In this week’s edition of Option Flows, Tony Stewart is commenting on continuation from the last report downside pressure, Sep 18k Puts, and ETH Merge trading.

September 7

Continuation from last report of downside pressure.

Sep 18k Puts bearing fruit.

Dec 10-15k Puts, now Sep+Oct+Nov 10-15k Puts bot x1k.

ETH Merge trades on sideline.

IV, already priced high cf to RV, only briefly spiked as BTC stopped dancing around 20k, falling, dragging ETH.

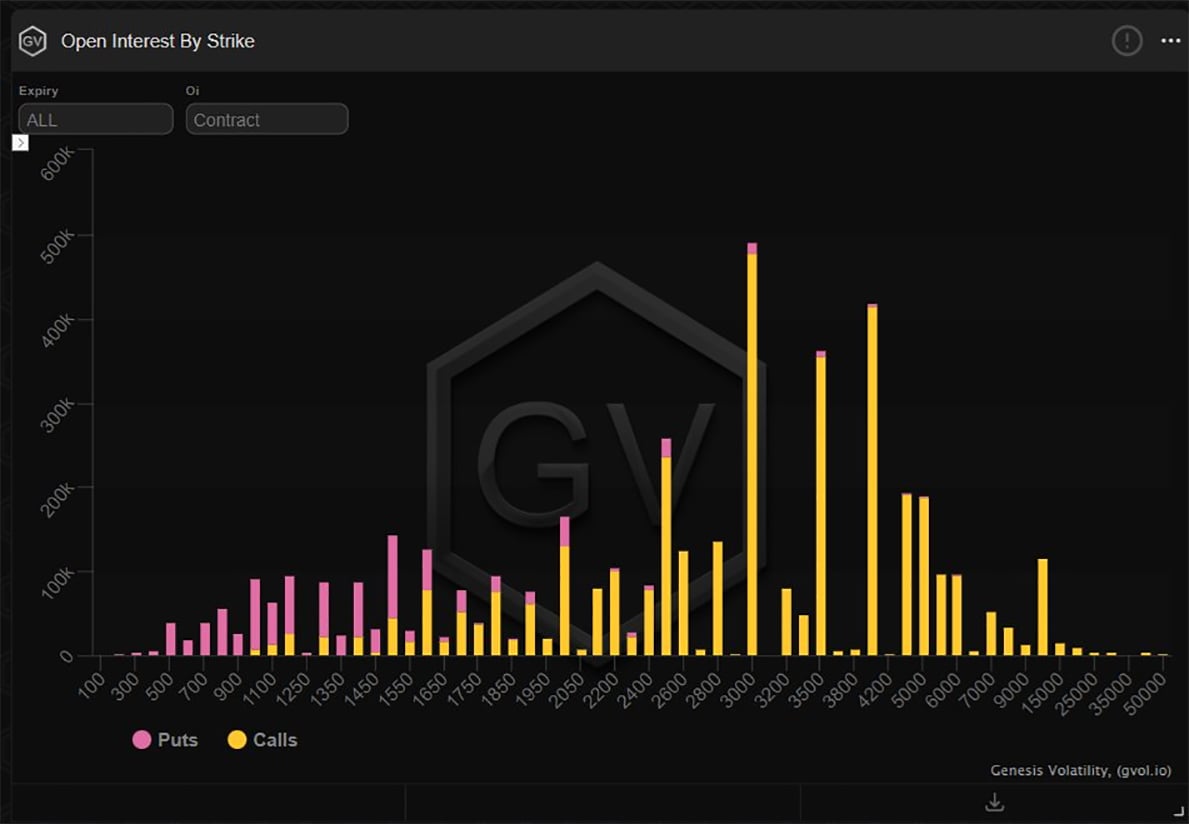

2) BTC Sep15k, Oct14k, and Nov10k the larger of the prints that totaled>1k, which given the market fall and current macro anxiety is not overwhelming at all.

