Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

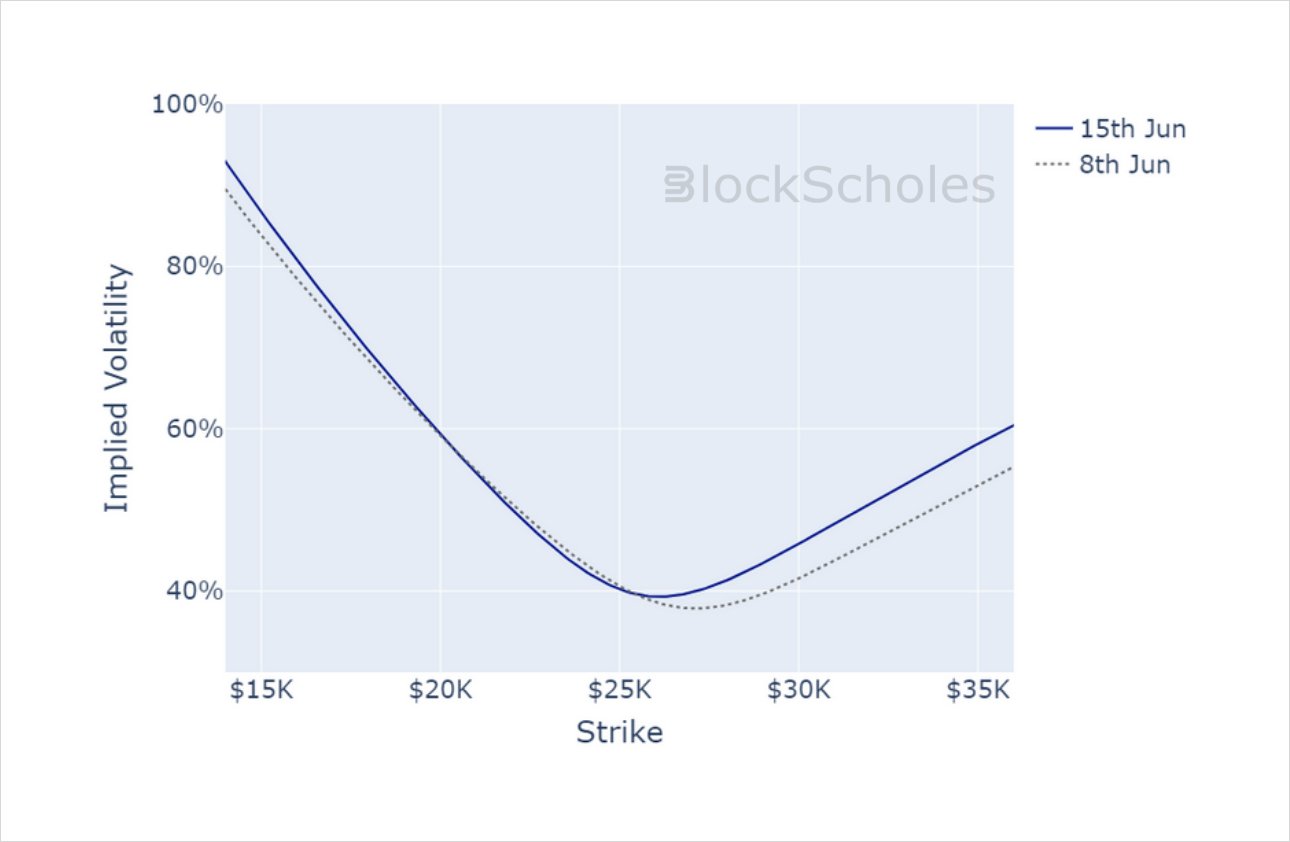

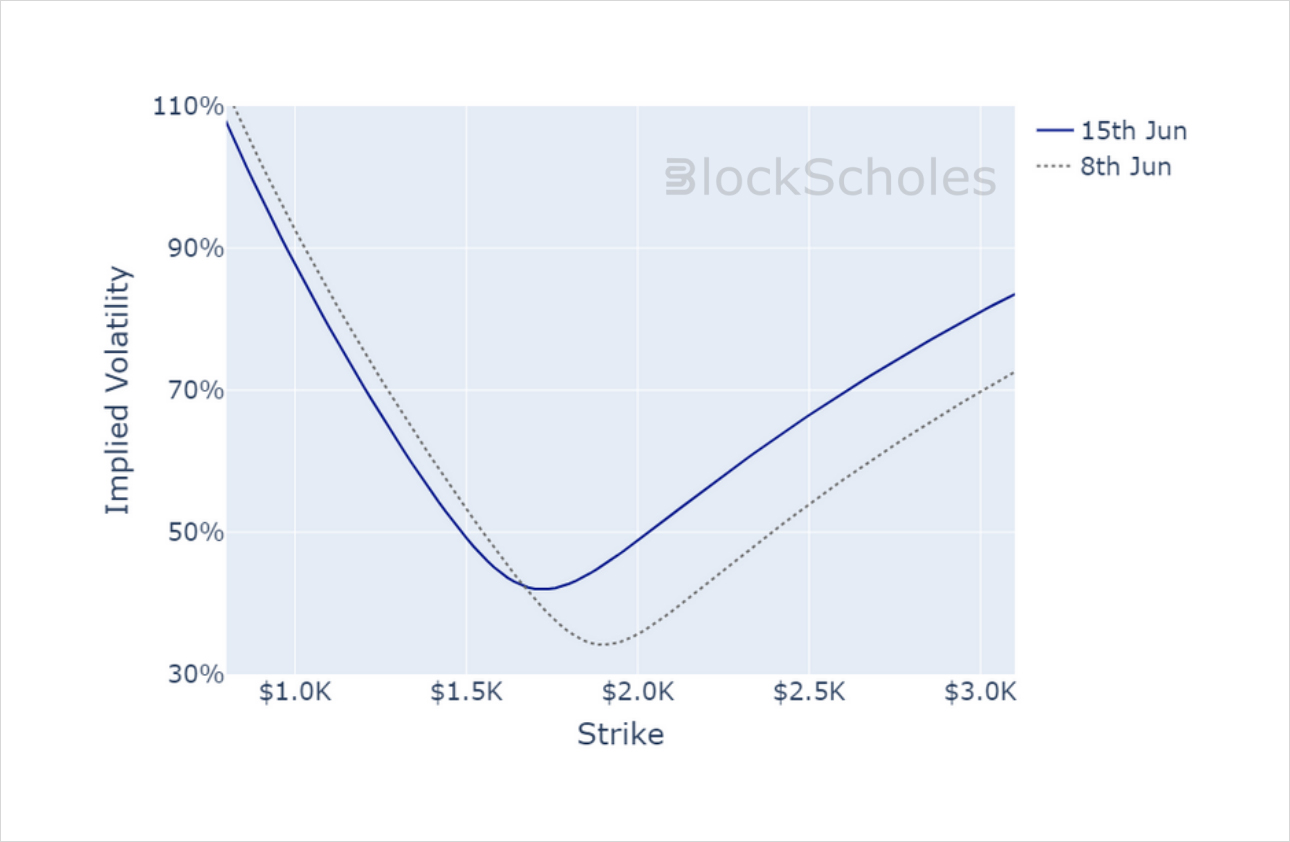

As with several recent increases in realised volatility, yesterday’s selloff in spot prices did not result in the extreme jump in implied volatility that we seen in more reactive market regimes. A fall in futureimplied spot yields at short tenors recovered soon after to trade at month-long highs, and the funding rate of both BTC and ETH perpetual swap contracts indicates a healthy demand for long exposure to the underlying assets. However, both volatility smiles express a distinct preference for downside protection.

