One of the first things you will be greeted with when you start using an options platform, is an option chain. An option chain is a list of all available option contracts for a particular asset, grouped by expiry date. It will list both puts and calls, and all available strike prices for the given expiration.

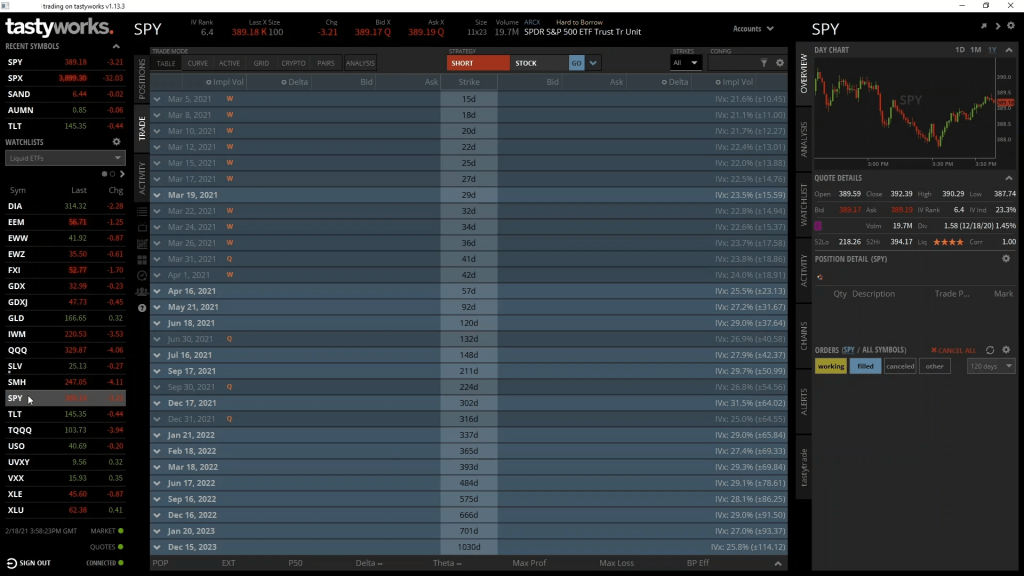

Tastyworks option chain

First let’s take a look at an option chain in the tastyworks desktop software. Tastyworks offer one of the most user friendly option interfaces I’ve seen, so it’s a great place to learn how an option chain is structured.

Let’s take a look at SPY, which is an ETF that tracks the US stock market, or the S&P 500 portion of the US stock market to be more precise. This is a very popular and liquid option market with many different expiry dates available.

To select SPY, we can type it into the search bar in the top right, or we can select it from one of our watchlists on the left. Once we’ve selected SPY the option chain will populate in the centre.

As you can see there are many different expiry dates displayed, but no options yet as each expiry date table is currently collapsed. To expand one or more we can click the little arrows like so.

