Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

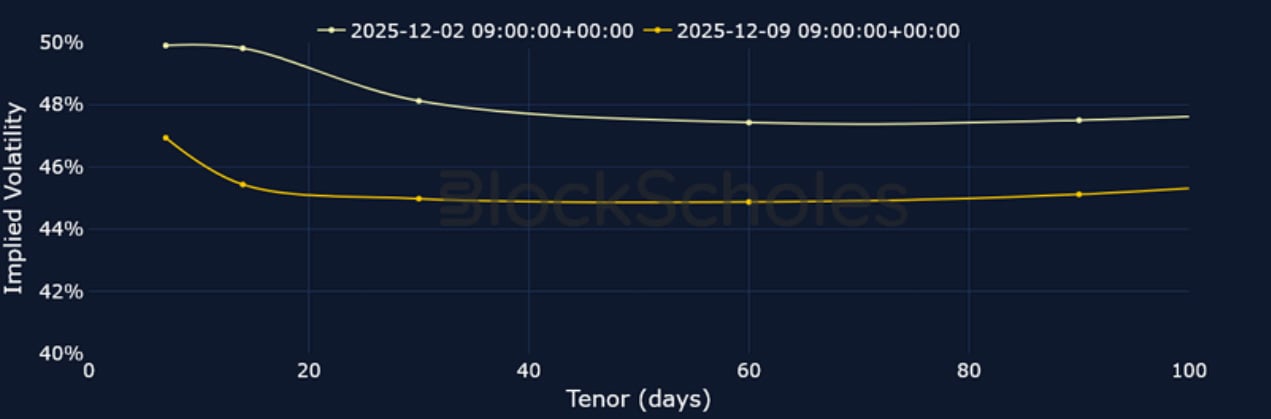

After a modest and short-lived inversion in the term structure of ATM volatility, implied vol levels have dropped off heading into the FOMC’s final meeting of the year. According to Fed Funds futures contracts, markets currently assign a 90% probability of a 25bps cut at that meeting. The drop in forward looking vol expectations is not a phenomenon unique to just BTC and ETH however. The VIX index is close to its year-to-date low, while the MOVE index is equally close to its 2025 low.

The past week has also seen a more bearish positioning in ETH leveraged swap contracts as well as futures prices relative to BTC. Funding rates for BTC have mostly been neutral-to-modestly positive over the past week, while ETH funding rates fell to -0.01% over the weekend. ETH short-dated futures prices also traded below spot price – a sign of bearish positioning and something we are yet to observe for BTC so far this month. In options markets, ETH’s vol smile skew temporarily tilted towards calls on Dec 4, though it is now firmly tilted back towards puts.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

