Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

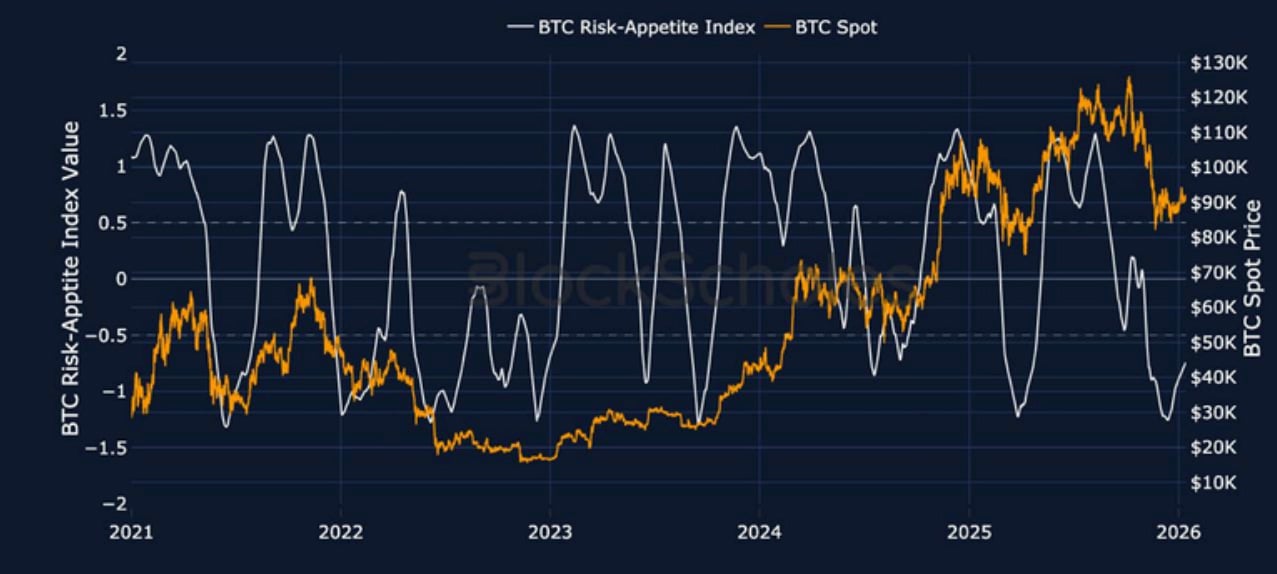

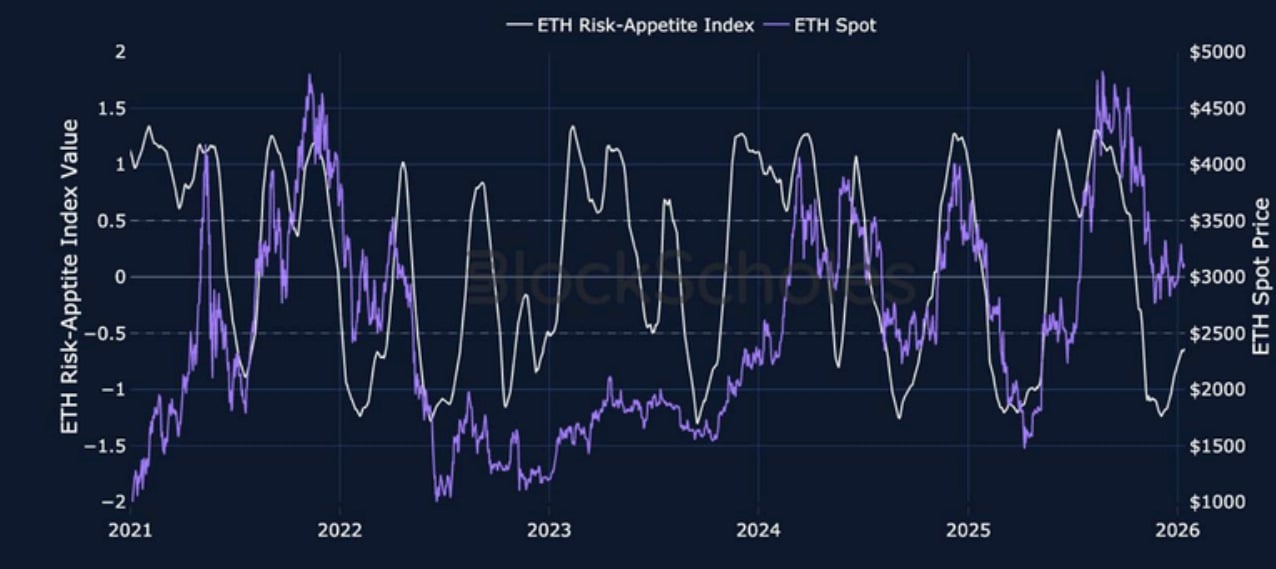

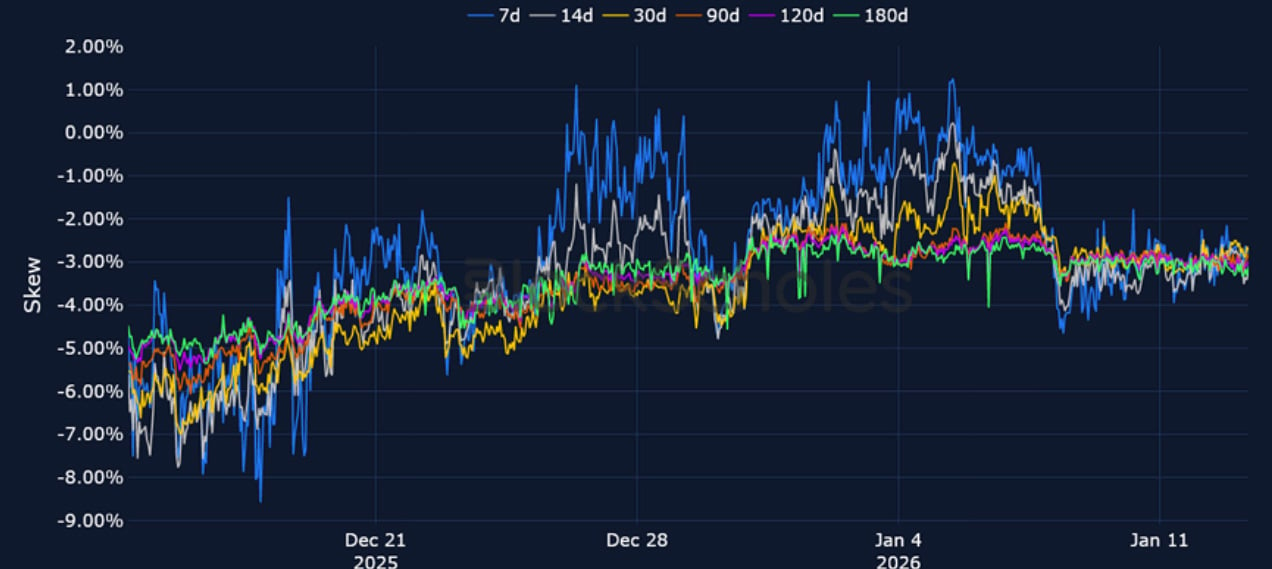

A number of big macro events over the past week have failed to materially disrupt the wider trend of a downward drift in BTC and ETH implied volatility. Last Friday saw a mixed NFP report for December: while the US economy added fewer jobs than expected (50,000 vs 70,000), the unemployment rate also came in lower than expected (4.4% vs 4.5%). The Supreme Court failed to reach a verdict on the legality of President Trump’s reciprocal tariffs, while more recently the Department of Justice served the Federal Reserve with grand jury subpoenas and President Trump announced a 25% tariff on goods from all countries “doing business” with Iran. ETH funding rates are currently flat and close to neutral levels signalling little demand for leveraged exposure and perhaps a reflection of the asset’s sideways spot lull around $3K over the past week. That’s also reflected in a seeming stall in our in-house Risk Appetite Index for ETH. Finally, volatility smiles for both assets also continue to price in a bearish put premium across the volatility surface.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

