In this week’s edition of Option Flows, Tony Stewart is commenting on trades during the weekend, and what to expect this week.

Wknd smart money bought Oct 28+28.5k Calls v BTC 27k, on the US govt shutdown pushback.

Risk-aversion unwinds on CME open Sunday jettisoned risk higher, BTC+ETH soaring 4%.

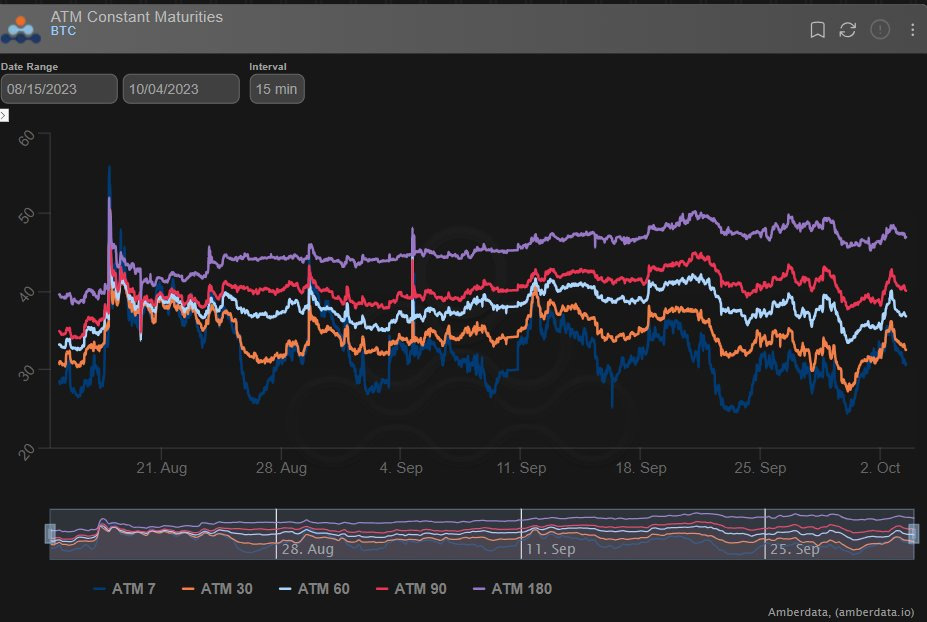

Option IV failed to react – easy Gamma.

ETH futures ETF FOMO Call buyers then pumped it.

Underwhelming.

2) Conspicous wknd spend of $350k on Oct20 28+28.5k Calls, partially funded by selling Nov 36k Calls blocked on Paradigm, sold into by perhaps unsuspecting MM unaware of the US govt shutdown pushback.

CME-related short-squeeze was enacted.

Forced liquidations, but no IV reaction.

3) Most Option participants weren’t around to play, IV didn’t move, little traded and only a few took advantage of the cheap Gamma from the immediate move, and ahead of the reaction to ETH ETF futures to trade <24h.

When Funds awoke, they scooped up Gamma, via Nov+Dec ~32k Calls.

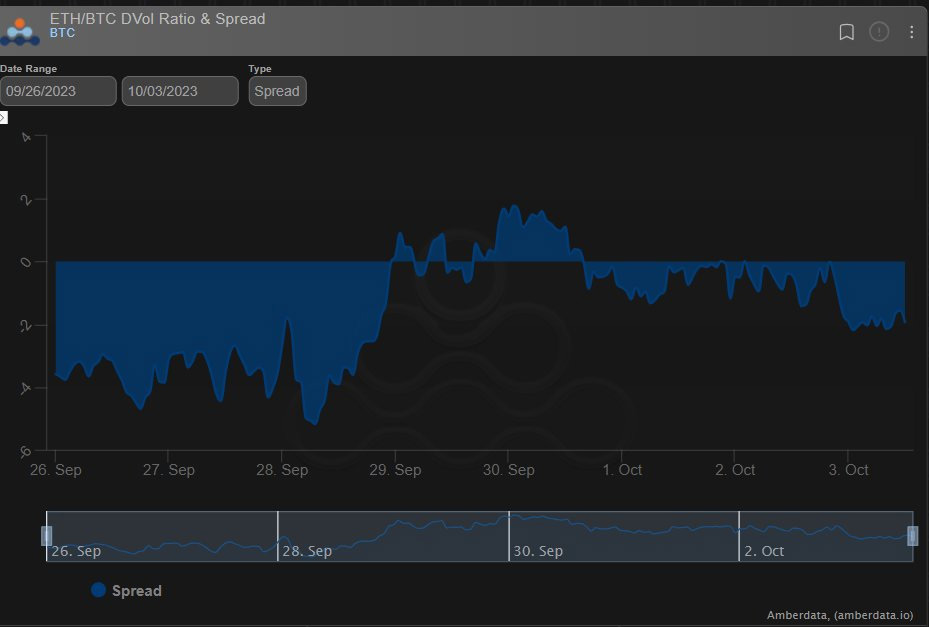

4) ETH natives were less impressed and awaited the actual ETH Futures ETF data, which was very underwhelming even for day1.

Quite interestingly, ETH did not shine for long as the narrative, ETH Option flows subdued and following rather than leading.

BTC+ETH plunged from 28.6/1760.

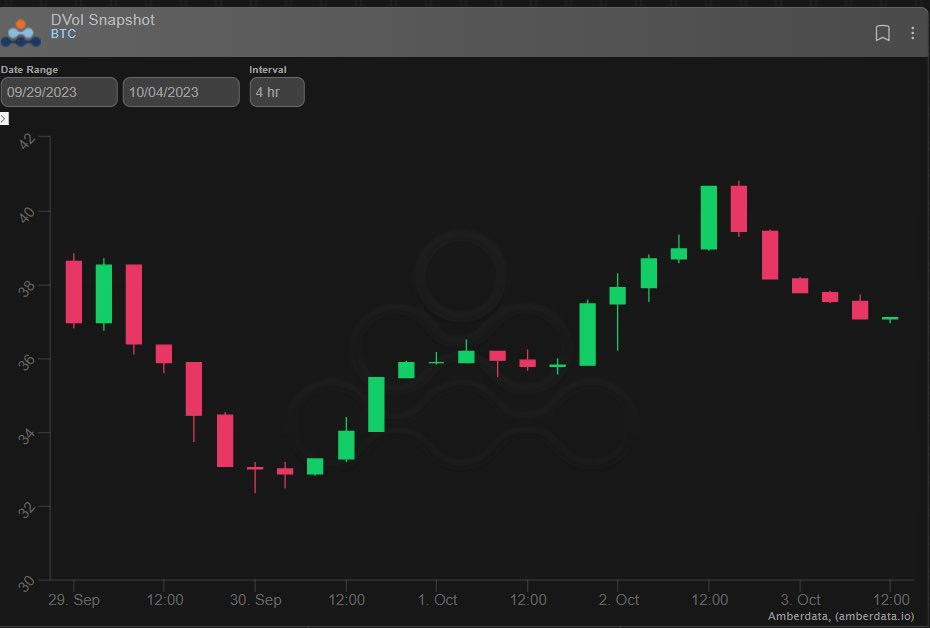

5) IVs followed, but more ‘meh’ drifted lower – ‘yeah that was the top’ – with only a small Nov Straddle seller showing any aggression to get out.

From the highs, IV has fallen back 3-4% (1month proxy), just chilling in the mid-ranges.

Long-term progress for Spot ETF, no cigar.

View Twitter thread.

AUTHOR(S)