Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Having traded at a discount for much of the past month, the prices of short-tenor ETH futures have recovered to trade on par with spot. We also see the demand for long exposure in its perpetual swap contracts matching that of BTC’s, as expressed by the funding rates of both instruments. Volatility levels remain steady in the 30%-50% range for both majors, but ETH options report a swift increase in the volatility implied by 25- and 10-delta puts relative to the levels of similarly OTM calls.

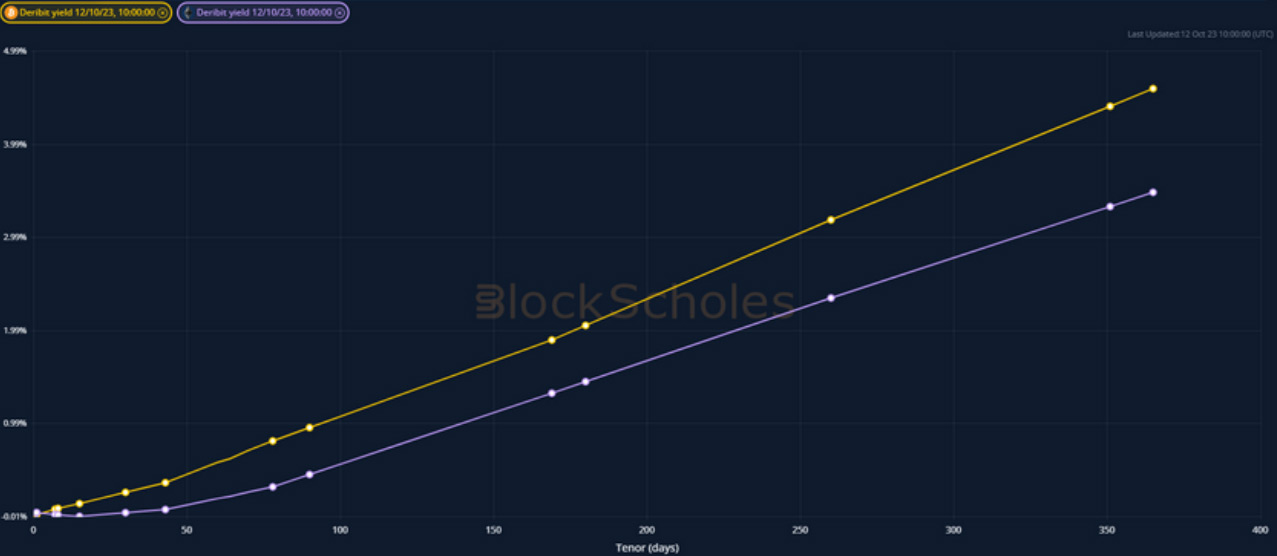

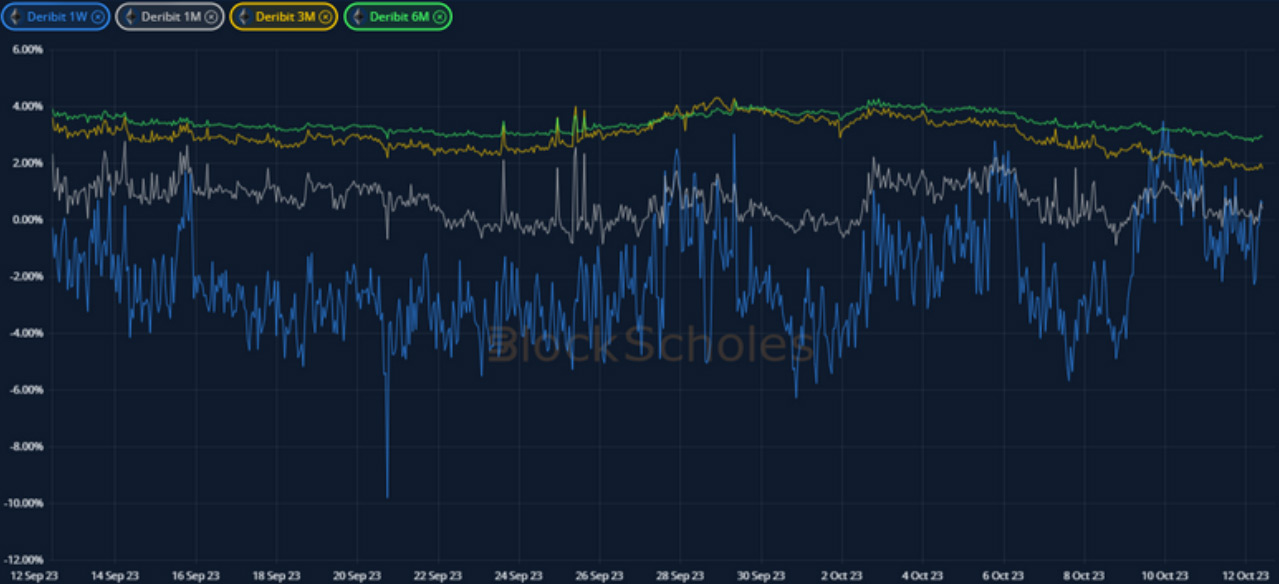

Futures implied yield term structure

