Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Implied volatility started the period low and has continued to fall throughout the last weekly period for both assets, following the successful implementation of the Ethereum network’s “Shapella” upgrade late last Thursday. ETH’s skew towards OTM puts has abated somewhat at shorter tenors, but low future-implied yields at short tenors and excess demand for long underlying exposure through the perpetual swap contract paint a less clear picture about its recovery.

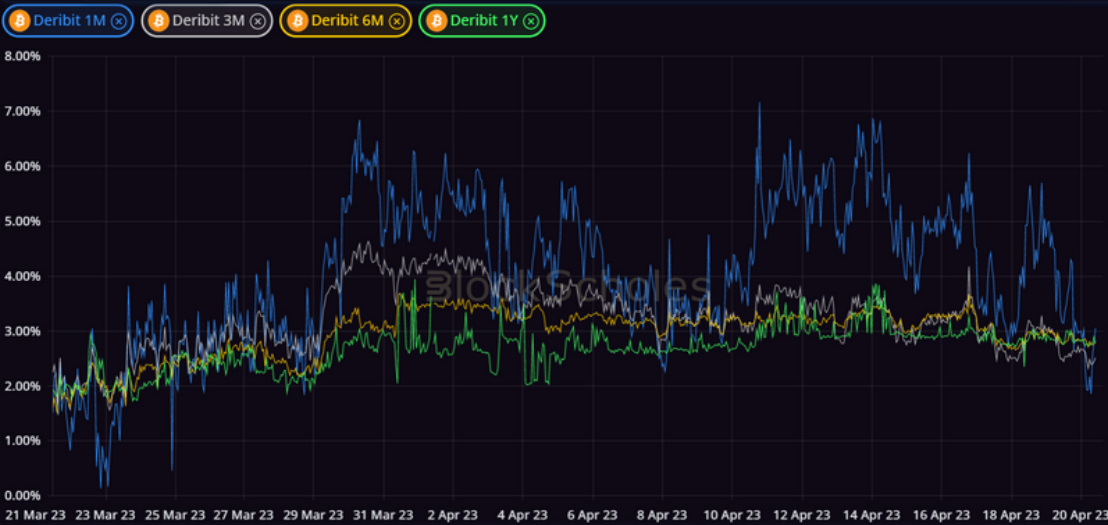

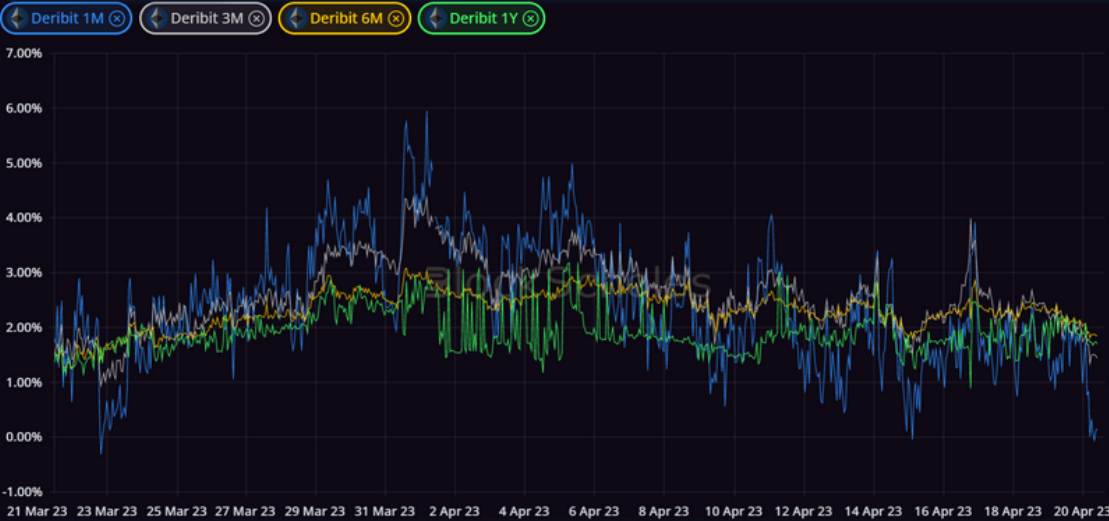

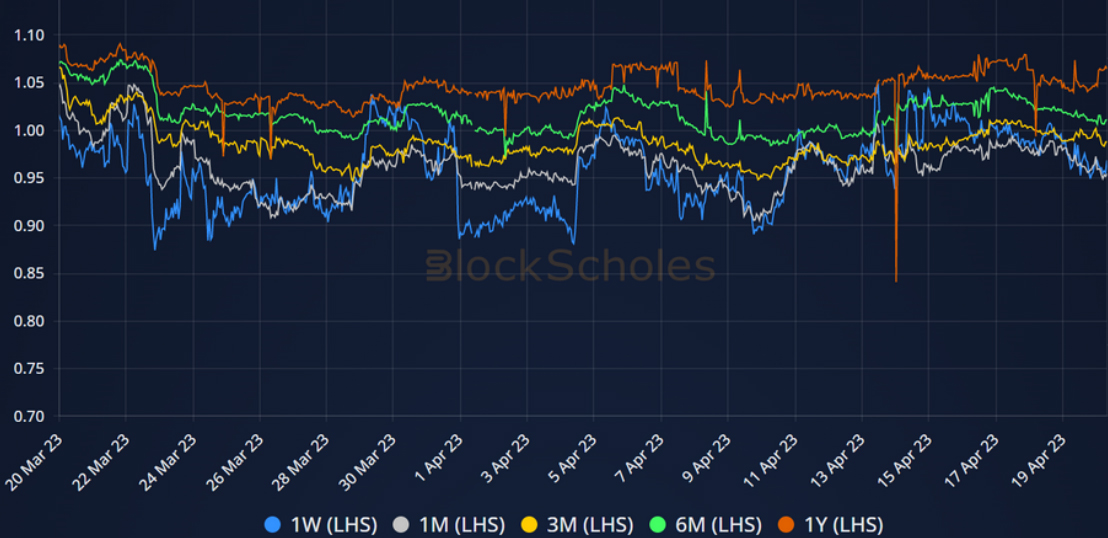

Futures

BTC ANNUALISED YIELDS – dominance of 1W yields have fallen, with all futures at all tenors trading near to 3% above spot at an annualised rate.

ETH ANNUALISED YIELDS – trade lower relative to spot, with 1W tenor futures at a similar level to their spot price.

