Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

November 4

Market Color

Crypto has traded well in a volatile week, and there seems to be a great deal of tension between crypto’s tendency to track macro risk assets, and the industry’s genuine progress in enabling adoption to a huge cohort of users. This is not to say that it’s time to waive the “crypto has finally decoupled from equities” victory banner; a risk asset is a risk asset, and on short timeframes, risk absolutely matters. What we are seeing recently is an escalation of headlines that represent crypto adoption, and that is being reflected in price action, with the coins involved outperforming.

Yesterday, Instagram announced that NFTs would be available directly on-platform. This is a platform with over two billion (with a “B”) monthly-active users; when Reddit launched NFTs on Polygon, it led to an 8% rally on MATIC, and Reddit “only” has 50m MAUs. MATIC is up 13% on the week, now trading above $1 and closing on some significant price levels. Instagram will utilize Arweave for data storage, and AR is up 45% on the week as a result. Interestingly, despite the fact that Solana will also be integrated, SOL is actually down 5% on the week.

Speaking of platforms with a large number of MAUs, it’s been a week since Elon Musk purchased Twitter and, without actually saying anything (except tweeting a picture of his dog), triggered DOGE season. DOGE has seen a giant range over the past week, from $0.06 to $0.16 before retracing today below $0.12. The retracement is based on rumors that Twitter is not prioritizing a crypto wallet; and while that rumor is just a single line in one article, rapid meme-based rallies can collapse just as quickly. In the meantime, as a play on Twitter-getting-involved-in-crypto, BNB continues to outperform other L1s this week after Binance made a sizeable contribution to the equity purchase.

Finally, after spending some time at the Singapore Fintech Festival this week, it is very apparent that payments in crypto is going to progress considerably in 2023. One of the most interesting projects I saw at the conference was Project Orchid, which is launching Purpose Bound Money as a way for users to use stablecoins to pay at point-of-sales while retailers receive fiat. This will be integrated with payment options that Singaporeans use every day, such as Grab, and it’s incredibly exciting to see this adoption of crypto payments technology begin to go mainstream. Longtime readers of this update know of my ardent desire to pay for coffee with crypto without it feeling like a gimmick, and between payment projects like this and partnerships like Polygon’s with Starbucks, that now seems like it has gone from a moonshot to a pretty achievable goal.

Macro is, of course, not doing great. The FOMC meeting did not give the market what it was looking for, and equities are trading at their lowest in nearly a month. Gravity usually wins, especially in the shortterm. But if crypto actually achieves meaningful, global adoption, it seems inevitable that this still-veryyoung asset class will decouple and outperform traditional risk assets over time.

November 3

What we are seeing in the markets?

1) Risk assets fell as Chair Powell ended yesterday’s presser sharing a worrying outlook: “window for soft landing has narrowed,” after acknowledging that the peak rate will likely be higher than previously expected (recall Sep median dot just 4.6%). Nonetheless, we keep in mind the introduction of dovish language in the statement, “Committee will take into account the cumulative tightening of monetary policy, the lags with which policy affects activity” and believe the probability of a pace reduction (i.e. 50 in December) is actually increasing. With high frequency indicators starting to turn and point towards slowdown (ISM services the latest today), we are turning cautiously bullish on risk and looking for efficient upside plays.

2) We are far removed from the days where headlines like these would cause BTC to pop 10%, but this week we had two massive crypto-bullish stories. Meta announced that Instagram users will soon be able mint and sell NFT’s to their platform’s 1.4 billion monthly active users. Second, financial services behemoth Fidelity opened the waiting list for their crypto offering.

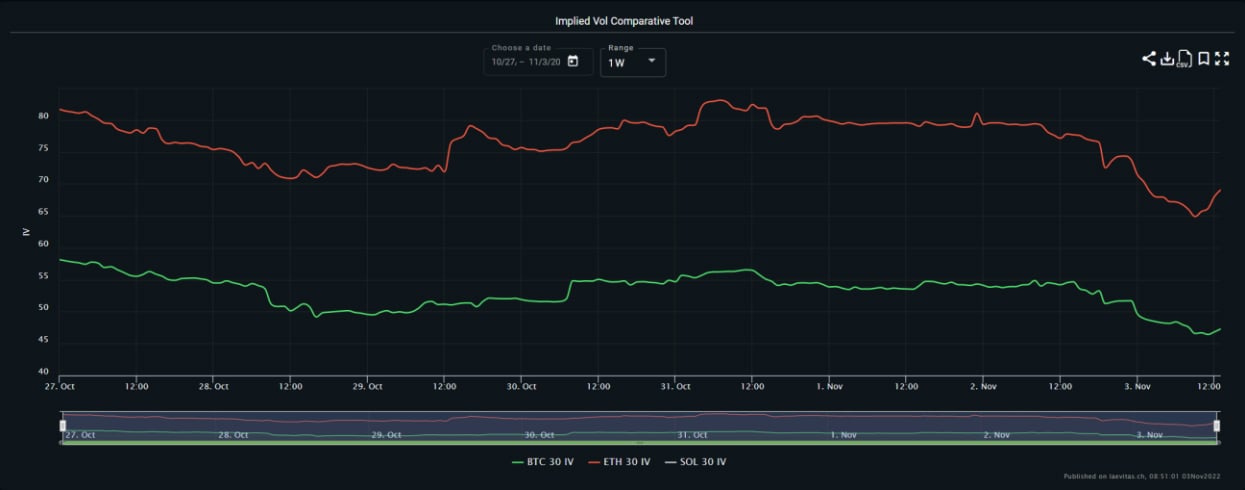

3) Realized vol has spectacularly underperformed in crypto—trailing 7d realized in BTC has been below 50% for the last month. With the fed meeting out of the way, implied vols have cratered. BTC 1-month vol hits a fresh YTD low of 46%.

Potential trades

1) Sell 11/11 – 11/25 straddle spreads in BTC or ETH – with Coinbase earnings, unemployment, and inflation data all being released in the next 7 days and World Cup starting November 18, we see little reason for this vol spread to be 2% over for 11/25.

2) Buy ETH December 2000-2500 call spread – with implied terminal rate above 5%, we see potential for a dovish surprise if we get weaker jobs or inflation data. Coupled with bargain basement implied vols, we like buying this call spread unhedged as a ~13 to 1 upside play.

October 31

What we are seeing in the markets?

1) Traders prepare for another 75bps hike from the Fed as inflation remains stubbornly high in September and the job market is showing little signs of cooling. More negative headlines from Bitcoin miners (Core Scientific/Argo) pushes spot back towards the magnetic $20,000 price.

2) Delivered volatility continues to underwhelm with 30-day realized at 37% & 54% for BTC & ETH respectively. Despite this, implied vol increased over the weekend as we saw buying of ~3,000x BTC DEC 30 15k & 16k puts. The next 10 days are expected to be busy in terms of news & economic data, including FOMC, unemployment, inflation, US mid-term elections, and Coinbase/Microstrategy earnings.

3) In the face of Fed rate hikes and miner default, skew has bounced back to neutral. This marks the richest calls have been since late March.

Potential trades

1) ETH steepener – With BTC Dec-Mar vol spread trading at 6%, we like putting on an ETH Dec-Mar steepener with the vol spread at 1.5%.

2) Buy 1-month BTC vol / Sell 1-month ETH vol – BTC/ETH implied vol ratio historically bottoms out around 65%. 1-month point currently down to 67.5%, making it a potentially attractive entry point.

3) Despite recent chatter about a Fed pivot, Powell seems resolute in taming inflation. Coupled with potential miner defaults, we like owning delta-hedged BTC puts from this low implied vol.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)