In this week’s edition of Option Flows, Tony Stewart is commenting on a Symphonic Option buying in directional discordance.

October 13

Symphonic Option buying in directional discordance.

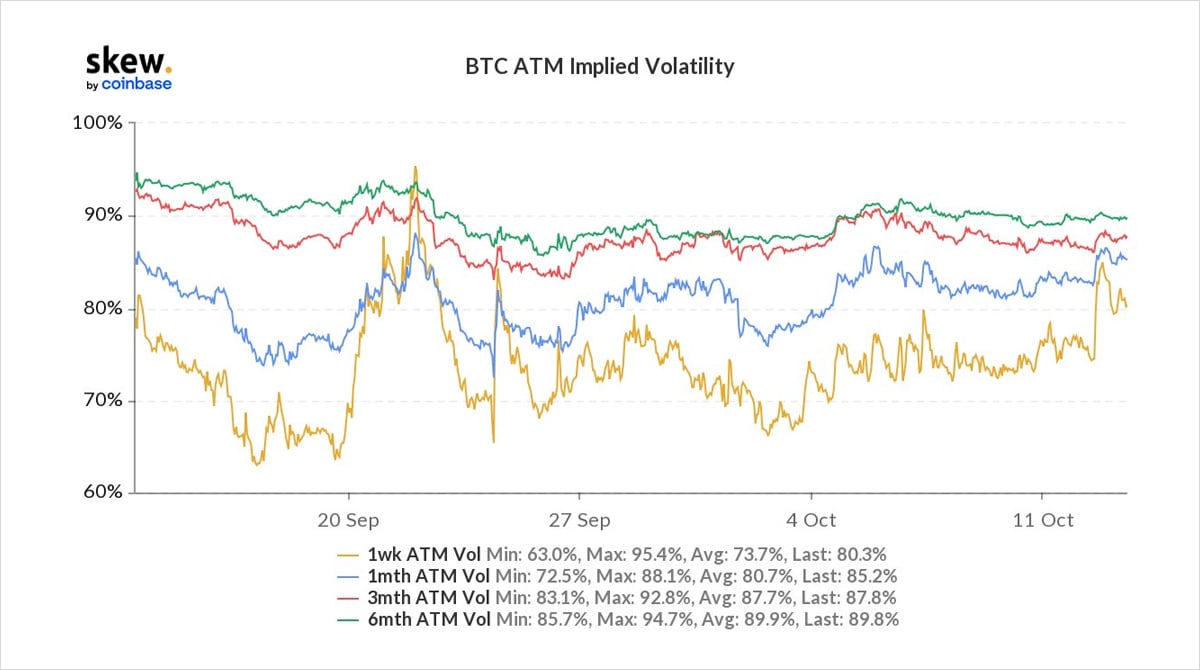

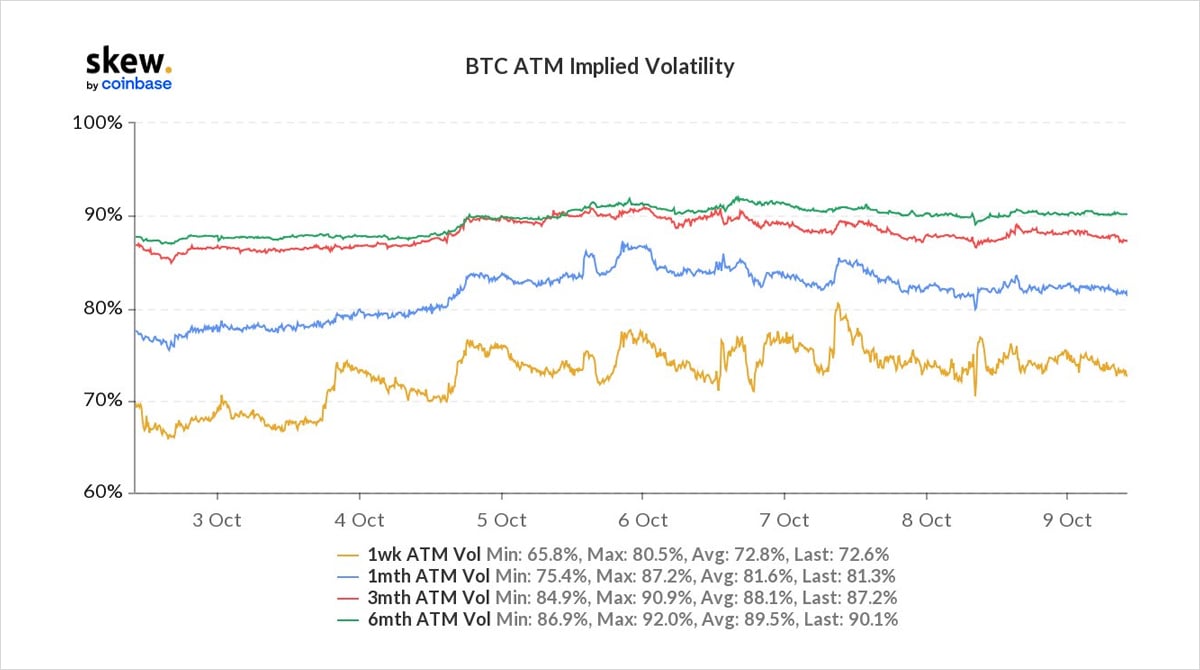