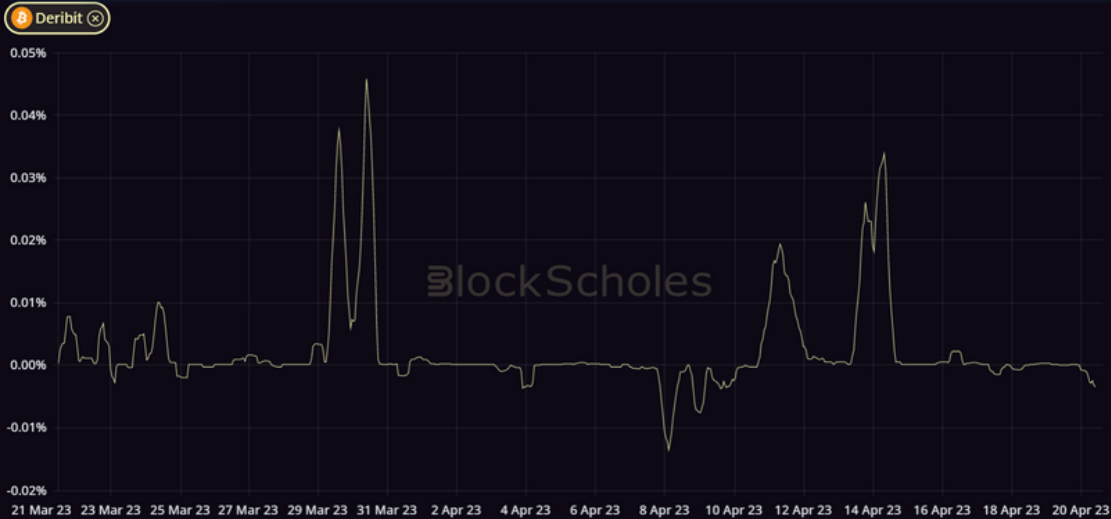

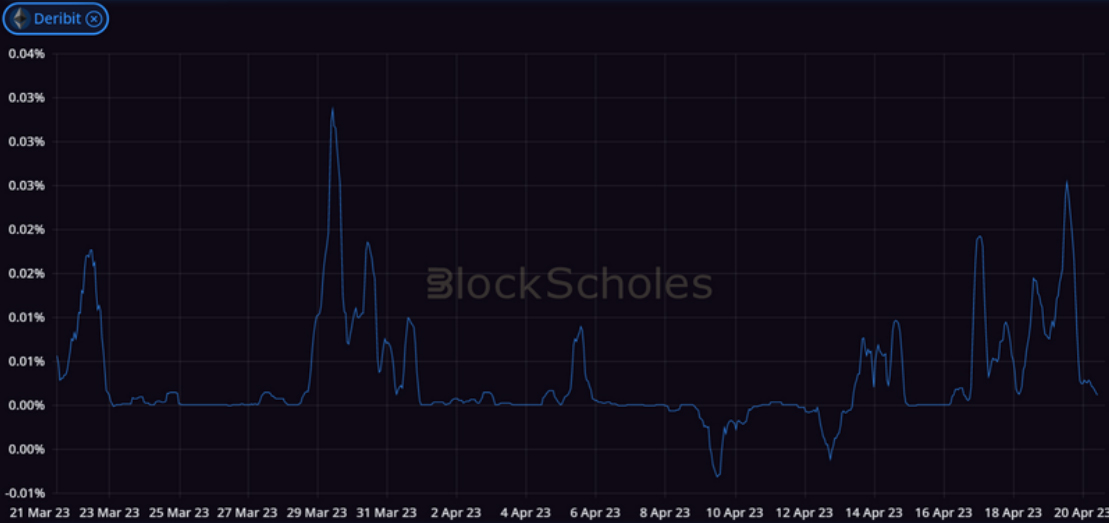

Perpetual Swap Funding Rate

BTC FUNDING RATE – saw a spike last Friday, with slight excess demand for short exposure in the last 24H.

ETH FUNDING RATE – show demand for long exposure to ETH’s spot price, in stark contrast to the behaviour of BTC’s funding rate over the last week.

Options

BTC SABR ATM IMPLIED VOLATILITY – continues to trade at lower levels, with shorter tenors falling below just 50 vol points.

ETH SABR ATM IMPLIED VOLATILITY – remains slightly higher than that of BTC options, but sees the same fall over the last 7 day period.