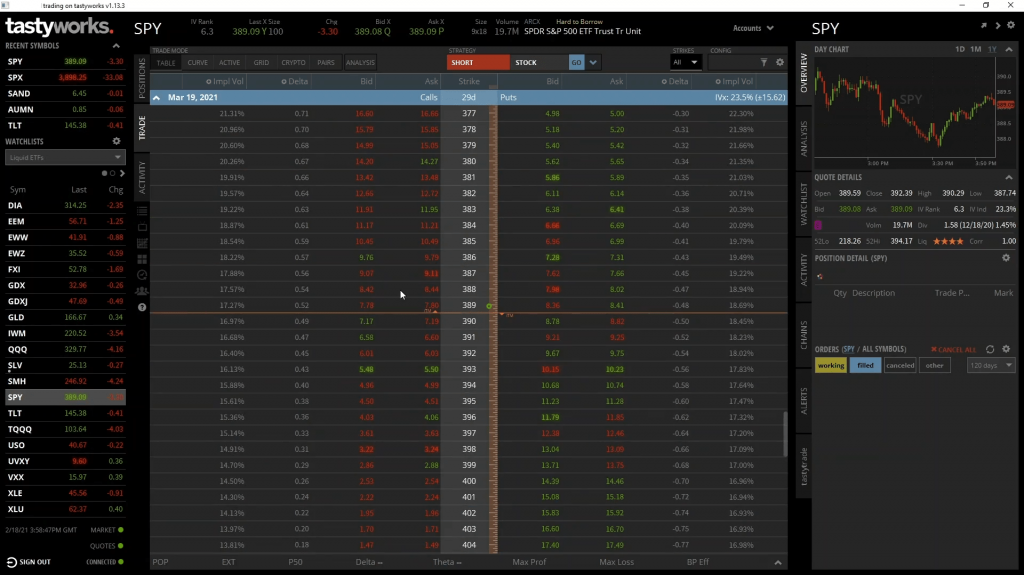

This now shows every single option available for this expiry date. If this is your first time seeing an option chain it may be an overwhelming amount of numbers. In a few minutes you’ll know exactly what you’re looking at.

The most important thing you need to remember, and this is true across different platforms as well, is that the strike prices are displayed down the centre, with call options to the left, and put options to the right.

So that’s each of the available strike prices in the middle column, call options displayed to the left of this, and put options displayed to the right.

Each row has one call option with the strike price in the middle column, and one put option with the strike price in the middle column.

Let’s use this row as an example. We can see in the middle column that the strike price is $340. To the immediate left of this is the current best bid and ask prices for the $340 strike call option. To the immediate right of this is the current best bid and ask prices for the $340 put option.

We will cover bid and ask prices and the bid ask spread again later in the course, but the ask price is the price you can currently buy the option for, and the bid price is the price you can currently sell the option for.

There are lots of other statistics you can display for each option in the other columns, but the strike price column, bid/ask columns for calls, and bid/ask columns for puts, are the only ones that are essential to understand initially. For this reason, no matter what platform you are using, make sure you acquaint yourself with the location of each of these five columns, and then you’re already most of the way there to reading the option chain.

I also have it set to display the implied volatility and delta for each option in the extra columns. Both are topics we’ll cover in great detail later.

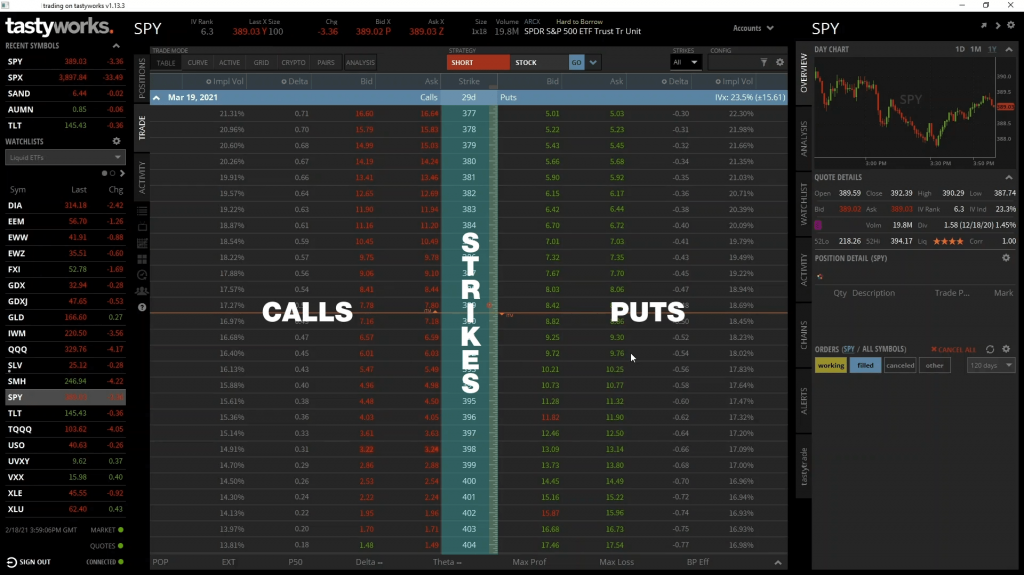

If we want to look at the options for a different expiry date, we can scroll up or down until we reach the one we are interested in. If we’re done with the current expiry date we can collapse it with the arrow, then find the one we want and expand that expiry date with the arrow on the left.

The same structure applies in each expiry date. Strike prices down the middle, call options on the left, and put options on the right.

We’ll be coming back to tastyworks later in the course to place some trades, but let’s now take a look at an option chain on another platform to see how it compares.

