In this week’s edition of Option Flows, Tony Stewart is commenting on UST/LUNA Contagion concerns.

May 12

Options market has moved firmly from Risk to Risk Management.

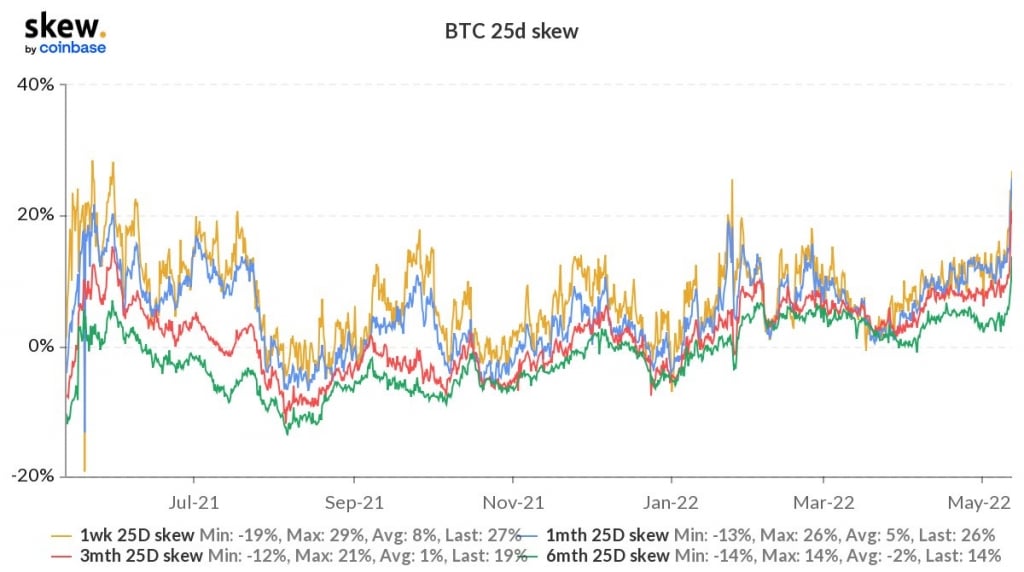

UST/LUNA Contagion concerns. Implied Vols blew up overnight as Demand across the whole term outstripped MM+natural supply. Put Skew surged to extreme levels as continued buying of far OTM Puts continued in BTC+ETH.

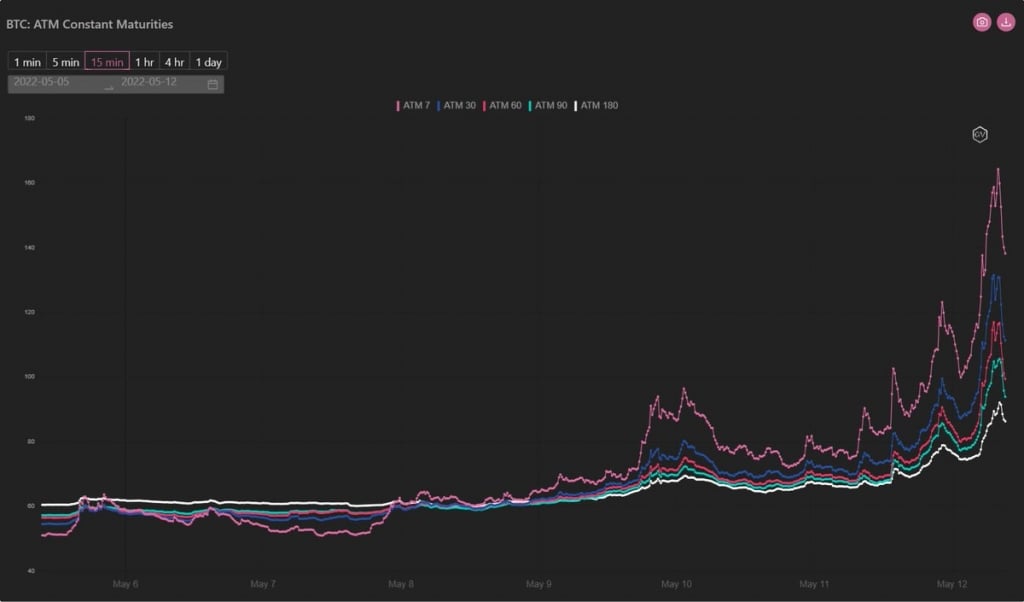

2) Demand for ATM+OTM Puts, Option short-covering, unwillingness to aggressively sell Vol, and Risk management has forced Implied Vols to justifiable highs and now clearly included in one of the historic blowups as near dated IV breach 200%, 1month >100%.

3) With Luna currently being sacrificed to support UST and many Funds having exposure, rumors of internal turmoil are prevalent.

Native structure is being attacked with other Pegs being tested.

Alts have been crushed.

Put Skew has pumped to extremes reflecting contagion fear.

4) These are extreme times. Risk management and Survival come first. Vol of Vol is high. See 3day chart below. Vols today are moving in 10-15% chunks within a couple hours, Spot dependent. Options market liquidity is orderly, but prices have naturally widened out to reflect risk.

View Twitter thread.

AUTHOR(S)