Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

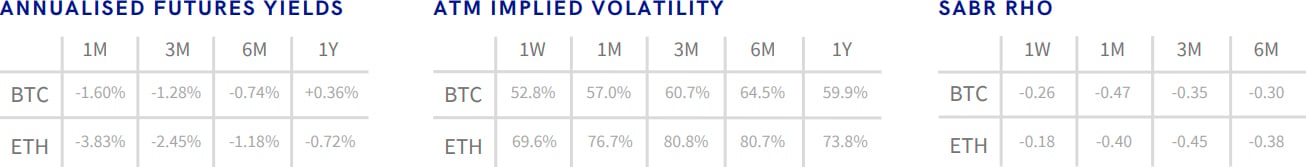

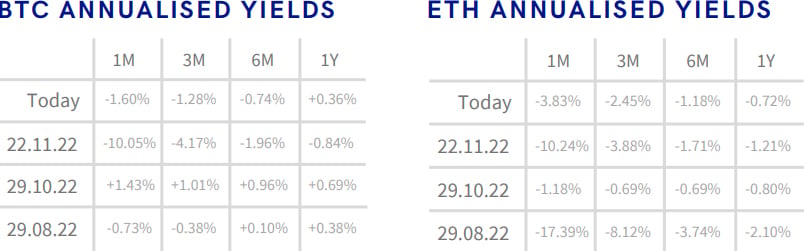

- BTC ANNUALISED YIELDS – undergo a strong and steady recovery over the last seven days, especially in shorter dated futures.

- ETH ANNUALISED YIELDS – sees a significant recovery over the last week like BTC’s.

