In this week’s edition of Option Flows, Tony Stewart is commenting on The Attack on 30k BTC and much worry on Crypto Twitter.

July 21

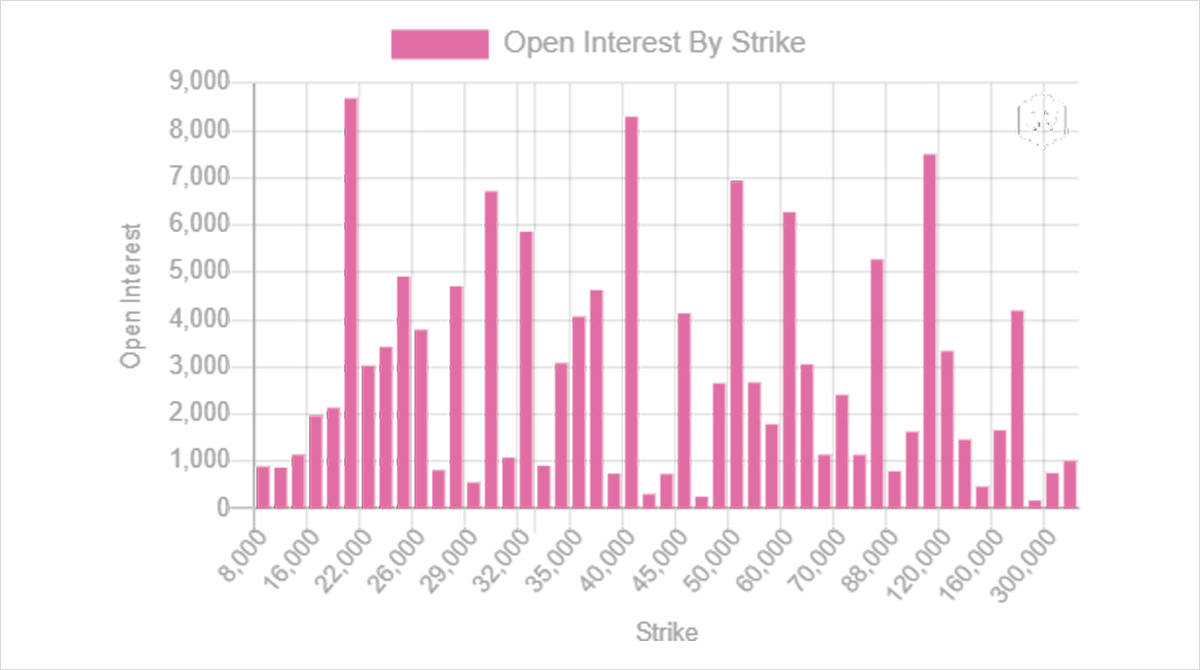

After a dearth of activity, the attack on 30k BTC was the catalyst that initiated a surge in Option flow as both Shorts and new Fast money bought the July 23+30 30k Puts.

Much worry on CT however has been levelled at prints in BTC+ETH EOY 65-70% OTM Puts.

Let’s delve further:

