Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

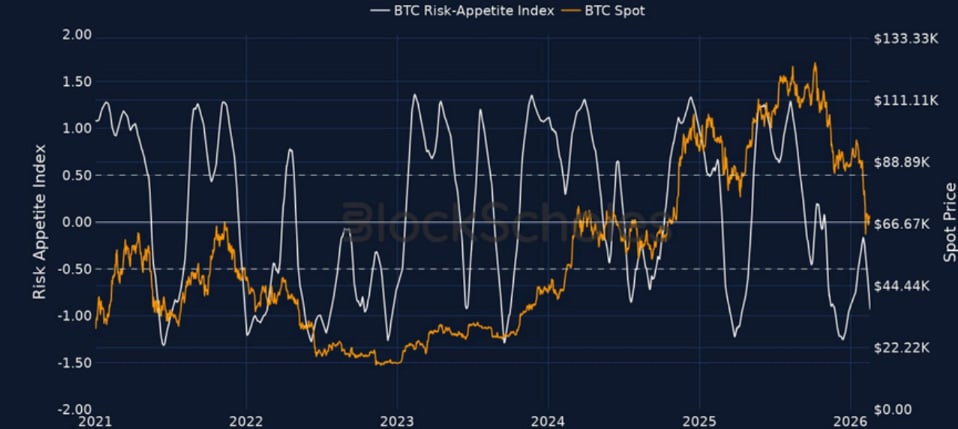

Sentiment in derivatives markets and risk-appetite in spot markets is consistent with what we would expect given the current 50% drawdown from all-time high for BTC. A lack of any clear catalyst to drive prices higher resulted in the fourth weekly loss in spot price last week and $360M of outflows in exchange-traded funds tracking BTC’s spot price.

7-day futures contracts continue to trade below spot, funding rates have been neutral-to-negative and volatility smiles in options markets maintain their preference for put contracts. Implied volatility for both BTC and ETH options has been repriced considerably following the Feb 5, 2026 crash to $60K, despite realised volatility still at relatively high levels.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

