Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A downturn in implied volatility over the last 24 hours takes the levels of both assets closer to their alltime lows. At the same time we see a further skew towards OTM puts in the volatility smiles of BTC and ETH, with the latter reporting a higher preference for downside protection. Future-implied yields show a similar sentiment to perpetual swaps, with little excess demand for long or short exposure through the derivatives relative to spot price.

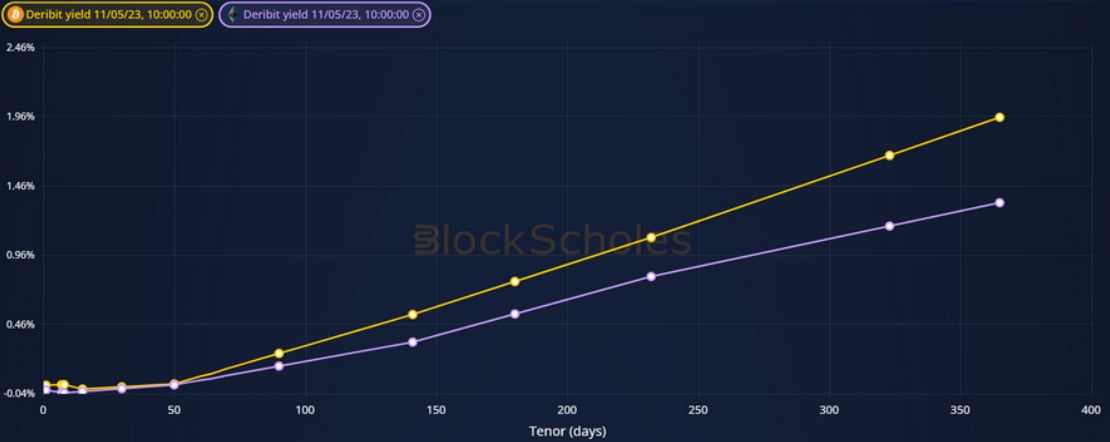

FUTURES IMPLIED YIELD TERM STRUCTURE.