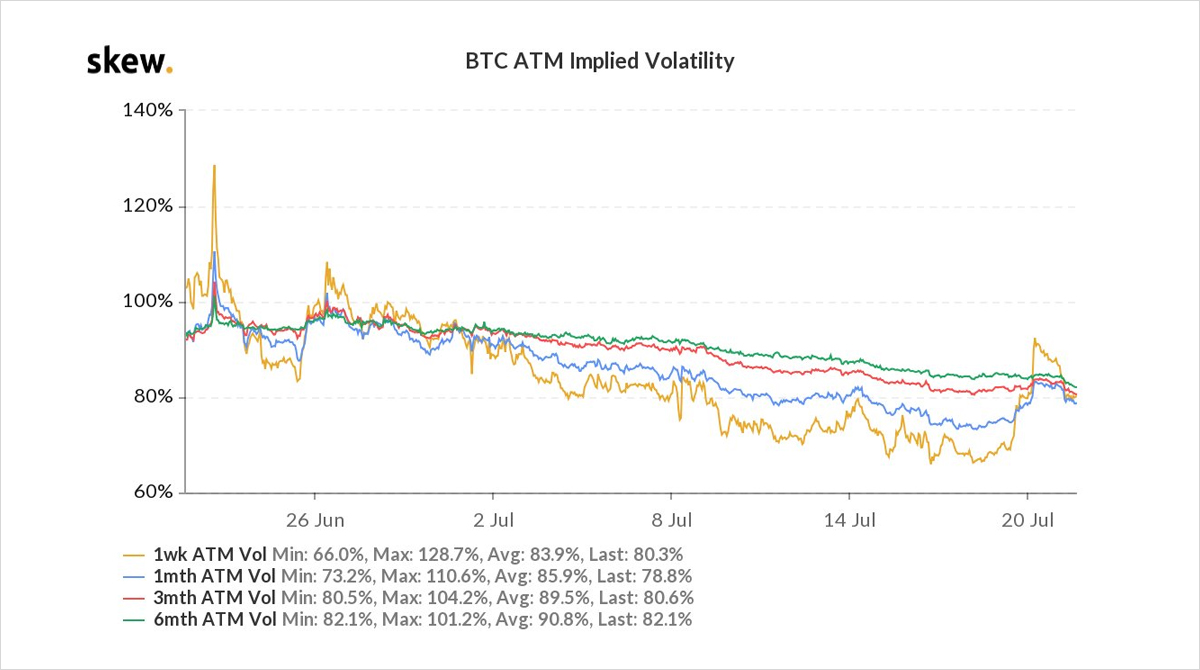

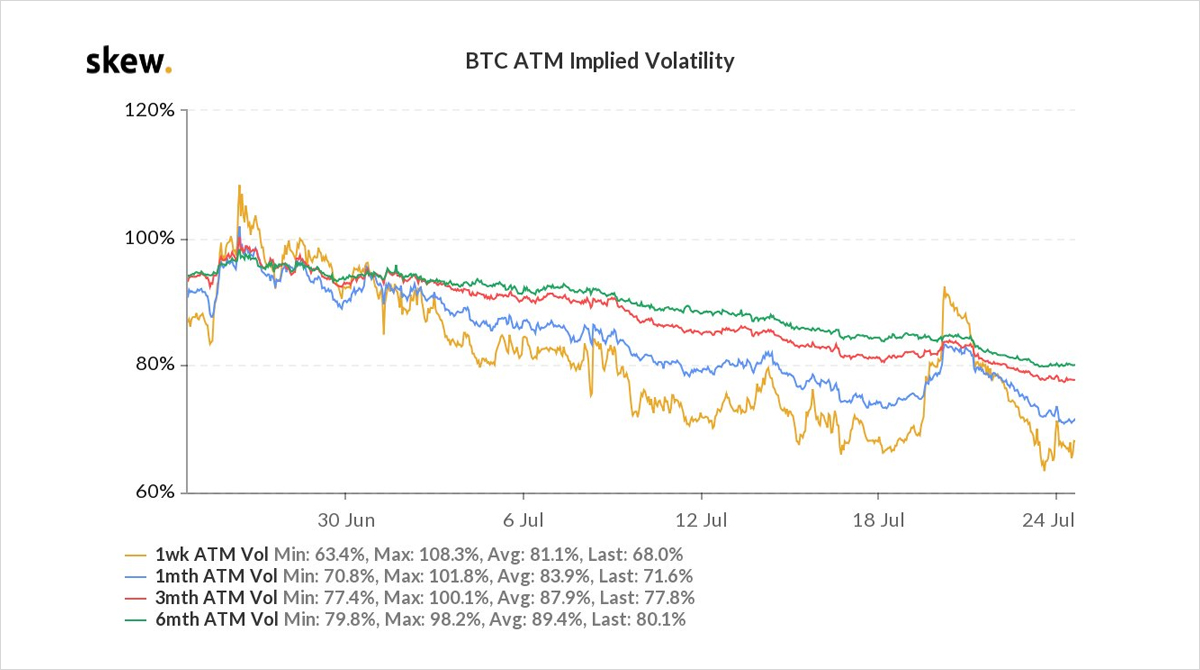

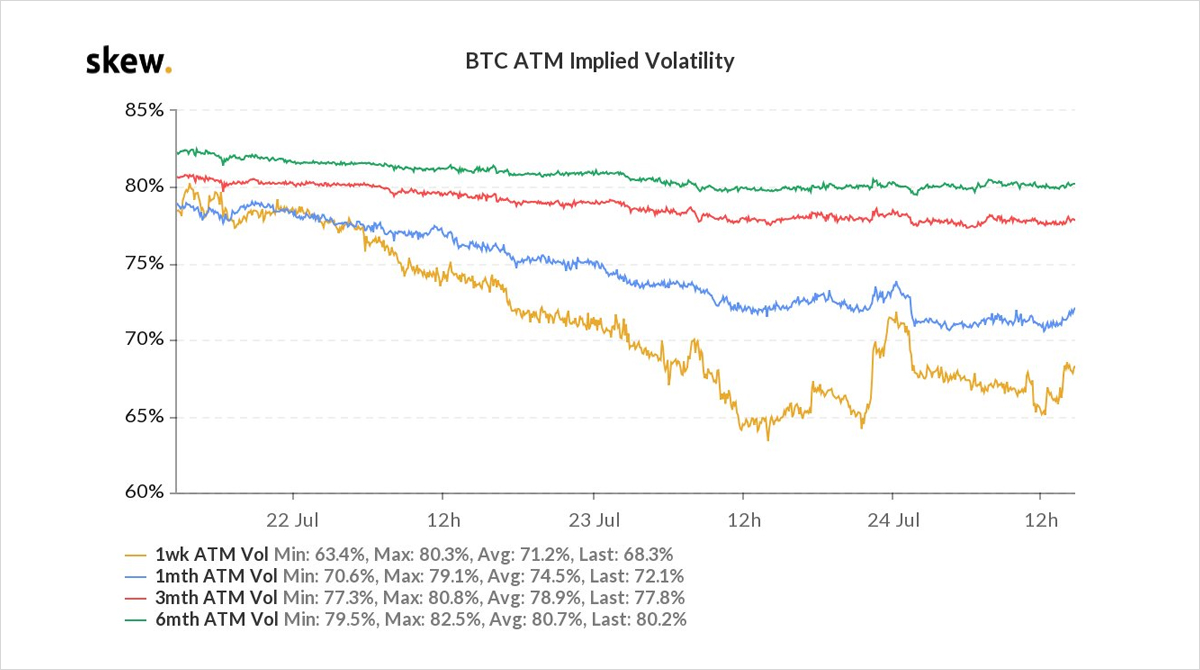

2) With near-dated Implied Vol having collapsed from 100% down to 70% on rangebound and lower spot drift, it was natural that hedged Shorts covered to take IV profits, naked Shorts covered to avoid losses, and Fast money bought the cheapest part of the curve.

Near-dated IV rose.

