In this week’s edition of Option Flows, Tony Stewart is commenting on long protective Put with Long spot and BTC 60k rejected.

March 20

Long protective Put (+spreads+ratios) with Long spot has worked well, nurturing peace during illogical FUD, as BTC nudges 59k again.

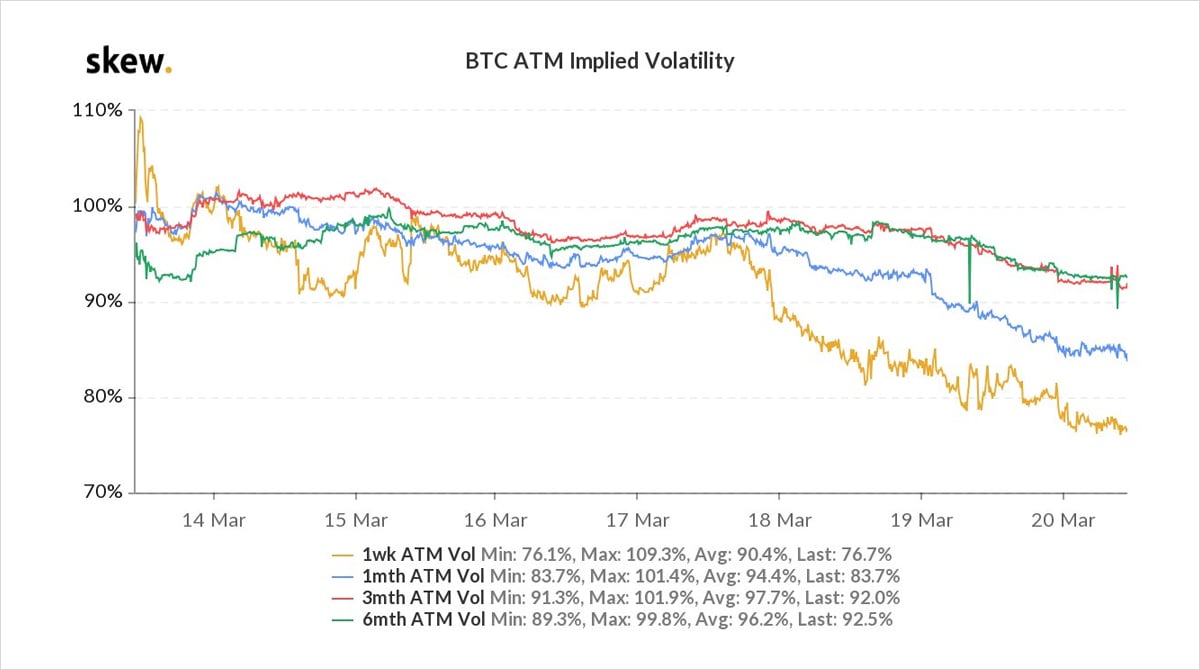

But 60k rejection + declining RV has pressured IV.

Call spreads fine, but long Call battling IV.

Observing flow change: 65k+ Call yield sales.

2) Previously, almost exclusively buy zones to leverage 60k/ATH blowout rallies, the last two days has observed selling in Apr2/9/30 66-84k Calls 1k+ in block clips.

This has dampened Call skew and added to softer Implied Vol, already drifting lower on falling Realized vol.

3) With BTC 10d RV 75%, 1m 85%, Implied Vol contango 75-90%.

IV hasn’t materially firmed on spot retraces but is expected if BTC >ATH again.

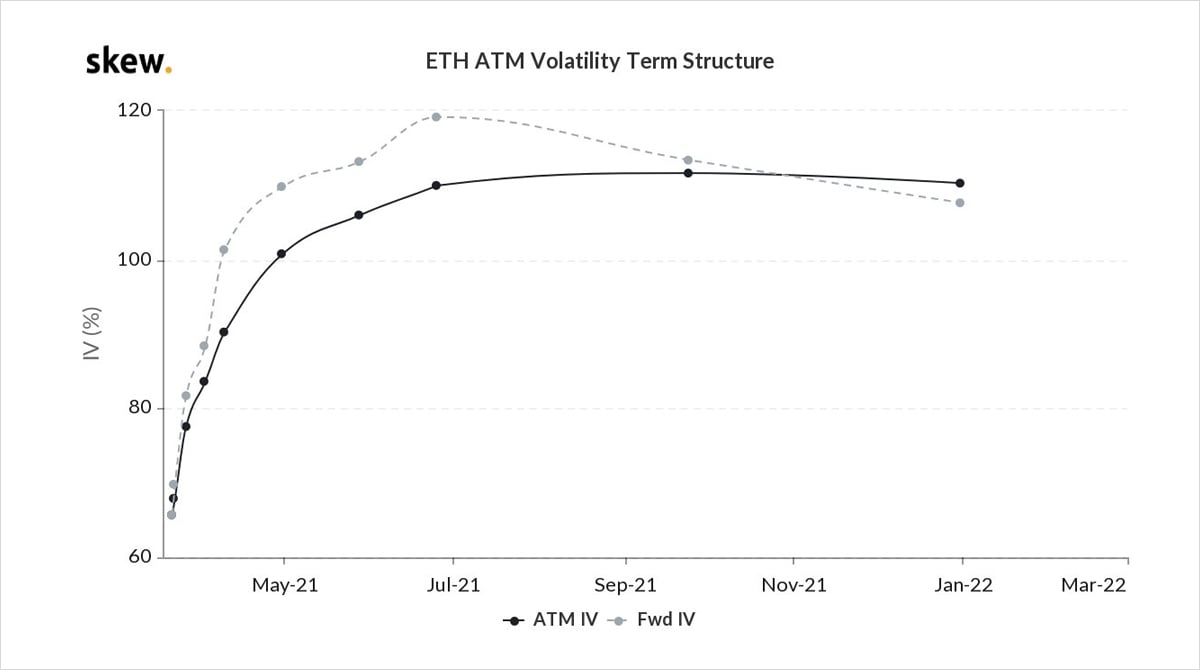

ETH term structure also turned contango, for the first time in a while as ETH spot stabilizes – 10d RV 80%.

EIP-1559 ahead interesting.

View Twitter thread.

AUTHOR(S)