For those who just want the PNL formulas, they are at the end along with some spreadsheets to help do the calculations for you. However it is a good idea to understand the theory underpinning them rather than just copy them down.

Many traders new to trading cryptocurrency derivatives that use the cryptocurrency itself as collateral, have a hard time switching their thinking of certain concepts away from dollars and into the cryptocurrency in question (for example bitcoin). These are often traders coming from trading cryptocurrency spot markets, or traders who are coming over from legacy market derivatives.

The one thing they have in common is a mind used to calculating everything in dollars, which is understandable as the value of their account will typically be displayed in dollars on the platforms they have been using. Additionally, on these platforms once they have closed all their trades, their collateral will also be stored in dollars. If they buy a quantity of 100 of a particular asset, let’s say $AMZN shares for example, and then sell those $AMZN shares back into dollars once the price moves up $10, they know they have made $1,000 ($10 x 100 shares).

On Deribit the balance of the account is the cryptocurrency itself. So if a trader deposits 1 BTC and doesn’t open any positions, their account will maintain a balance of 1 BTC. How much this is worth in USD will vary depending on the BTCUSD price. If BTCUSD is currently at $5,000, the 1 BTC account will be worth $5,000. If BTCUSD then rises to $10,000, the account will then be worth $10,000.

This is rather obvious of course, but what is sometimes less obvious to new crypto derivative traders is the PNL calculations once we start adding some trades into the mix. When measured in USD the calculations are similar to the above example with $AMZN shares. For example, if a trader goes long the Deribit BTC perpetual contract with an initial position size of 1 BTC, they will make $1 for every $1 increase in the BTCUSD price. However, as we touched on, the balance in the Deribit account is stored in bitcoin. Any profits or losses are also paid in bitcoin, so how much BTC is paid into the account will vary depending on the bitcoin price at the time.

Example

A trader opens a long position of $8,000 on the BTC perpetual with an entry price of $8,000. The position size measured in BTC is then of course 1.

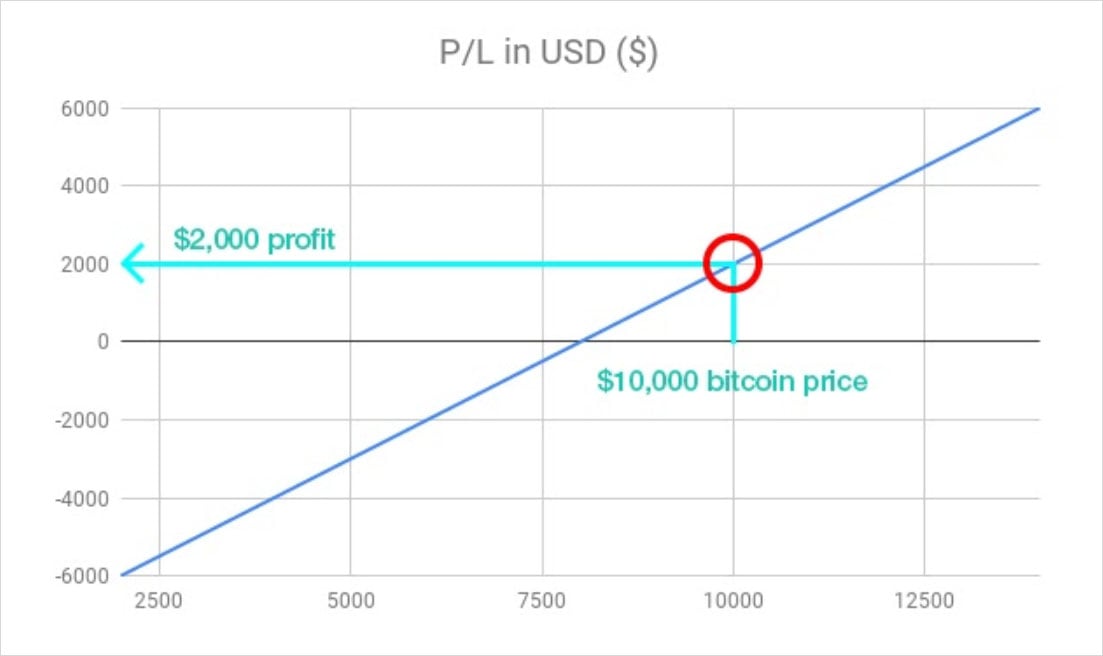

If the price of bitcoin then rises to $10,000, it’s relatively simple to see that the position has made a profit of $2,000.

And this can be seen more generally for this position on the following USD profit and loss chart, which displays the profit and loss in dollars on the y axis, and the BTCUSD price on the x axis:

If the trader closes the position at a price of $10,000, they will receive $2,000, but with the inverse contracts on Deribit this profit will be paid in BTC at the rate at the time of closing. So how much is that in BTC?