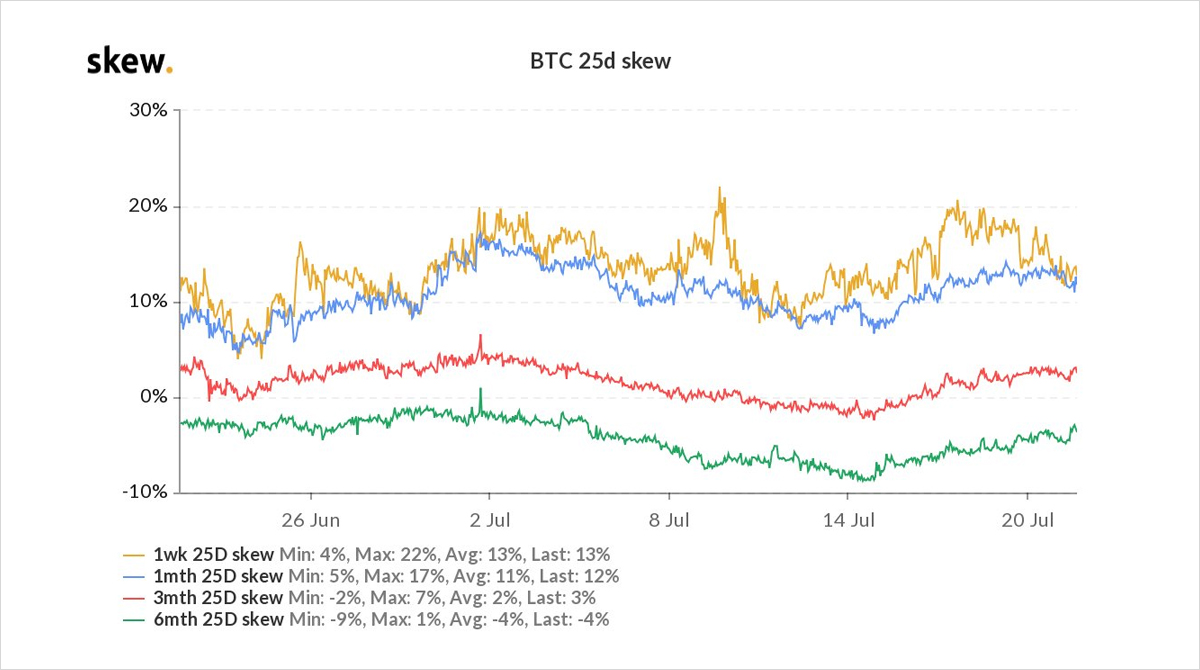

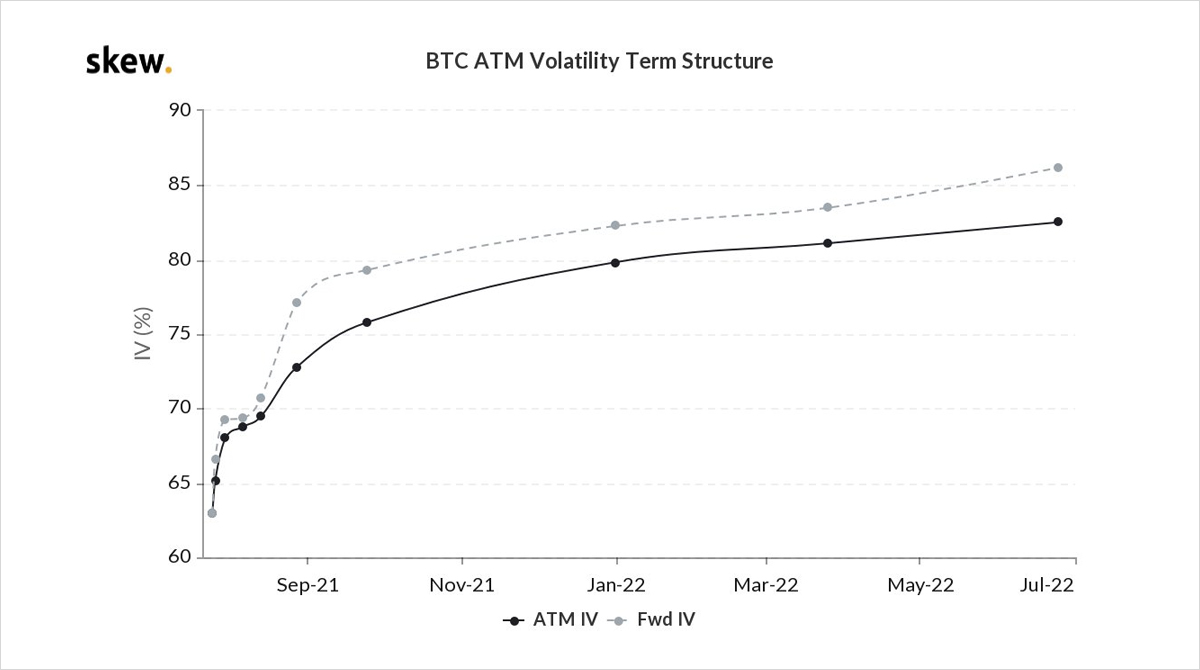

3) Note that longer-dated Implied vols continued to remain under pressure and longer-dated Skews were sub-0 for the Puts, making the case for longer-term bearish bias/concerns to take advantage of 6month OTM Puts.