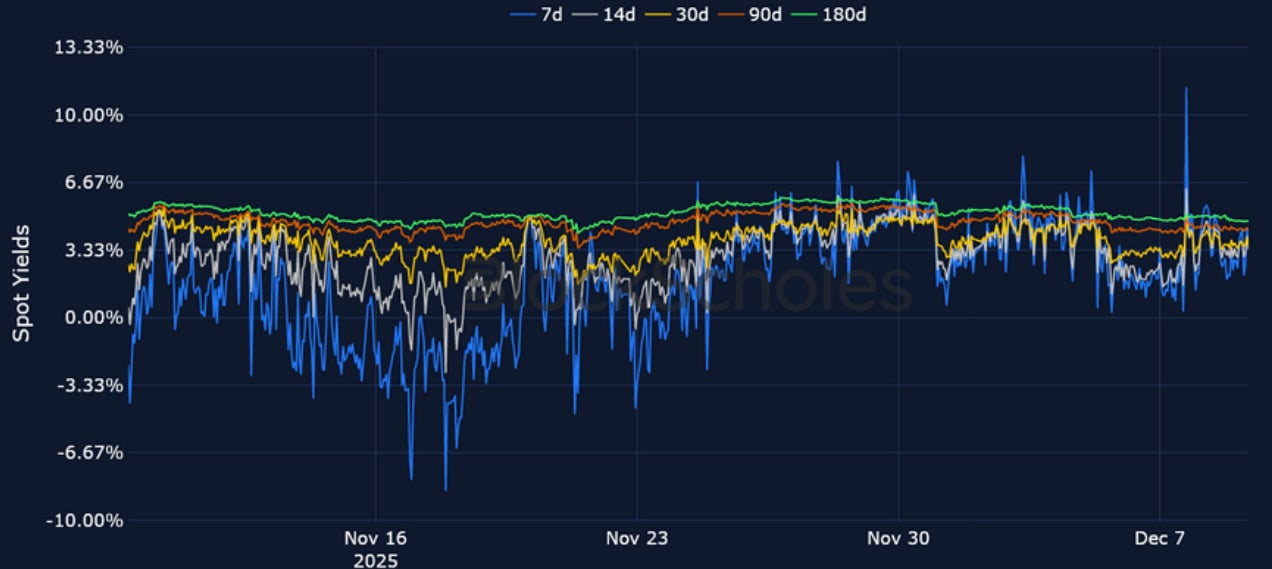

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

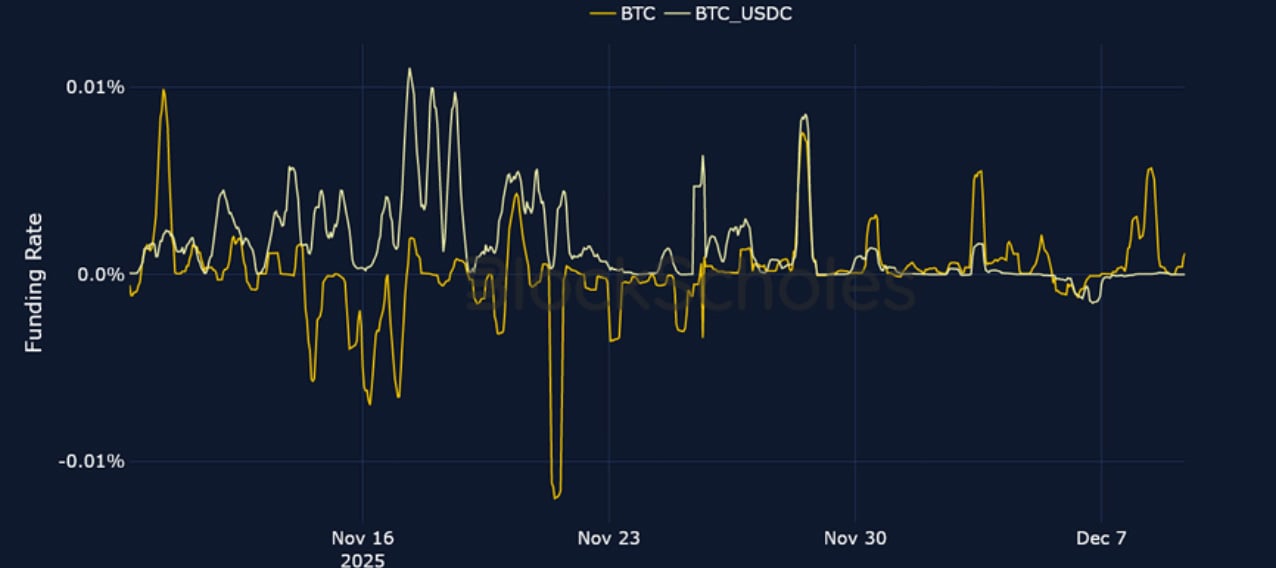

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates saw a modest increase on Dec 8, 2025 coinciding with an intraday high of $92.1K, though quickly fell back down as spot price dropped below $90K.

ETH FUNDING RATE – In contrast to the flat-to-modestly positive funding in BTC, ETH funding rates fell to -0.01% over the weekend.

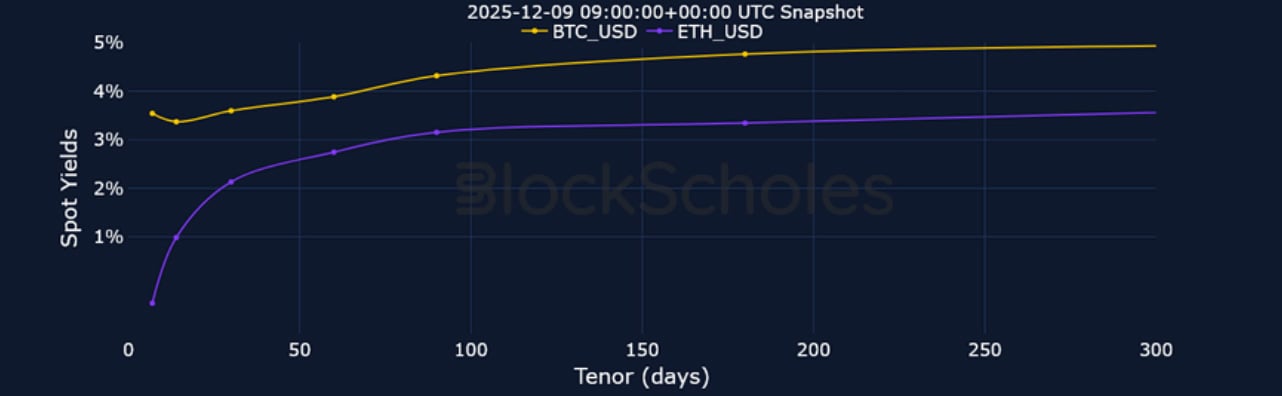

Futures Implied Yields

BTC Futures Implied Yields – The extreme bearish positioning of November , which saw futures prices trade below spot, has yet to occur in December.

ETH Futures Implied Yields – Short-tenor ETH futures traded at a sharp discount to spot in the first half of the weekend when ETH fell as low as $2,900.

