Macro & Structure: Financialized Bitcoin, Fragile Confidence

Bitcoin rebounded toward $71k after renewed ETF inflows but has since drifted back near $68k as macro tensions reassert control. The rebound appears flow-driven rather than structurally bullish.

Crypto is now deeply embedded in institutional portfolios via ETFs and futures. When cross- asset funds de-risk, BTC becomes a liquidity source. The prior selloff looks more like systematic deleveraging than crypto-specific failure.

Adoption continues across blockchain infrastructure, but token value capture remains selective. In the short term, Bitcoin trades as a macro asset—sensitive to positioning, rates, and geopolitical risk. Discipline matters more than conviction.

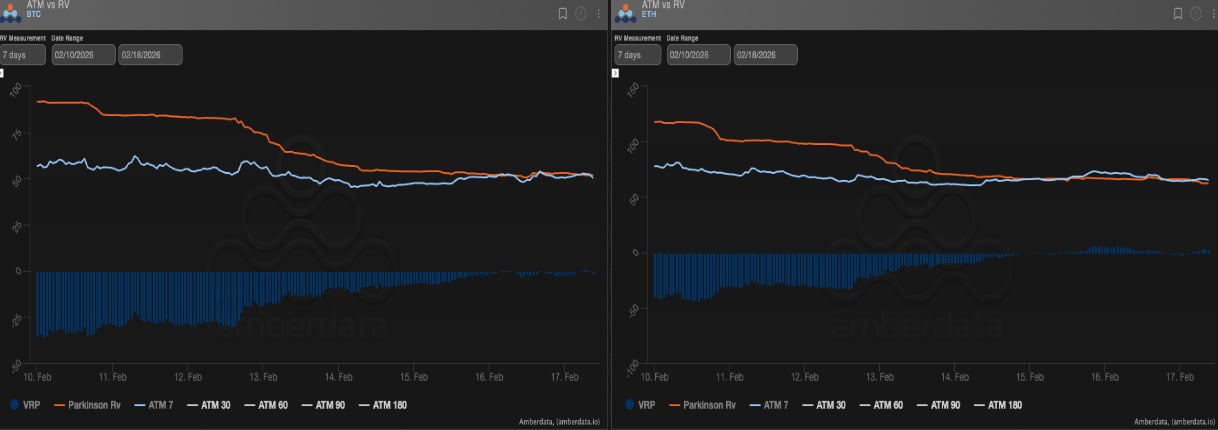

Realized Vol: Convergence and Compression

Realized volatility has cooled, converging toward implied levels (BTC ~50, ETH ~65). Implied volatility has also declined, with ETH softening faster than BTC in the front end.

Carry is roughly neutral. There is not much edge in aggressively shorting gamma after such a big vol reset. Implied ranges have largely held, suggesting stabilization rather than expansion.

The setup feels transitional—less reactive than the prior shock, but vulnerable to another downside attempt.

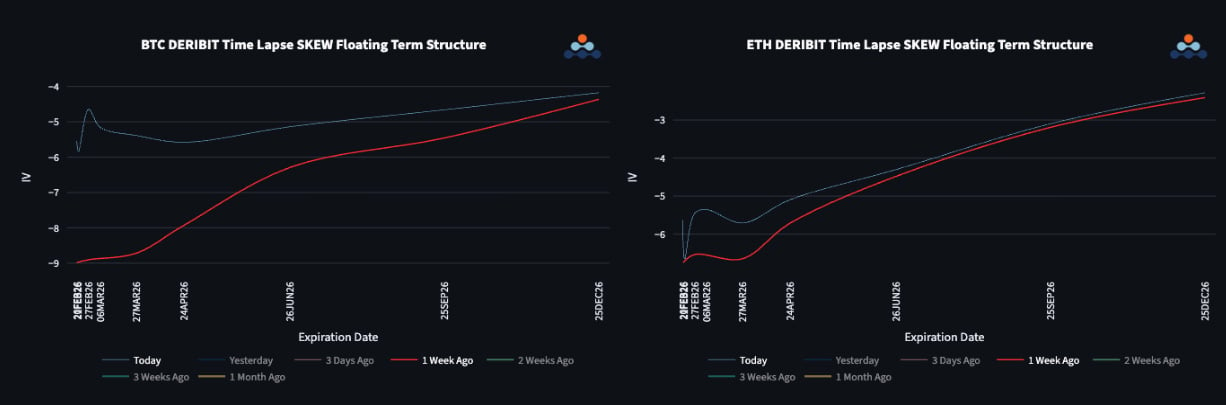

Term Structure & Skew: Fast Normalization

Skew has flattened quickly as panic faded. Front-end put skew has reset to modest levels around 5–6 vols. BTC’s curve remains relatively flat even in longer maturities, while ETH’s backend skew is lighter, hinting at a marginally more constructive long-term bias.

Call demand in February maturities suggests traders are tactically leaning toward rebounds, though not aggressively.

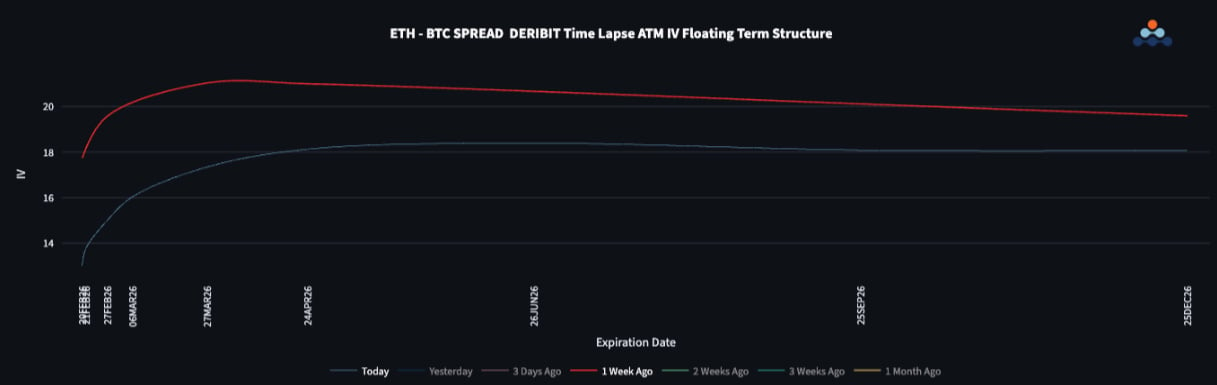

ETH/BTC Dynamics: Relative Downside Premium

ETH/BTC remains stuck near recent lows around 0.029. The volatility spread has narrowed in the front end but holds firmer further out.

If ETH revisits 1,500, the percentage downside exceeds BTC’s likely move to comparable support. Relative value currently favors owning ETH downside versus BTC.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)