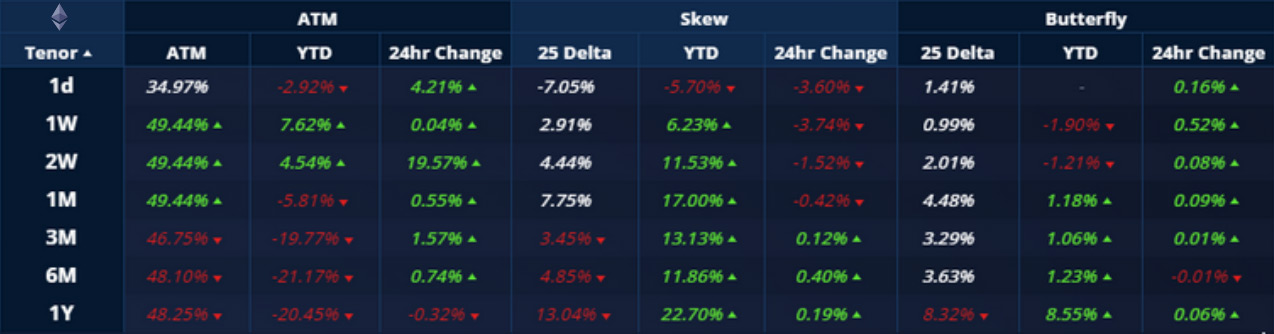

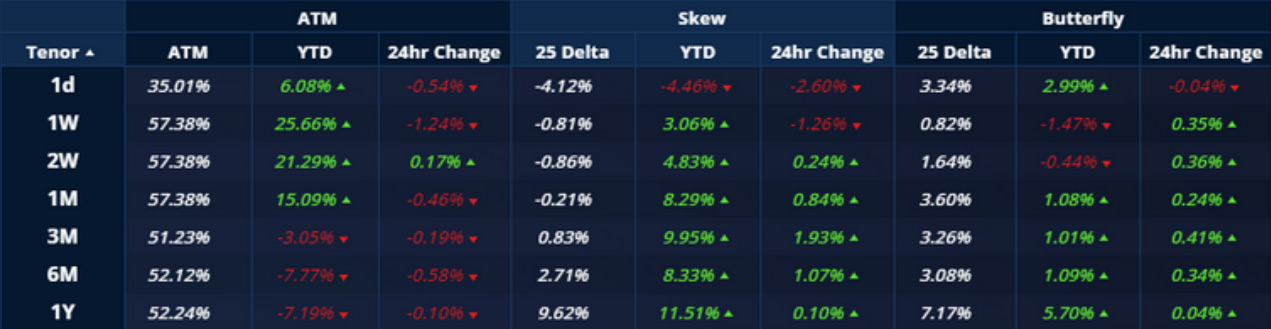

Volatility Surface Metrics

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

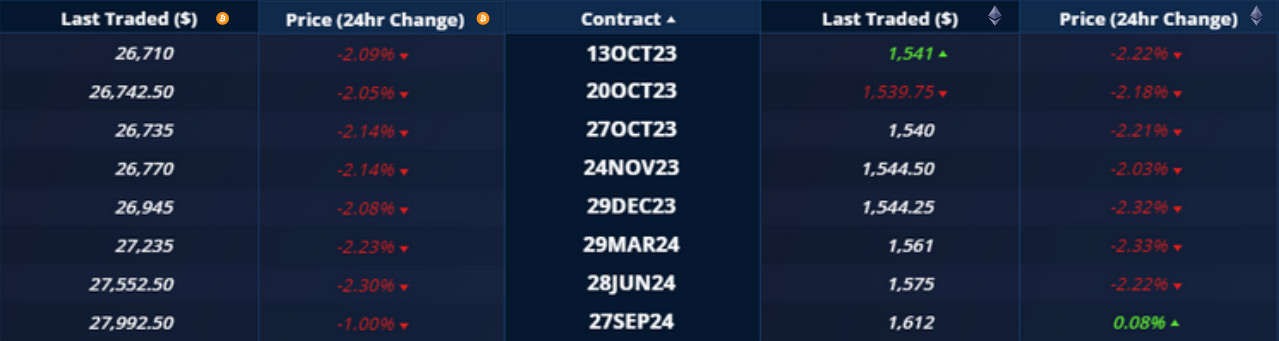

Futures

BTC ANNUALISED YIELDS – have reported a small slide at tenors longer than 1-month alongside spot prices over the last two days.

ETH ANNUALISED YIELDS – 1-week tenor futures prices have risen from 2% below spot prices at an annualised rate to trade on par.

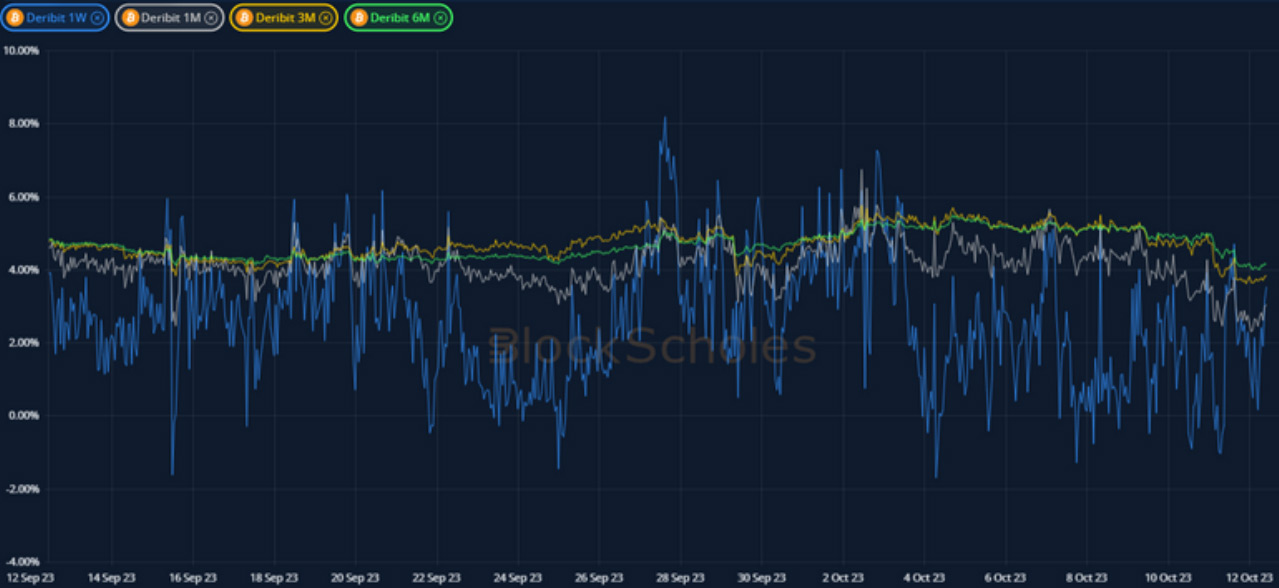

Perpetual Swap Funding Rate

BTC FUNDING RATE – strong positive rates show a willingness of long positions to pay for exposure through the contract.

ETH FUNDING RATE – have climbed higher this week after a short period of inactivity.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – trades between 30% and 50% across the term structure.

BTC 25-Delta Risk Reversal – continue to show a slight lean towards puts at 1W and 1M tenors, while 6M tenors report a slight tilt towards calls.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC movements with vols across the term structure seeing little change in levels since last week.

ETH 25-Delta Risk Reversal – has shown a strong trend towards OTM puts at a 1W tenor and more of the same smaller tilt towards downside protection at 1M and 3M tenors.