2.5k 20-24k+10k ETH Dec OTM Puts have been bought.

Response:

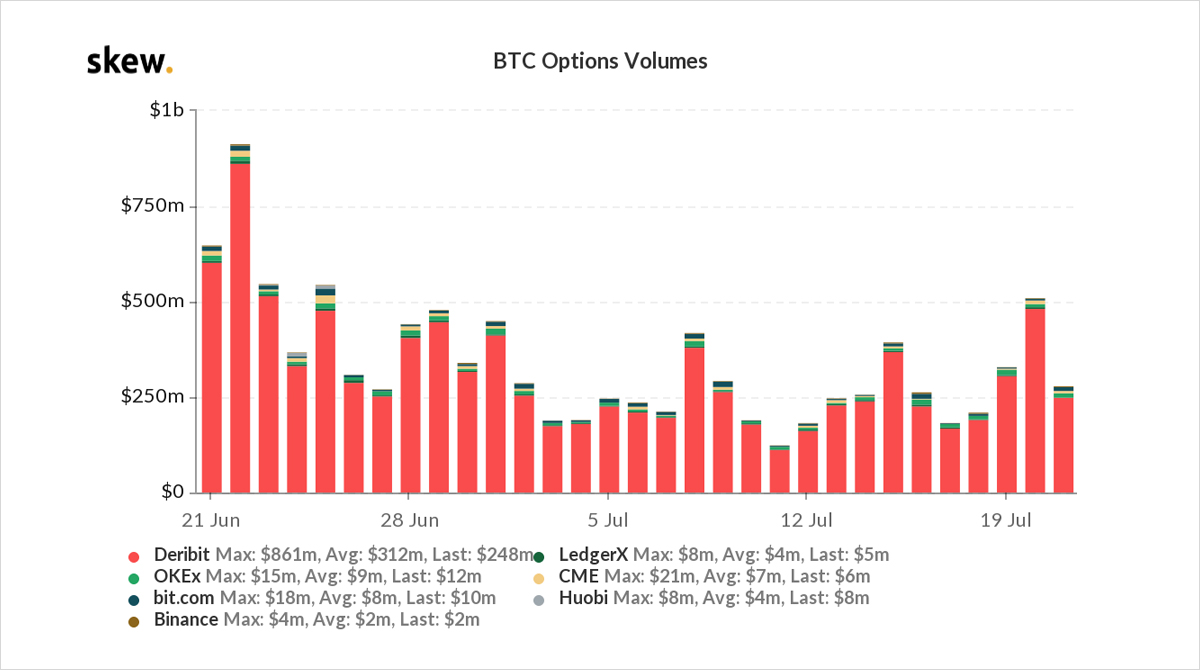

4) While large prints in the current depressed volume environment, these purchases were absorbed by one MM seller.

Net delta ~400BTC, ~1500ETH that MM sold to hedge over 3days clips. Vega ~ 60% of ATM strike.

All very manageable.

The MM was aggressive to sell the flow and onside.

5)

Highlighted above the technical reasoning for buying 6m OTC Puts on a relative basis, but this still has to fulfill the Put buyer’s bias.

The most likely justification is a medium-term -ve spot bias or crash protection view.

Why?:

6) If Buyer was imminent bearish, was optimum to buy near-dated near-ATM Puts, low cost, high theta, big delta, high return.

– If Buyer wanted to cover spot longs, a near-ATM strike (maturity dependent on timing), was ideal, either outright or funded via Spread or Calls.

7) The current environment is one of regulatory & macro concerns, so the buyer may be ultimately comfortable in long spot or cash, but need longer-term crash exposure.