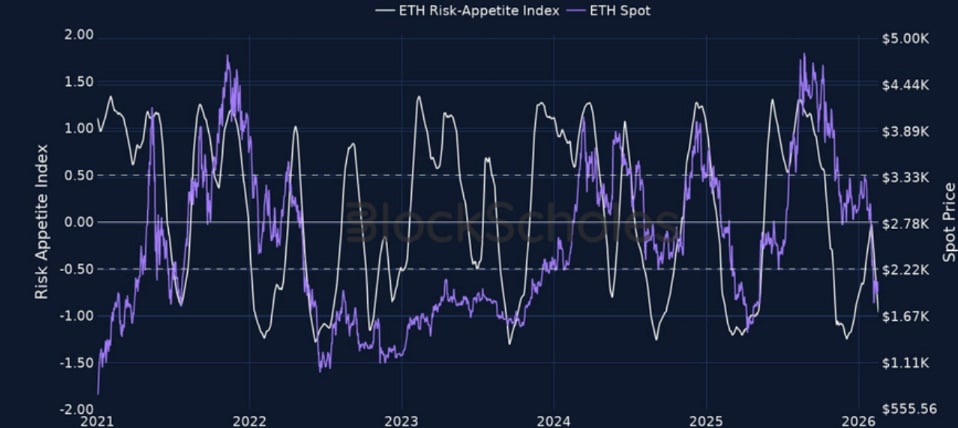

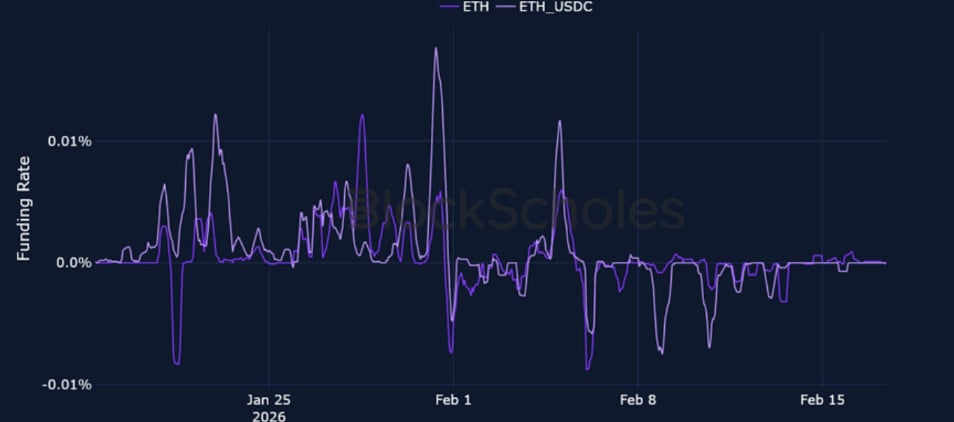

Perpetual Swap Funding Rate

BTC FUNDING RATE – The lack of a clear catalyst to drive prices higher has seen both spot price and funding rates trade sideways over the past week, as BTC continues to consolidate between $65K and $70K.

ETH FUNDING RATE – Funding rates for ETH perps spent much of the past week below zero, a sign that traders were positioned for further downward pressure.

Futures Implied Yields

BTC Futures Implied Yields – The extreme bearishness priced in by futures markets over the weekend has abated, though short-dated tenors still trade at a discount to spot price – a classic bearish derivatives signal.

ETH Futures Implied Yields – With spot price trading below $2,000 and $160M of outflows in Spot ETFs over the past week, near-term ETH futures contracts also traded below spot prices.