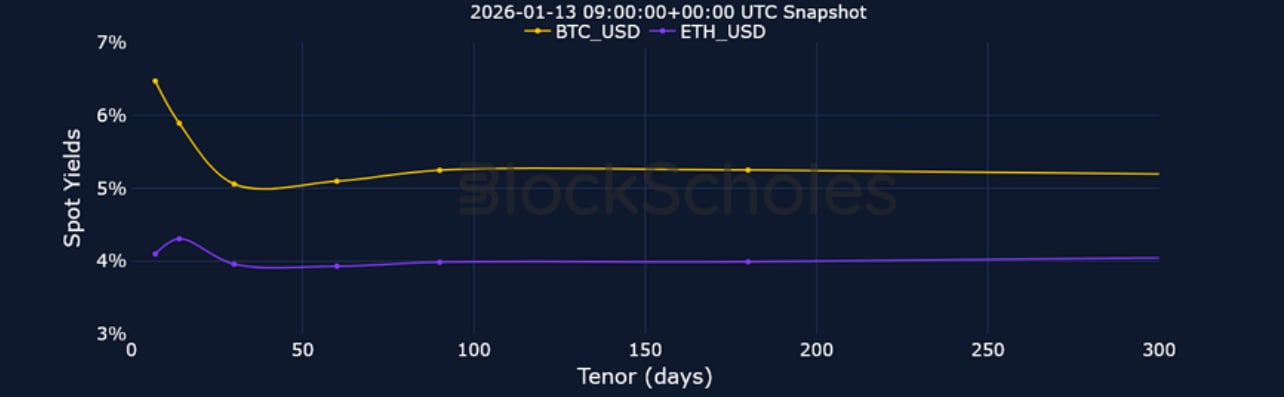

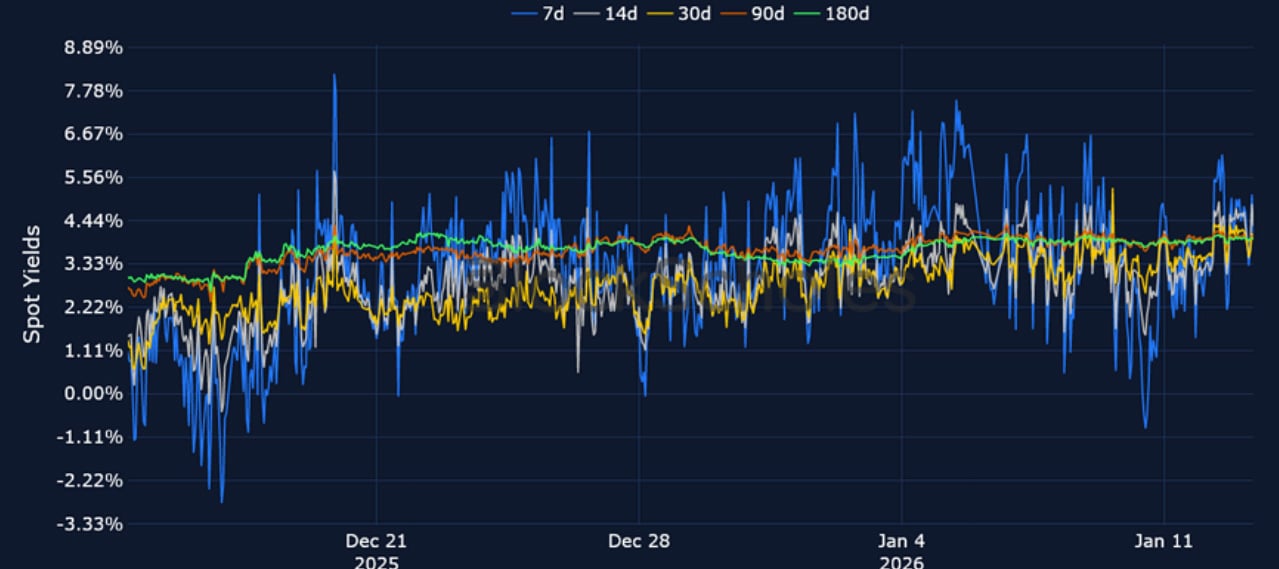

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

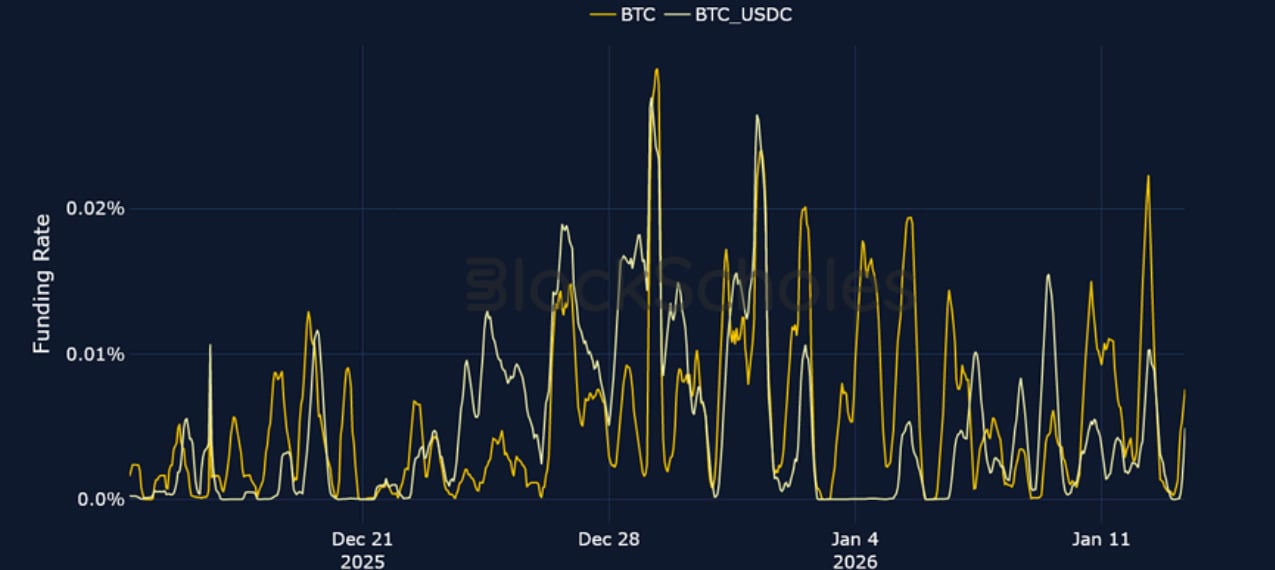

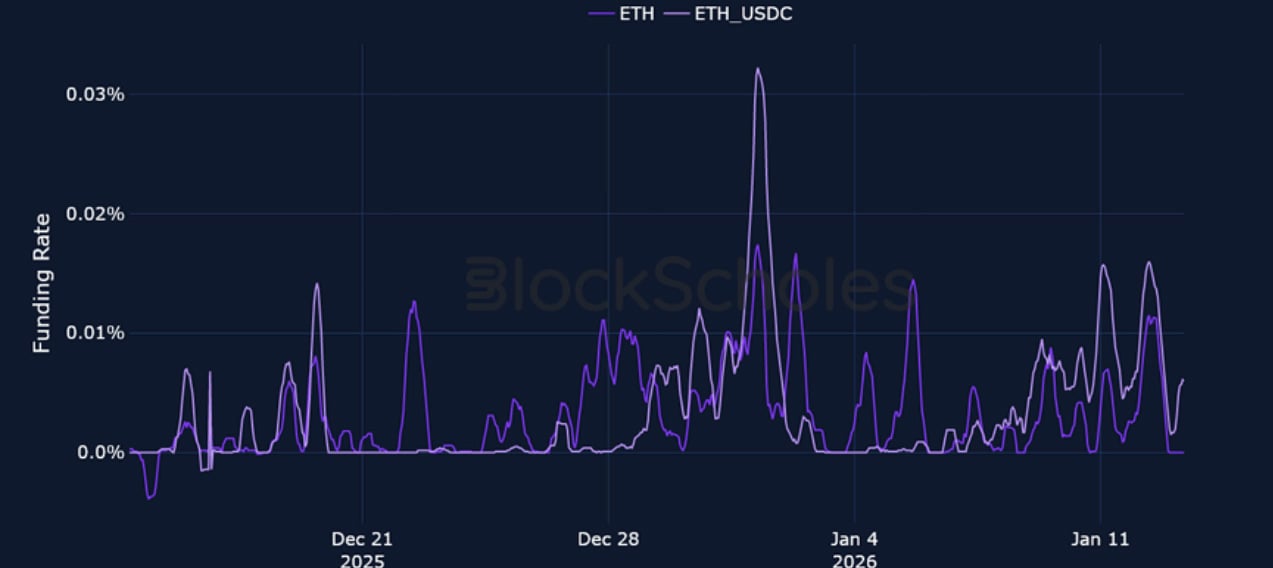

Perpetual Swap Funding Rate

BTC FUNDING RATE – Perp contracts still show a willingness to pay for bullish exposure, despite BTC attempting to break the $94-95K resistance and failing earlier last week. Since then it has mostly traded around $90K.

ETH FUNDING RATE – ETH funding rates have been more modest and close to neutral currently – perhaps a reflection of the ongoing sideways spot trading.

Futures Implied Yields

BTC Futures Implied Yields – Yields have mostly traded between 3-6% in the past week. Short-tenors still maintain a higher yield, resulting in an inverted term structure, and a sign of some speculative short-term positioning.

ETH Futures Implied Yields – The futures term structure for ETH is mostly flat with futures trading at a 4% premium to spot at all tenors.