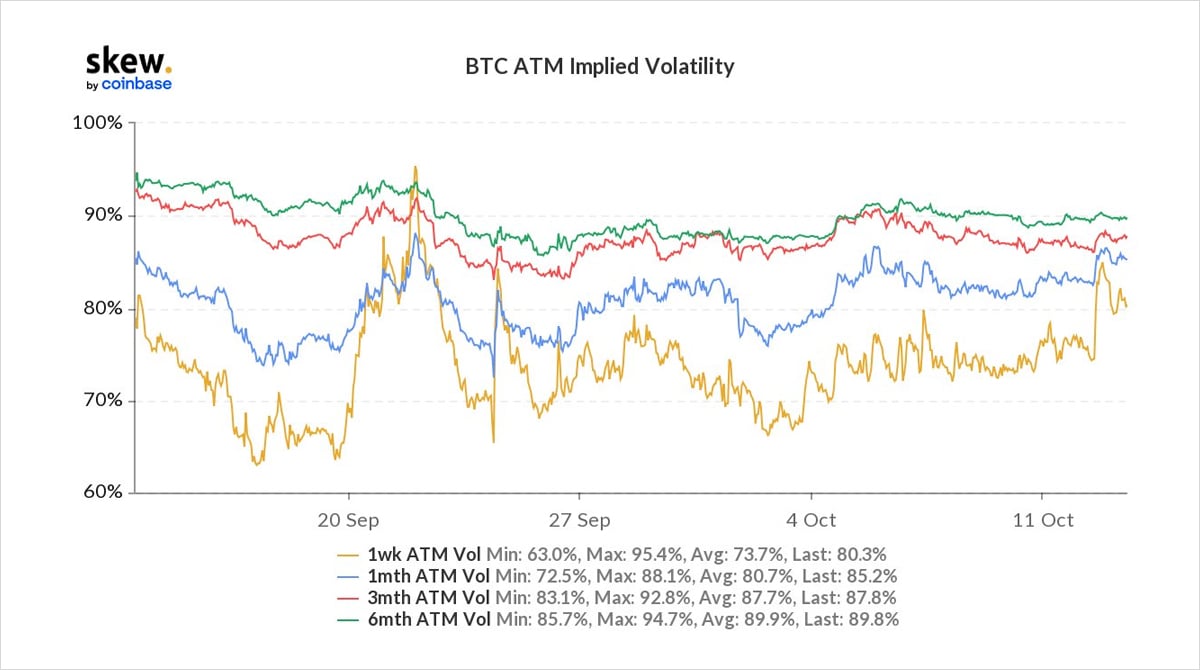

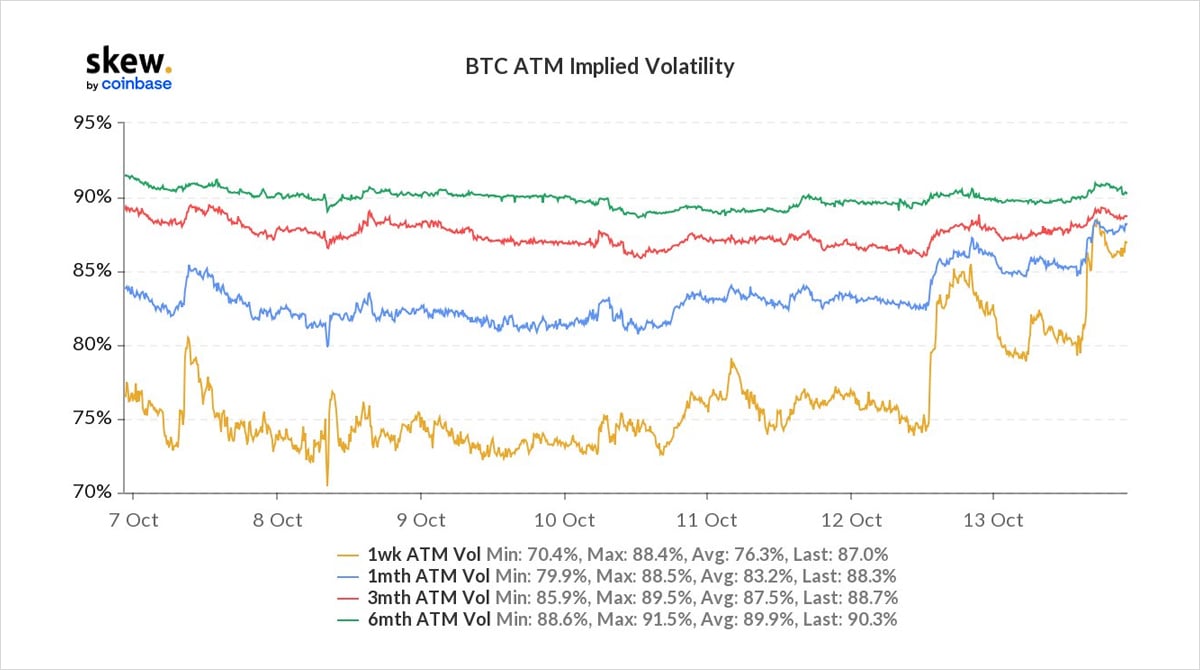

As BTC hovered at 57k, ~1k Oct29 65k Calls & ~700 Oct22 48-53k Puts purchased, driving IV higher ~10%.

The subsequent BTC 54k touch wick was too sudden for large trades, but the bounce encouraged further Call (+IV) buyers.

2) Oct29 65k Call buyer(s) have been active before, but often hidden beneath opposing large flow.

Likewise, ITM Call spreads eg Oct22 52-58k, Oct29 45-55k and directionally opposing Oct29 50-45k and Oct29 55-50k Put spreads.

Frequently below the discussion radar, size building.