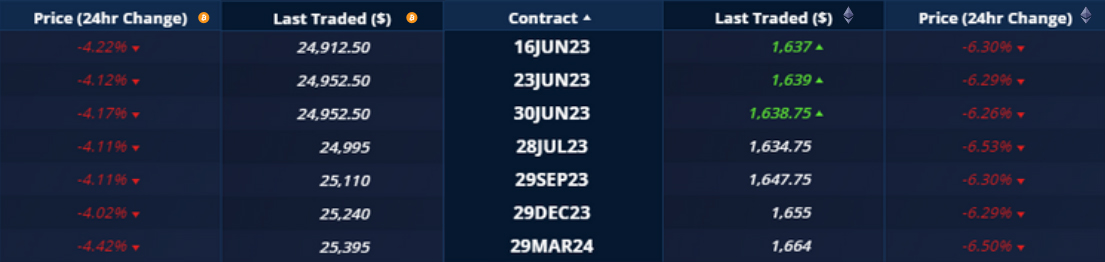

FUTURES IMPLIED YIELD TERM STRUCTURE.

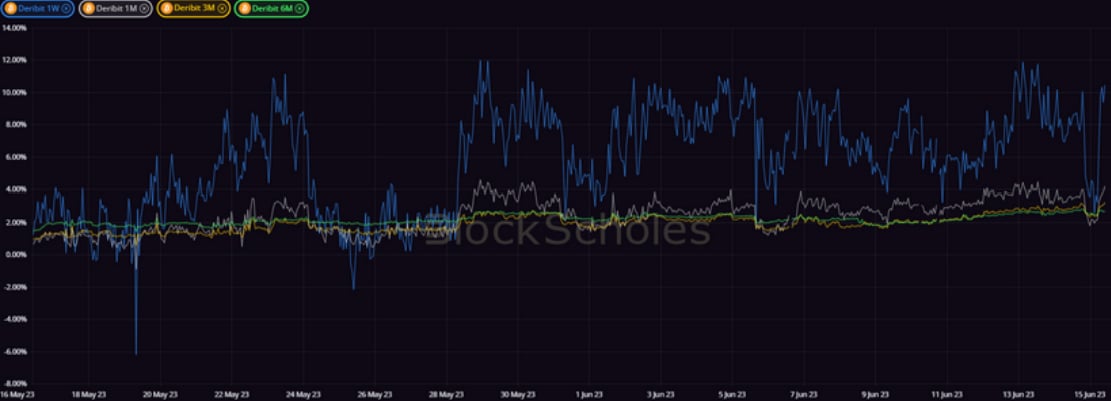

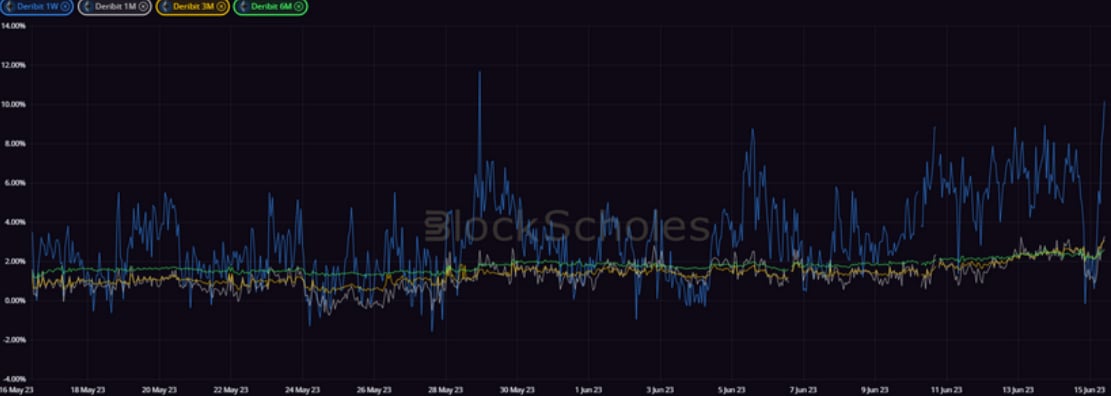

VOLATILITY SURFACE METRICS.

