When a hedge leg is added to an option structure in a block trade, Deribit now reduces the trading fee for the hedge leg to zero until the end of 2026. This applies to block trades initiated through the Deribit Block RFQ interface, and also to block trades executed elsewhere, including third party block trade partners.

With the exception of a few delta neutral structures, most option structures will have an associated delta, and if the trader chooses to do so, they can add a hedge leg to the block trade to hedge this delta. The hedge leg can use either the perpetual or a dated futures contract, and it is this futures leg that has the fee waived.

Are there any limits on the fee amount waived?

There are no size limits on the fee waiver, however Deribit will only waive the fee on any portion of the hedge leg that hedges the delta of the traded option structure. For example, if the options have a calculated delta of +10, then the fee will be waived on any hedge leg with a delta of up to -10. Any under hedge, e.g. -5 deltas, would still have the entire fee of the hedge leg waived. However, if the trader chooses to over hedge, with for example a hedge leg delta of -20, Deribit will only waive the fee for the portion of the hedge leg that is hedging the delta of the options, which in this case would be 50% of the hedge leg.

Why make hedge legs fee free?

The hedge being on the same platform as the main position is beneficial for both traders and the platform. It helps with both capital efficiency and risk management, because if a hedge leg is placed on a separate platform, the trader will need to constantly monitor their margin requirements and collateral levels on the two separate venues, and funds may need to be moved between the two venues when prices move. Alternatively, with both the main position and the hedge leg on the same platform, the risk of the main position and the hedge are at least partially offset, and therefore total margin requirements are likely to be considerably lower. There is also no need to move funds between platforms to balance PNL between the hedge and the main position.

To make the experience of placing both the main option trade and the hedge leg on the same venue as seamless and attractive as possible, Deribit has decided to waive the fees for hedge legs that are executed as part a block trade.