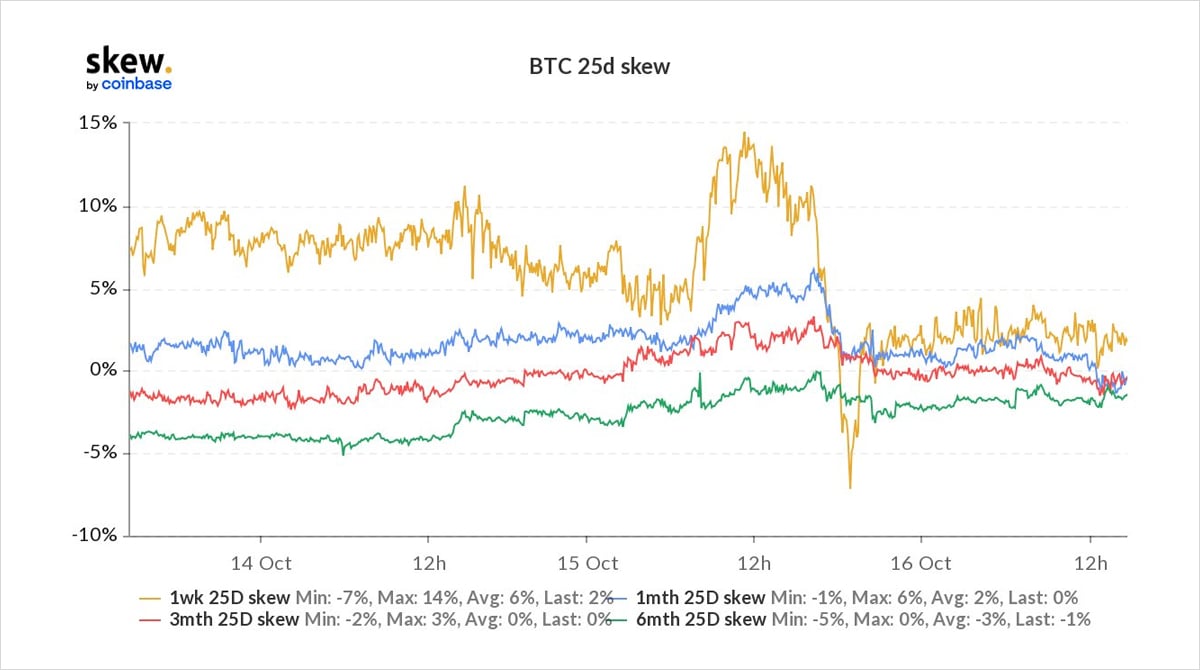

3) Skew is firming for Puts across all maturities, but well within normal trading conditions.

