After several months of a cooling implied volatility, derivatives markets saw a jolt this week in reaction to UST’s dramatic depegging event and the subsequent crash of its equity token LUNA.

The effects of the crash were felt across a crypto market that was already reeling from a sharp drop in price towards the end of last week. The drop in the BTC price happened in a very volatile manner. Whilst the move lower was somewhat priced in by the put-call skew, the volatility with which it happened was not, as highlighted by our previous report.

Although outright levels of vols spiked higher to reflect the increase in delivered vol, the put skew spiked to even higher levels. This would imply that either the market is correctly bracing against a further price drop and that implied vol is primed to spike again, or that the selloff has already played out and the current richness in puts is too expensive.

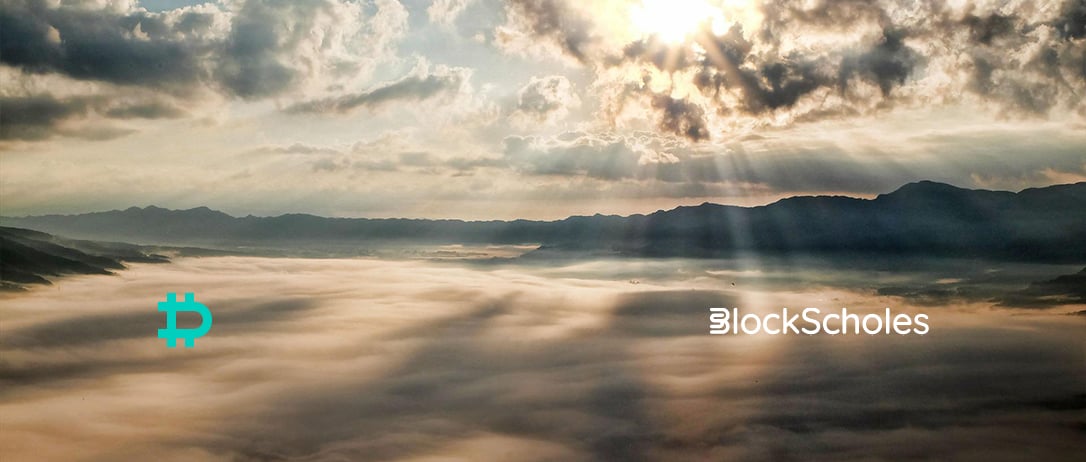

Figure 1 Bitcoin’s implied yields at standard tenors

On Monday, bitcoin futures recovered from last week’s drop to push near-dated implied yields positive again, with the 7-day annualised yield trading at 3.2%. This remained higher than both the 14-day and 30-day yields, at 1.1% and 2.1% respectively, for 48 hours, representing a short-lived inefficiency in the market.

The rally was quickly dashed after UST’s depegging event resulted in both the 7-day and 14-day yields trading at a significant discount to spot prices. The continued compression across all tenors reflects a pessimistic forecast by the market and is far from the large positive implied yields historically enjoyed by bitcoin futures.

Figure 2 Bitcoin’s implied ATM volatility at standard tenors spiked this week

We previously highlighted the strange dislocation between a falling ATM implied vol and the increasingly high relative value of low-strike puts compared to similarly high-strike calls. The high prices assigned to downside protection made ATM volatility appear surprisingly cheap, even when the stagnant spot price was taken into account.

Figure 3 ATM implied vol at 30-day tenor (blue) and a 30-day rolling estimate of delivered volatility (grey)

However, this week ATM volatility spiked heavily in reaction to the crash, with onemonth tenor vol at 125% on Thursday and volatility across all tenors reaching their highest levels this year. In the days since, ATM implied vol has settled below 75%. It may be that, as the dust settles following LUNA’s crash, the market has judged that the immediate risk of contagion to other cryptoassets is limited. But as the volatility of implied vol has increased and both wings of the volatility smile grow steeper, we may see ATM continue to drift higher to reflect the market’s uncertainty about the direction of spot price.

Figure 4 Ratio between the implied vols of 180-day 25-delta puts and 25-delta calls

Current put-call skew levels highlight the market’s uncertainty too, which now prices the implied vol of 25-delta puts at 1.1 times that of 25-delta calls, much higher than the 1.04 we previously reported as strangely out of step with ATM volatility. This means that, despite rising significantly, the current ATM vol is at odds with the put-call skew just as it was before the crash. Either at-the-money vol is still trading at a discount or the market is pricing downside protection too high in anticipation of a further drawdown.