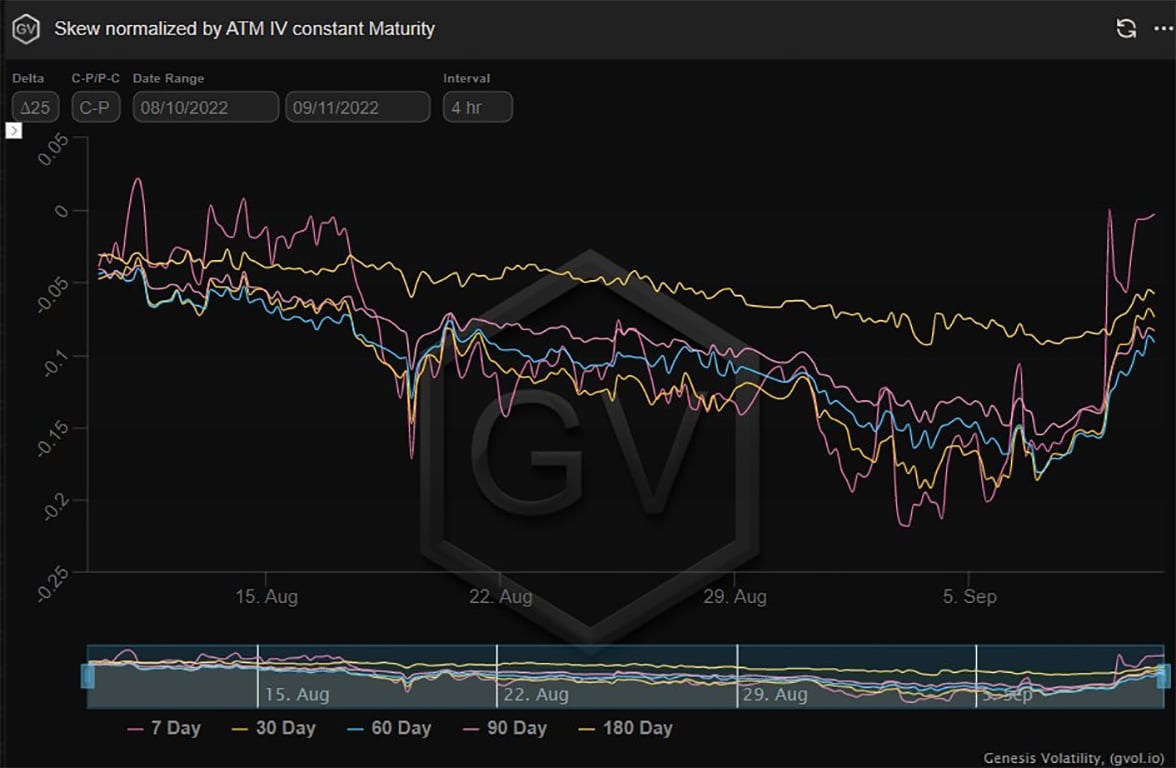

Put Skew continuing to squeeze higher, but contained.

Only limited Put buying on ETH suggesting Funds positioned as reqd.

3) IV spiked at the Gamma near-dates, but also only a quite reserved 2-3% 1-month and longer.

In fact, during early European hours, that near-end spike has been curtailed and reverting with concern that Spot could sit around as it did at 20k/1.6-1.65k and decay away premiums.

4) With Merge now <8days, and ETH 1.5k, there is less activity than many might have hoped for.

Yes, as stated in the last report, the large Call Flys +Call spreads still exist, but simple naked Calls that would signal real conviction are not outsized.

Is it just because IV>100%?

View Twitter thread.

September 10

Merge narrative = crowded positions:

Long ETH/BTC, Long SpotETH/ShortETHFuture, Long ETH vol, short BTC.

These can rupture.

With BTC dismissed, a buyer during Asian hours squeezed shorts >20.5k.

During OpEx aggressive Sep 23k Call buyers assisted.

Then Sep24k, Jun40k+ Calls.

2) BTC Option flows dominated ETH as shorts fell victim to a cruel Asian hours D1 buyer.

Not only that, but Friday OpEx Flow front-runners shorting Gamma into DOVs+Expiry sales+Weekend had to hope for a Spot retrace from 20.5k, but it didn’t come.