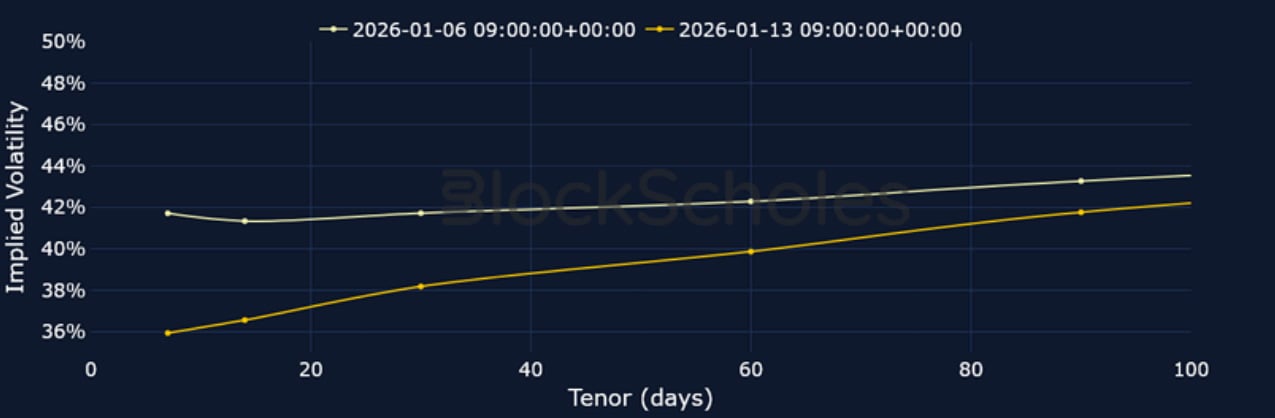

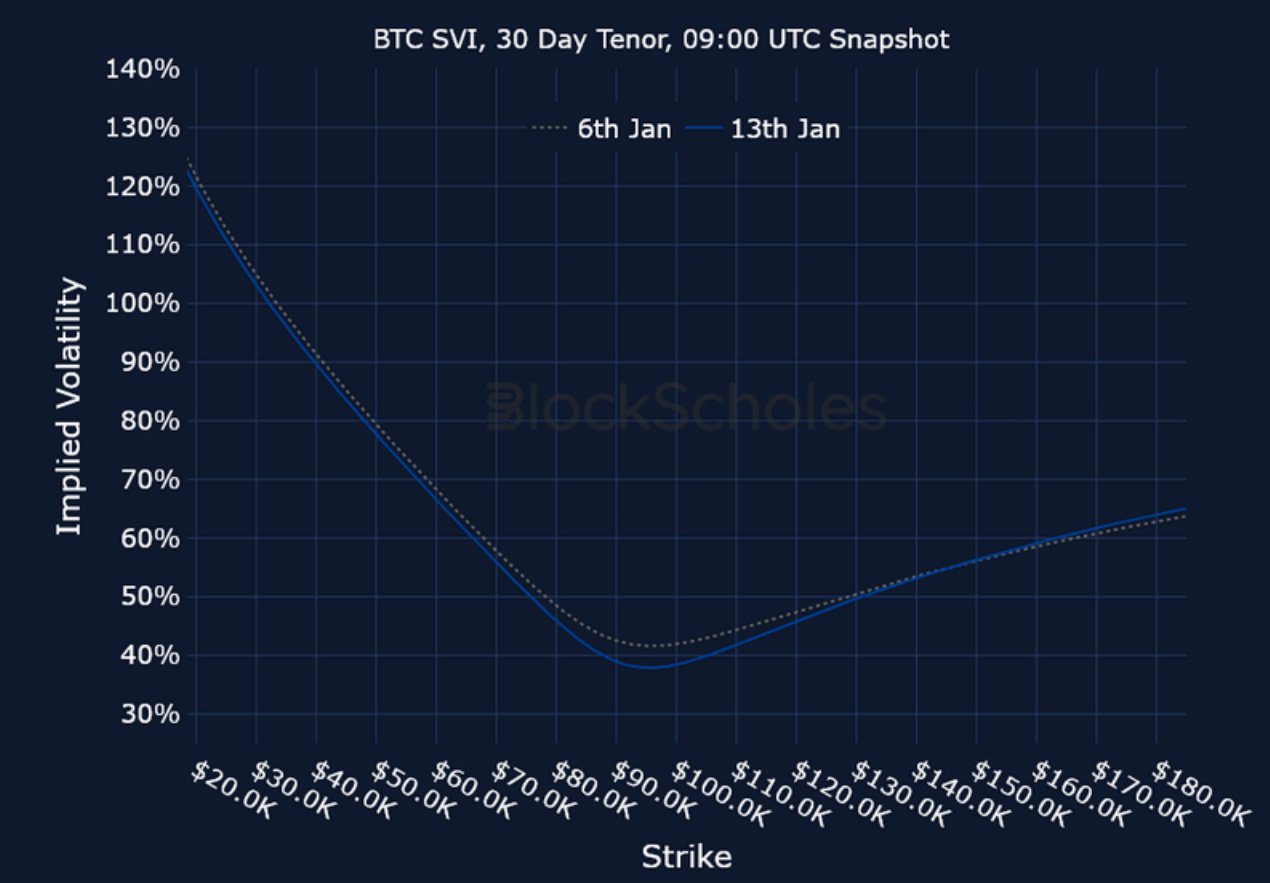

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Despite a month heavy with macro events, BTC volatility has continued to dwindle lower since Jan 5, 2025.

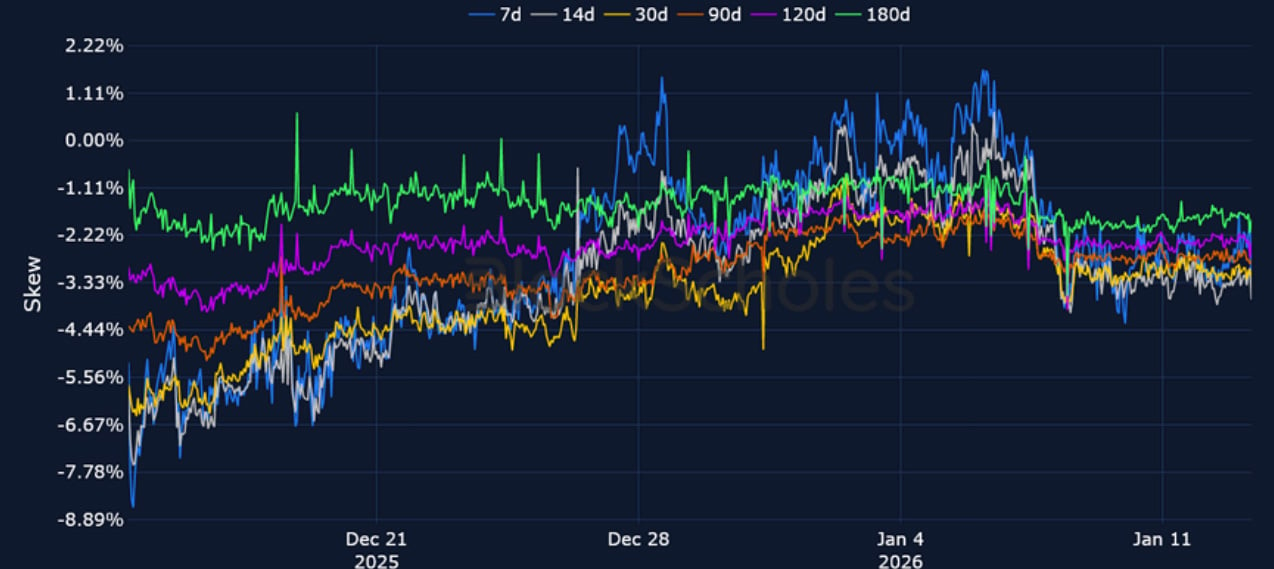

BTC 25-Delta Risk Reversal – After a brief skew towards OTM calls at the start of the year, smiles at all tenors now show modestly bearish expectations for spot in the near future. 7D smiles assign a 2.8% premium towards OTM puts.