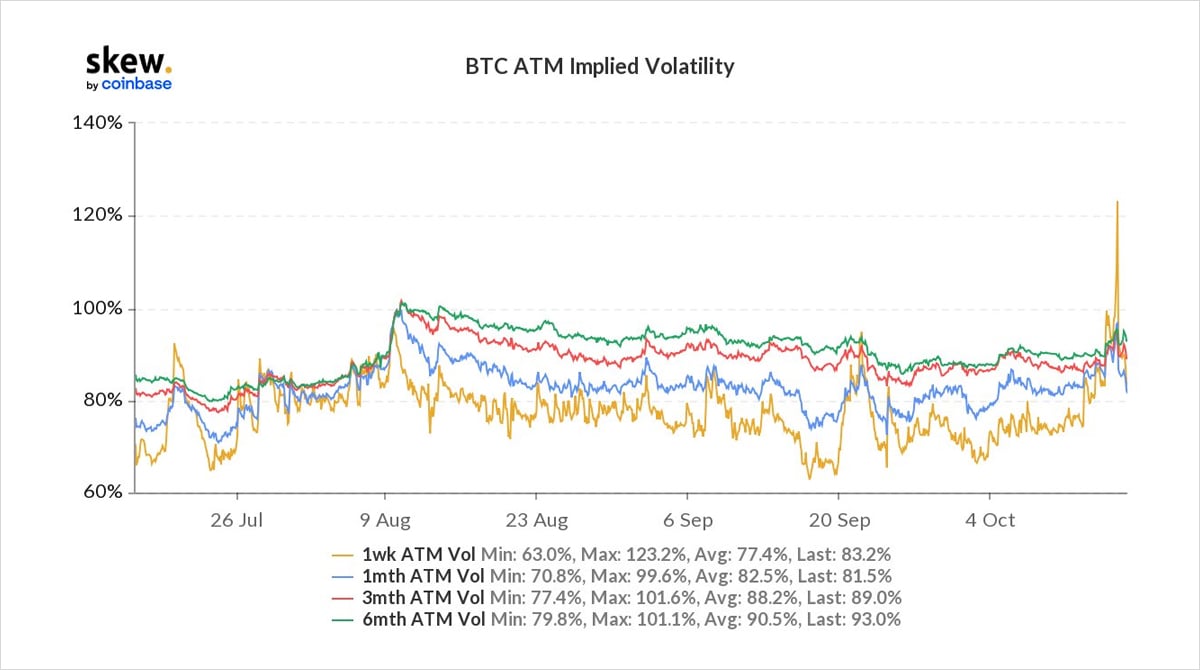

IV is starting to adjust for next week’s BTC futures ETF uncertainty, having firmed on flows, but not crashing back lower (yet), as seen on more recent IV spikes once spot had settled.

View Twitter thread.

October 16

An extremely rare occurrence for Bitcoin is the Event-driven trade, observed as Futures ETF deadlines approached, & then approved.

Options are a perfect tool to employ in these scenarios.

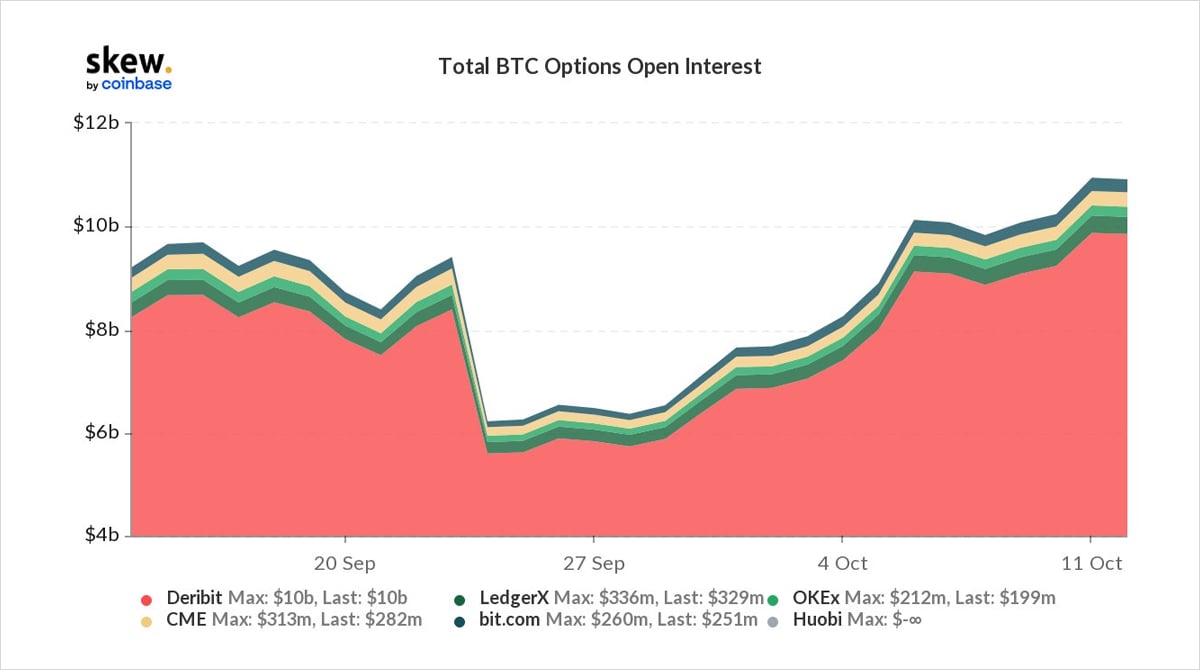

48hour volumes exceeded 4.5bn notional.