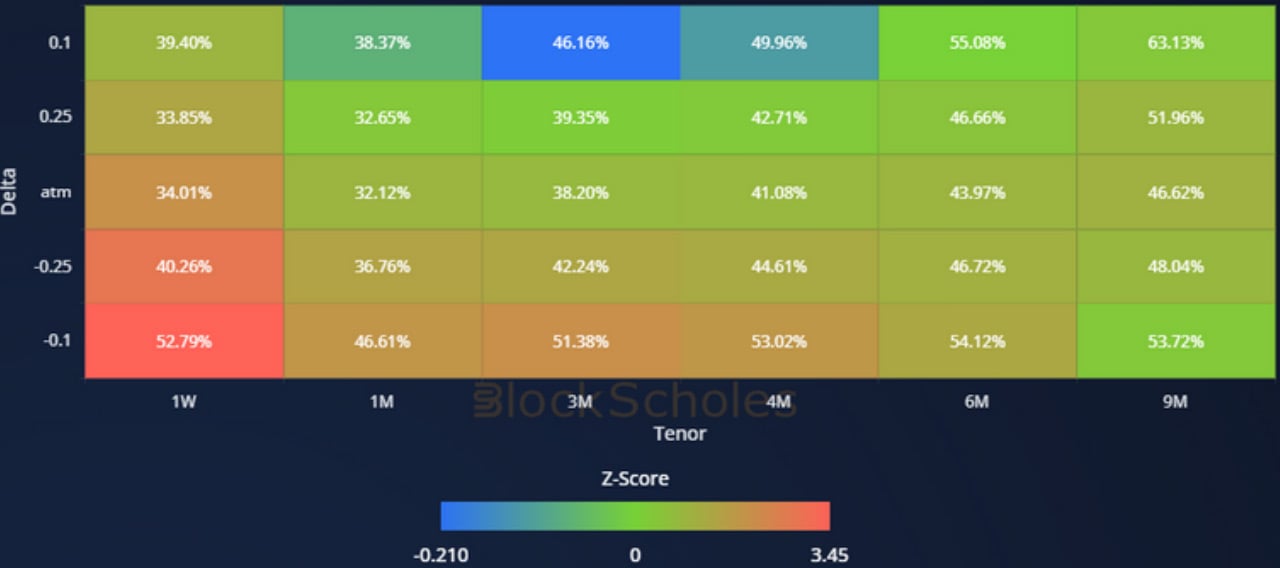

Volatility Surface

BTC IMPLIED VOL SURFACE – shows that short-tenor OTM puts have seen an smaller increase in implied vols, but much lower than the trend observed at the same point on ETH’s surface.

ETH IMPLIED VOL SURFACE – highlights the strong tilt of the 1-week smile towards OTM puts as the implied volatility of downside protection out paces the growth elsewhere on the surface.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