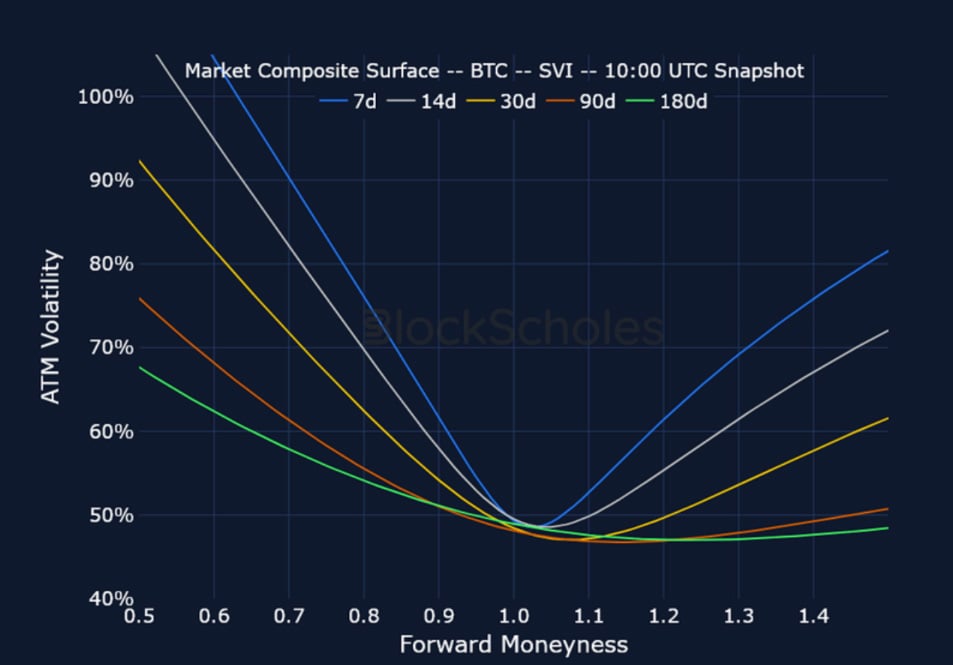

BTC Options

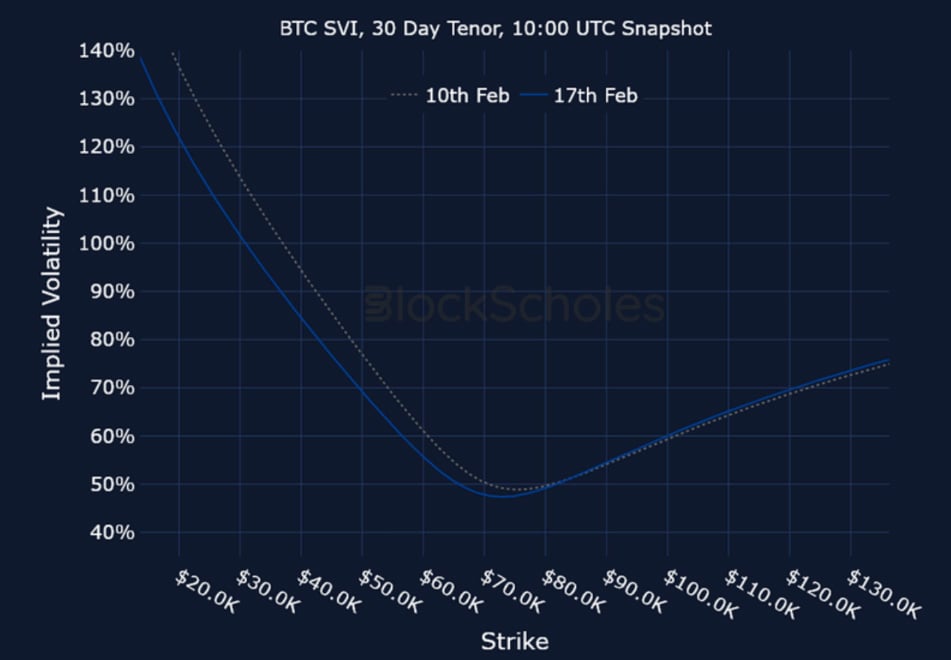

BTC SVI ATM IMPLIED VOLATILITY – IV levels snapped lower following the early Feb selloff, with vol compressed around 50% across the term structure.

BTC 25-Delta Risk Reversal – In a near-50% drawdown from ATH environment, demand for put options continues to outweigh the demand for calls. BTC’s skew is far less bearish than it was on Feb 5, 2026, however, when it fell to the lowest since November 2022.