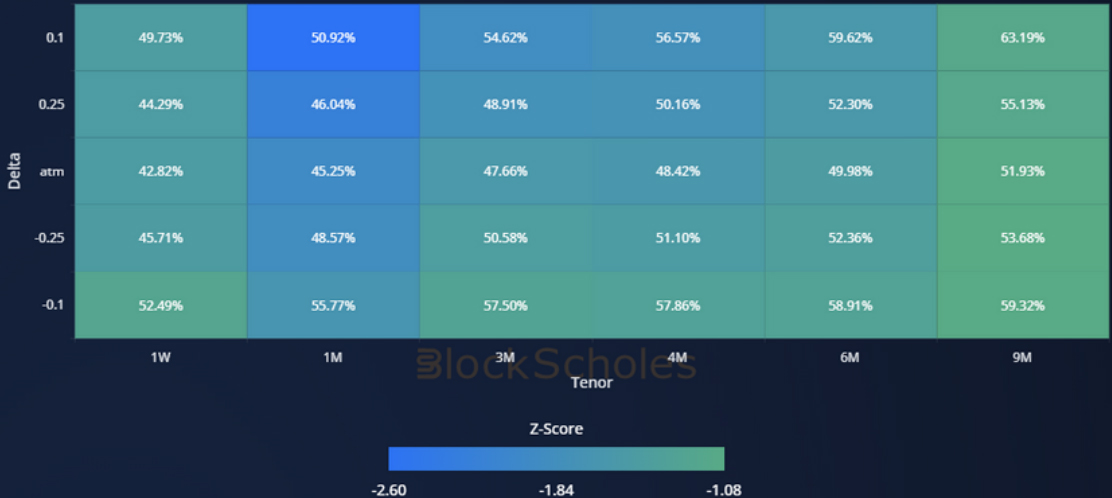

VOLATILITY SURFACE METRICS.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

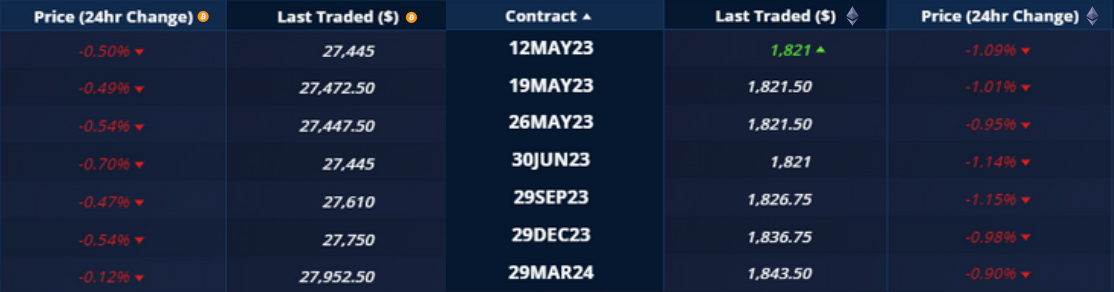

Futures

BTC ANNUALISED YIELDS – all tenors trade sideways in a range just above zero, with 1 week tenor futures seeing the most volatility relative to spot.

ETH ANNUALISED YIELDS – are negative at a 1 week tenor, with longer tenors trading just above zero.

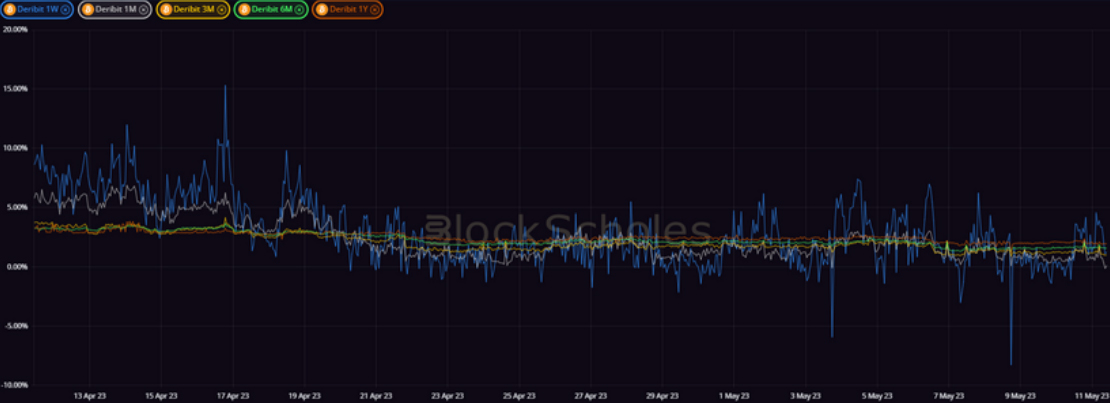

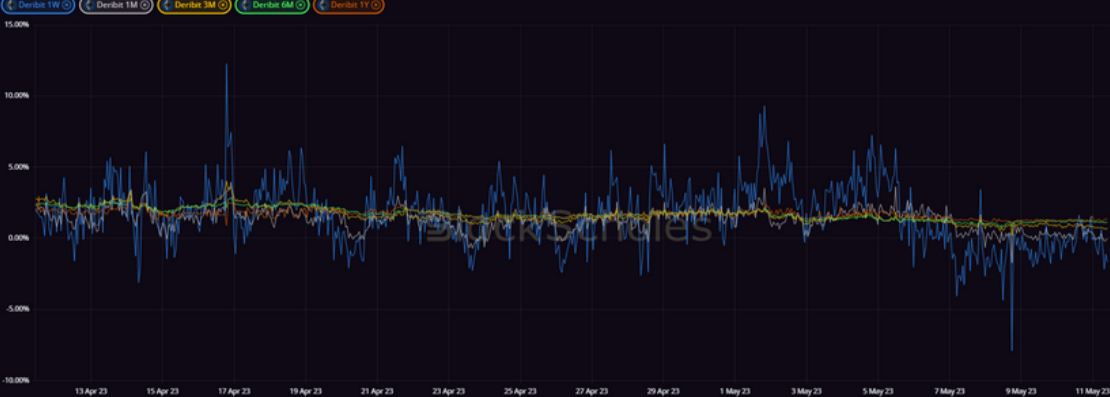

Perpetual Swap Funding Rate

BTC FUNDING RATE – continues close to zero similar to its behaviour over the last month.