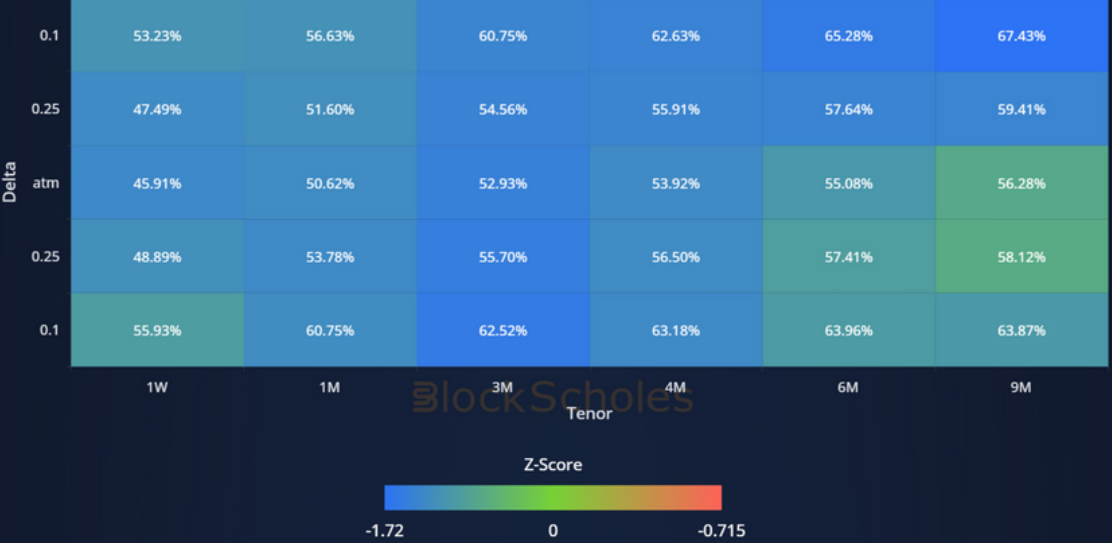

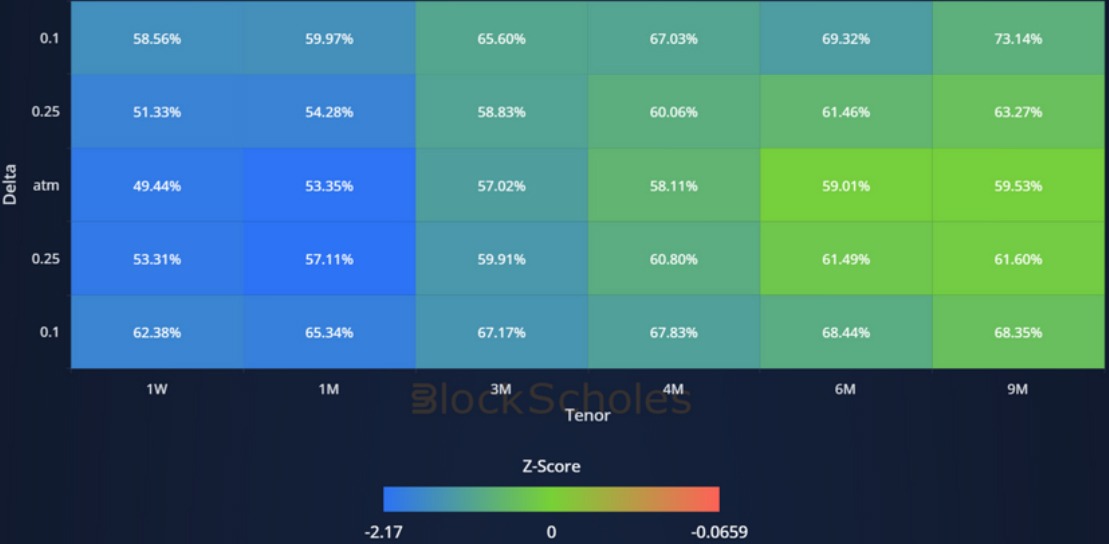

Volatility Surface

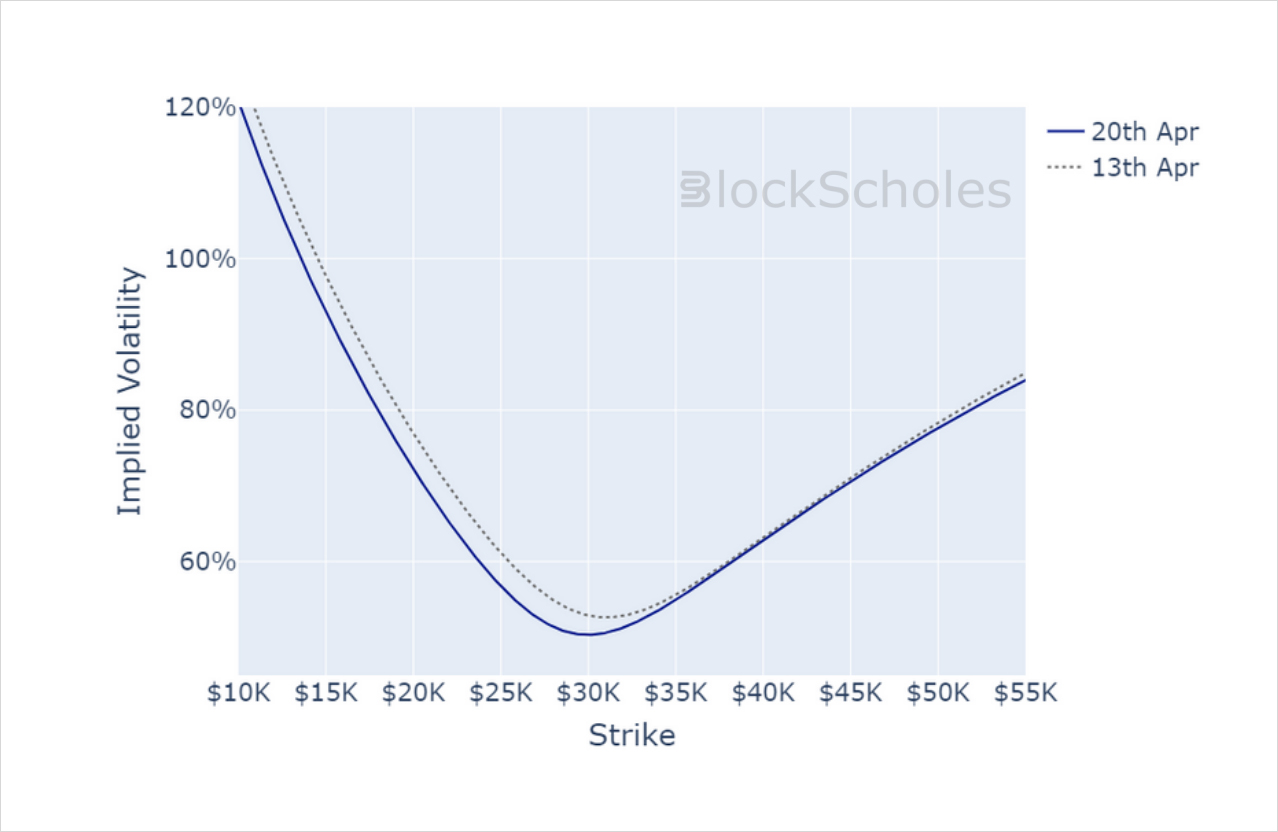

BTC IMPLIED VOL SURFACE – shows that the fall in implied volatility is not limited to ATM options, with points across the entire surface cooling.