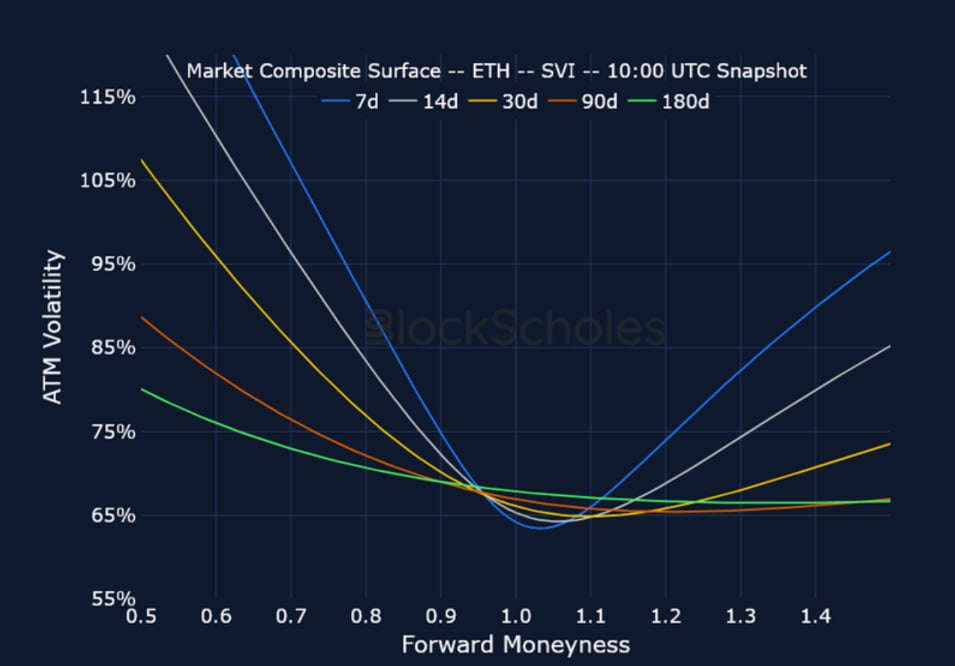

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Similar to BTC, the term structure of volatility is flat after a major spike at the start of the month.

ETH 25-Delta Risk Reversal – Short-dated ETH skew has slowly priced out the extreme preference towards OTM puts of early February, though sentiment is still undoubtedly bearish in ETH options markets at all tenors.