All data in tables are recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – recover their positive, double-digit levels after a brief fall late this week.

ETH ANNUALISED YIELDS – now trade near their highest levels in the last month at short tenors after a brief fall to near 0%.

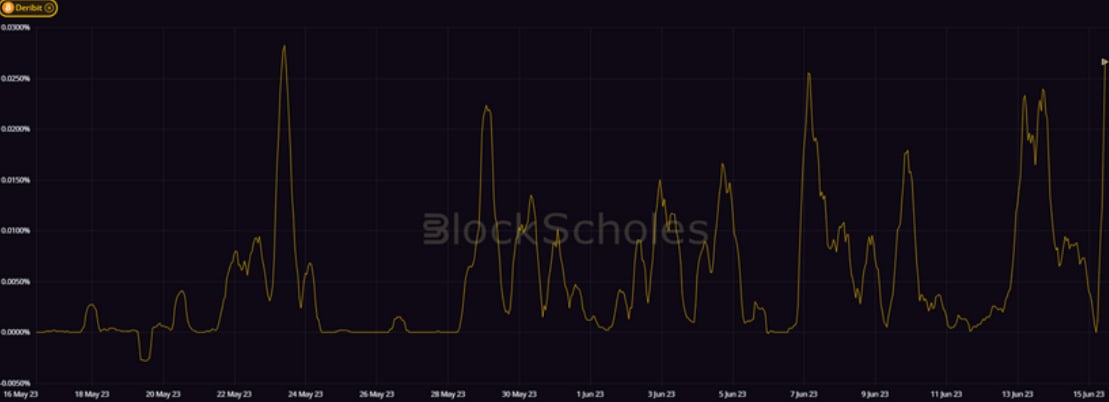

Perpetual Swap Funding Rate

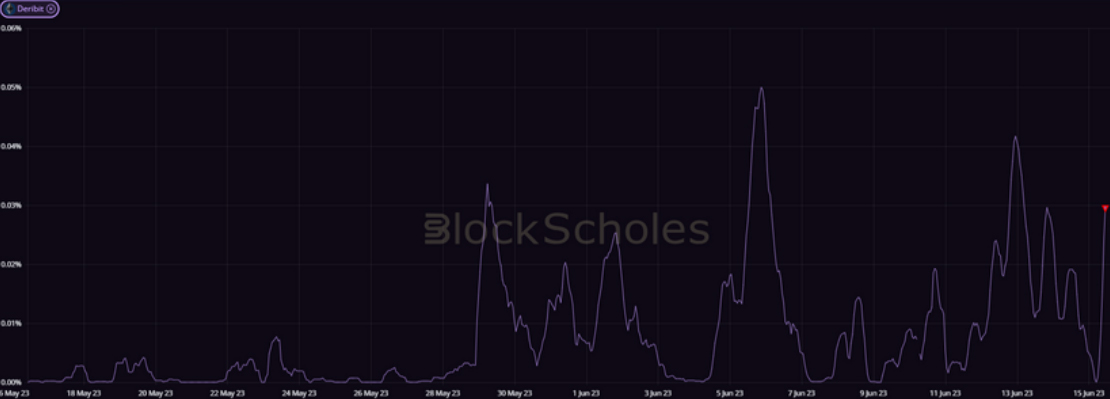

BTC FUNDING RATE – continues a strong positive streak, expressing strong demand for long exposure through the perpetual swap.

ETH FUNDING RATE – like BTC, shows that long positions are still willing to pay for long exposure to ETH.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – despite a selloff in spot continues to trade sideways between 40% and 45% across the term structure.

BTC 25-Delta Risk Reversal – has drifted downsides over the past week, reaching the lowest levels seen over the past month at short tenors.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – remains near to historically low levels despite a small upwards trend in the last 7 days.