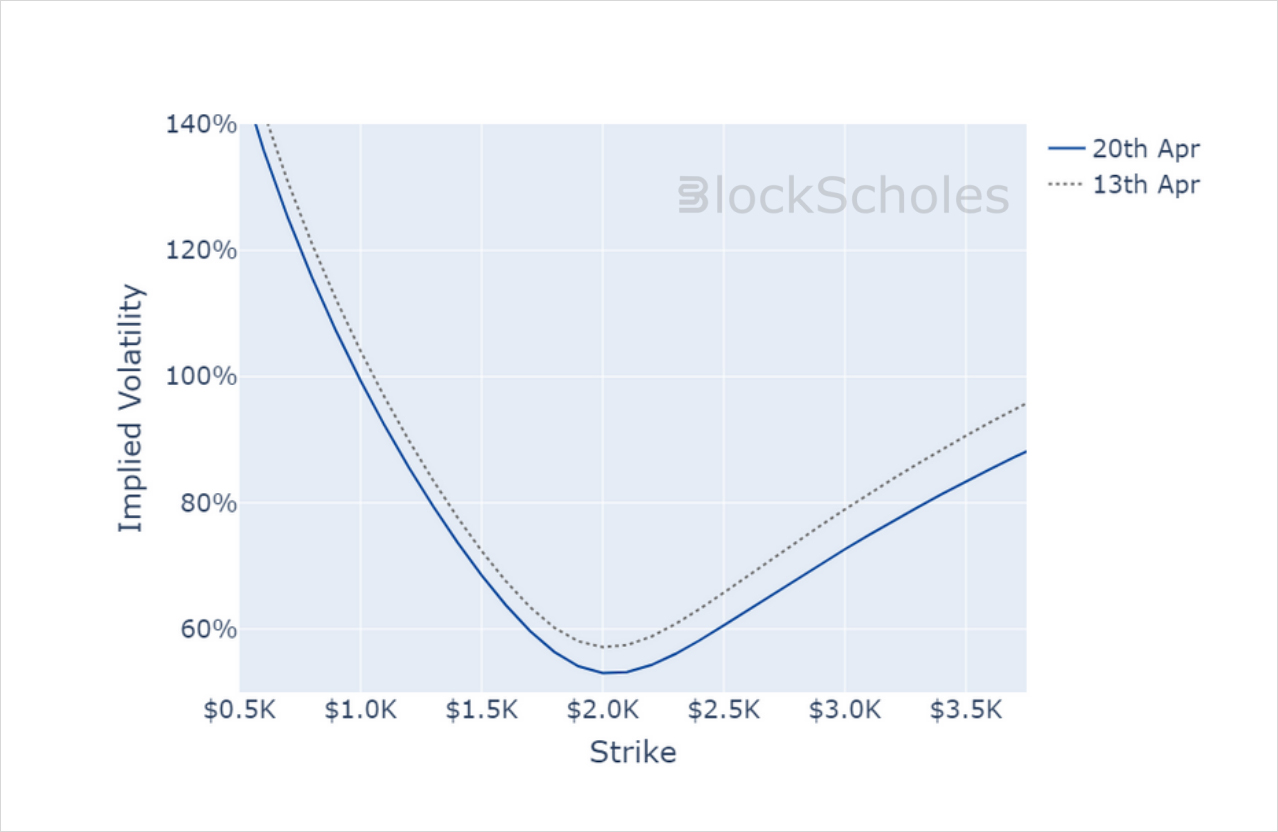

ETH IMPLIED VOL SURFACE – sees a sharper cooling in implied volatility across the strike domain at shorter tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

Put-Call Skew

BTC 25 DELTA PC SKEW – shows a more optimistic tilt at longer tenors than short, with options at all tenors pricing OTM volatility symmetrically.

ETH 25 DELTA PC SKEW – has recovered most dramatically at shorter tenors following the pessimistic expectations for the Beacon chain unlock.