BTC Options

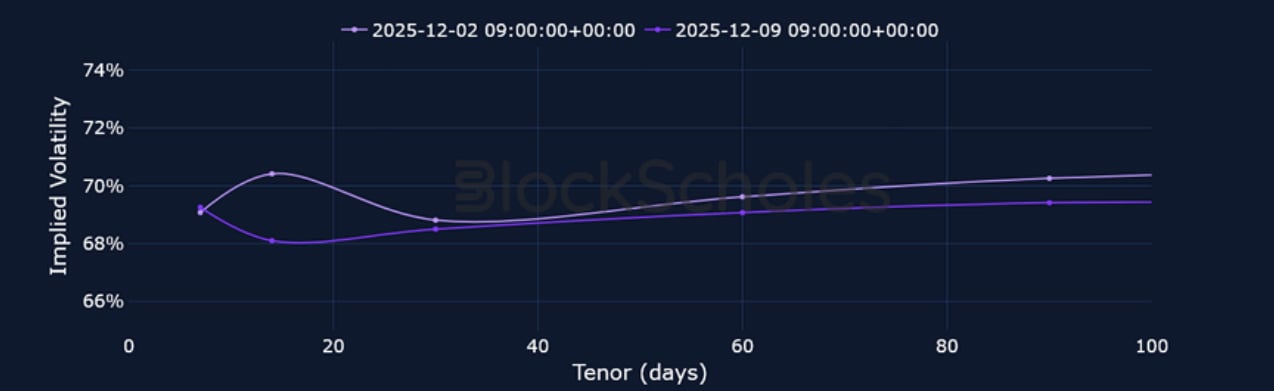

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor IV has compressed ahead of the FOMC meeting, following a short-lived inversion earlier this week.

BTC 25-Delta Risk Reversal – BTC options markets are not yet pricing in for a ‘Santa rally’ as skew across the term structure is firmly tilted towards puts.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure briefly inverted in the latter half of the weekend, but has since fallen alongside BTC IV.

ETH 25-Delta Risk Reversal – After temporarily skewing towards calls for the first time since late October, short-tenor vol smiles now price in a 6% vol premium for OTM puts relative to calls.