Market Composite Volatility Surface

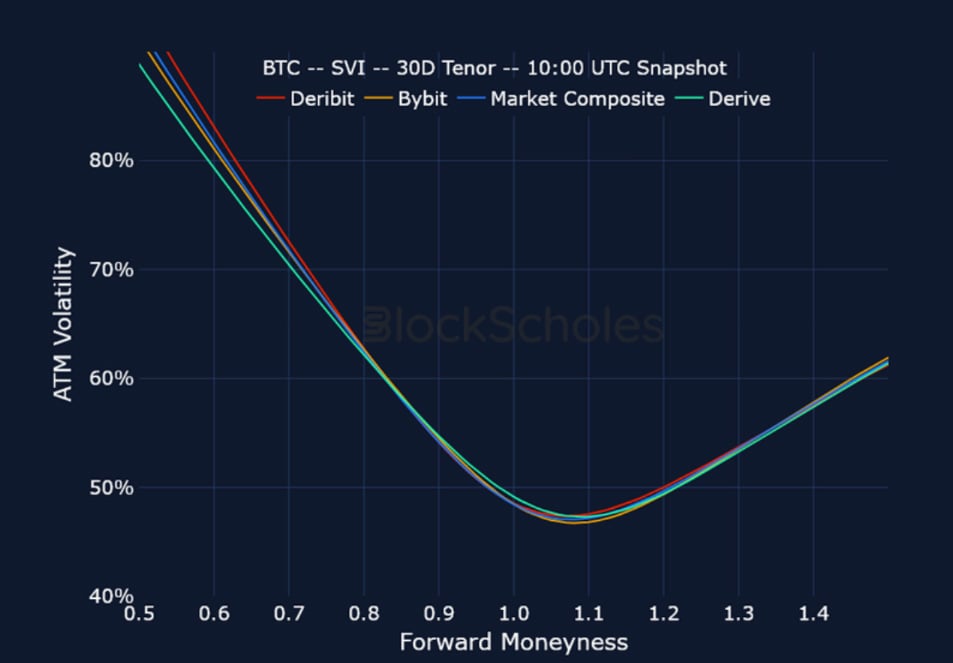

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

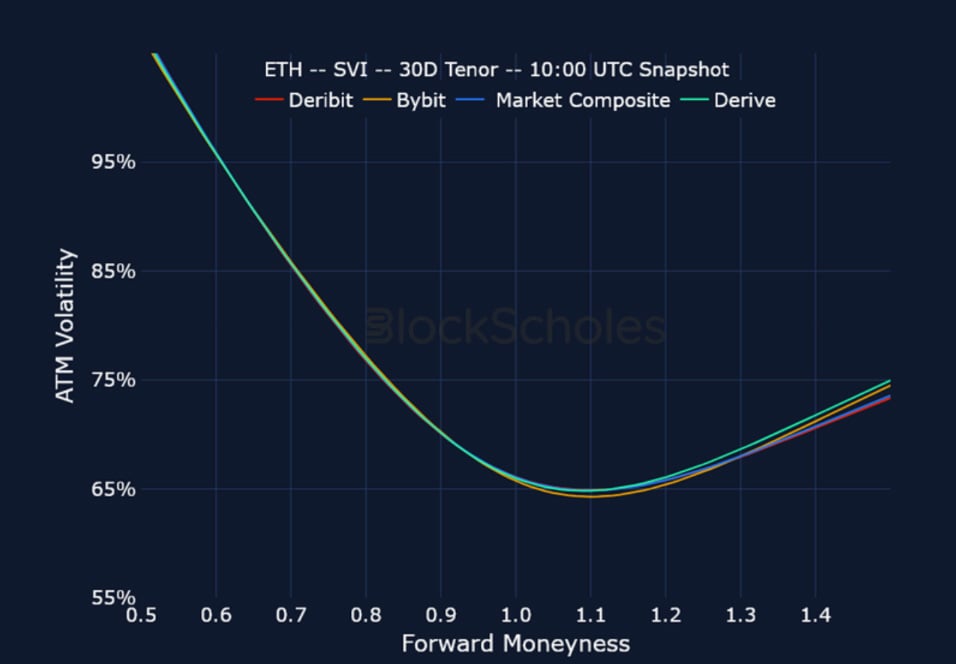

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

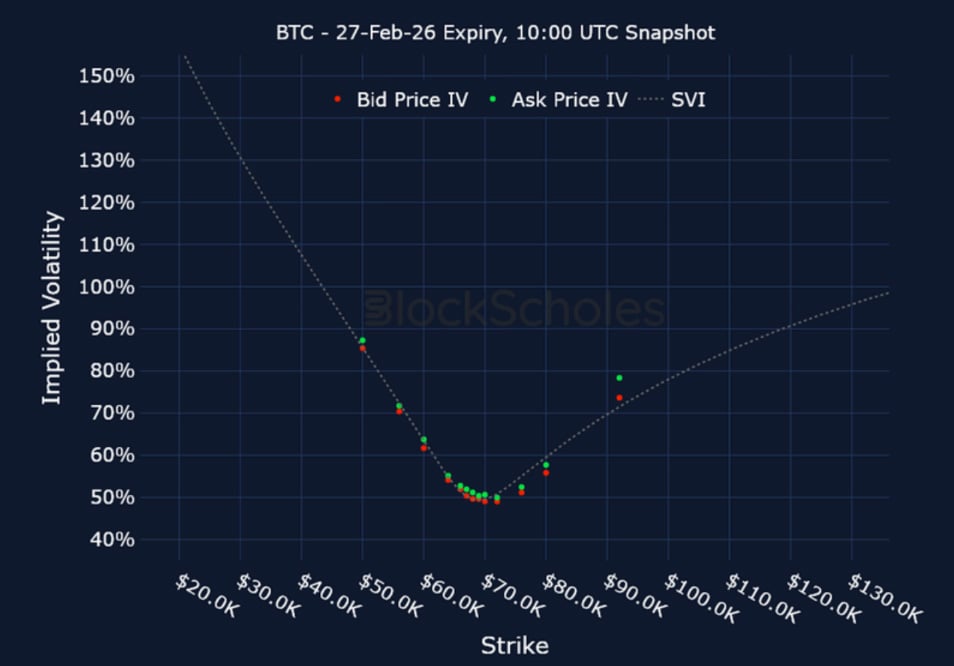

Listed Expiry Volatility Smiles

BTC 27-FEB EXPIRY – 9:00 UTC Snapshot.