ETH Options

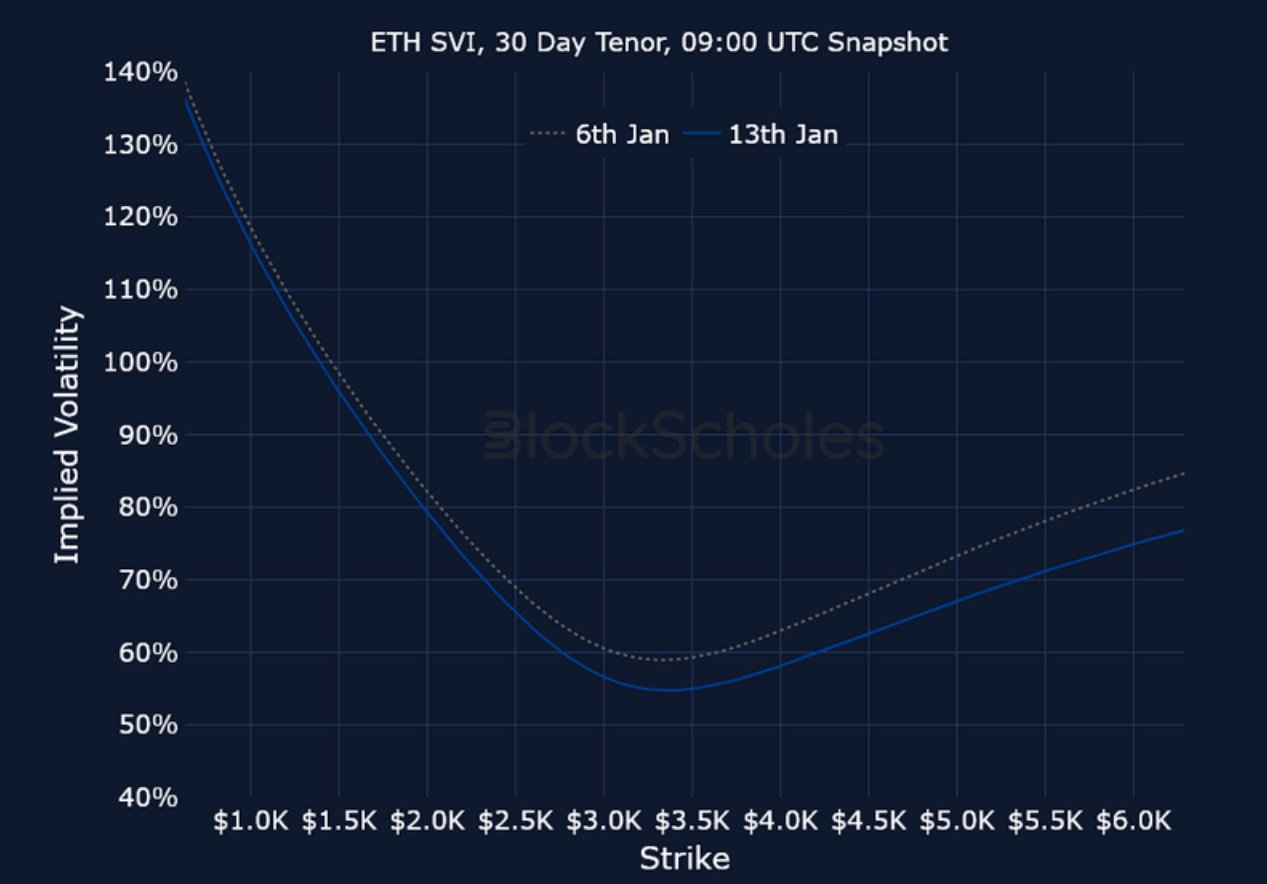

ETH SVI ATM IMPLIED VOLATILITY – Similar to BTC, ATM implied volatility has slowly drifted lower over the past week.

ETH 25-Delta Risk Reversal – The call premium of early January has now reverted back towards put contracts for ETH, though smiles are far less bearish than they were at the tail-end of 2025.