Implied Vol ranged 100%.

Let’s Dive in.

2) Up to Tuesday 12th, BTC options flow had been predominantly bullish with large buys of cross maturity Call spreads and Nov 70k+ Calls.

One exception was a 4k buyer of Oct22 46+48k Puts.

The Call spreads and Nov Calls, both accumulated over many days had no material IV impact.

3) Not only was the Put buyer an outlier in Option directional bias, but also a buyer in Oct22, the week of ETF deadlines.

Fund was hedging its BTC AUM vs a large rally & an ETF ‘No’.

Such short-dated Options succumb to large theta so timing is critical.

Visit Investopia here.

4) Market knew ETF binary decision loomed.

Options can be used in one of many ways:

Buy Calls to (add) leverage upside for a YES.

Buy Calls to replace spot under uncertainty.

Buy Puts to leverage downside for NO.

Buy Puts to hedge underlying spot.

Choose Oct22. Gamma payoffs.

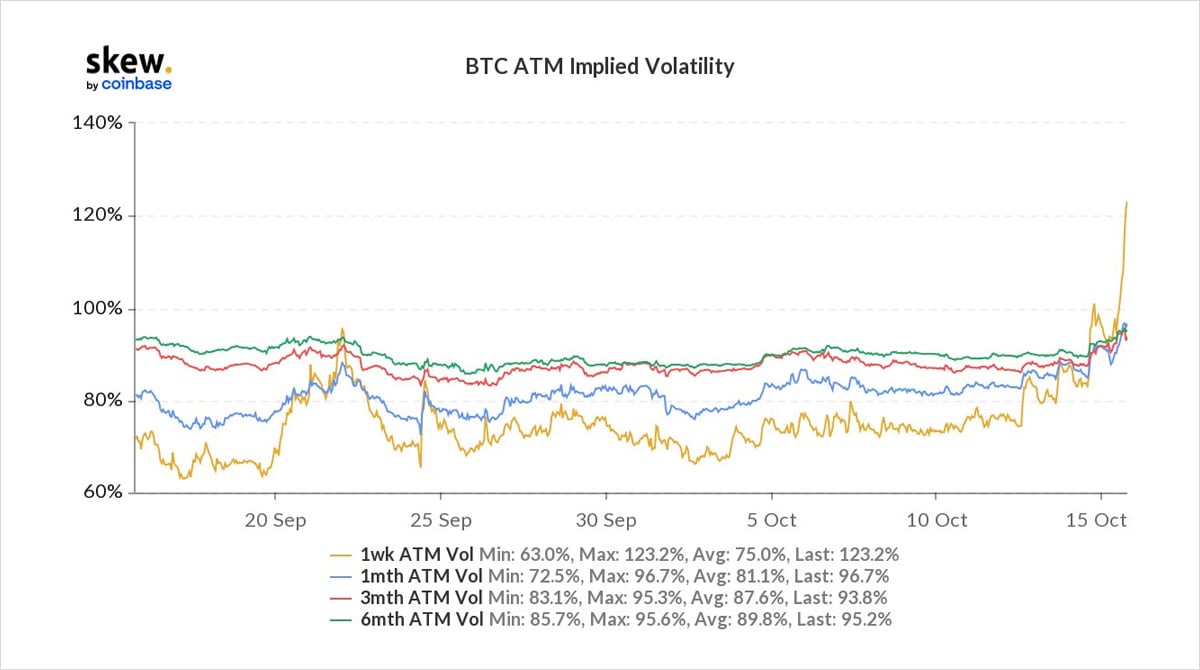

5) So on the 12th Oct, we start to observe increased flows, focussed on gamma+theta heavy Oct22-29th expiries adding to fast money 15th Oct expiry Options.

BTC was 57k. ~1k Oct29 65k Calls, ~700 Oct22 48-53k Puts bought, driving Oct IV 10% higher.