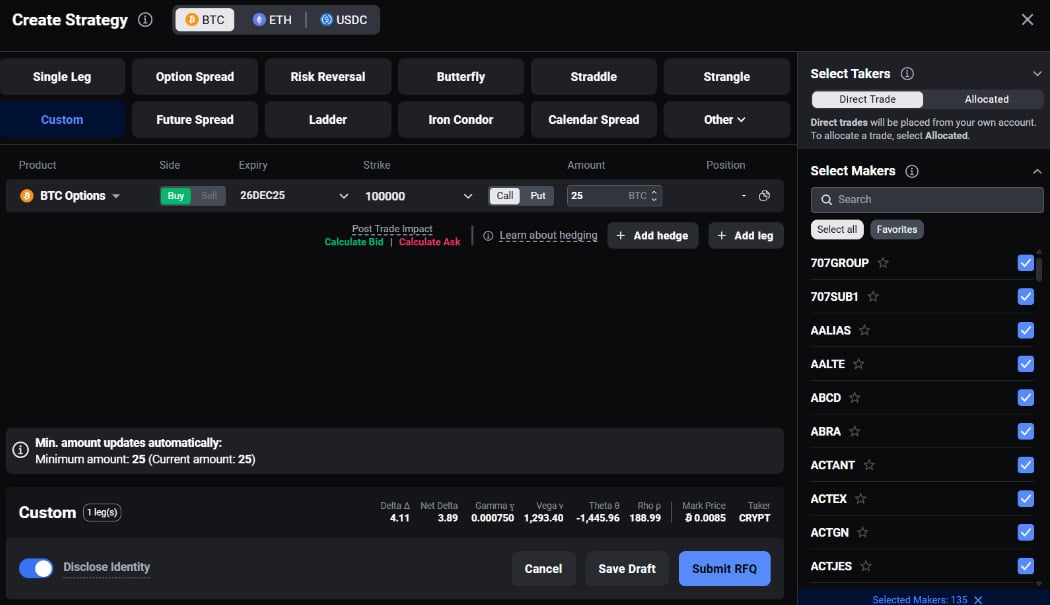

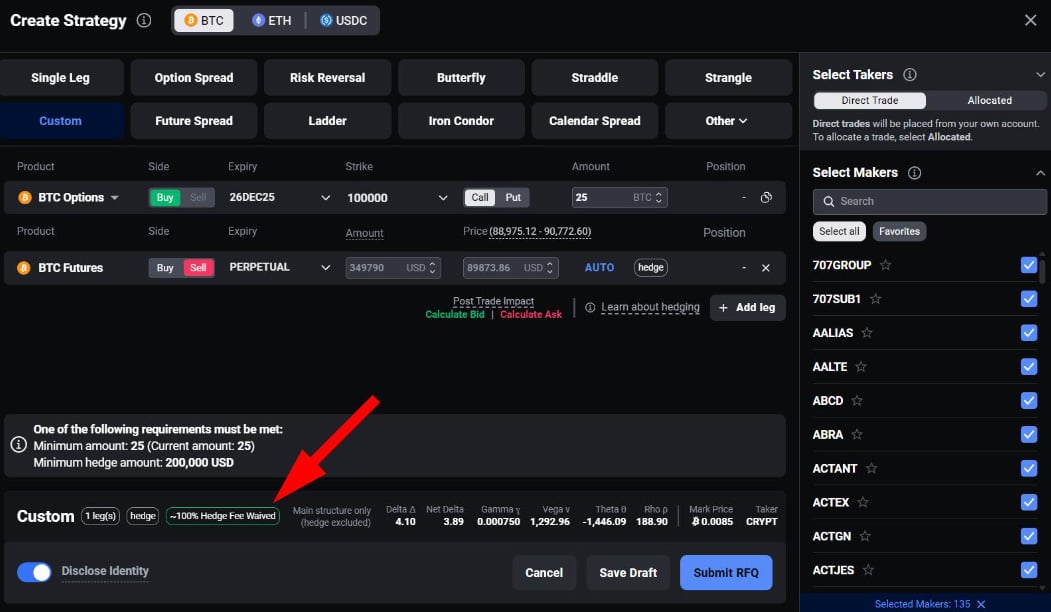

How does this look in the Deribit UI?