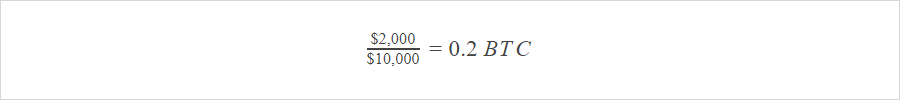

The price at the time is of course $10,000, so it’s calculated as:

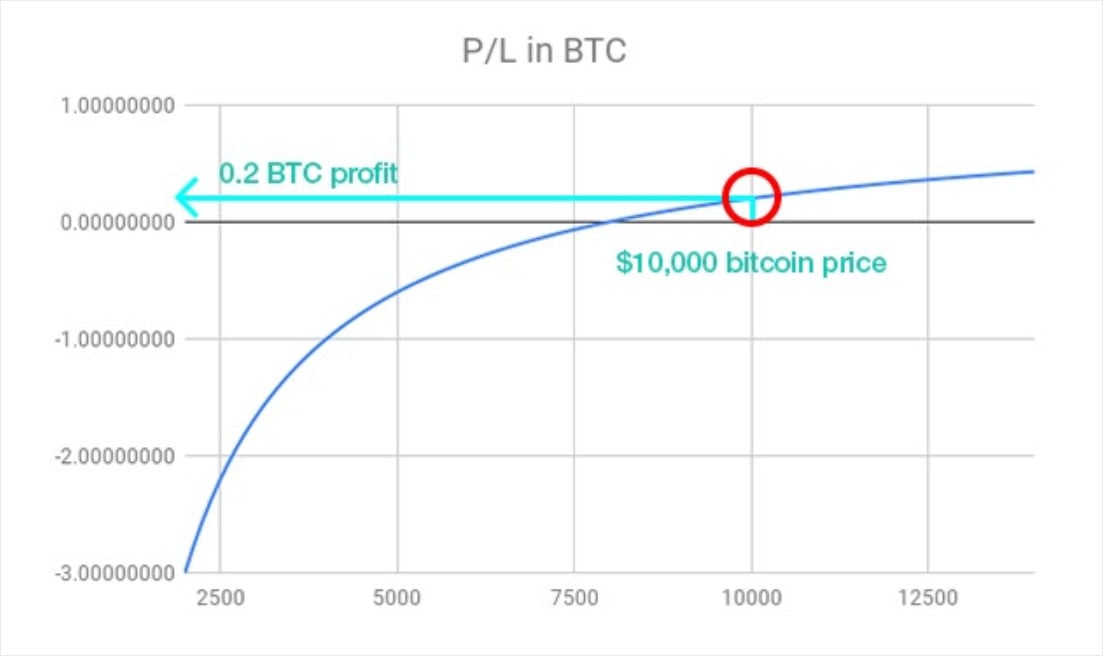

We can similarly plot the profit and loss of the position in BTC on a chart, but you will notice a very different shape compared to the USD chart above.

The profit/loss line is instead curved. Let’s take a look at an example of how this affects the profit payments at different points.

Now suppose instead of closing at $10,000, the trader holds the position and the price continues to rise to $12,000. Remember they initially bought at $8,000 with a position size of 1 BTC, so it’s relatively simple to see they have made a $4,000 profit. Price has moved twice as far as before, so they’ve made twice the amount of dollars.

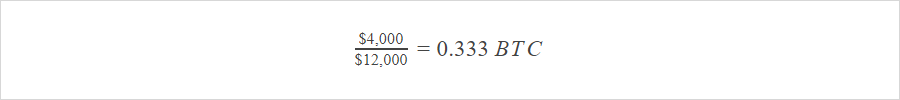

If they close the position at $12,000 how much BTC will they receive?

The profit is $4,000 and now the price is $12,000, so it’s calculated as:

“Hang on a minute!” our new crypto derivatives trader will exclaim, “The first $2,000 profit paid me 0.2 BTC, but when the dollar profit doubled to $4,000, the BTC profit did not double. Only an extra 0.1333 BTC was received.”.

This is because as the bitcoin price changes, so does the value of $x when measured in BTC. For example when the bitcoin price is at $10,000, $1,000 is 0.1BTC (1000/10000). However, when the bitcoin price is at $12,000, $1,000 is 0.0833BTC (1000/12000).

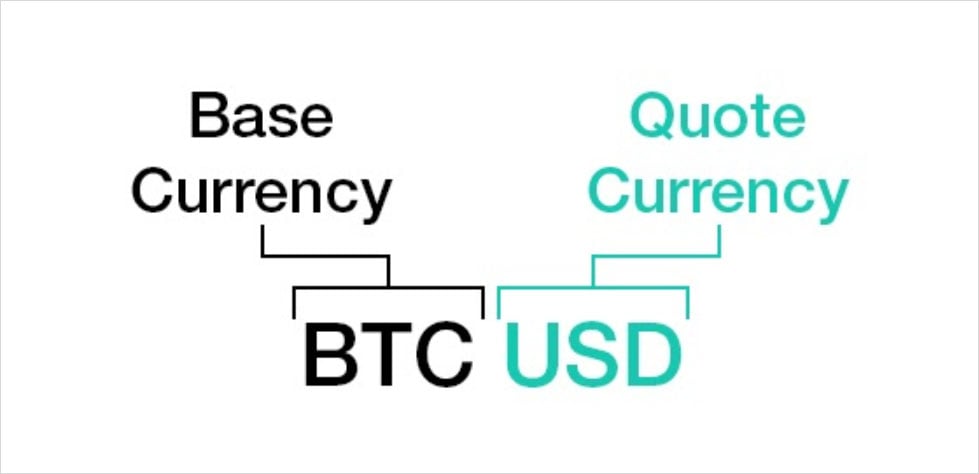

Base currency and quote currency

This little mathematical quirk comes from using the base currency for collateral and payments, rather than the quote currency. The profits are still calculated in the quote currency (USD), but they are paid in the base currency (BTC).