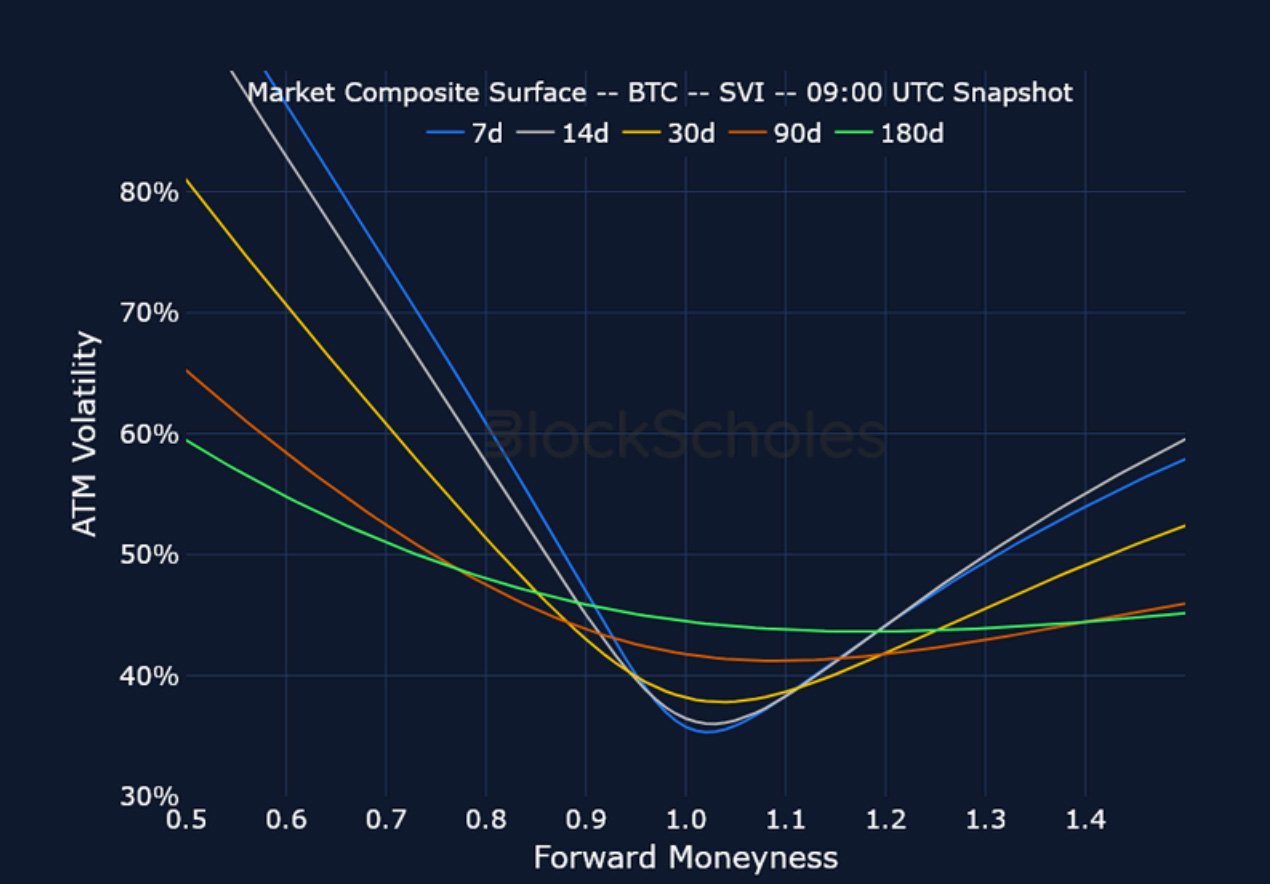

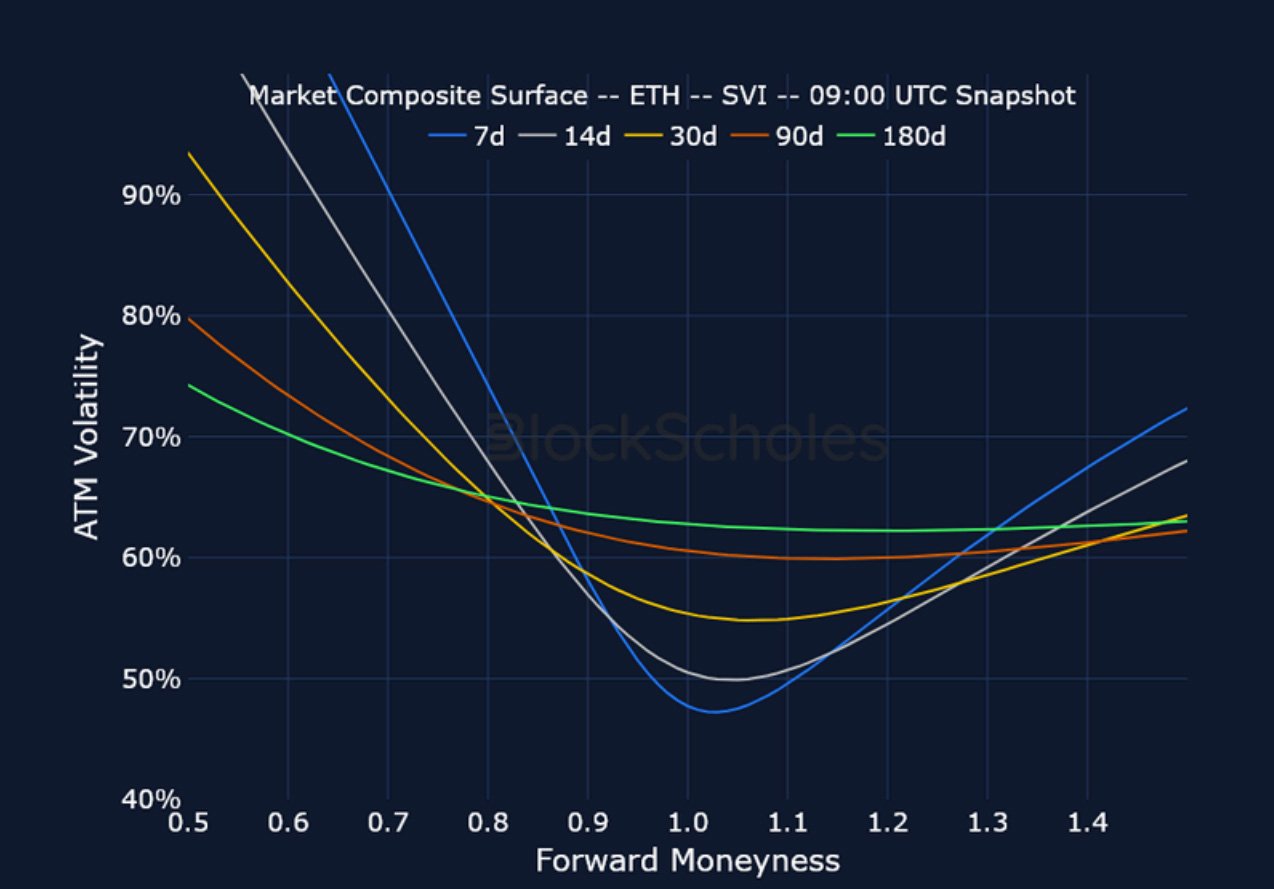

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

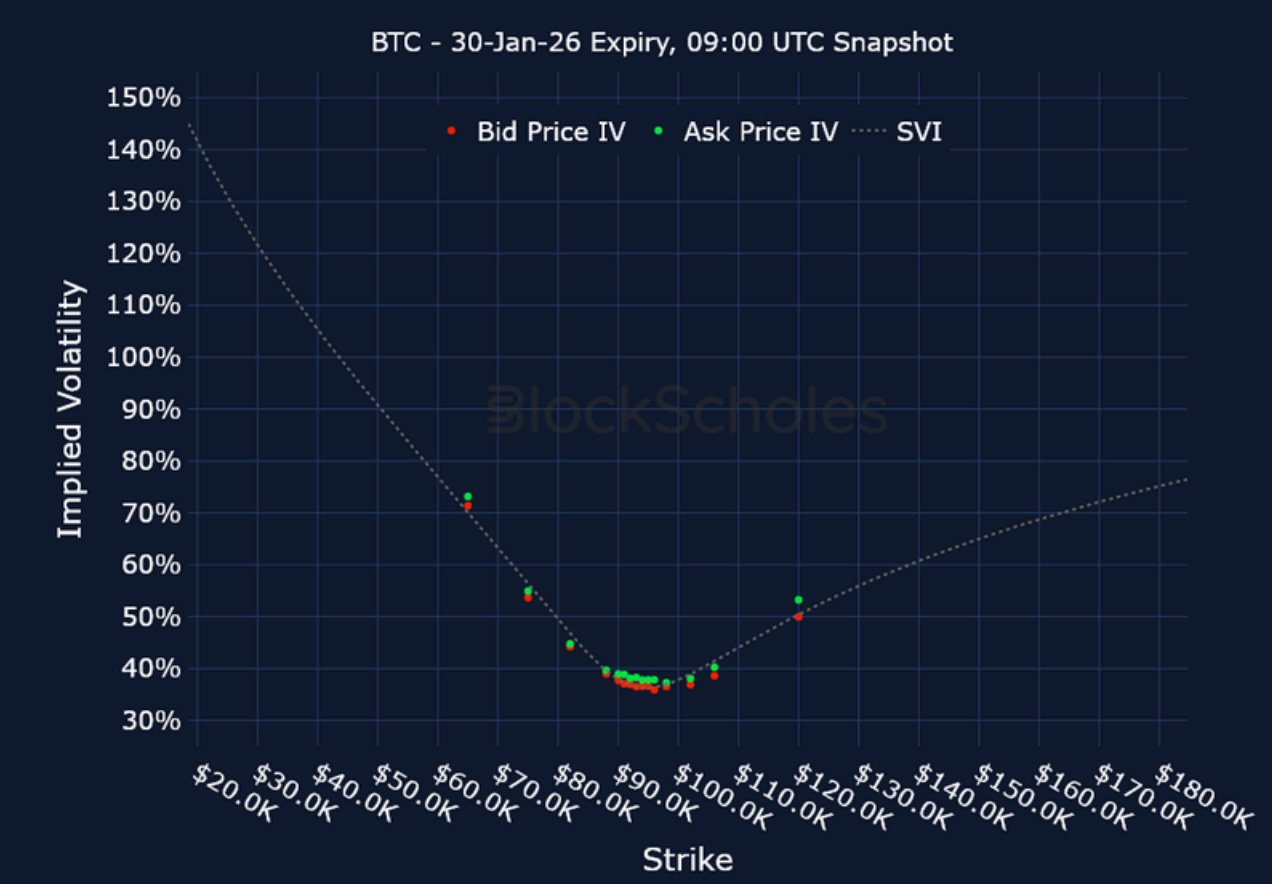

