There are two main types of order you can place on Deribit, limit orders and market orders. It is important to understand the difference between the two as they behave very differently to each other. Each one has advantages and disadvantages, so there will be different situations where you may want to use each.

Limit orders

A limit order is an order that is placed at a specific price chosen by the trader before it is placed. If it does not execute immediately , it will sit in the orderbook at the limit price chosen until it is either filled or cancelled.

Limit orders give a guaranteed price as they can not execute at a worse price than the limit price chosen. However this of course means that they are not guaranteed to be filled.

For example, let’s assume Bitcoin is currently trading with a best bid of $9,999 and a best ask of $10,001. If you place a limit order to buy at $10,000 your order will now sit on the orderbook at $10,000 as the best bid. It can not execute at a worse (higher) price, however to be filled another trader must now sell into your bid. If the market moves upwards away from your buy limit order you will be missing out on the upwards price movement.

If you don’t want to miss out on any movement, there is a way to get on board straight away by using a market order. However, using a market order comes with its own disadvantages.

Market orders

A market order will execute immediately at the best bid (for a market sell) or best ask (for a market buy). If it fails to fill completely at the best bid/ask because there are not enough orders at that price for a complete fill, the remaining portion of the order will then move on to the next best price. If after exhausting all the orders at that level the market order is still not completely filled, it will again move deeper to the next best price. This process will repeat until the entire order has been filled.

Note: There is one exception to this if the order moves so deep into the orderbook that it hits the trading bandwidth, at this point, a limit order would be left at the bandwidth price for the remainder. You can read more about this in our blog on ‘Market order with protection’ here.

As you might imagine this has the potential to execute at a worse price than intended if the orderbook does not have a lot of opposing orders in it for the market order to execute against. This phenomenon is known as slippage i.e. how far the order slipped into the orderbook.

Maker vs taker orders

A maker order is one that sits on the orderbook, providing liquidity for other traders to trade against. Only limit orders can be maker orders.

A taker order is one that executes against a maker order, thereby taking liquidity off the books. Market orders will always be the taker, but it is possible for a limit order to be a taker order. If the limit price is higher than the best ask (for a buy), or lower than the best bid (for a sell), then it will execute immediately and act as a taker (unless the order has post only selected, more on this soon).

Deribit operates a maker-taker fee model for the futures and perpetual products. This structure offers a small reward (rebate) instead of a fee for orders that provide liquidity (maker orders), while charging a fee to orders that take liquidity (taker orders).

For example, if trader A has a BTC sell order for $1,000 sitting in the orderbook at a price of $10,000, and trader B then executes a market order to buy $1,000 which executes against trader A’s order. Trader B is said to be the taker and so will pay the taker fee. Trader A is said to be the maker and will receive the maker rebate. Trader A will not pay a fee.

Placing a limit order on Deribit

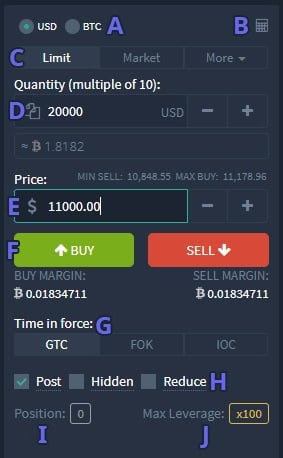

This is the limit order form for the BTC perpetual contract.

A. Here you can choose whether you would like to select your position size in USD or BTC. Bear in mind that no matter which one you choose, all orders are rounded to the nearest $10 for BTC futures and perpetuals.

B. Clicking this icon will bring up a handy profit/loss calculator.

C. Here you choose what type of order you would like to create. Clicking ‘More’ will show the options for stop orders. We will cover stop orders in a separate lesson.

D. Quantity – This is where you enter your position size. For example, if you want to place an order with a position size of $20,000, you simply enter 20000 as shown in the image.

E. Price – This is where you enter the price you would like your order to be placed at. The order in the image here is showing an order size of $20,000, to be placed at the price of $11,000. You will also notice just above the price box, there is a MIN SELL and MAX BUY. These two figures represent the current trading bandwidth.

Note: The bandwidths are set a certain percentage either side of the current mark price. Limit orders may still be placed outside these bandwidths, but no trades will execute outside of this level until the mark price moves.

F. BUY and SELL buttons. You will notice underneath these buttons are the minimum margin requirements for placing each order. This is the minimum amount of available margin you need in your account to open the position.

G. Time in force:

- GTC – Good Til Cancelled. This order will stay open until it is either filled or cancelled.

- FOK – Fill Or Kill. This order must be filled completely or cancelled.

- IOC – Immediate Or Cancel. This order must be filled immediately or cancelled. The difference here being that a partial fill is acceptable. So if an IOC order for $20,000 is placed at a certain price, but only $7,700 is available at that price, then $7,700 will be filled and the remaining $12,300 will be cancelled.

H. Additional optional settings for the limit order:

- Post Only – A post only order will only act as a maker order i.e. it will not execute against an existing order in the orderbook. If the limit price selected would otherwise cause it to execute immediately, the price is adjusted to one tick away from the price that would cause instant execution. For example, if the current best ask is $10,000 and you place a limit order to buy at $11,000 with post only selected, the order will be placed at $9,999.50 so as not to execute immediately.

- Hidden – A hidden order will not be visible in the orderbook to other traders. However, hidden orders will always pay the taker fee.

- Reduce Only – A reduce only order will only be used to make a position smaller. It will never make a position larger or open a new position.

I. Your current position size. Short positions will display as a negative number.

J. The maximum leverage currently available on this instrument.

Placing a market order on Deribit

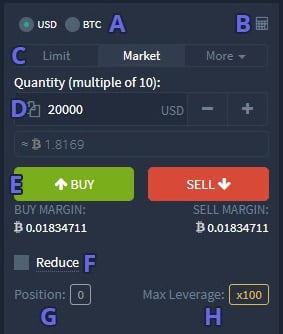

This is the market order form for the BTC perpetual contract.

There are of course many of the same features as the limit order form, but some of the items are gone as this order will be immediately executed. However the order form is largely similar to the limit order form.

A. Here you can choose whether you would like to select your position size in USD or BTC.

B. The profit/loss calculator.

C. The order type.

D. Quantity.

The market order form is different from the limit order form in that you can not choose the price for a market order, it is instead executed against either the best bid (for a sell) or best ask (for a buy)..

E. BUY and SELL buttons.

F. Reduce Only. Note that there is only a reduce only toggle here, as the order is executed immediately, post only and hidden cannot be used.

G. Your current position size, this is separate for each instrument.

H. The maximum leverage currently available on this instrument.

Summary

A limit order gives a guaranteed price, but not a guaranteed fill.

A market order gives a guaranteed fill, but not a guaranteed price.

Which one you choose for a given situation depends on which you value the most, making sure your order gets filled, or making sure you get a specific price.

AUTHOR(S)