In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

It’s hard not to root for players with conviction, even if that wavers a little in the face of SC Tariffs, Iran, Crypto Bill delays, + Spot impact.

Readers of recent reports will recall sizable buying then cutting of Jan98k+Feb100k Calls.

Back again with $10m+ to reallocate.

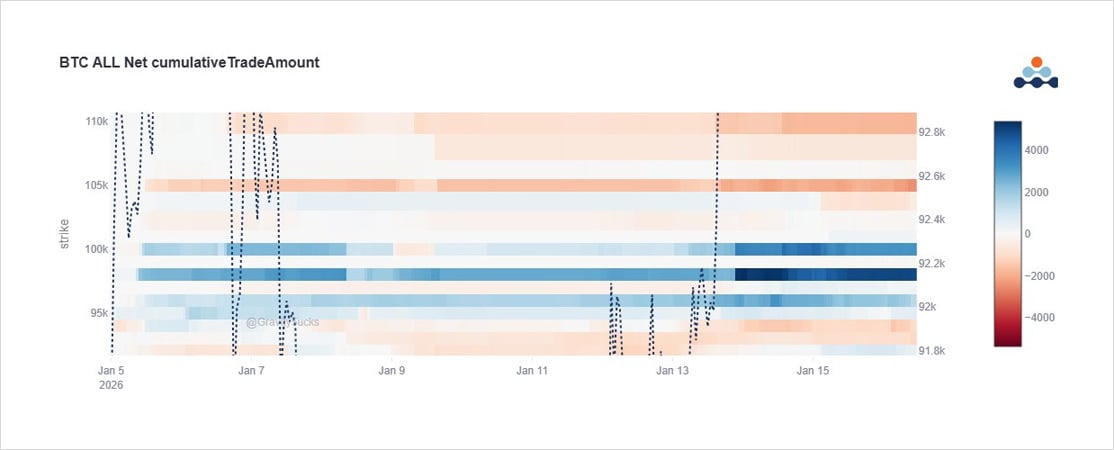

The Jan30th 98k+100k and Feb27th 100k Calls dominate the overall picture within current flows.

The blue shows the original buys, then lighter blue as Spot retraced and 98k cut, and partial cut of Feb 100k, then new spend of $10m.

Jan 100-105+110k Call spread bought too.

In the run-up to New Year, the Jan100k calls were bought, followed by the Jan98k+Feb100k on the 5th.

It’s clear on the DVol chart the impact on raised IV.

It’s also clear on the sales.

The most recent purchases on 13/1 vs ~95.4k had far less impact as liquidity has returned.

It’s clearer to see the impact on Call Skew and overall market sentiment momentum at the times of these trades. The Call buyer is ahead of Spot on his two purchases, with markets rallying strongly after, but then in both cases falling back. Monitoring if markets retrace again.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)