Market Composite Volatility Surface

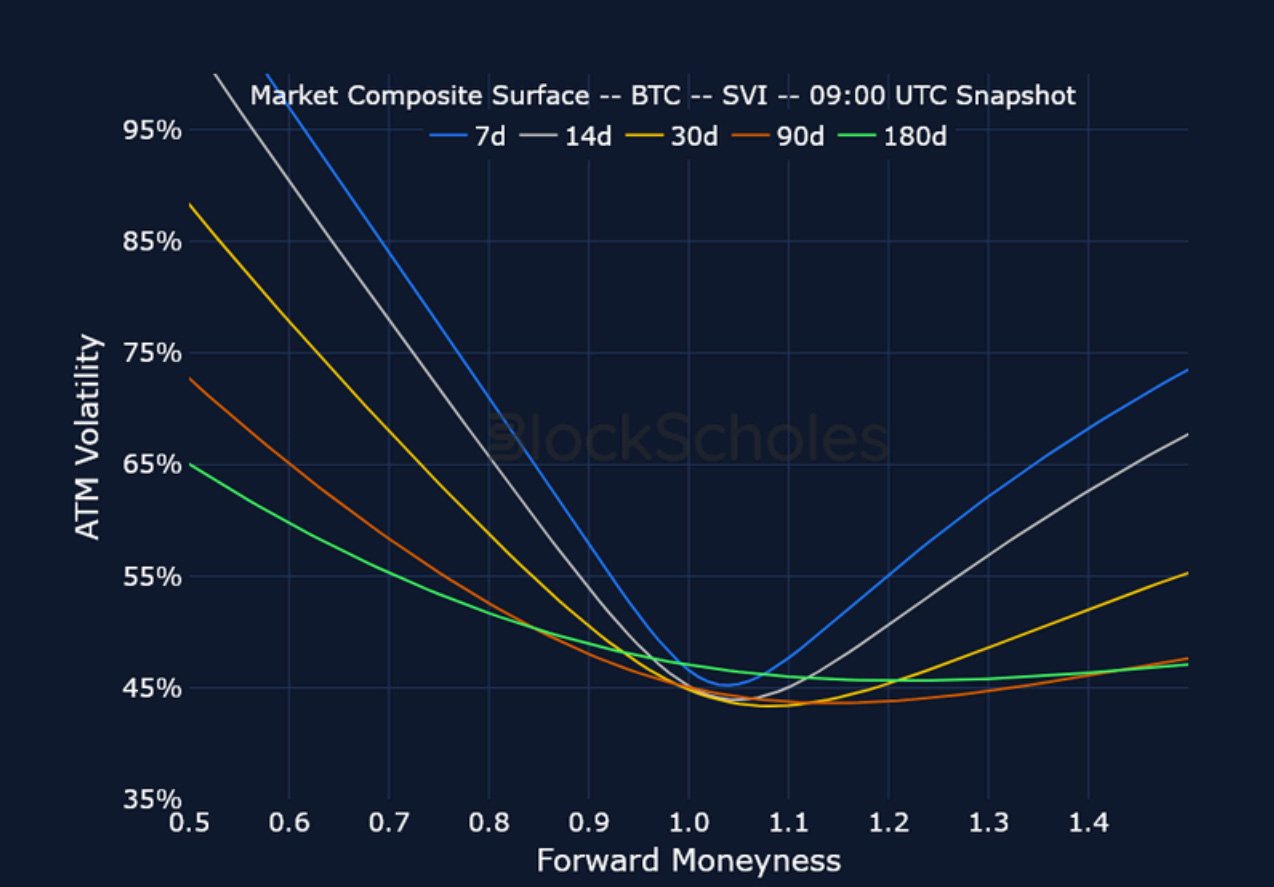

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