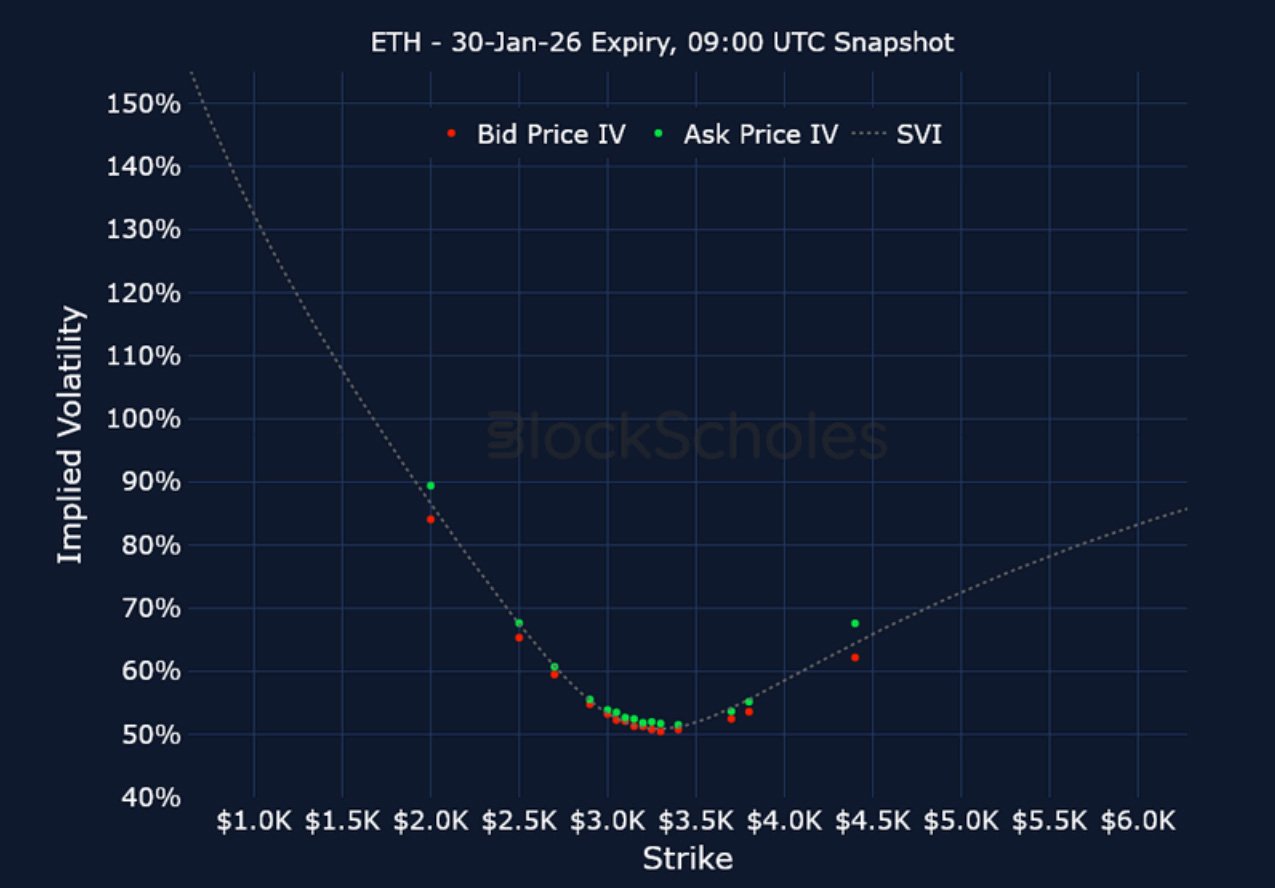

Listed Expiry Volatility Smiles

BTC 30-JAN EXPIRY – 9:00 UTC Snapshot.

ETH 30-JAN EXPIRY – 9:00 UTC Snapshot.