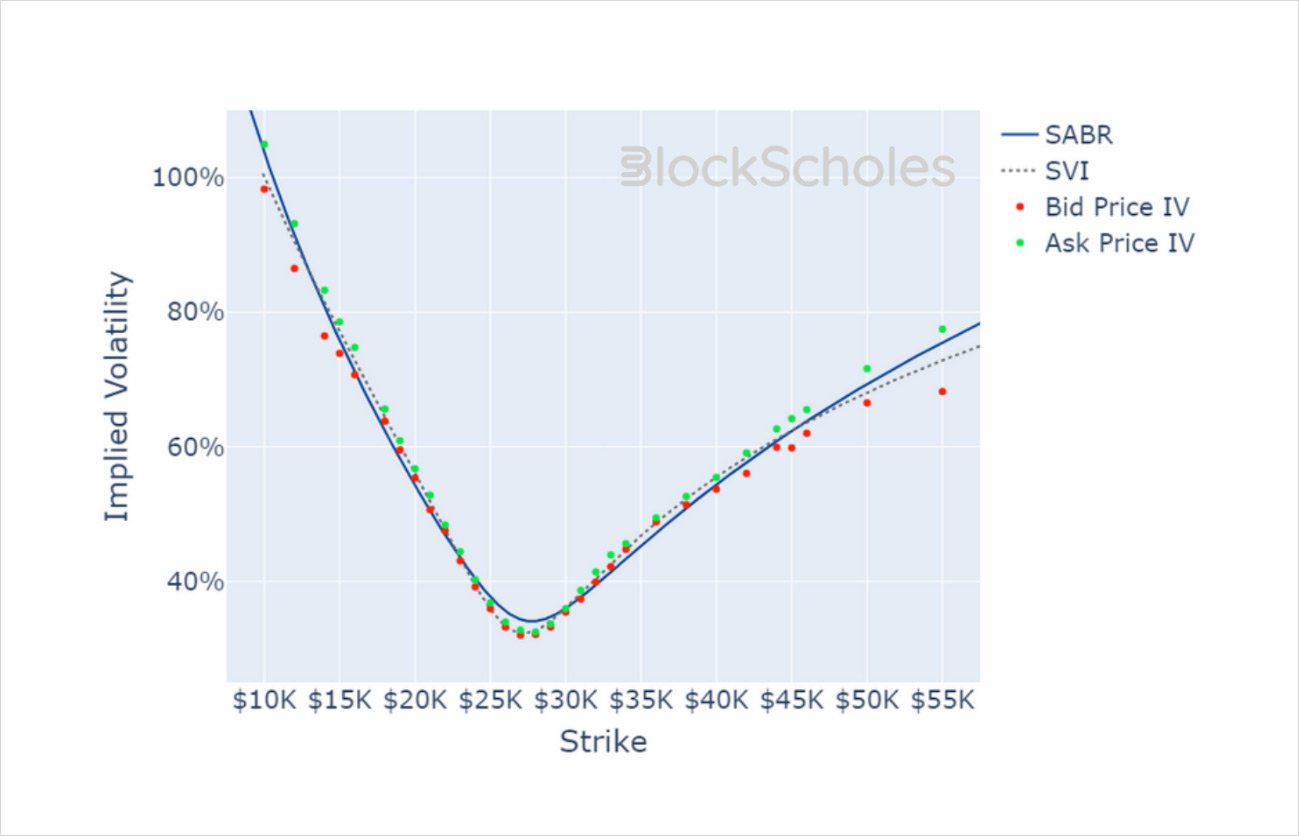

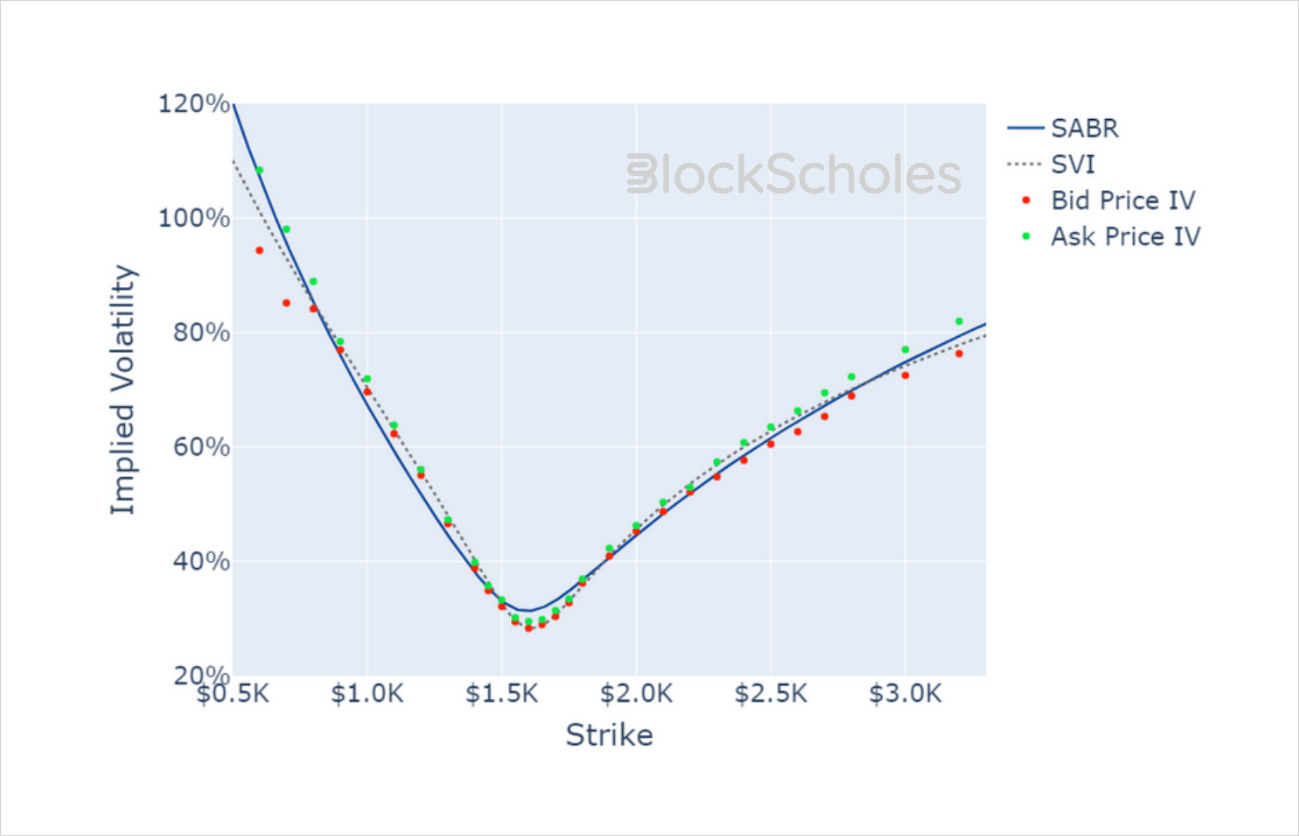

Volatility Smiles