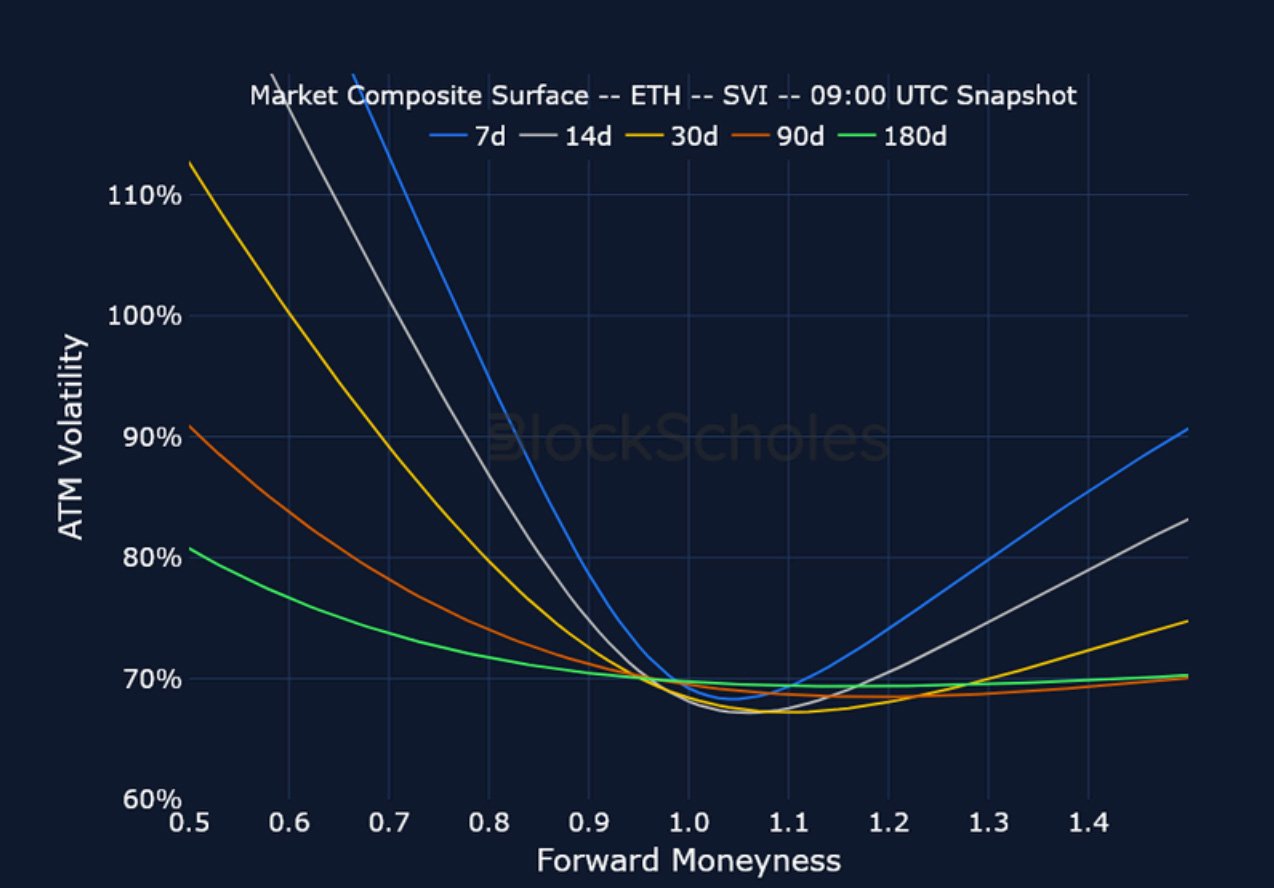

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

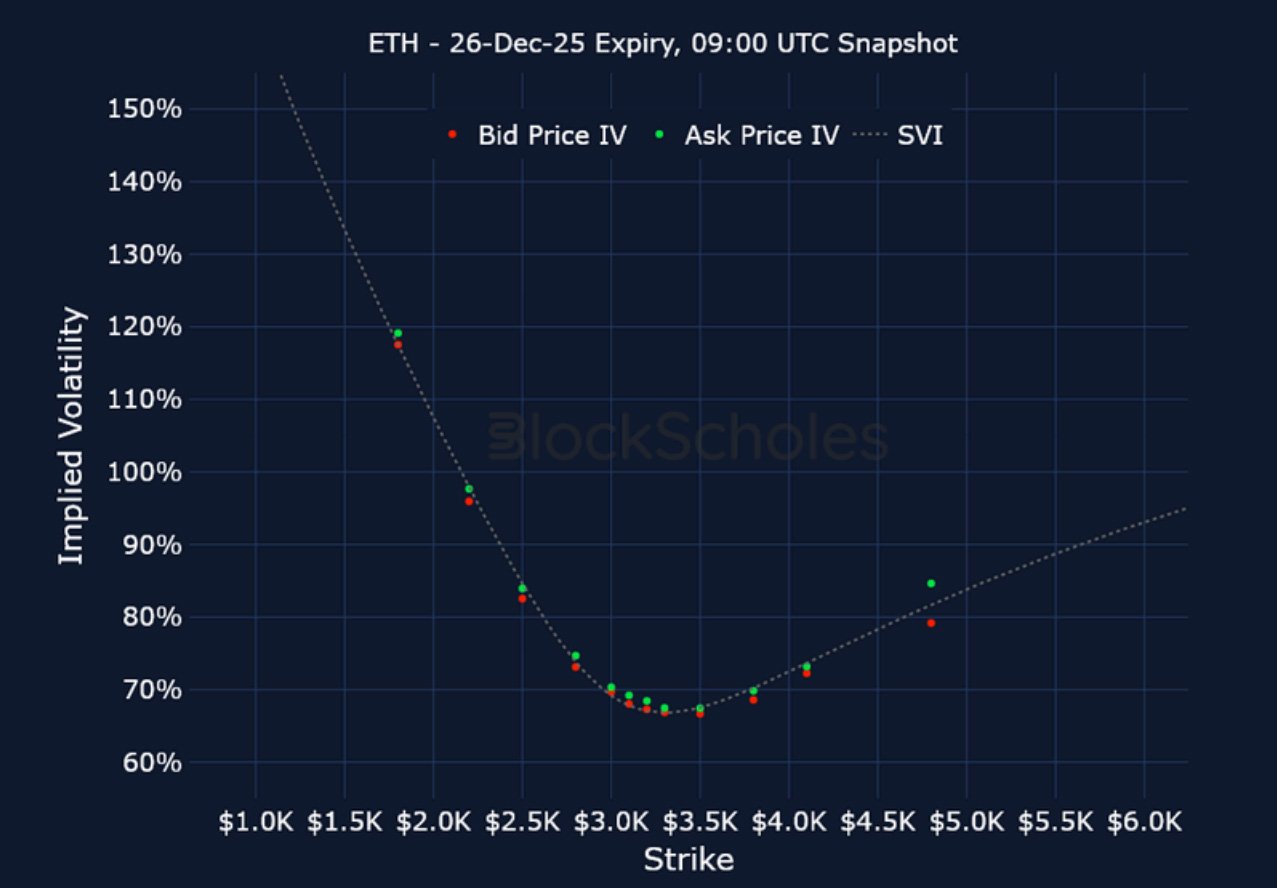

Listed Expiry Volatility Smiles