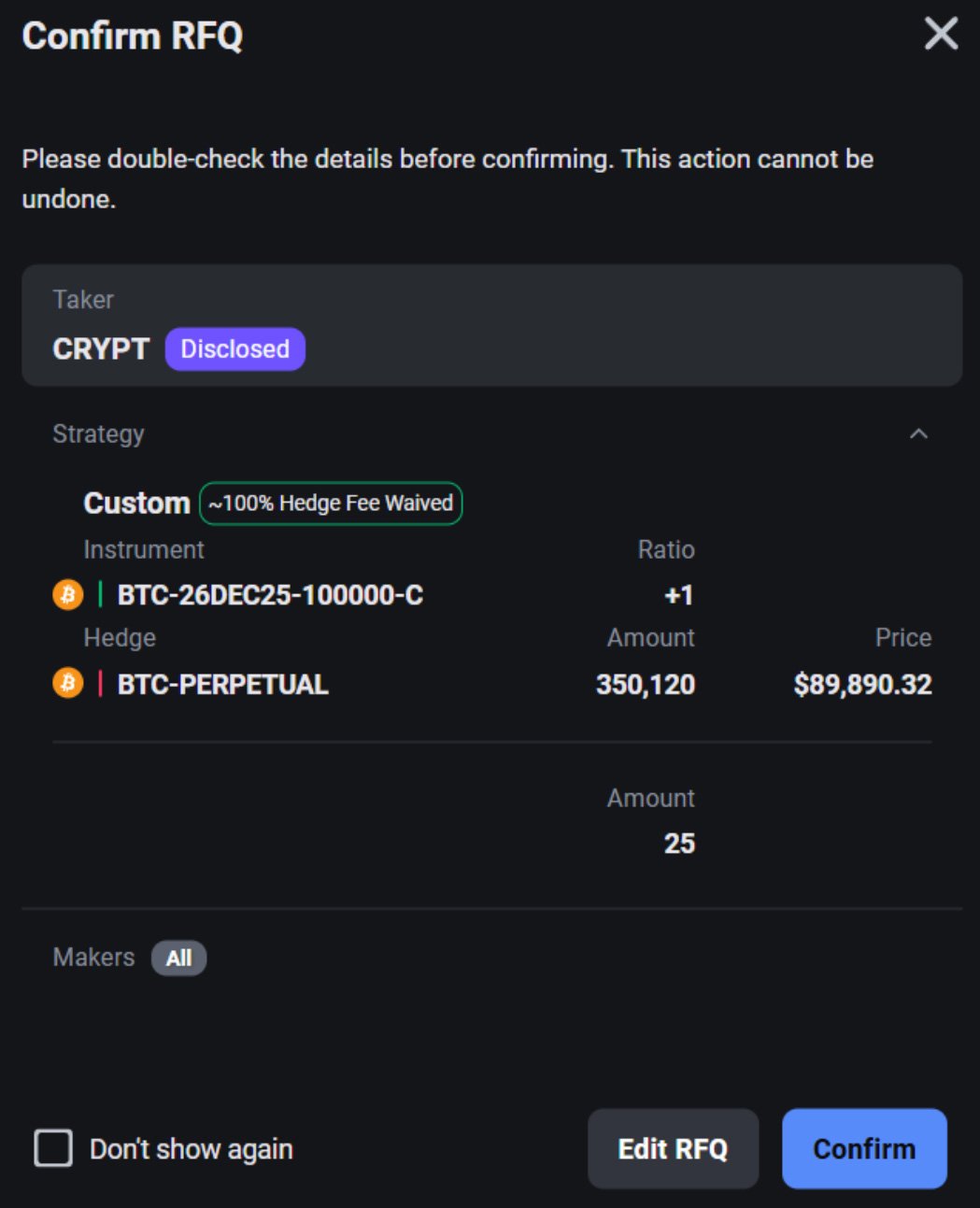

In the Deribit Block RFQ interface, the fee waiver is indicated visually with a tag on both the RFQ creation screen, and on the RFQ confirmation screen.

This screen shows the Block RFQ strategy creation screen where a trader is creating a Block RFQ for a BTC call option. At this stage they have not added any hedge leg.

If they then click the “Add hedge” button, a hedge leg on the BTC perpetual is added. By default the amount and price of the hedge leg are automatically filled so that it perfectly hedges the delta of the option, as calculated by Deribit. This can be changed if the trader prefers though.

As can be seen by the “100% Hedge Fee Waived” tag, when the hedge leg perfectly hedges the delta of the option, 100% of the fee is waived.

This detail is also included on the confirmation screen.

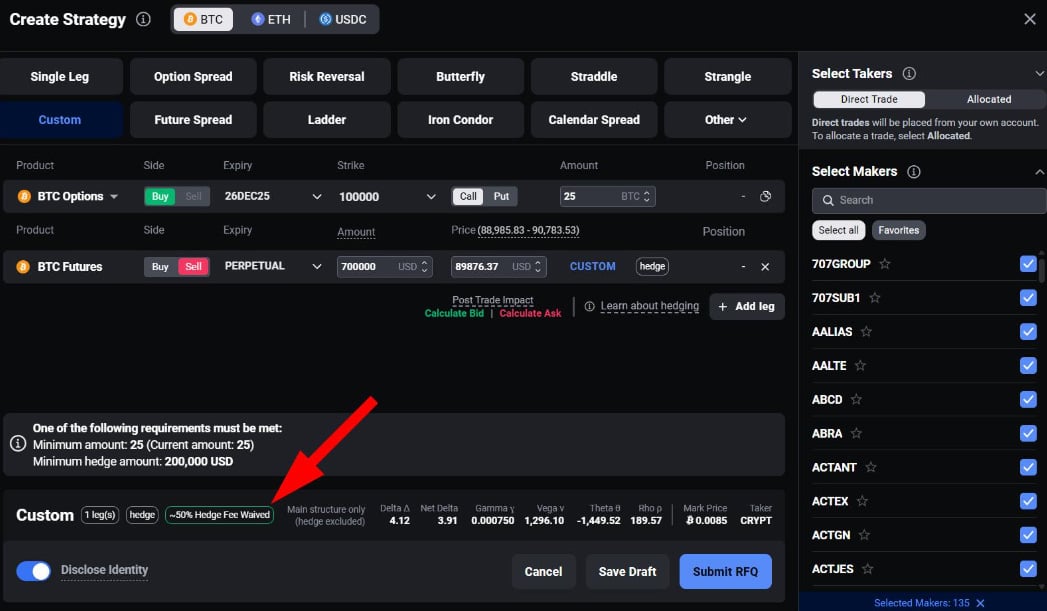

In the following screenshot, the amount of the hedge leg has been roughly doubled, so that the hedge leg is actually hedging double the amount of delta that is coming from the option.

Deribit will still waive the fee on the portion of the hedge leg that is hedging the option delta, however, because the hedge leg is double the size it needs to be to hedge the option delta, this results in only 50% of the total hedge leg fee being waived. This is indicated by the tag changing to “50% Hedge Fee Waived”.

Summary

Deribit has now made it more attractive than ever to add hedge legs to option structures when executing via a block trade.

The ability to cheaply add the hedge leg on the Deribit platform means traders can avoid the extra work of maintaining linked positions across multiple venues. They can also benefit from the reduced margin requirements this is likely to bring.

Try it out now in the Deribit Block RFQ interface here.

AUTHOR(S)