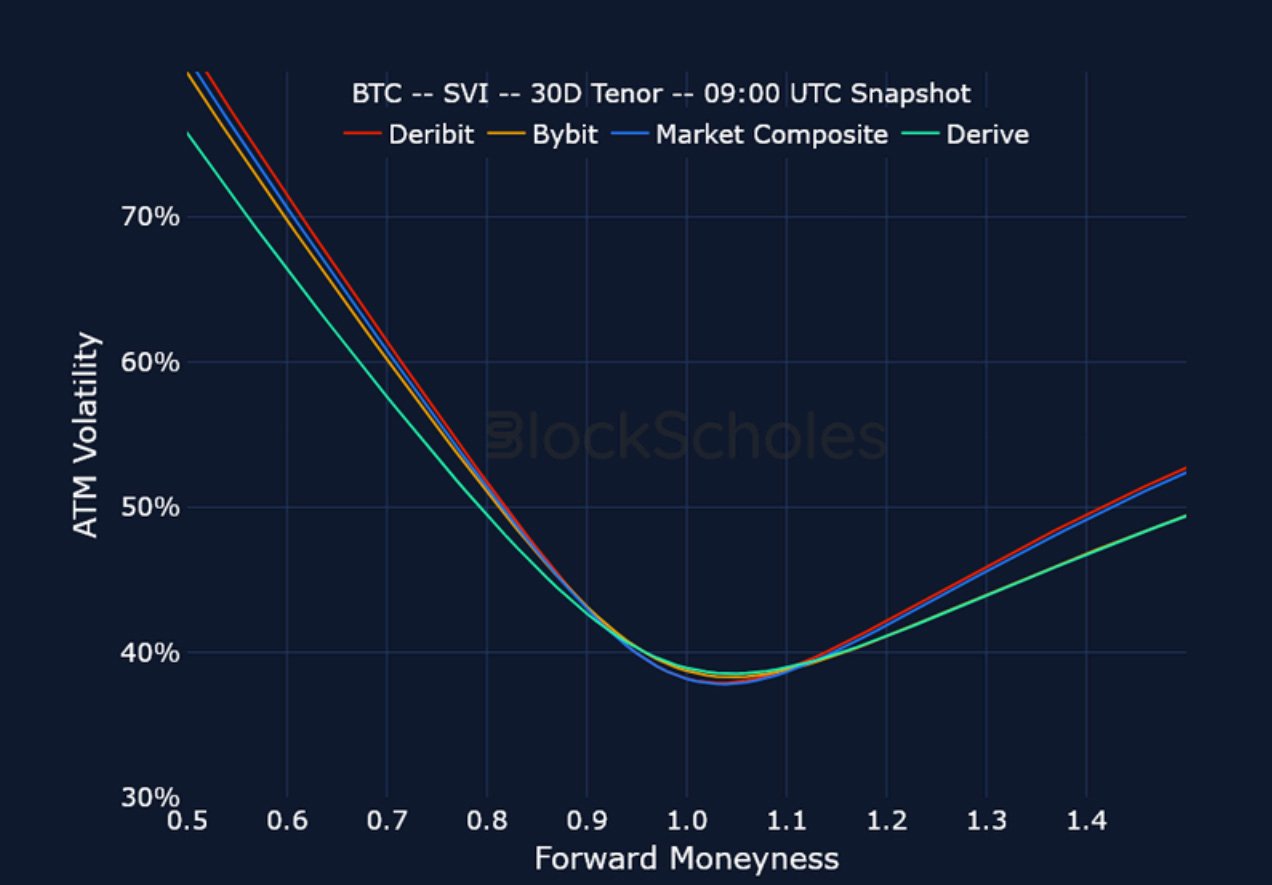

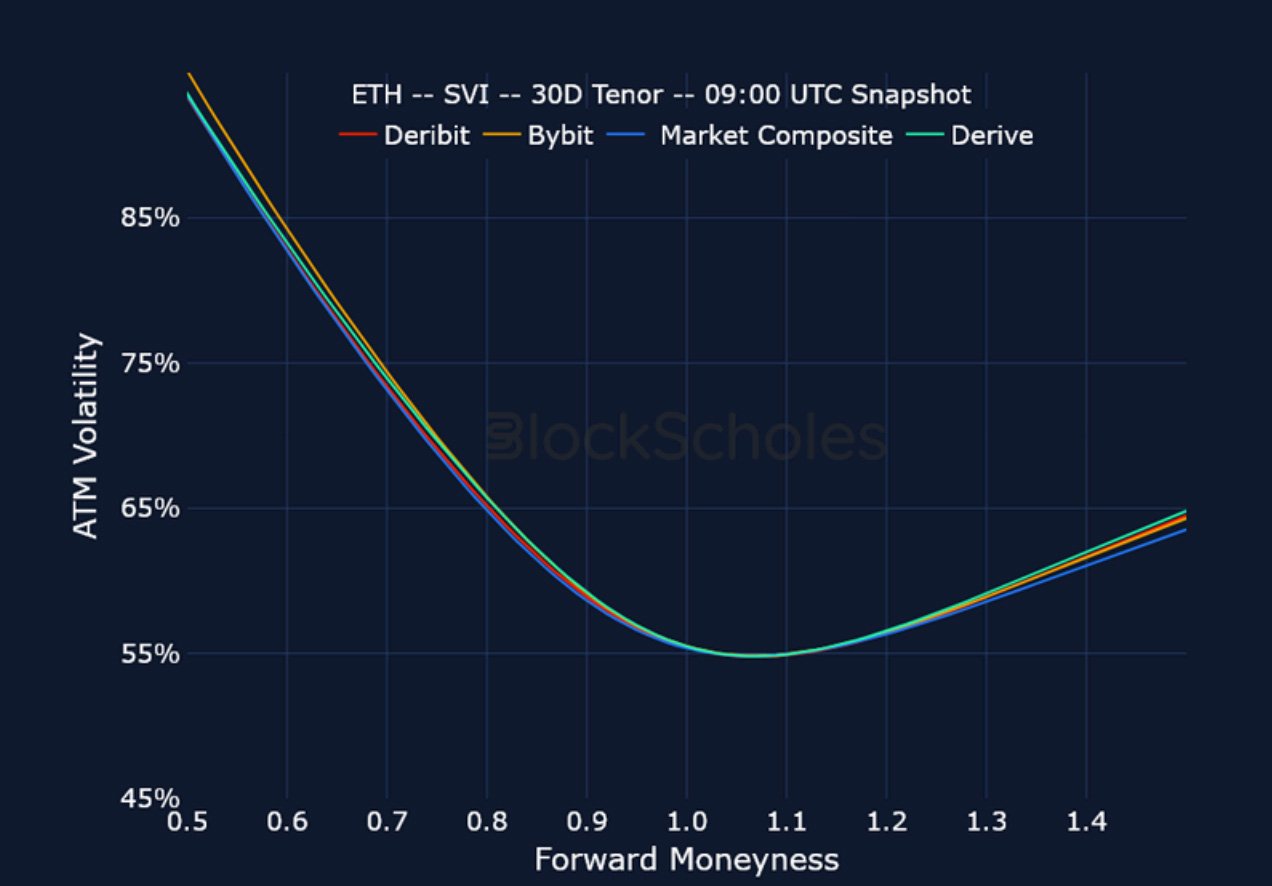

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)