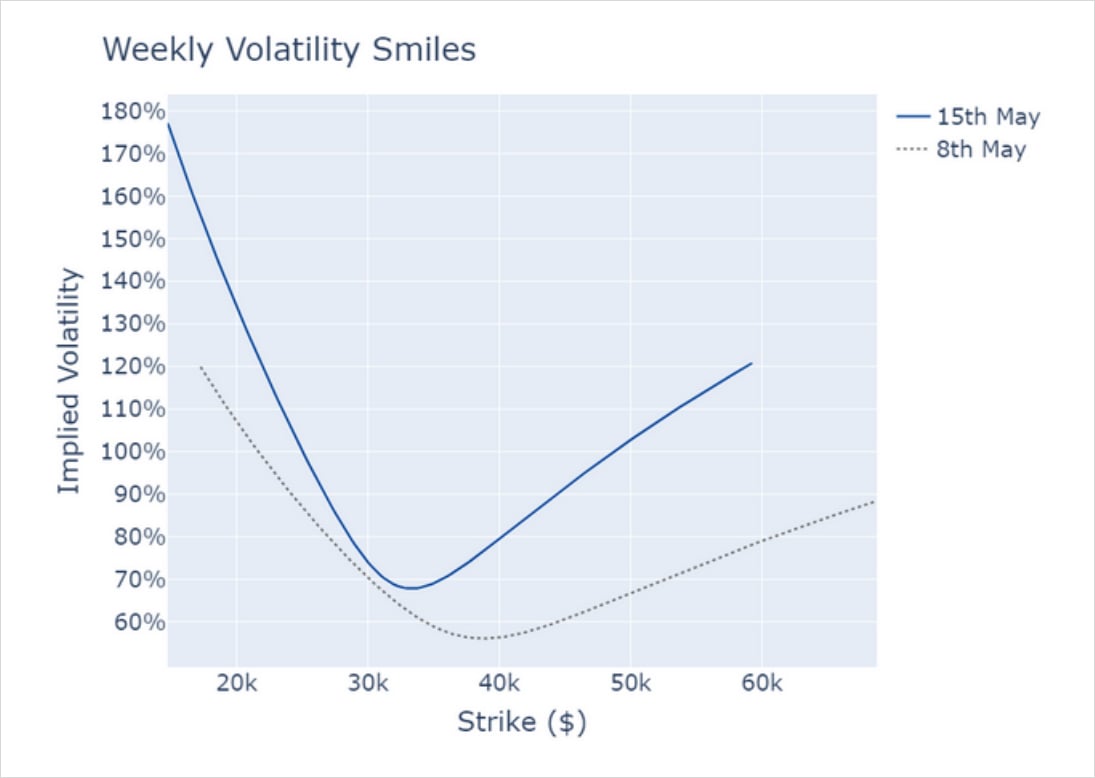

Figure 5 Volatility smiles from 15th May (blue) and the 8th of May (grey)

This strange behaviour is clear when considering the volatility smiles from today and one week ago (after last Thursday’s crash, but before this week’s UST depegging). It shows that the increase in PC skew has occurred in spite of much higher premia being assigned to OTM calls. Should the market be vindicated in its high valuation of puts with a repeat of last week’s price action, we may see another increase in the implied vol of options struck above the ATM, and particularly in deep OTM calls.

Whilst billions of dollars in market cap were wiped from the market, UST’s depegging event has not killed interest in cryptoassets entirely. However, it may have done lasting damage to the DeFi sector, as investor confidence in the space has been significantly eroded. This was more evident in ETH’s spot and derivatives markets, as the Ethereum network hosts the most popular DeFi projects. Further high-profile failures in DeFi protocols are likely to continue to send shockwaves through the crypto market, but may allow protocol assets with solid fundamentals to be found at a discount.

This week has made it clear that bitcoin is not immune to events in the DeFi space. The derivatives market seems confident that the shockwaves of LUNA’s crash have largely played out, but still braces against further drops in BTC’s price. The DeFi ecosystem’s continued growth brings with it a more deeply interconnected network of protocols. This time around, Terra was sufficiently isolated from other projects for the space to absorb the shockwaves. But as the composability of protocols increases, so too does the systemic risk to the wider crypto industry.

AUTHOR(S)