ETH 25-Delta Risk Reversal – remains negative across the term structure, reflecting a distinct preference for downside protection.

Volatility Surface

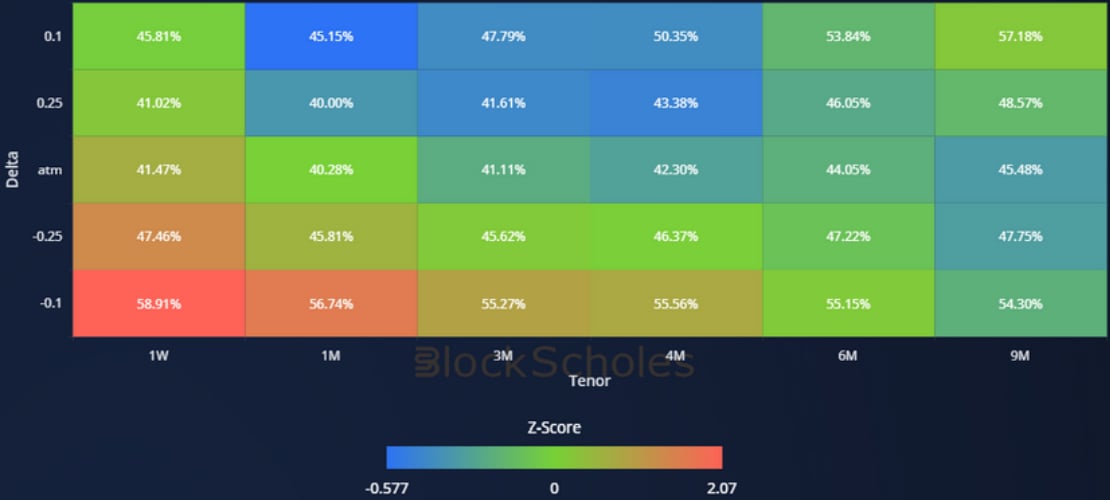

BTC IMPLIED VOL SURFACE – reverses several weeks of surface-wide cooling, showing a pick up in downside protection at short tenors.

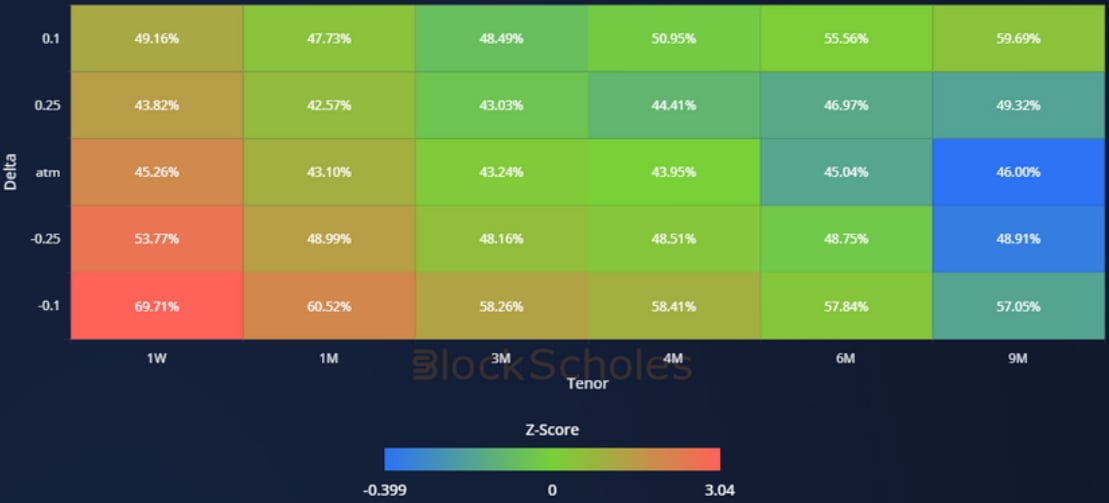

ETH IMPLIED VOL SURFACE – displays a similar increase in the implied volatility of near-side options, with a tilt towards OTM puts.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