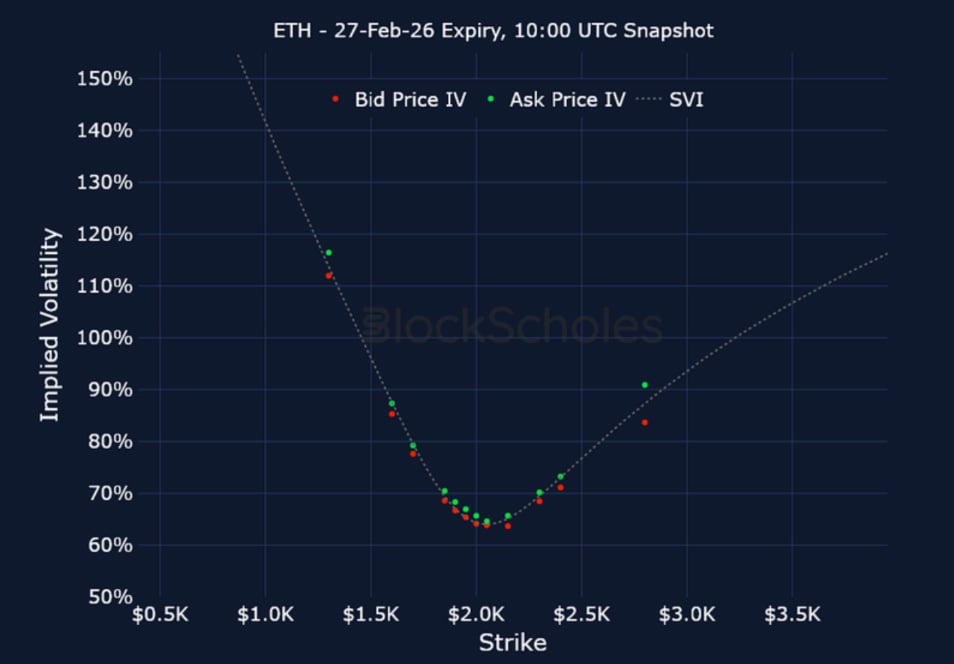

ETH 27-FEB EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

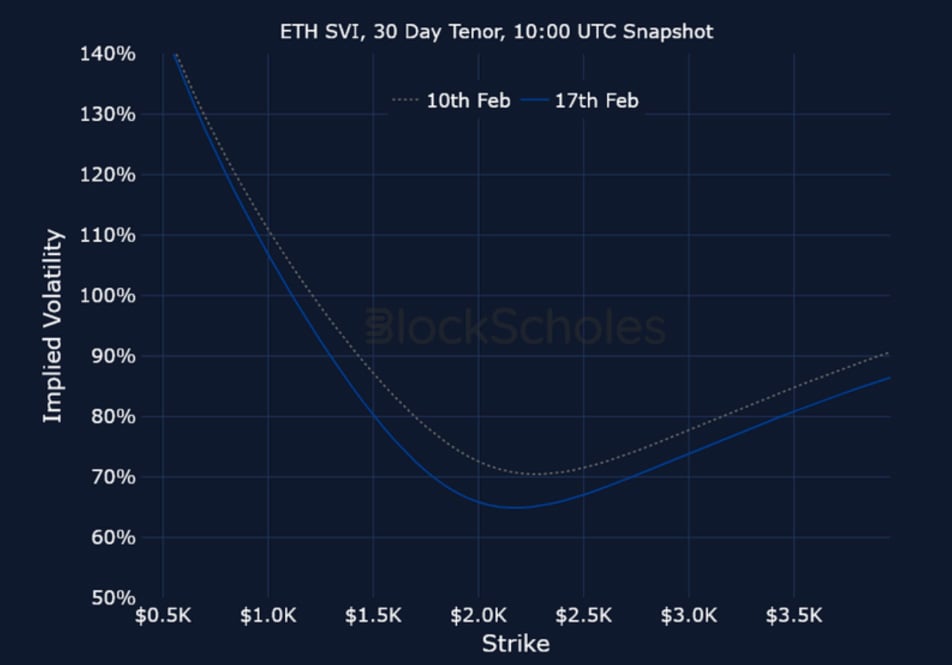

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)