The opposite.

Ripple in time:

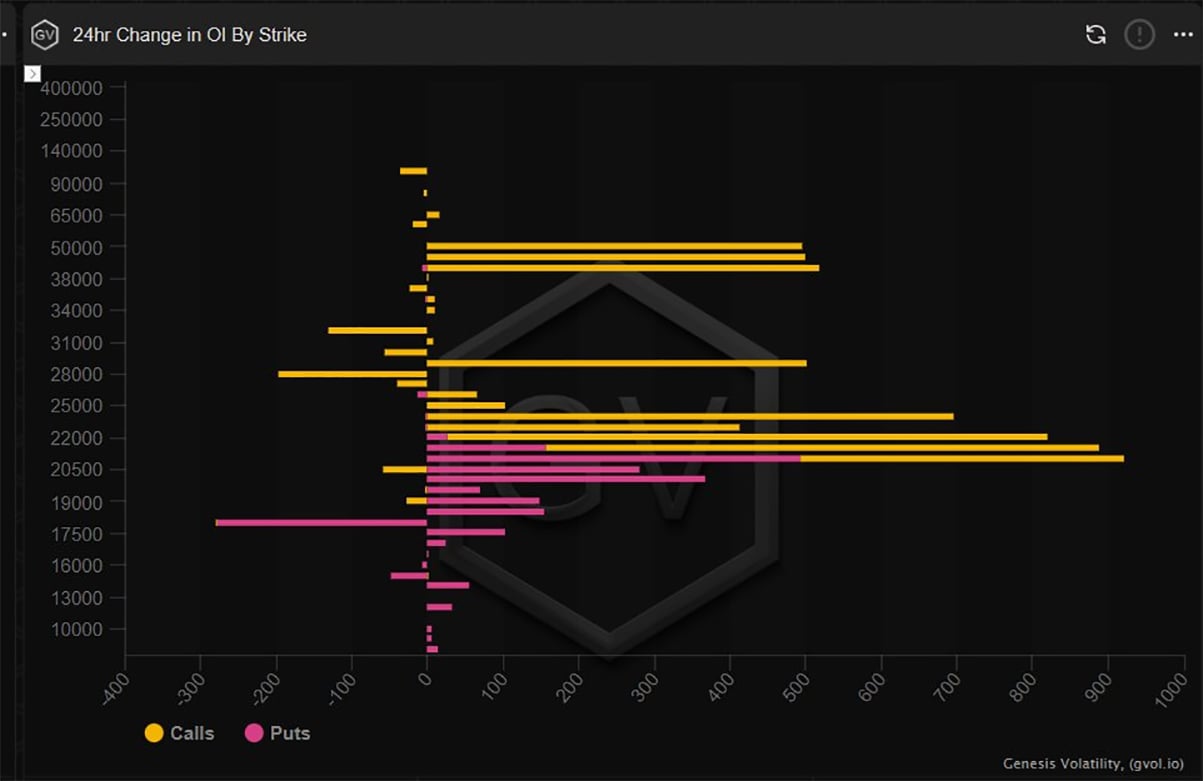

3) First, an aggressive buyer on Blocks + Deribit screen Order Book lifted offers in Sep16+Sep23k 23k focussed Calls 2k+ driving near-IV up ~10%, many MMs being run-over at the lower levels.

Then as Spot steadied at 20.6-20.9k, the natural Friday selling flows drifted IVs lower.

4) As BTC Spot showed no sign of retracing and Risk assets were strong, D1 shorts and Gamma were forced to cover Delta adding to D1 liqs.

A large Buyer Sep30 24k Calls bot >1k, using upside Oct 28-30k Calls to fund the purchase.

3 clips x500 Jun40k+ Calls bot finished the day.

5) With so much emphasis on BTC downside hedging+bearish plays, the Short-dated Call Skew broke back to flat in sharp measure due to the Call buying.

But the 1m BTC/ETH Dvol measure at the end of the day held ~38vols, suggesting Options players considered the BTC move isolated.

View Twitter thread.

AUTHOR(S)