These Puts don’t work great on a slow drift lower.; they are also relatively expensive premium being Dec expiry.

8) Therefore:

– given the expense, likely crash Protection rather than punt; punts view logically in near-dated cheap premium Strikes.

– given the Strike, crash rather than drift exposure.

– given the Maturity, a medium-long term view.

This, of course, assumes justified logic.

9) Also the possibility of a structured product that uses 6month 65-70% OTM Puts to hedge/cover exposure.

Also perhaps that Buyer was a Fund buying back a short-vol position or (with OI increasing) entering a new Long.

Many possibilities; it seems disproportionate to overreact.

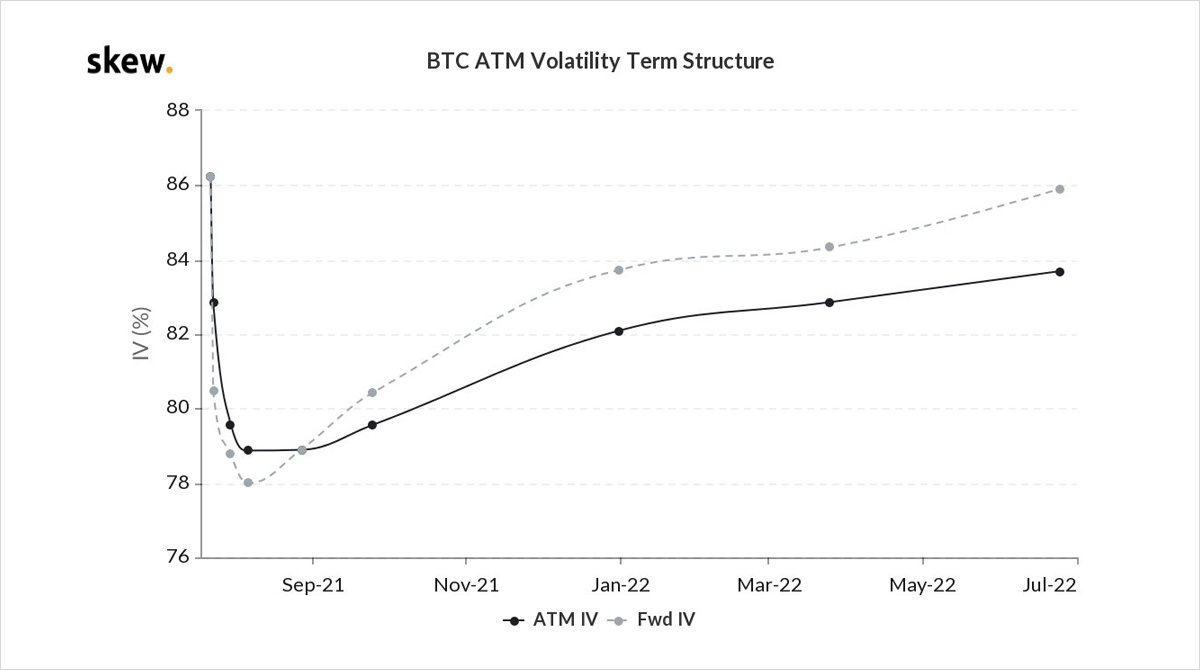

10) Finally, the IV reaction after today’s bounce off the lows is one where short-dated has not been hit hard and the front part of the term structure remains in backwardation.

This is perhaps ahead of the much-anticipated conf discussion with Elon, Jack (Twitter) & Cathie(Ark).

View Twitter thread.