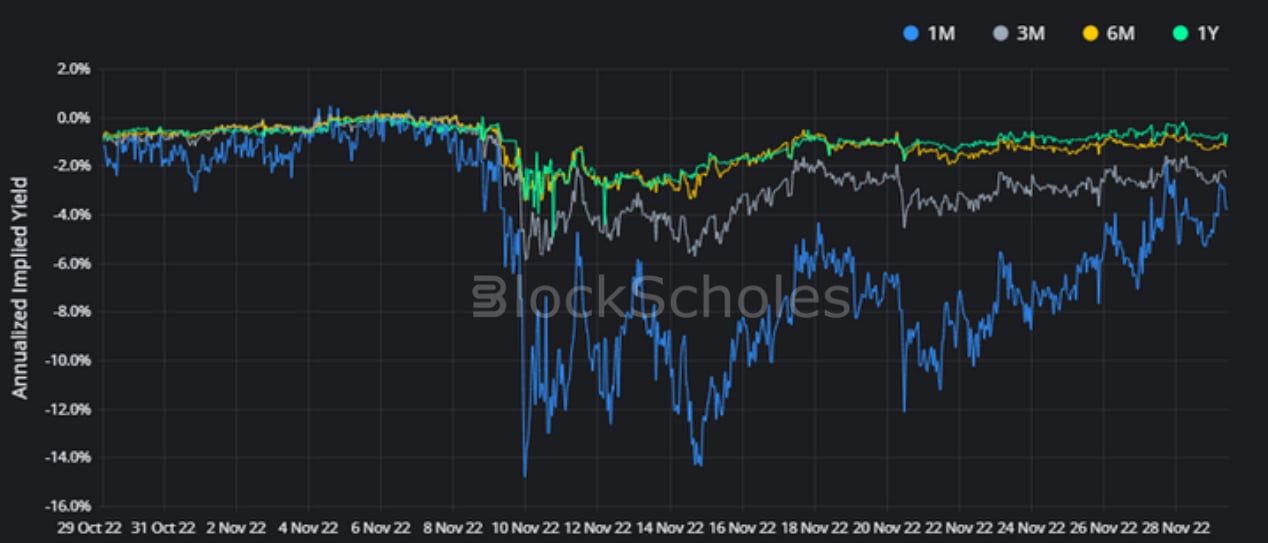

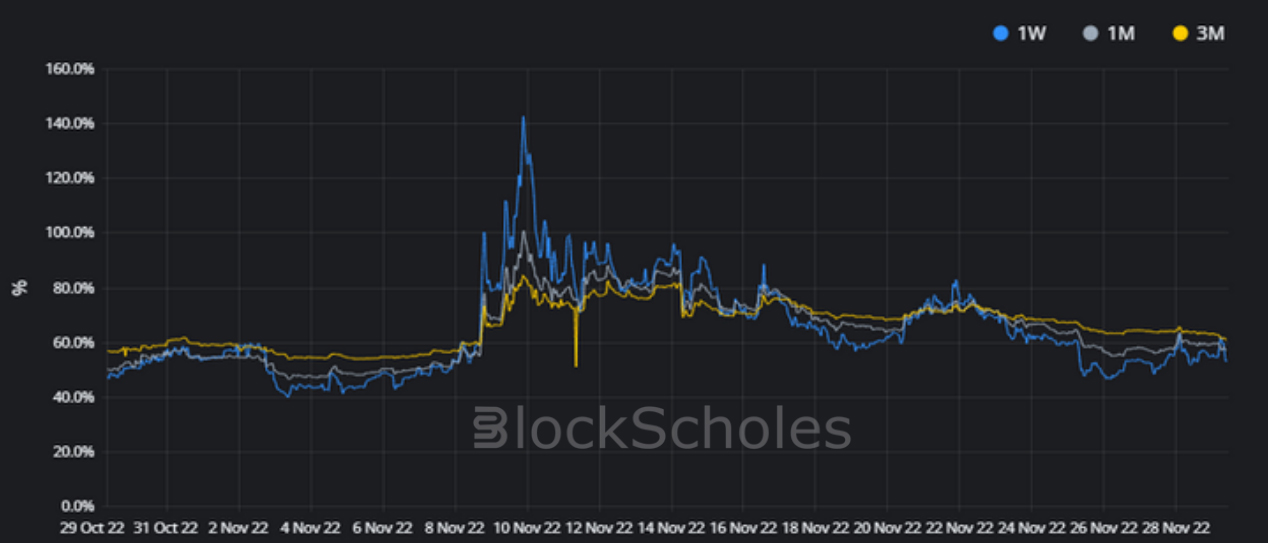

- BTC SABR ATM IMPLIED VOLATILITY – has begun to fall again since the pick up last week, now much closer to pre-FTX-collapse levels.

- ETH SABR ATM IMPLIED VOLATILITY – whilst still nearly 20 vol points higher, begins to cool in tandem with BTC’s.

- BTC IMPLIED VOL SURFACE – cools across nearly the whole surface, with 6M 0.1 delta calls the only recorded point to outperform its recent values.

- ETH IMPLIED VOL SURFACE – sees the same surface-wide cooling, without the same richness in 6M OTM calls.

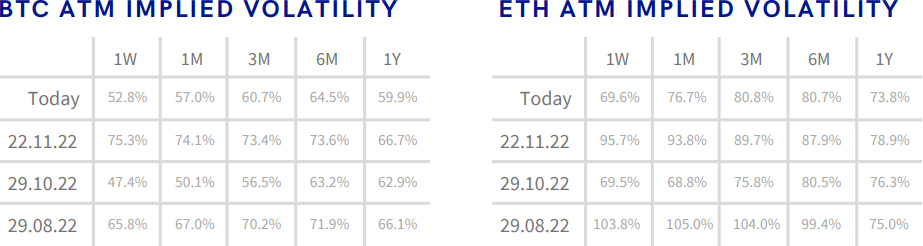

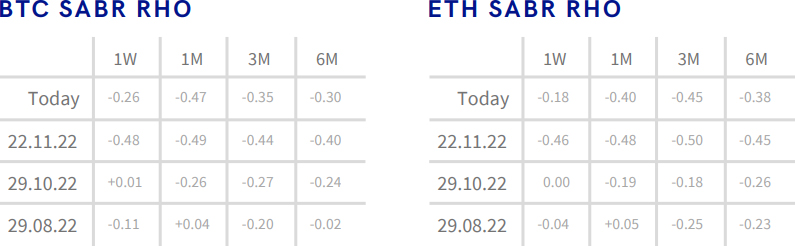

- BTC SABR RHO – has reduced significantly in the past seven days, with the skew towards OTM puts rapidly dwindling.

- ETH SABR RHO – reaches near month long lows too, as shorter dated volatility smiles assign less of a premium to OTM puts.