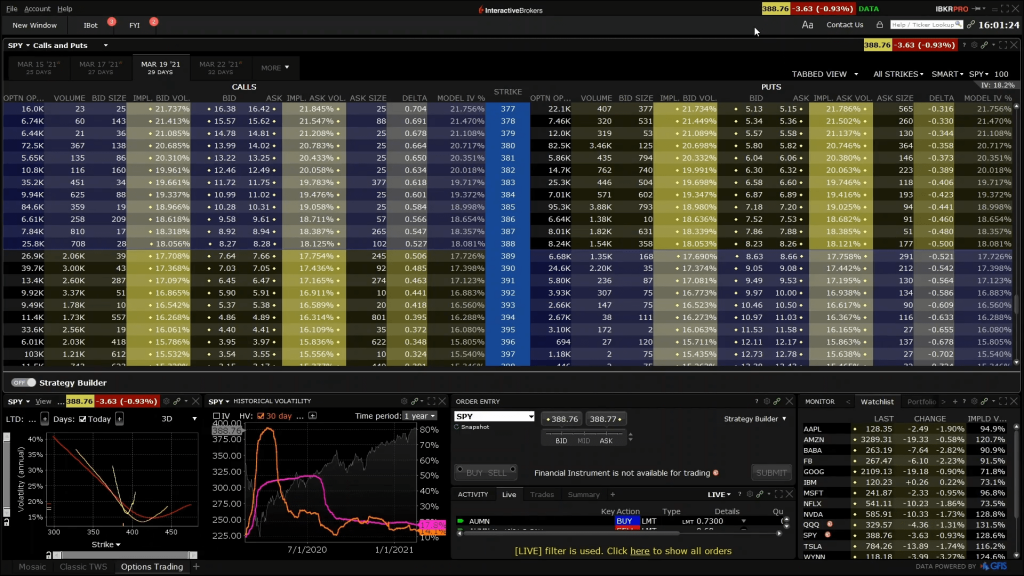

Interactive Brokers option chain

Here we have the Interactive Brokers desktop application, which is called Trader Workstation. Interactive Brokers software isn’t as pretty or user friendly as Tastyworks, but they do offer access to almost any market you can think of and are available in many countries.

We’ll look at the option chain for SPY again so it’s a like for like comparison. To display the option chain for SPY we can type SPY into the search function in the top right, press enter, then select the top result of SPY. As we are on the same product as before, all the options we look at here are exactly the same options we were looking at on Tastyworks, but displayed in the Interactive Brokers software instead.

Firstly, the main structure we emphasised previously is the same. Strike prices are displayed in this middle column, with calls on the left, and puts on the right.

I have a few more statistics displayed on Interactive Brokers, leading to a more cluttered screen, so let’s highlight the most important columns that we identified earlier, the bid and ask columns for each option.

As we mentioned we have strikes in the centre, and moving to the left we have the bid and ask for the call option at each strike price in these two columns. Moving over to the right, we have the bid and ask for the put option at each strike price in these two columns.

You can see each of the column headings at the top, and indeed this is very customisable on Interactive Brokers. If I just right click one of the column headings here and go to ‘Insert Column’ there are many different statistics that can be added. For now there is no need to know any of these. Just be sure you’re comfortable with finding the strike price, and bid and ask columns.

One difference you may have already spotted above the column headings is that the different expiry dates are displayed differently in Interactive Brokers than in Tastyworks. They are displayed as tabs above the option chain. If you want to select a different date you simply click the desired tab. If the one you are interested in is not shown, click ‘MORE’, and the other available dates will be shown in this menu. The SPY is a very popular product so there will always be lots of additional dates, but some smaller markets will have far fewer choices of expiry date. Some may not have any additional dates to the ones being displayed.

Again we will come back to Interactive Brokers for some live trade examples, but for now if you have an Interactive Brokers account, just have a quick practice of selecting a product, finding an expiry date, and then locating the strike price, bid columns and ask columns.