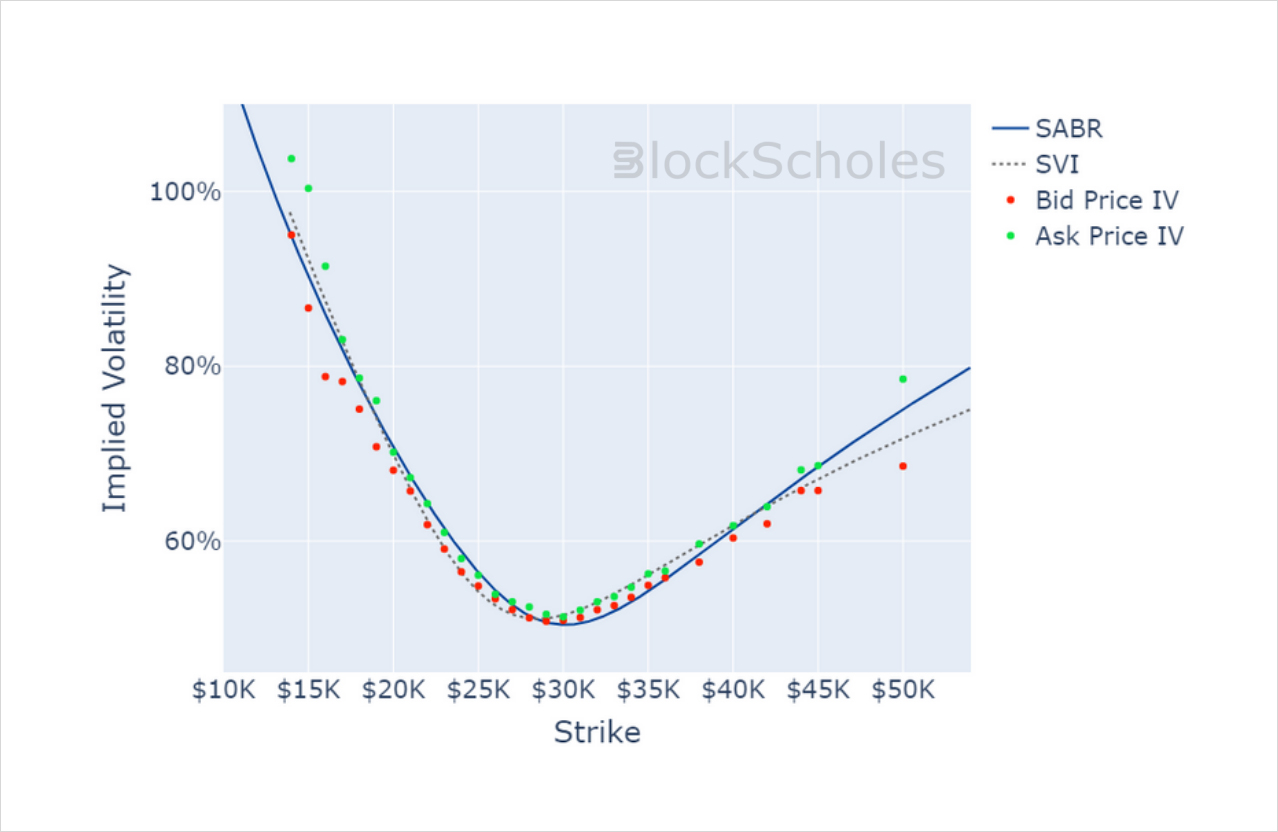

Volatility Smiles