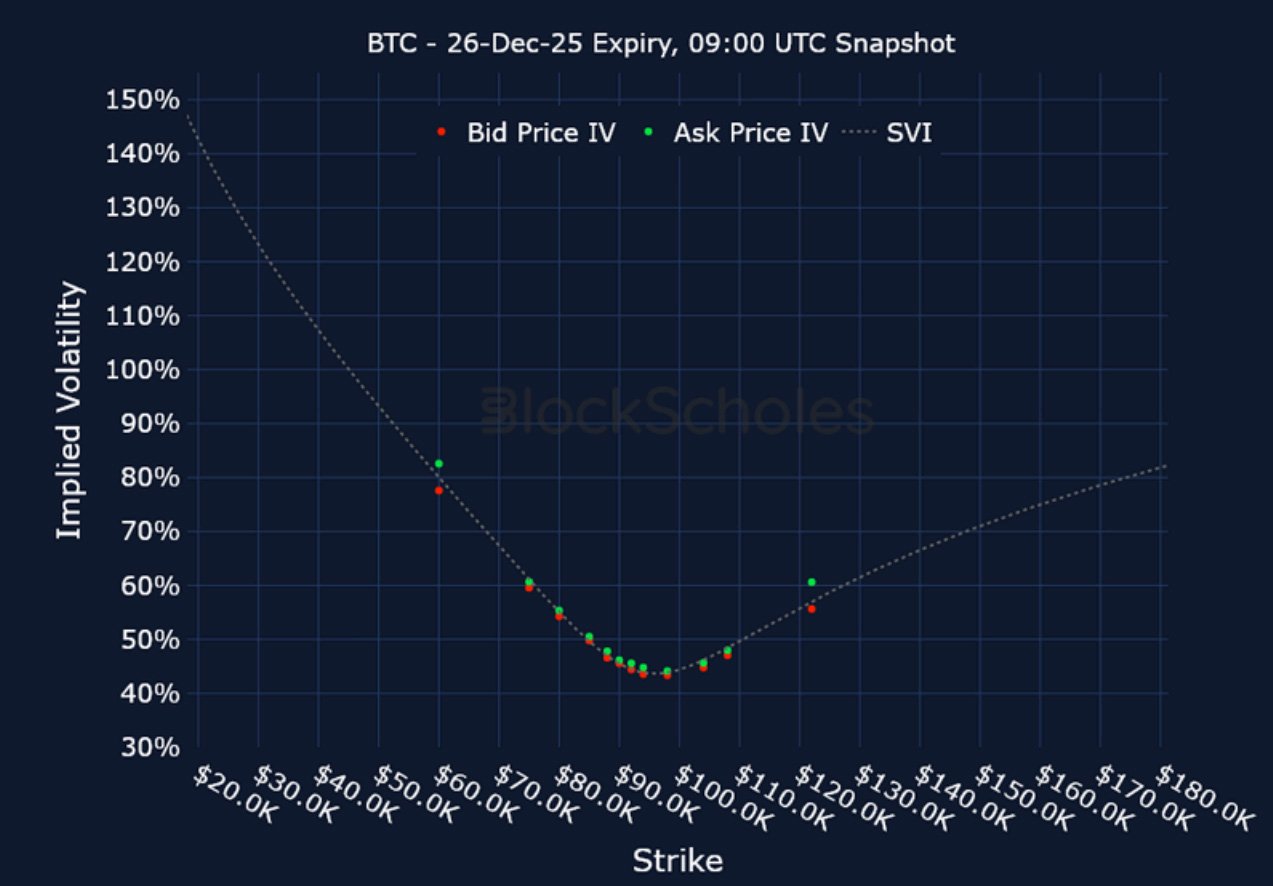

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

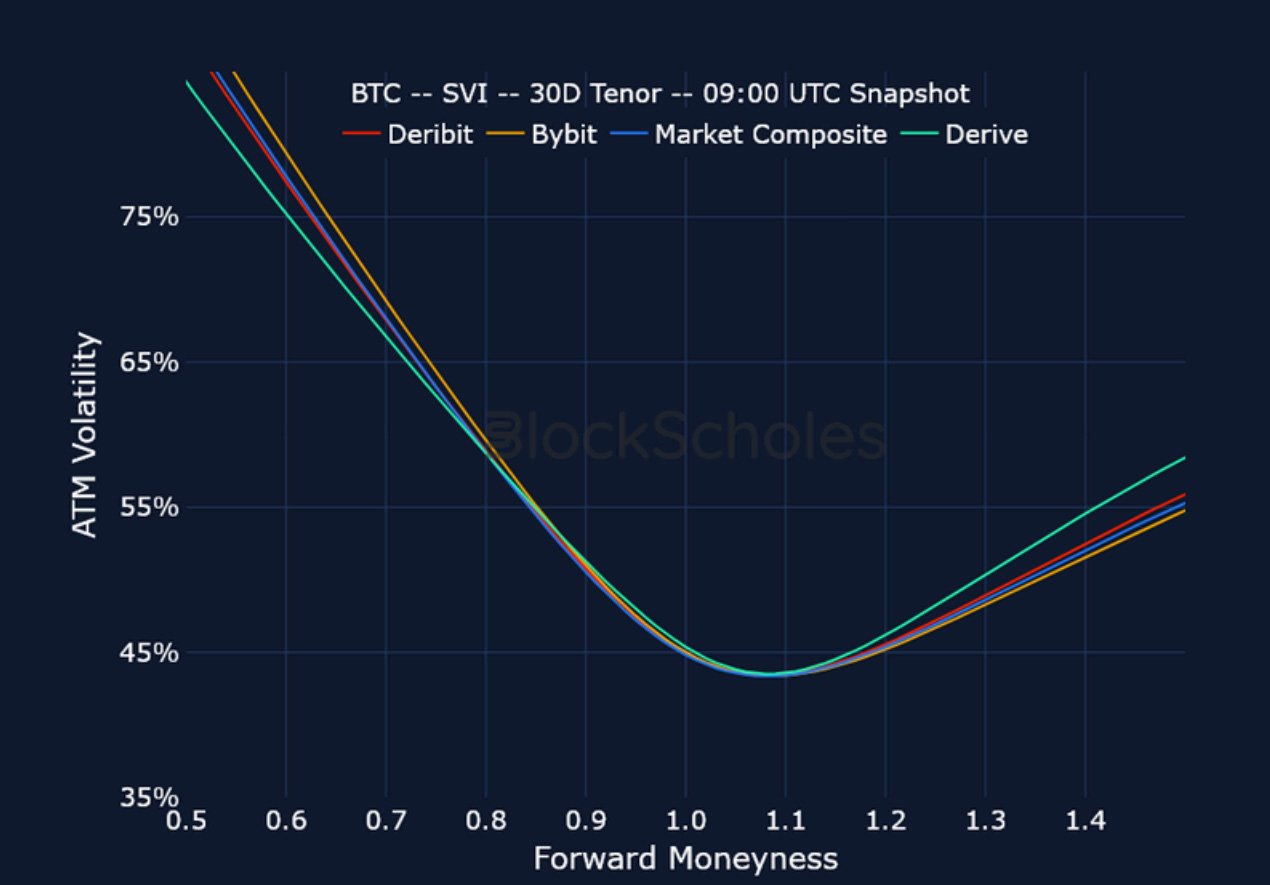