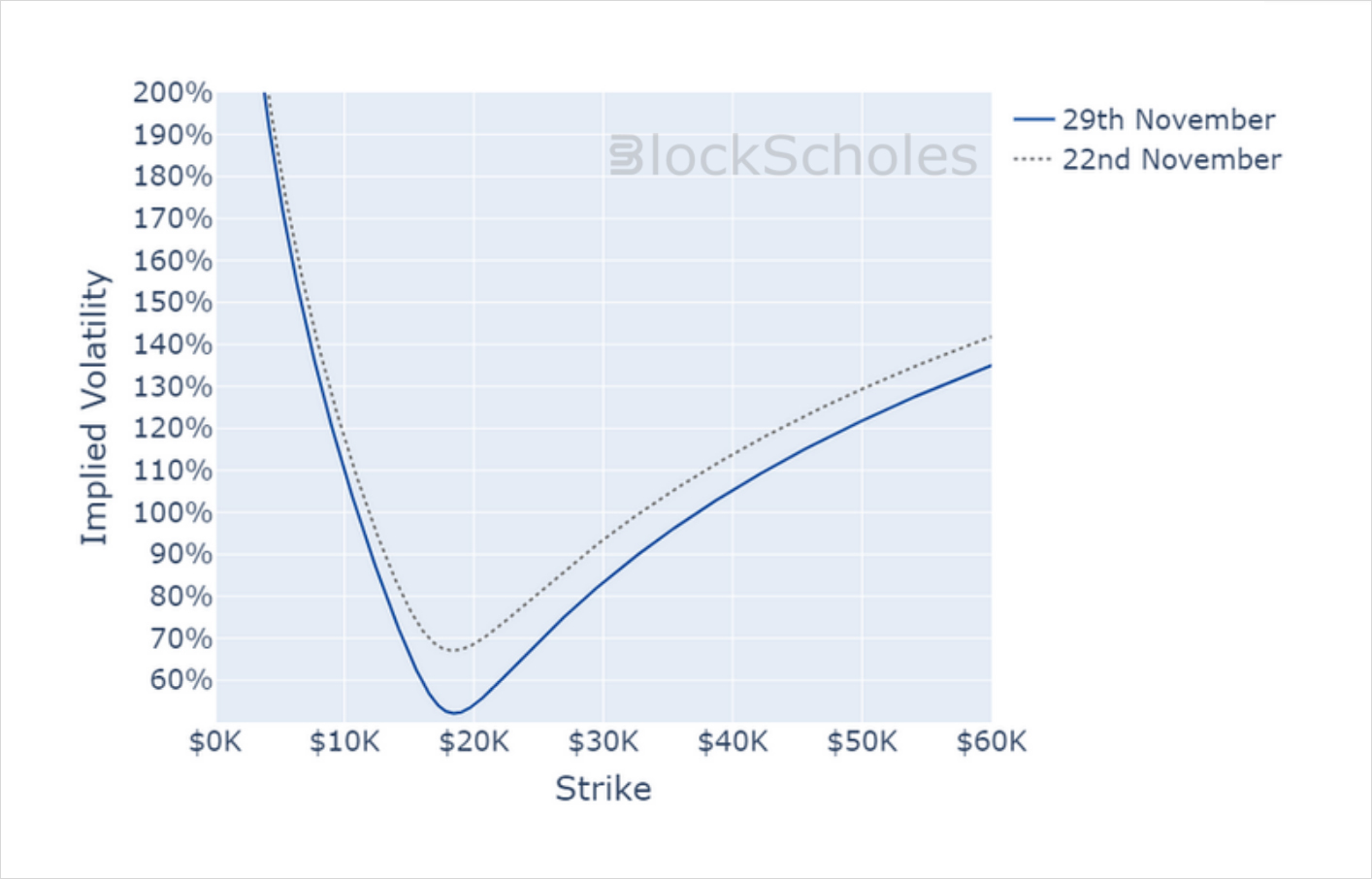

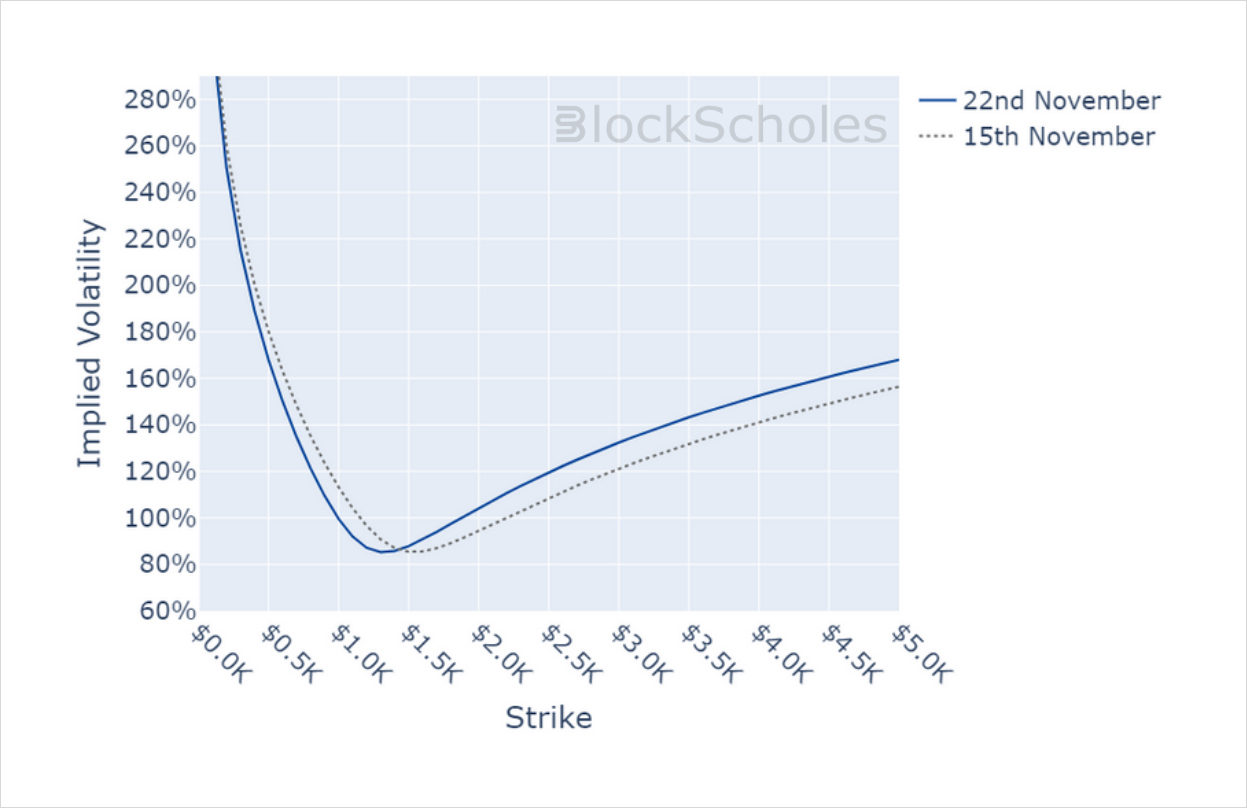

A relatively quiet week for crypto-assets sees most derivatives metrics indicating a sombre recovery from the previous month of FUD. The volatility smile of both BTC and ETH is now lower and less skewed towards downside protection and, whilst not yet at pre-crisis levels, appears to be moving towards the levels we saw at the end of October. That said, we note that the steepness of the smile remains well above those levels, indicating that deep OTM options are retaining their richness.

Futures

BTC ANNUALISED YIELDS – undergo a strong and steady recovery over the last seven days, especially in shorter dated futures.

ETH ANNUALISED YIELDS – like BTC’s, see a significant recovery over the last week.

Options

BTC SABR ATM IMPLIED VOLATILITY – has begun to fall again since the pick up last week, now much closer to pre-FTX-collapse levels.

ETH SABR ATM IMPLIED VOLATILITY – whilst still nearly 20 vol points higher, begins to cool in tandem with BTC’s.

Volatility Surface

BTC IMPLIED VOL SURFACE – cools across nearly the whole surface, with 6M 0.1 delta calls the only recorded point to outperform its recent values.

ETH IMPLIED VOL SURFACE – sees the same surface-wide cooling, without the same richness in 6M OTM calls.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

SABR Rho

BTC SABR RHO – has reduced significantly in the past seven days, with the skew towards OTM puts rapidly dwindling.