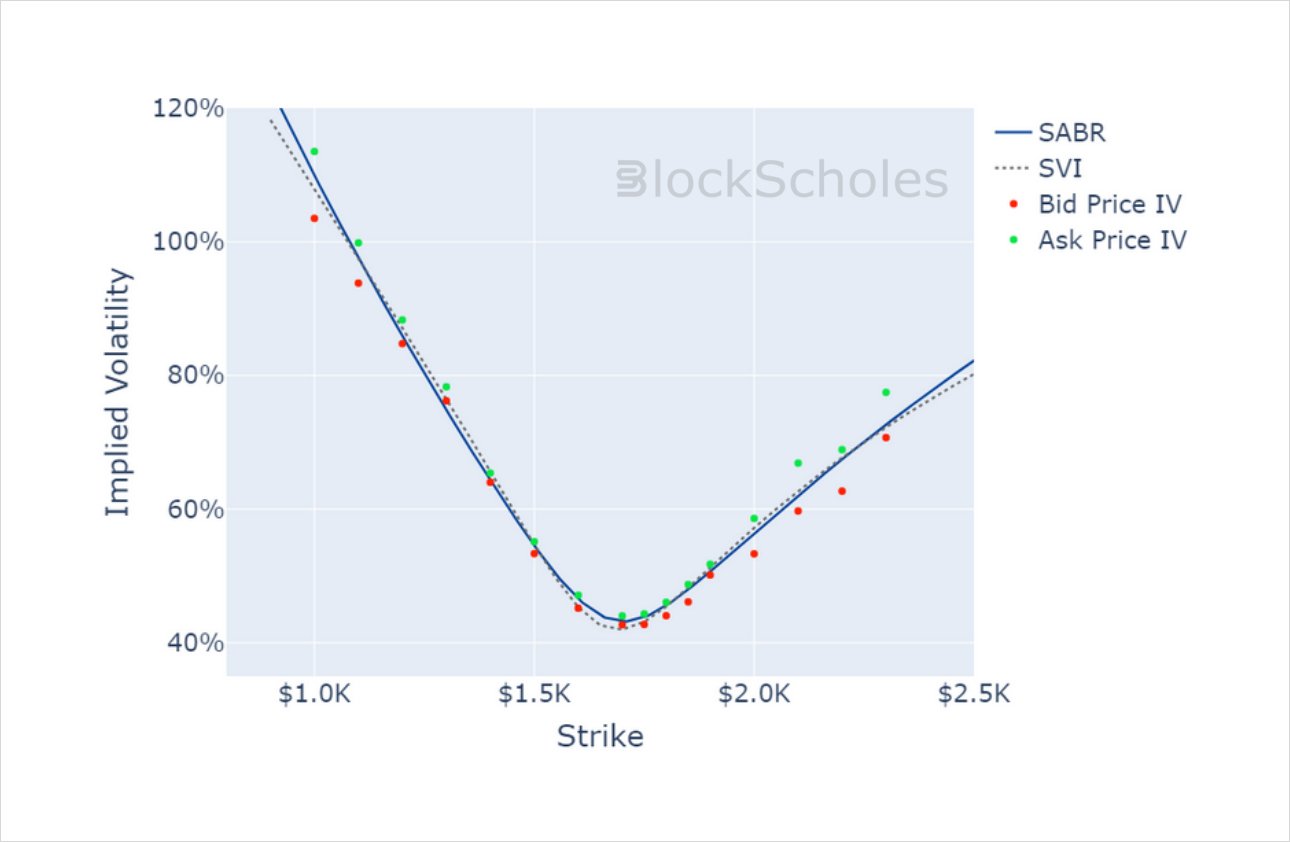

Volatility Smiles

BTC SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)