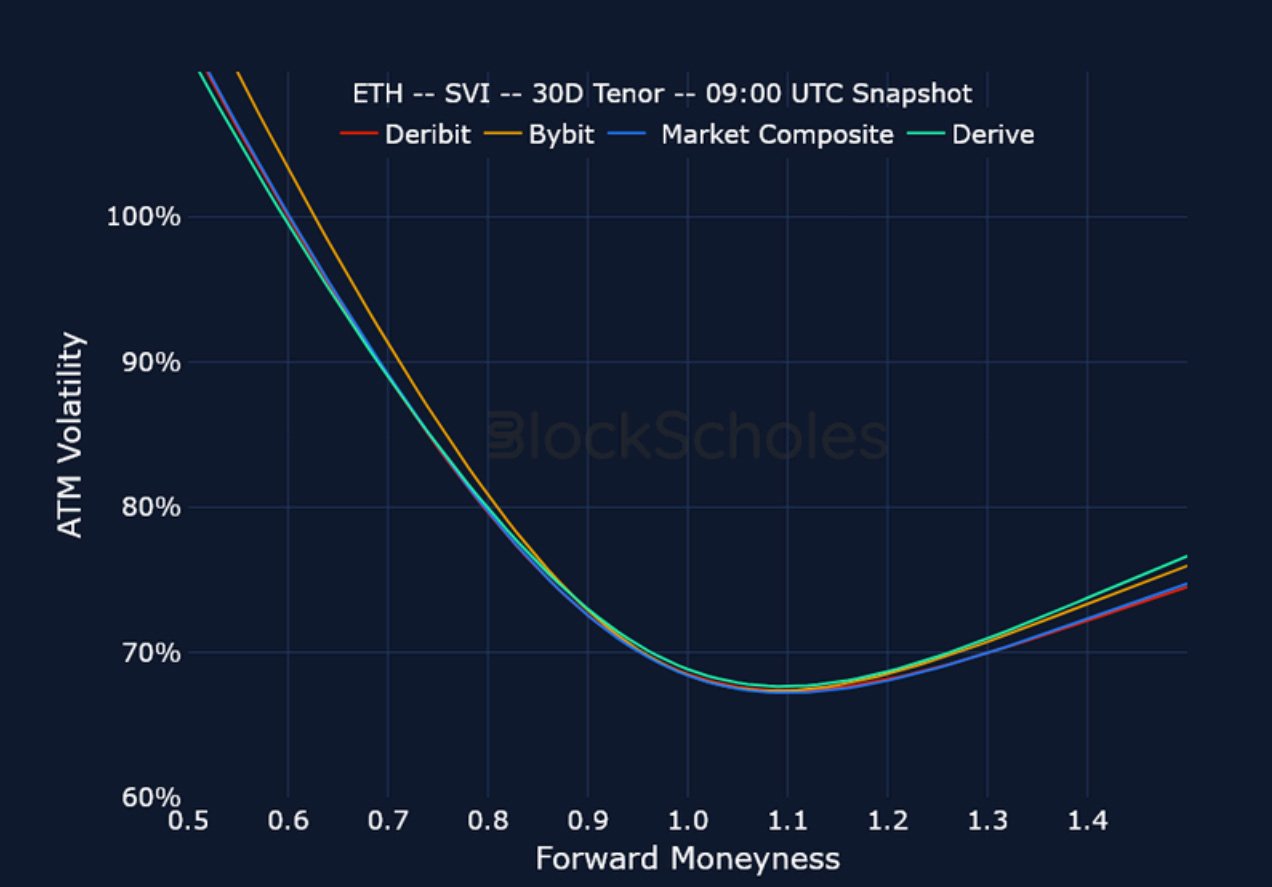

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

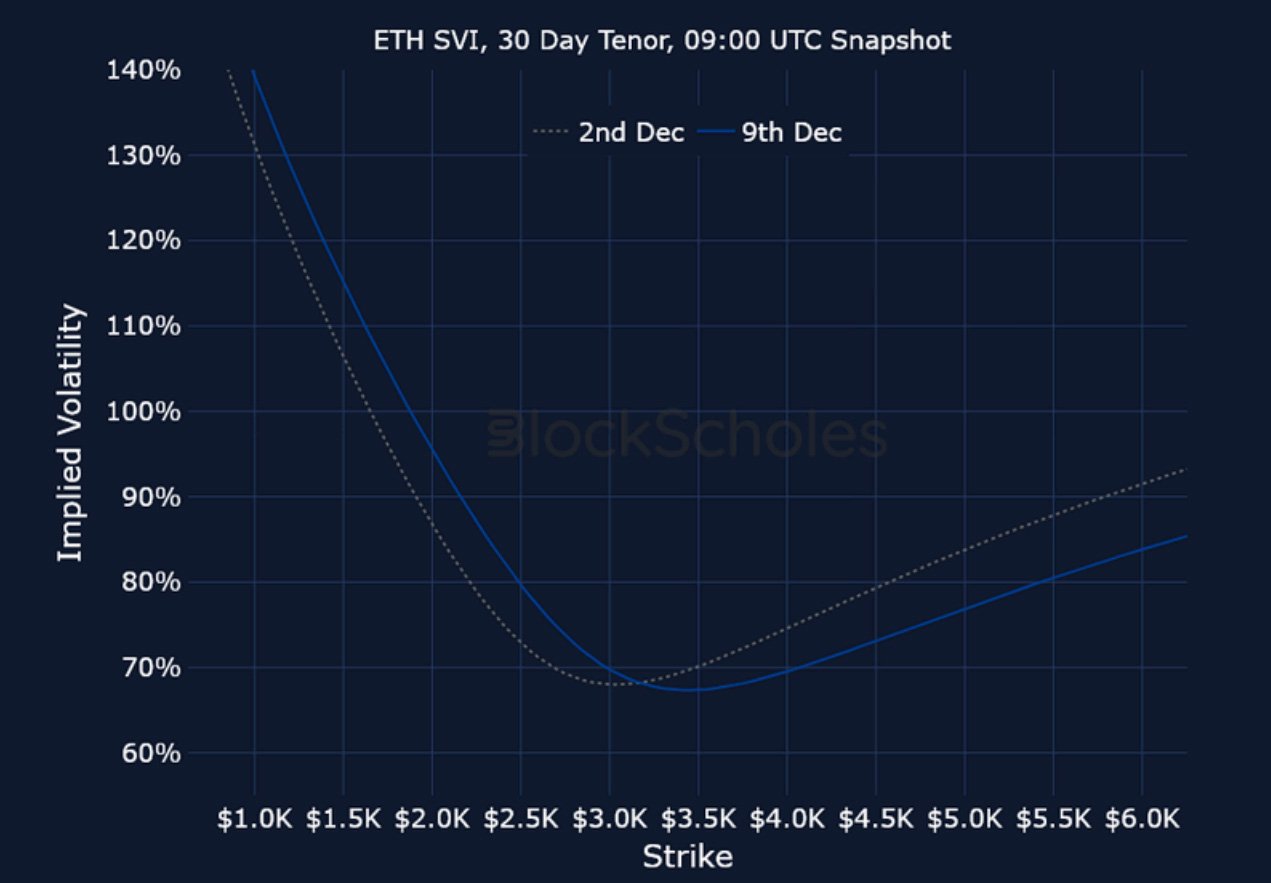

