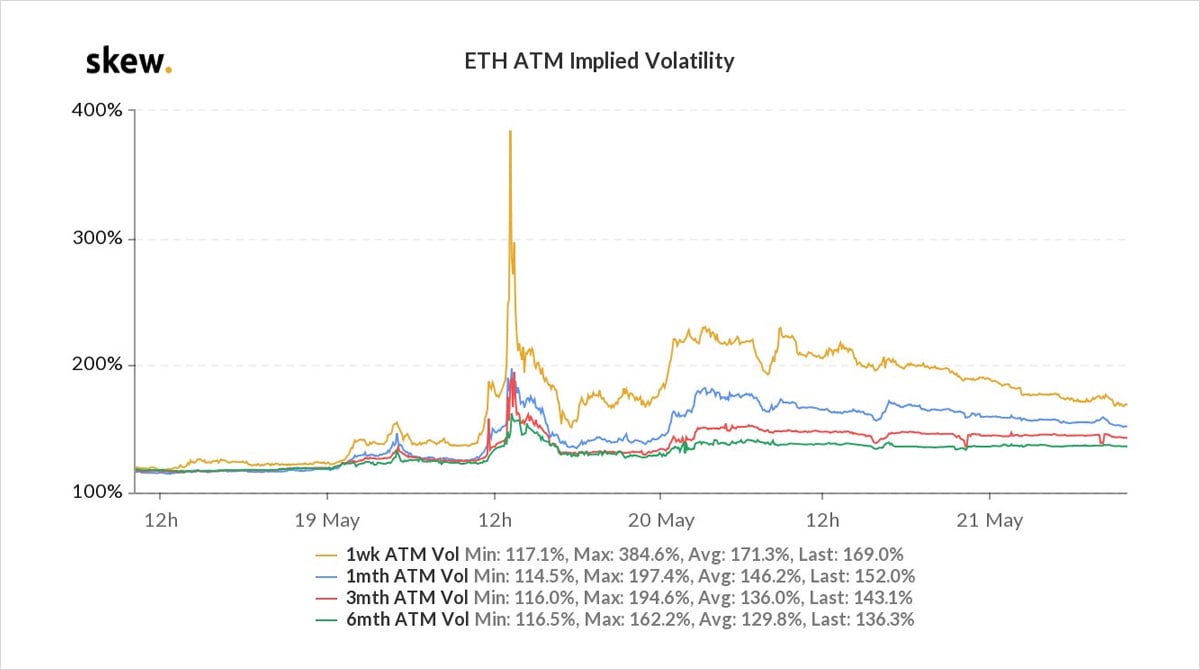

48hours in ETH Options:

19/5 Short gamma+vega positions forced closed in explosive spot volatility. Fast market pricing surged Implied vol >350%; Realized way higher.

But on 20/5 while BTC Options were calm, ETH Option flows saw large Straddle buyers pre-empting a big move.

2) Initially, Short Options covered, MM widened prices in line with RV+risk; Longs took profits.

Can see this in the IV spike, then retrace.

But, then buyer(s) of May+Jun near-ATM Straddles lifted IV >200%, where it stabilized before drifting on small volumes post expiry today.

3) Straddle buyers simplistically expect underlying movement, not defining direction.

This could be a short cover from selling IV>300% on 19/5, (it’s unlikely a short cover from pre-19/5 as risk mitigation probably would have hit earlier) and could also be a new gamma/vol buyer.

4) Put Skew has also continued to firm, with even long-maturities edging into +ve Put territory, and near dated +20%, inferring continued hedging/concern/speculation on the downside.

Funding and Skew both illustrate (in BTC+ETH) protecting dip gains or representing spot retrace.

View Twitter thread.

AUTHOR(S)