July 24

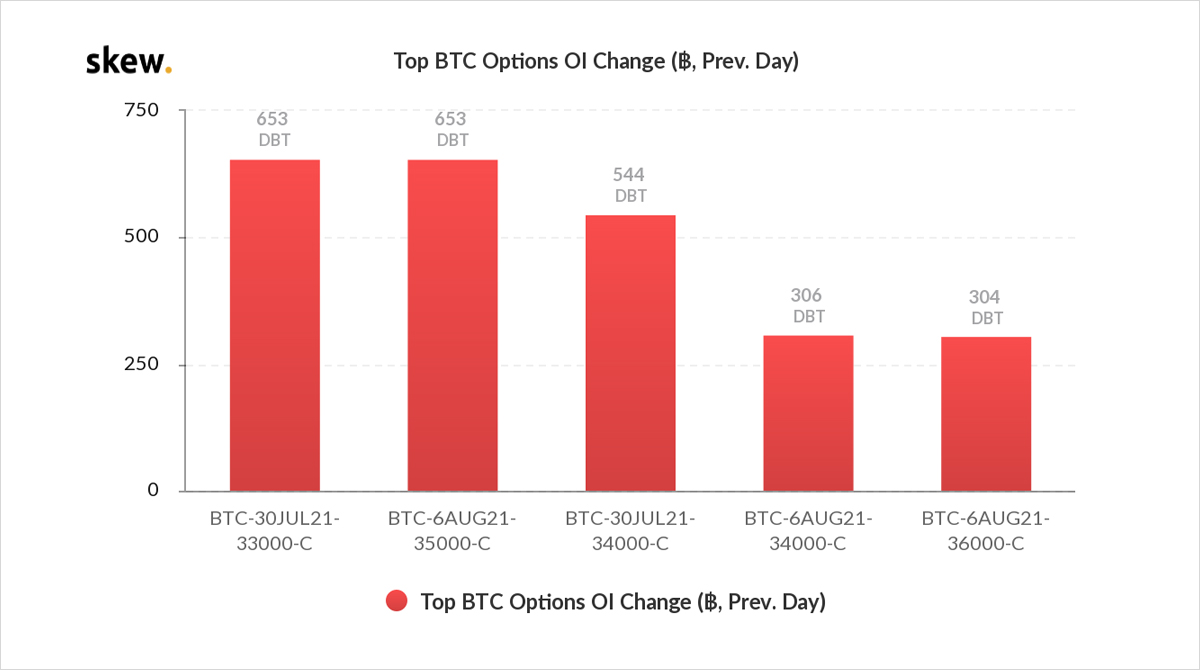

Just as Implied Vol had collapsed and Options traders metaphorically turned off their machines for the weekend, post US close, a large buyer of near-dated (July 30th+Aug 6th) 33-36k Calls x2.5k (~1k delta) lifted offers as BTC spot moved from 32.5-33.5k.

Near-term bullish bet.

2) As opposed to the Dec Put buyer mentioned in the last thread, this Call buyer is making a short-term aggressive play.

The maturity and the delta of the Options have significant theta, so need imminent higher spot move to perform.

Smart purchase in terms of IV vega low point.

3) All executed via @tradeparadigm, the buyer bought over a couple hours, but spaced out in clips of no larger than x100.

On July30 expiry, the 33+34+35k Calls were bought.

On Aug6 expiry, the 34+35+36k Calls were bought.

Open interest data increased, so this was opening Longs.

4) Execution interesting.

Buyer (almost certainly one Fund only) chose to block, not use screens, yet also chose not to buy the whole size exposure in one block (or 5×500).

This tactic is often used to distribute risk around MMs, to avoid impacting IV + delta hedging adversely.

5) The buyer chose not to ‘marry’ with delta, so this is most likely a near-term bullish spot play, not a defined IV/gamma play.

But as the buyer accumulated, MM’s had to hedge and this ~1k of delta assisted the push up in spot and may have increased the speed of buying.

6) While the buyer didn’t choose the most liquid time of day to execute, the timing of IV low was precise.

The Call buying did increase IVs 4-7%

July30 33k C moved from 66 up to 73%.

Aug6 36k C (less sensitive) from 66 up to 69.5%.

IV drifted lower on market inactivity since.

7) As I write, BTC spot touching 34k, all Calls onside.

The market did not observe similar action on ETH Calls.

While the Term Structure has reverted Contango, if you look closely you can see remnants of the Call buying as July30+Aug6 are slightly elevated to a smooth curve.

View Twitter thread.

AUTHOR(S)