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

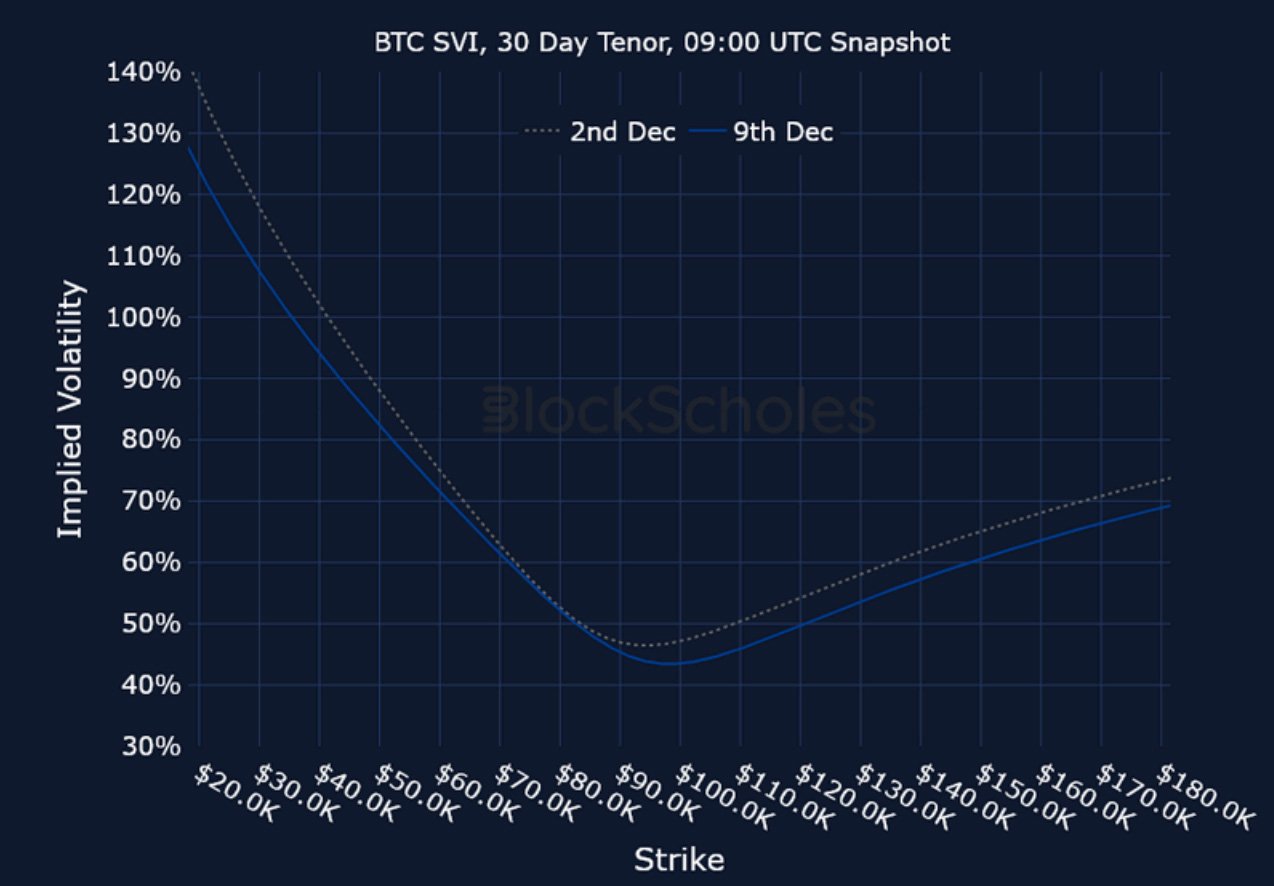

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)