In this week’s edition of Option Flows, Tony Stewart is commenting on fast money on the BTC market – Panicked on shorts, closed risk and profit taking.

June 23

As BTC <30k, fast money did what fast money does – focussed on large Jun25 expiry – panicked on shorts, closed risk, took profits.

But the real story was generated by Fund Call buying near spot support, Jul 32-40k, Aug 45-50k, Sep50-56k, in addition to large delta1 purchases.

2) With so much cash on the sidelines, the break <30k BTC and <1.8k ETH, while forcing liquidations to some, did not spark cascading stops as many anticipated.

Large funds took this opportunity to employ capital, leverage purchase fair priced Calls; some brave souls sold Puts.

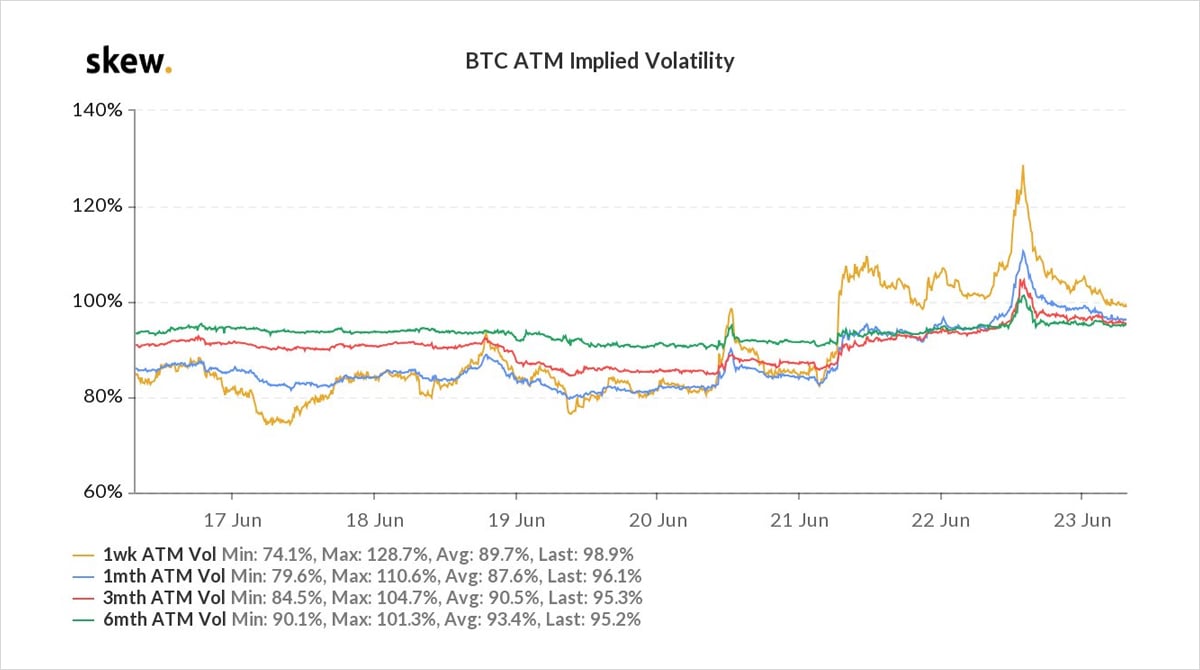

3) With spot breaching comfort zone support, Option short-cover + Call buying demand, Implied vol pushed higher, but was orderly.