ETH FUNDING RATE – joins BTC’s close to zero, halting its strong positive rate paid from long to shorts in the early weeks of the past month.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has traded at historically low levels even before a significant fall in the last two days across the term structure.

BTC 25-Delta Risk Reversal – has turned more negative in the last two days, shifting the vol smile skew further towards OTM puts.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – drifts lower still in a tighter range, without a significant premium to that of BTC options.

ETH 25-Delta Risk Reversal – trades significantly lower than BTC’s across the term structure following a downturn over the last week.

Volatility Surface

BTC IMPLIED VOL SURFACE – shows that the fall in implied volatility over the last month has not been limited to the ATM strikes.

ETH IMPLIED VOL SURFACE – reports a similar surface wide fall in implied volatility over the past month, as values trend towards historic lows.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

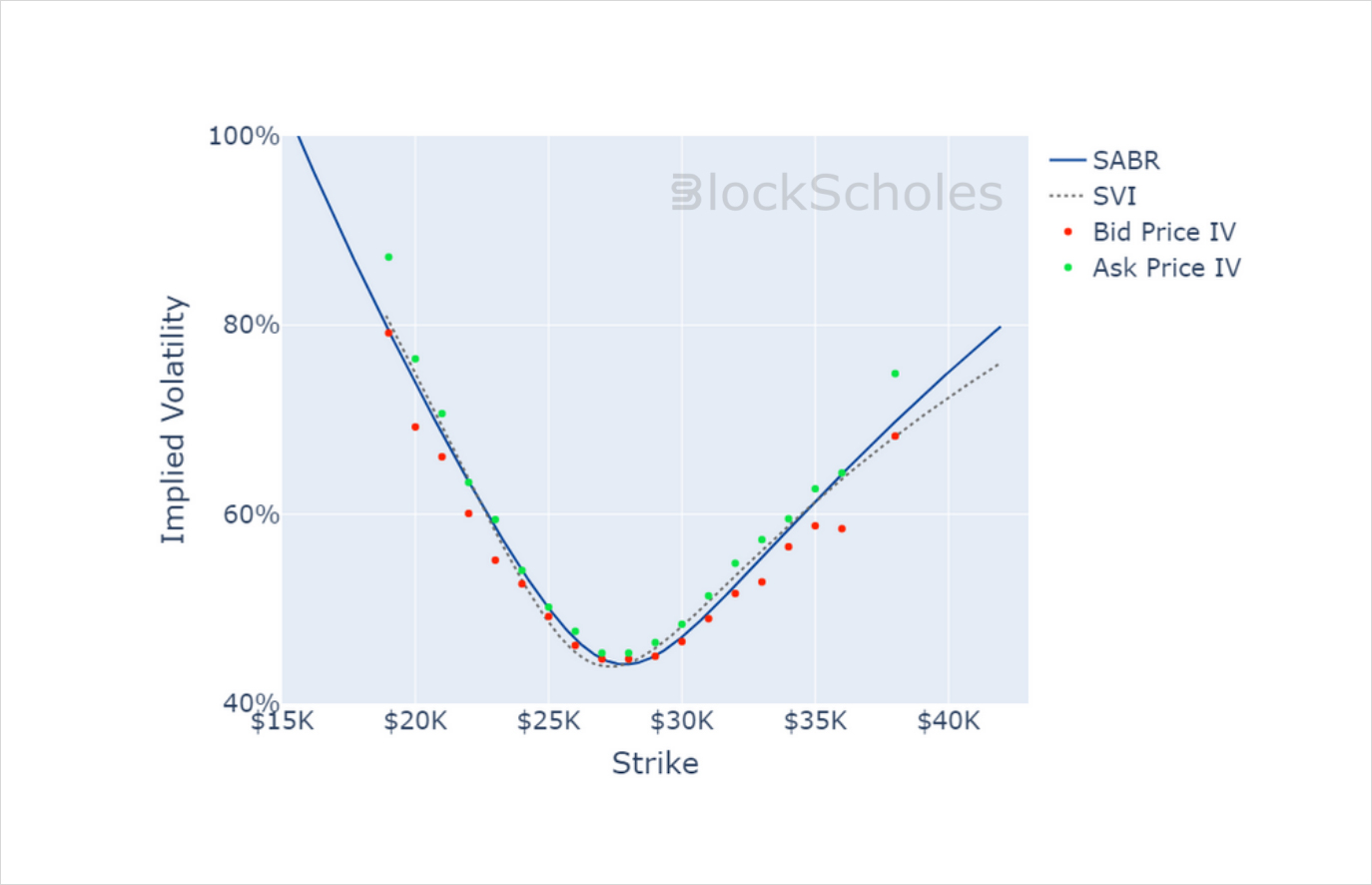

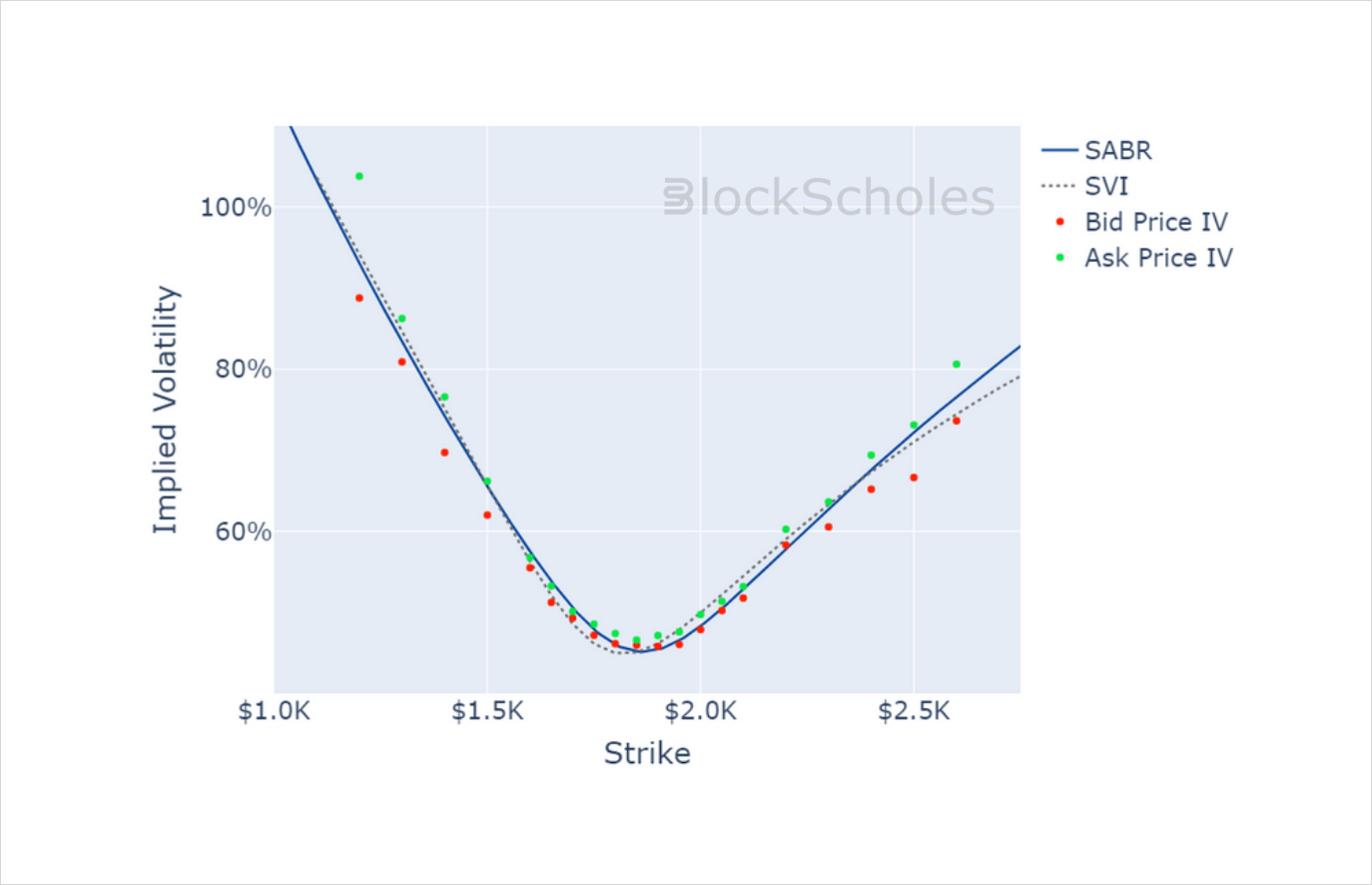

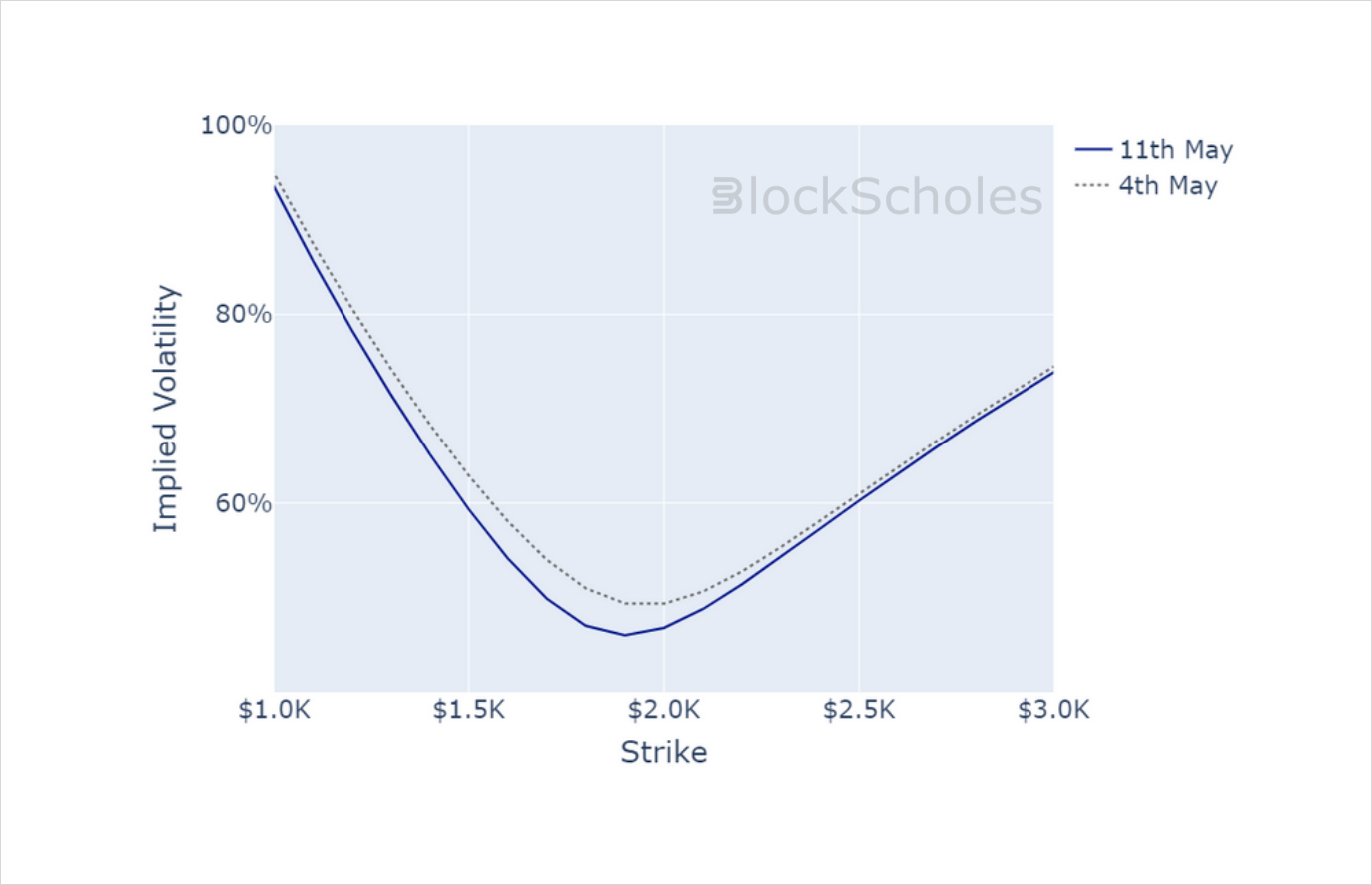

Volatility Smiles

BTC SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

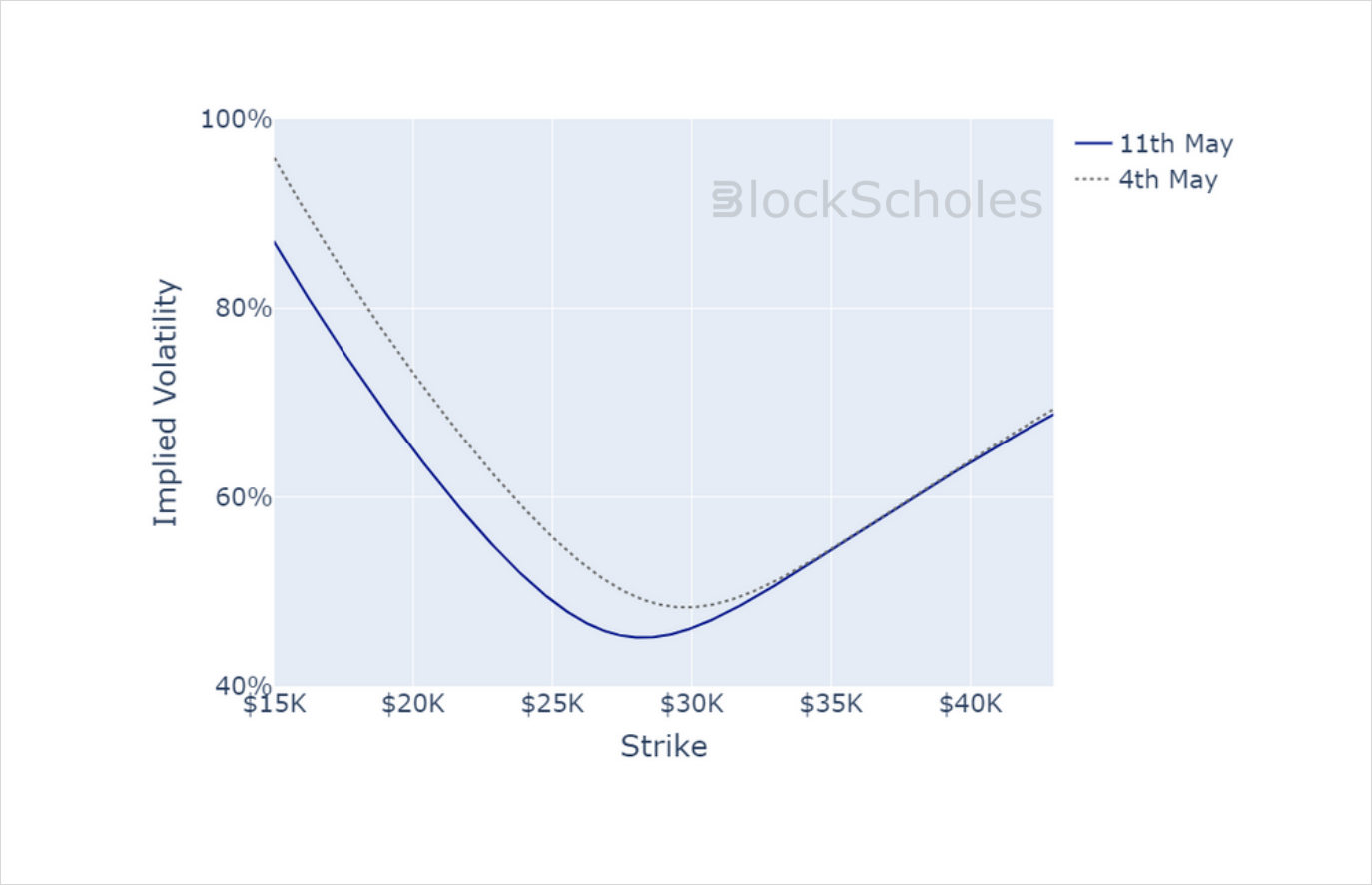

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)