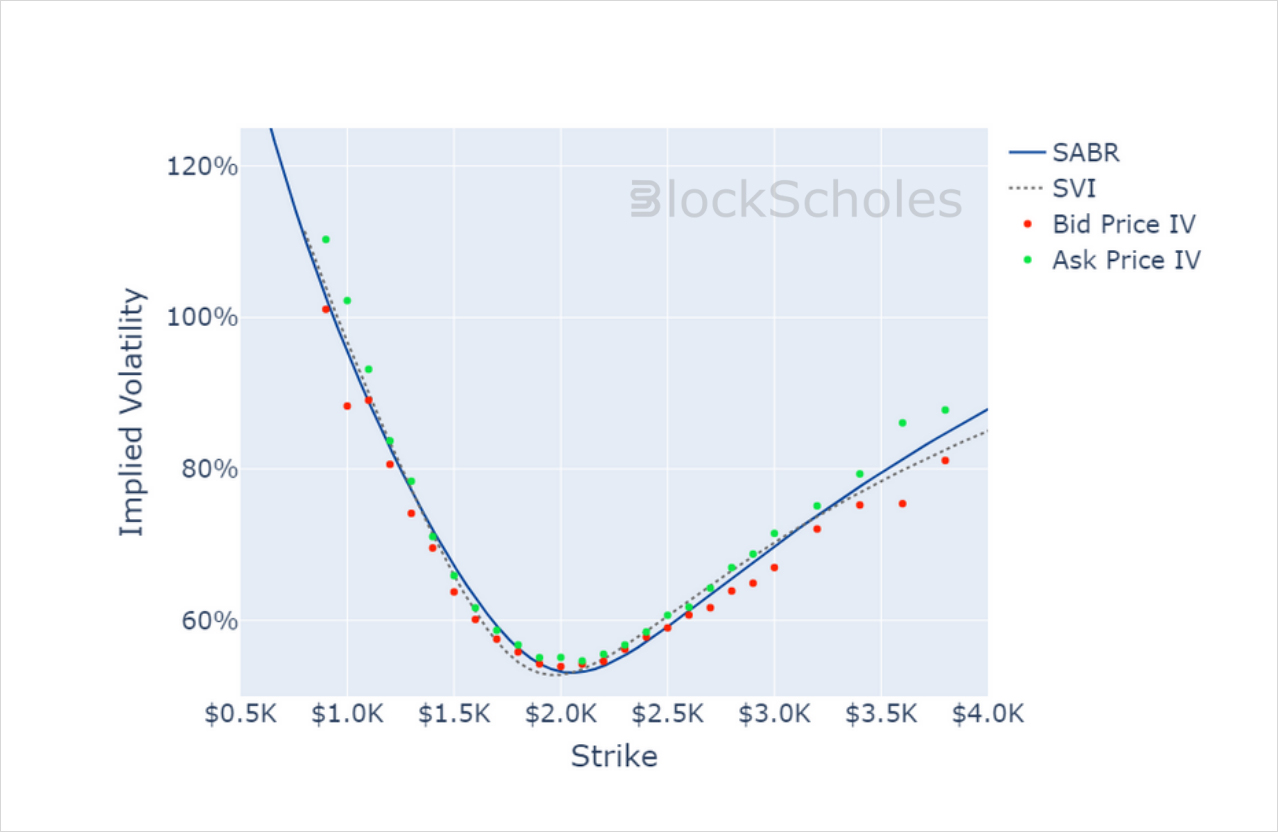

BTC SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)