After a drop to 54k. IVs firmed.

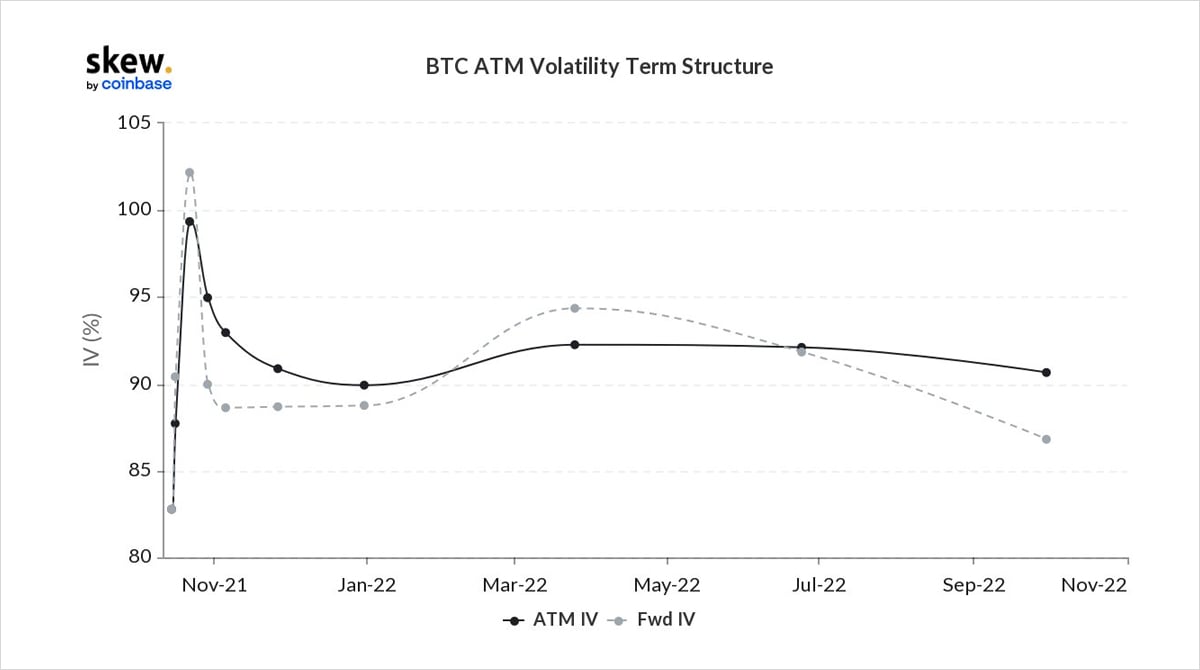

6) The Options term structure illustrates on the 14th Oct the demand for near-dated gamma, but note the 15th-17th Oct expiries discounted.

The belief at the time was the SEC announcements would often come down to the wire, probably Mon18th or possibly on the 15th US post-expiry.

7) Interestingly timed leak (late 14/10) fired speculation.

Before investing in a fund that holds Bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.

Check out our Investor Bulletin to learn more here.

8) BTC spot jumped to 60k, retracing to 59.3k for the 15th Oct expiry.

Some systematic expiry-related Option flow supply briefly dipped IV, but was eagerly snapped up by MMs.

Then buyers stepped in.

Aggressive buying of Oct22+29 60k+62k+65k Calls, 3k+, dominated.

IV surged.

9) Not only were Calls bought but also Oct22+29 Puts(+spreads) in case of a ‘buy rumour sell news’ situation.

Who was going to step in front of these buyers?

MMs added liquidity as best they could, but require 2way flow to be able to provide consistent size.

IV Short-squeeze.

10) Option IV pump, Basis+Futures funding squeeze. BTC rally >61k, with sympathy rally in ETH>3.8k.