You can think of any currency or asset pair as the price of the base currency, quoted as an amount of the quote currency. Or put another way, how many of the quote currency it takes to purchase one of the base currency. In this case, how many dollars it takes to purchase one bitcoin.

This doesn’t just apply to bitcoin of course, any exchange rate you see has a base and quote currency. EURUSD for example is one of the most traded currency pairs in the world, and is simply the exchange rate between euros and dollars. It shows how many US dollars (the quote currency) it takes to purchase one euro (the base currency).

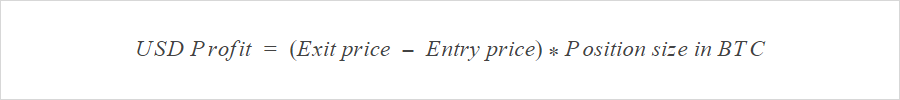

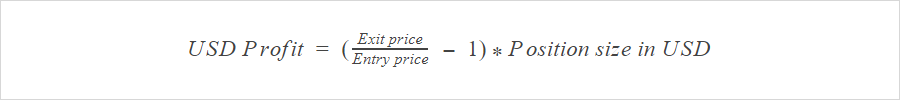

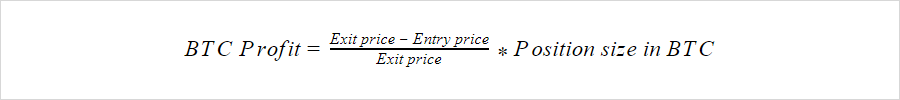

Calculating USD profit/loss for Deribit inverse futures

Using BTC position size (at time of entry):

Using USD position size:

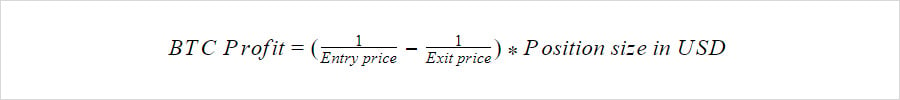

Calculating BTC profit/loss for Deribit inverse futures

Using BTC position size (at time of entry):

Using USD position size:

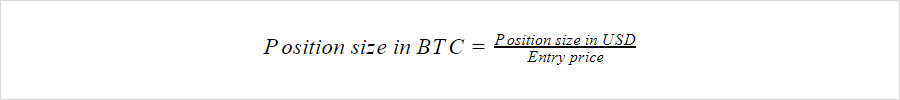

Bear in mind:

- Position sizes for shorts are entered as negative values. For example, if you are short with a position size of $5,000, you would enter -5000 as the position size in USD.

- As the position size is fixed in USD, the position size in BTC will vary over the lifetime of the position as the BTCUSD price fluctuates. For the above formulas, it is the position size in BTC at the point the position was opened that is used.

If you’re a nerd like me you may wish to check that these formulas are equivalent by substituting the following appropriately:

Some implications of these formulas

- Futures longs will lose more BTC if price moves down $x than they will gain if price moves up that same $x.

- This means the liquidation price for longs is closer than some new traders realise.

- Futures shorts will gain more BTC if price moves down $x than they will lose if price moves up that same $x.

- The liquidation price for a short will be further away from the current price than the liquidation price of an equally sized long. And it’s even possible to have no liquidation price for a short. More on this here

- Selling naked put options (or going long using futures) that use BTC as collateral has the potential to lose very large amounts of BTC. So be sure you know exactly what your risk is.

- Conversely shorting naked call options (or shorting futures with a position size of 1 BTC) has a maximum loss of 1 BTC.

Spreadsheet links and position builder

To speed up doing these calculations on the fly I’ve made a very simple spreadsheet that shows profit/loss in both USD or BTC for futures positions here.

Or for a much more detailed profit/loss calculation with multiple positions including options, and a visualisation of the PNL charts, you can use this one.

There is also a great web based Deribit position builder tool that you can find at here.

In summary, when the quote currency (USD) is used for position size and profit calculation but the base currency (BTC) is used for collateral and profit payments, the profit/loss calculations are different. The payouts are non linear as the amount of BTC required to pay each dollar varies depending on the BTCUSD exchange rate.

Once you get used to this it really is second nature and you won’t even have to think about it, but if you’re struggling to wrap your head around it initially it’s certainly worth investing a little time working through some examples using one or all of the tools given above.

AUTHOR(S)