Deribit option chain

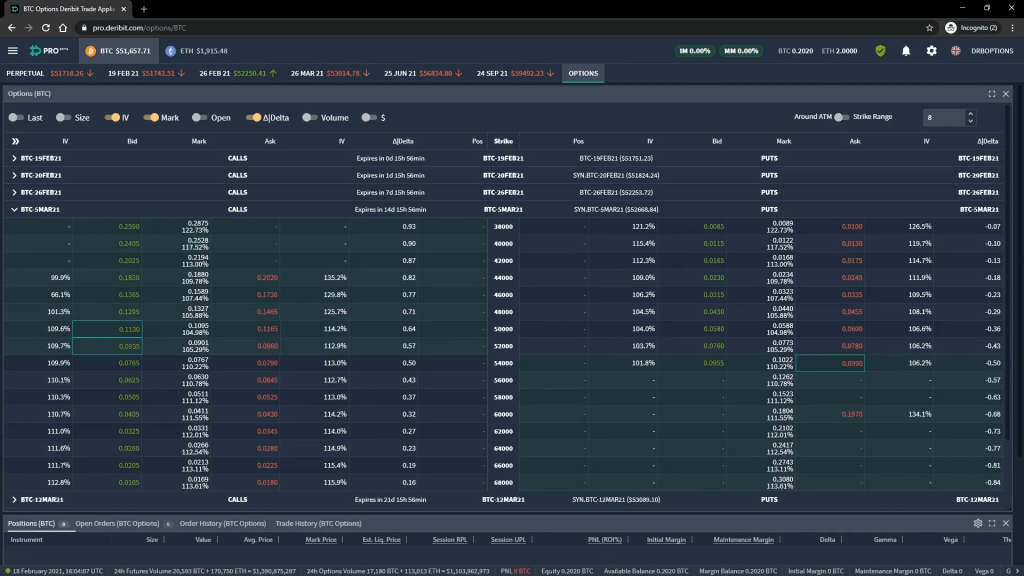

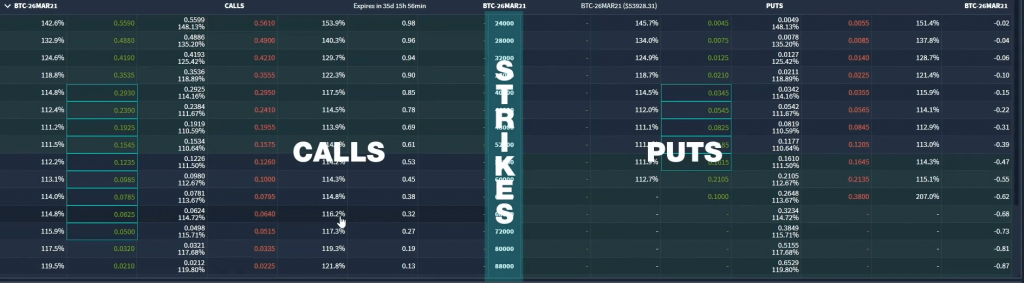

Finally let’s take a look at an option chain on Deribit. This is the Deribit pro UI, which is displayed in a browser here, rather than in a desktop application like the first two exchanges. We are currently looking at the bitcoin products, and to get to the options chain we just click ‘OPTIONS’ in the menu.

The layout of the Deribit options chain is similar to the Tastyworks option chain, in that the different expiry dates are displayed in a collapsible list on a single page. We can click one of the arrows to collapse or expand an expiry date.

As you can see, Deribit uses the same structure of strikes down the middle, calls on the left, and puts on the right. The bid and ask columns for calls can be found on the left, and the bid and ask columns for puts can be found on the right. On Deribit the bids are in green text and the asks are in red text, which helps your eye find things a little quicker.

To navigate to a different expiry date, we can scroll up or down, and of course we can collapse the date we’re currently looking at if we’re done with it.

As with the other platforms, there are also several other statistics that can be displayed in other columns. These can be enabled or disabled at the top of the option chain. We’ll be coming back to many of these extra statistics that are available later in the course.

Summary

You should now know what a typical option chain looks like, and how to navigate to the desired expiration date. Once you are looking at the desired date, you should then be able to find the list of strike prices, the bid and ask prices for calls, and the bid and ask prices for puts.

On most platforms you can also customise the option chain to suit your needs. You can do this by adding optional statistics that can be displayed in additional columns. These can include implied volatility, delta and other Greeks, open interest, volume and many others.

In the next section we will take a more detailed look at call options.