ETH SABR RHO – reaches near month long lows too, as shorter dated volatility smiles assign less of a premium to OTM puts.

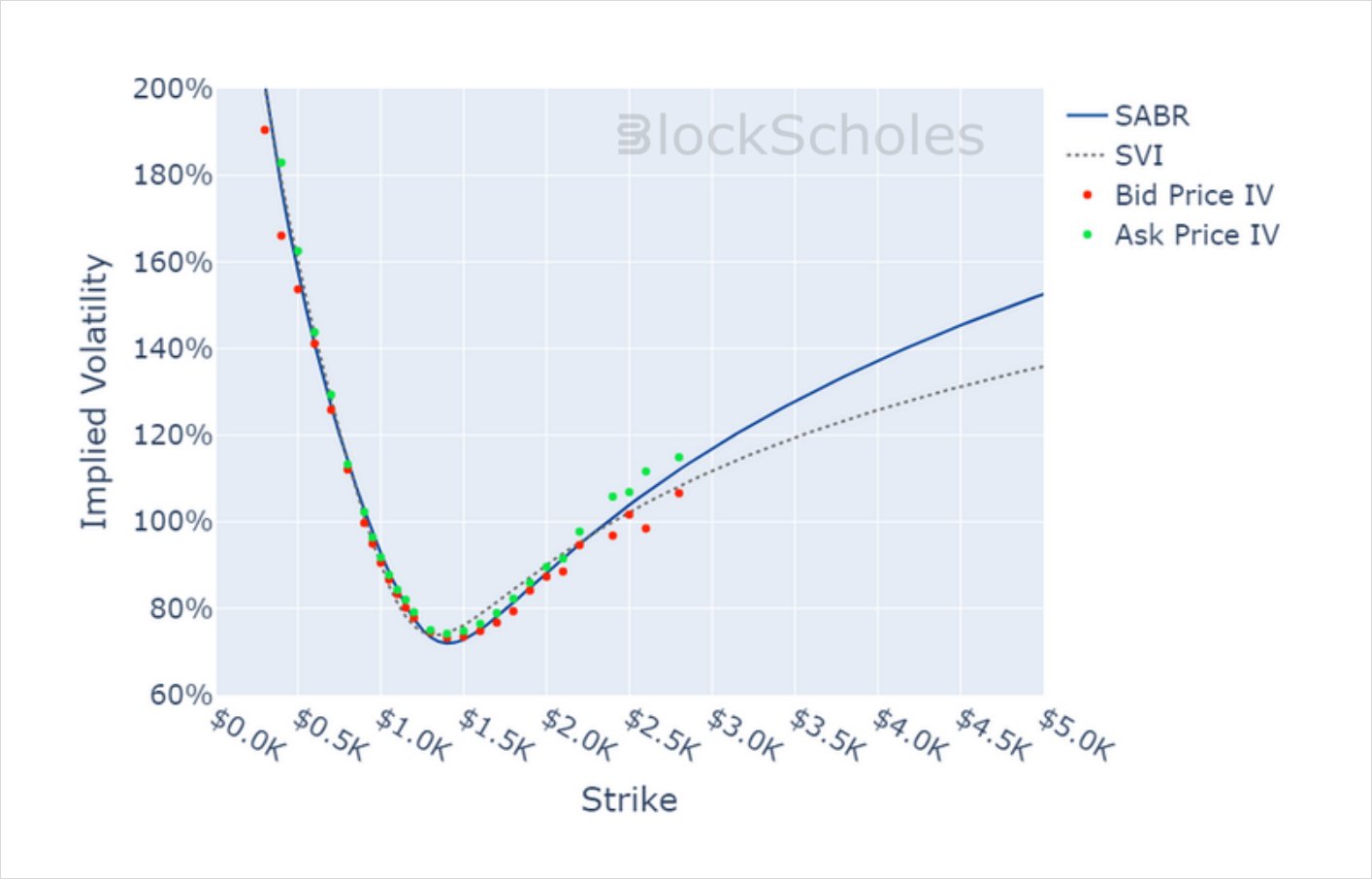

Volatility Smiles

BTC SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)