BTC SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

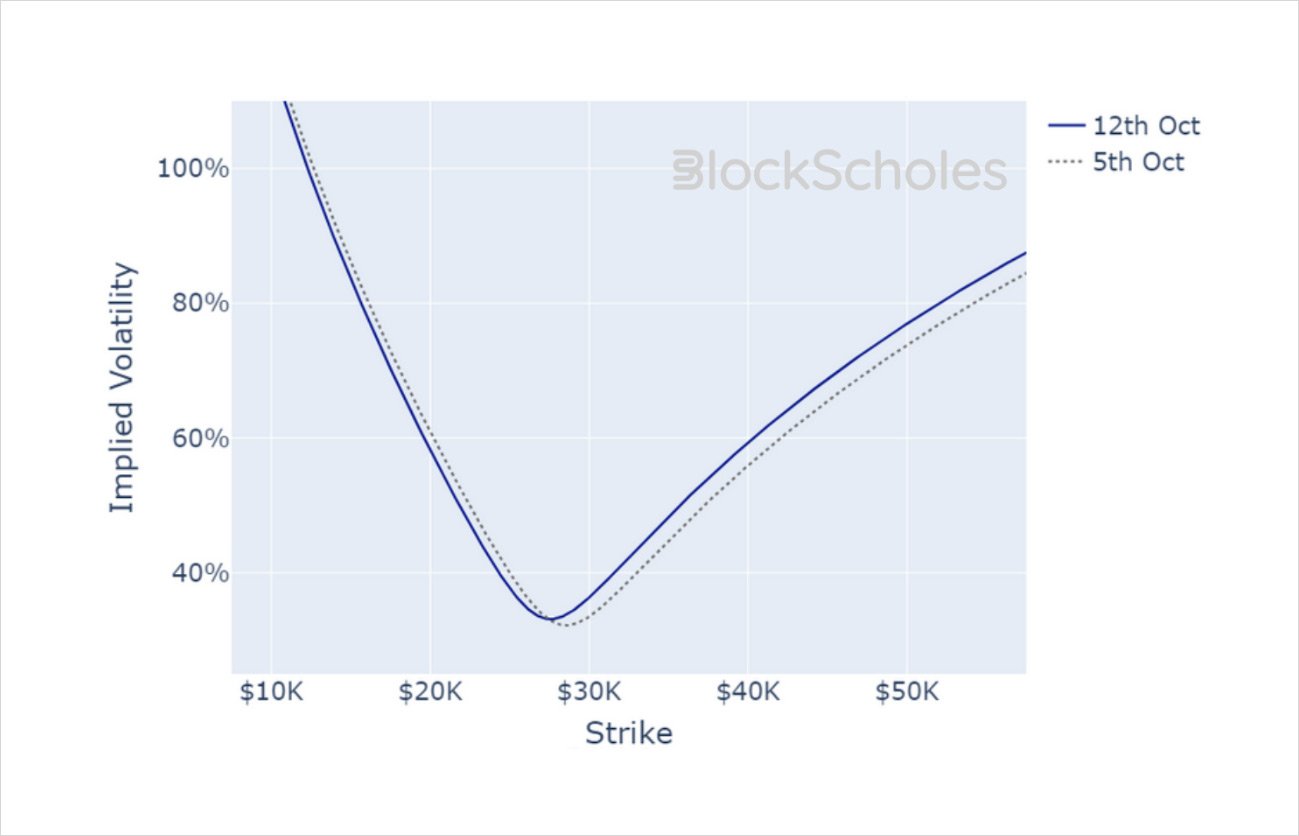

