In this week’s edition of Option Flows, Tony Stewart is commenting on the Eurex Bitcoin ETN news.

August 20

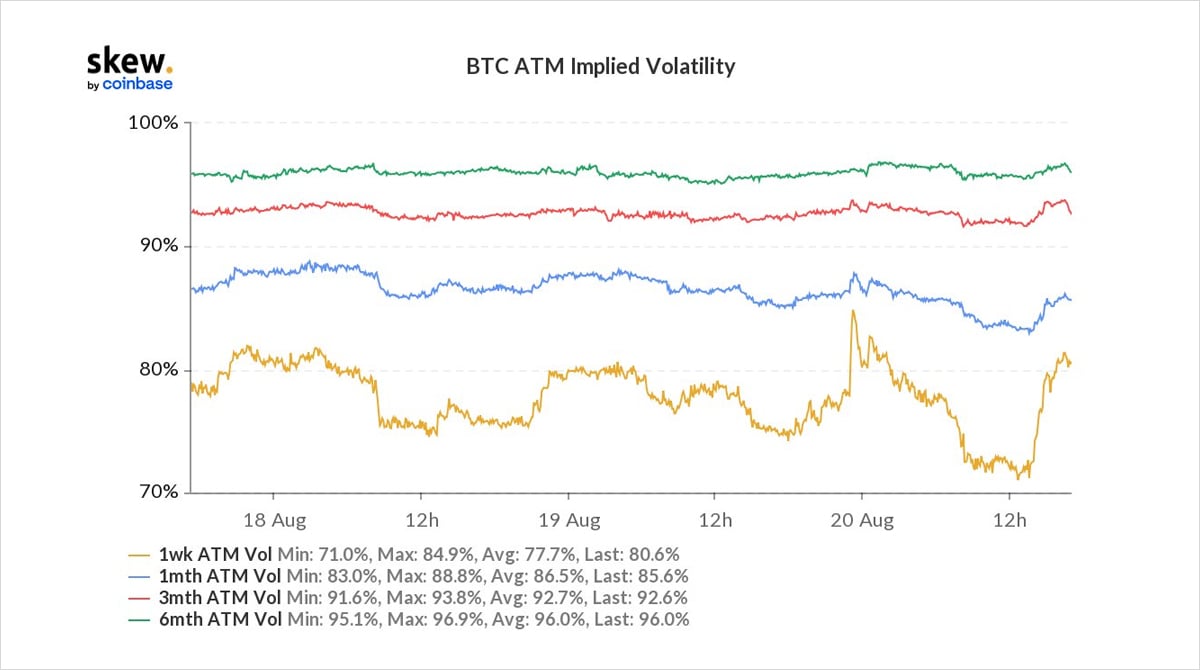

The Eurex Bitcoin ETN news may have accelerated the Friday buyer earlier in the day than normal, as large spot buying combined with Aug 50-52k Calls x2k frustrated MM hedging delta+vol risk.

Although the buyer has been termed the ‘Friday Ape’, there’s more refinement involved.

2)

The large Fund has acted on all but one, over the last four weeks, buying Calls, combined or aside large spot buying of BTC/ETH.

Normally the timing is after US close, post Deribit+CME expiry + pre-weekend, when IV is often low due to expiry yield flows + MM theta avoidance.