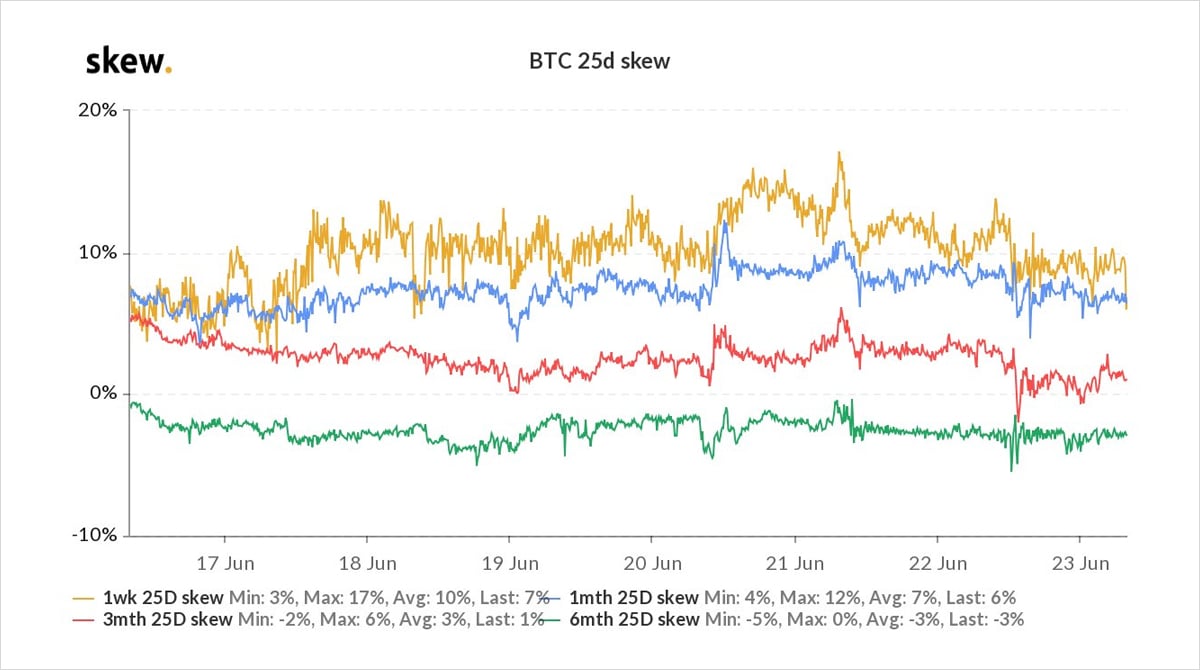

Market positioning- elevated Put Skew, -ve funding anticipated a test, but also responsible for the massive spot short squeeze.

IV matches 100%+ RV.

4) Some speculation that a large Dec-Mar restructure (selling existing Dec64k Calls x1.2k rolling to Mar 70k x800, premium flat) executed at the same time as Aug+Sep Calls bought, could be linked to maintain notional exposure, but either way long-term upside plan remains in play.

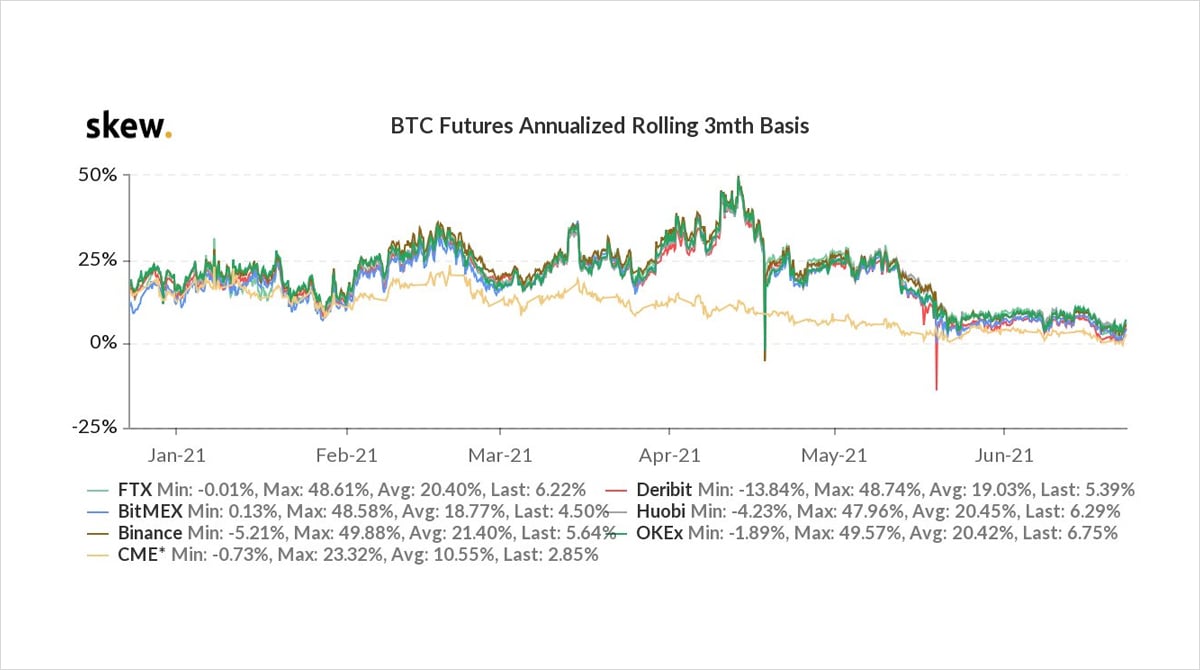

5) Not only did July-Sep Call purchases (and Jul-Dec Put sales) gain upside notional exposure, they also gained forward exposure, from a flat/-ve basis entry.

This accelerates value on upside spot and offsets some potential vol and theta decay for the Calls.

6) Note that Put Skew did not pump as in previous ‘corrections’. The market positioning actually gave opportunities to sell Puts and buy Calls in an optically efficient manner.

But not surprisingly +ve Put Skew still intact for near-dated Options, but weakening medium-long-term.

View Twitter thread.

AUTHOR(S)