But the market wanted ETF confirmation, the primary candidates were the ProShares and Valkyrie ETFs.

Bloomberg ProShares ticker, BTC to 62k, forced Oct16 60k Calls cover at 195%.

11) Evident to Few, was that on each release of dripped information, making the likelihood of approval more probable, the spot market was behaving in a bullish but controlled manner.

But Option IV had reached a point (Oct 120%+) that required severe spot moves.

Time to unload?

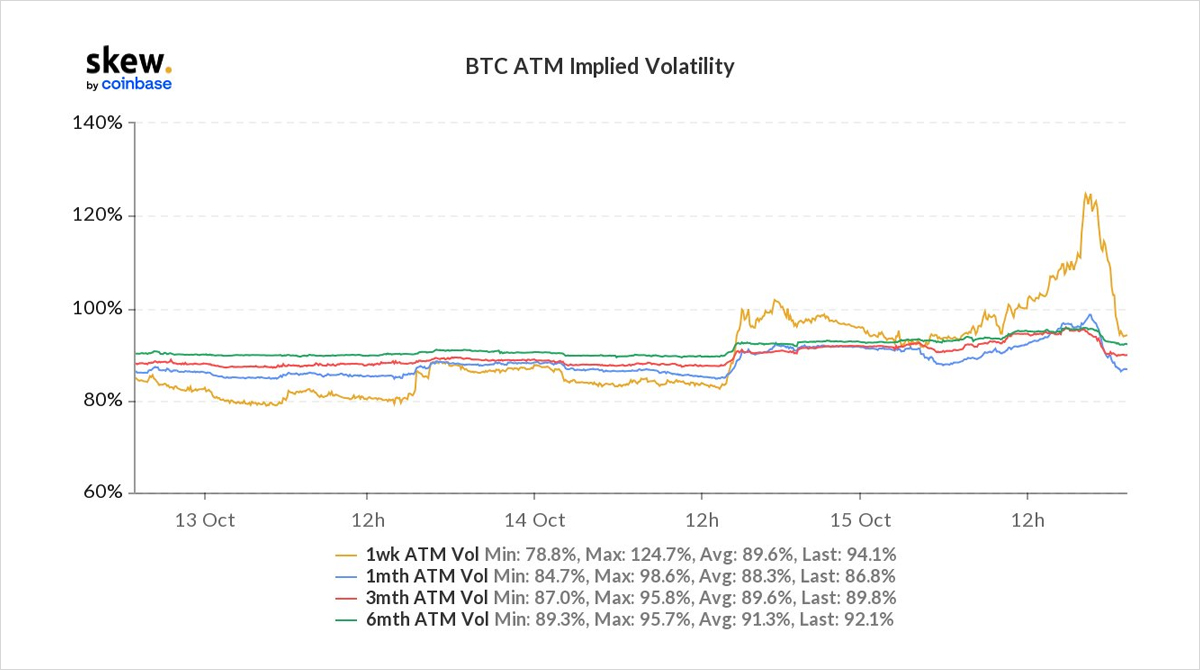

12) Small Nov70k and Oct22+29 ITM 50-60k Calls came first, then an onslaught of Puts, including the large Fund Oct22 46+48k Puts, other Oct22 52-60k Puts (fresh & existing OI dumped) and Put spreads, accumulated over the week but sold in large blocks, hitting the 54-60k strikes.

13) Profits taken on some OTM Calls, but few Call spreads. Upside Bias remains.

Put Skew took a hit with flows, but now is fairly flat, which often happens at higher Vol levels.

Market feels positioned short-term positive but awaiting to see whether ETF take-up is substantial.

14) Proshares & Valkyrie ETFs approved.

BTC wicked.

Expectations fulfilled. Settled.

Longer-term IV barely participated.

Short-term gamma/Optionality play, with only the maturities within 10days still evidencing the long Calls still held and market uncertainty (now much calmed).

View Twitter thread.

AUTHOR(S)