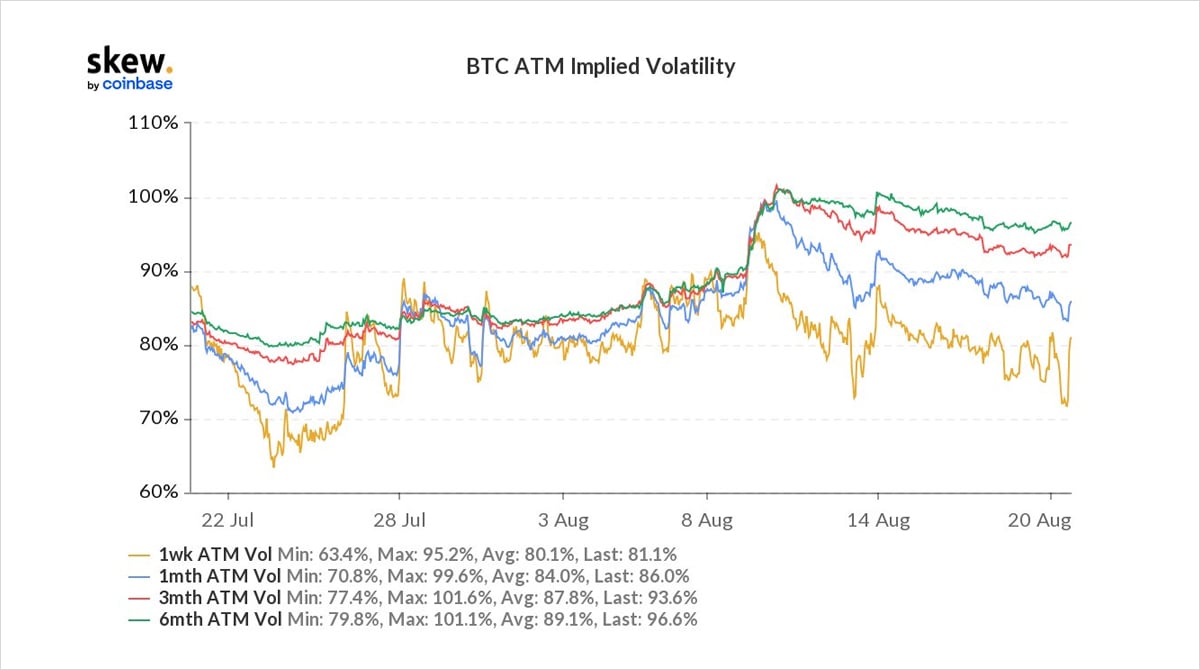

3) One exception was a day when 7-14day IV (usual choice of maturity – in yellow) was >85%, ie relatively high, as opposed to the other executions when IV started mid-70s (relatively cheap within the current environment).

If IV was low on other days, would it be the ‘Friday’ ape?

4) One ‘tell’ from the execution of this Fund is the rapid quoting+execution of relatively small clips of 50-100.

This attains quick fills vs MM vol engines.

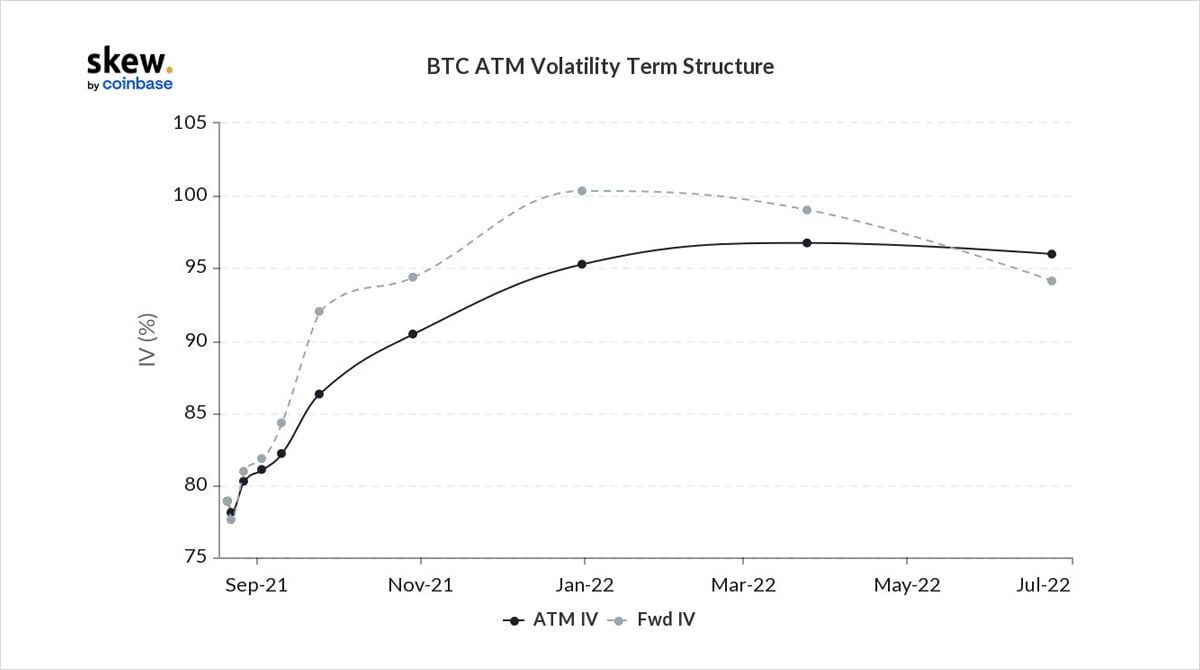

Today, engines sold aggressively to start, suggesting that MM’s have been long near-date vs short far on contango curve.

5) This expression of directional bias, with precise timing of current IV range lows on the Friday’s, when IV holds up fairly well at the weekends, continues to work well.

The ‘Ape’ attachment however is appropriate in the sense that there is little finesse once buying comences!

View Twitter thread.

AUTHOR(S)