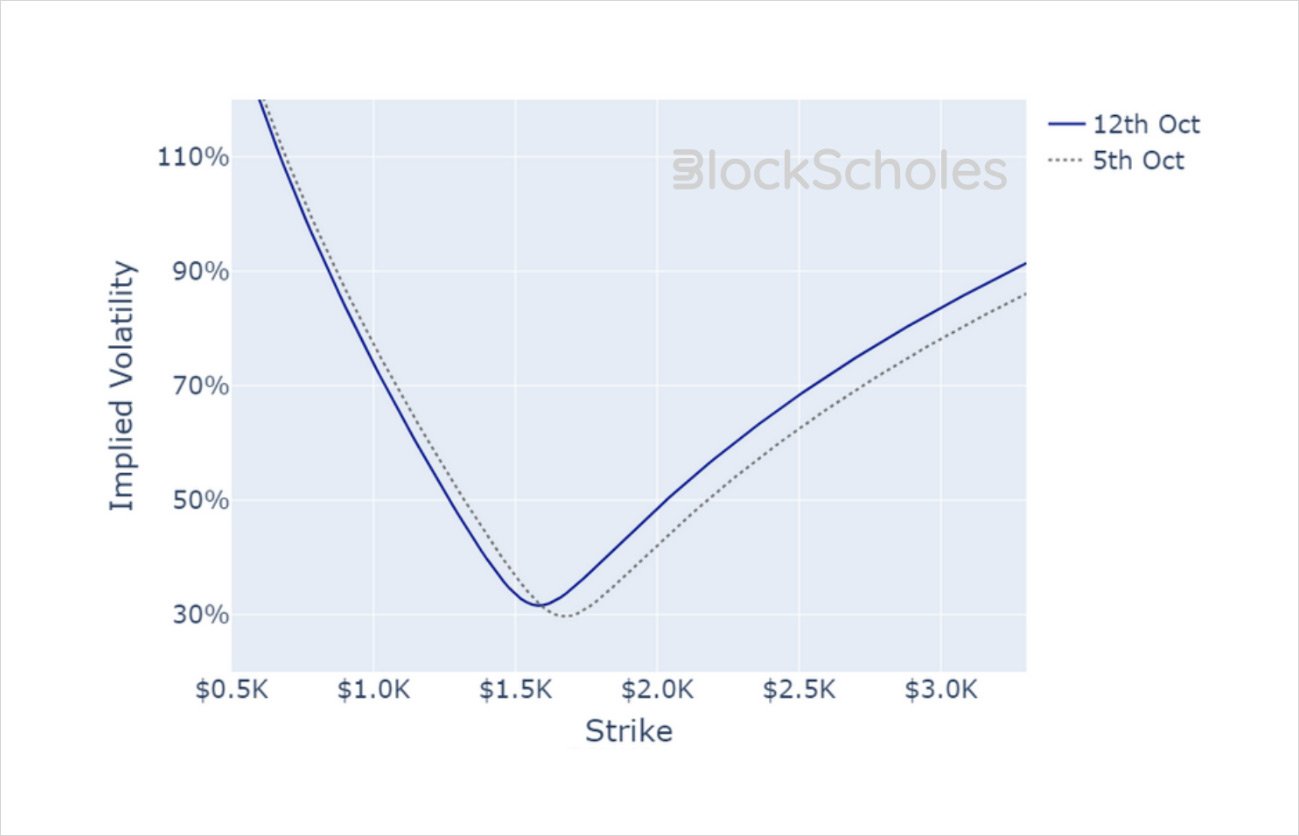

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)