Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Monday’s ETF false alarm did little to raise volatility expectations for either asset long term. However, short-dated BTC optionality had trended upwards as early as last Friday, corresponding with the news that the SEC will not appeal the Grayscale ETF decision. This saw an improvement in spot-yields, skew, and funding rate alike. In the week since, sentiment in both majors’ derivatives markets has returned to the low-volatility, slightly put-skewed environment that it has enjoyed for much of the past month.

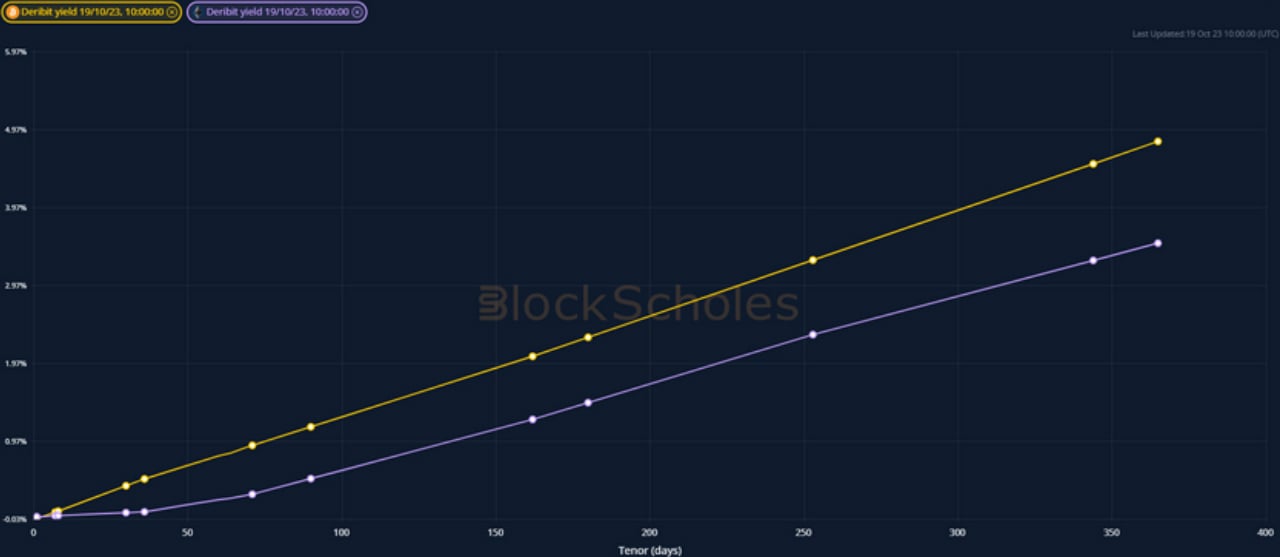

Futures implied yield term structure

Volatility Surface Metrics

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

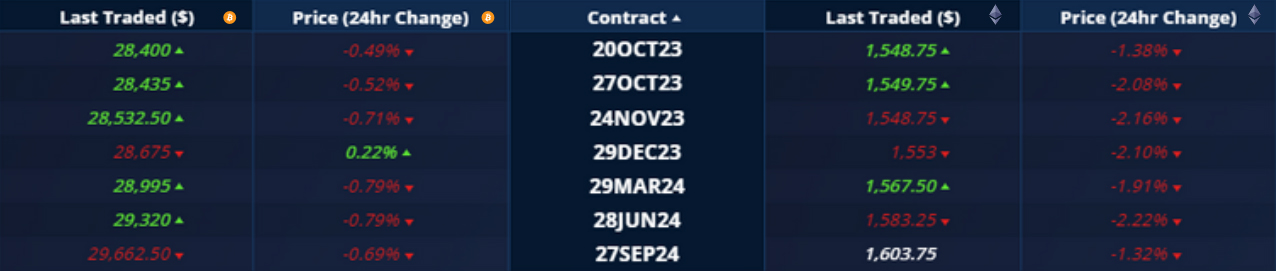

Futures

BTC ANNUALISED YIELDS – rose in response to ETF speculation on Monday, before returning sharply to last week’s levels at a 1W tenor.

ETH ANNUALISED YIELDS – remain noticeably lower than BTC’s at a 1W and 1M tenor, with 3M and 6M tenors between 2% and 4%.

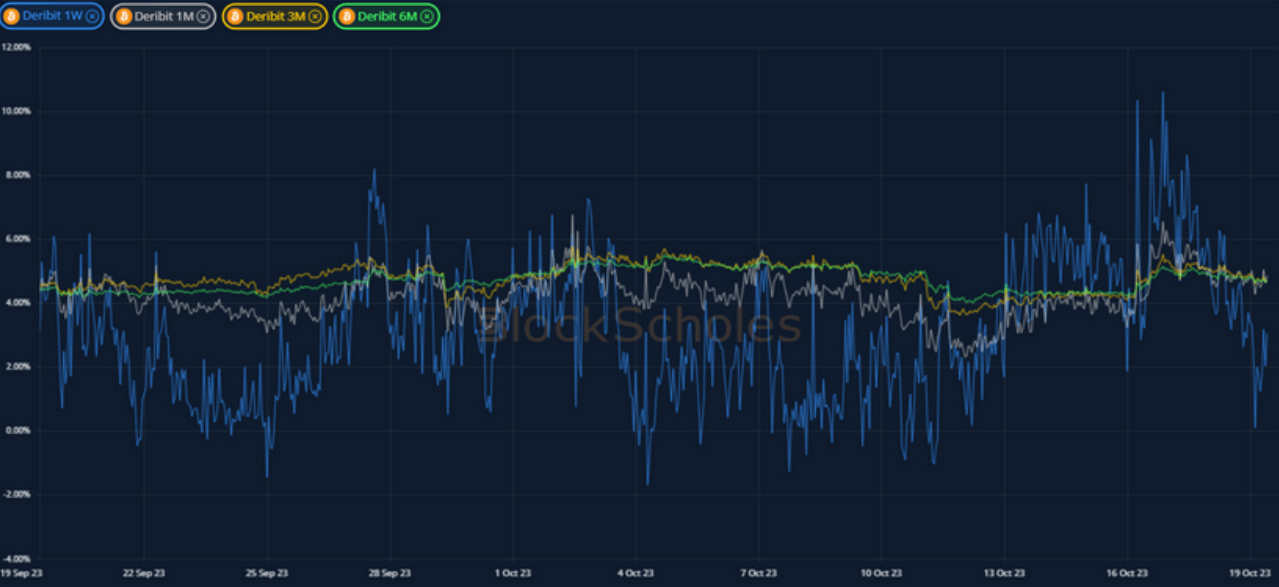

Perpetual Swap Funding Rate

BTC FUNDING RATE – have indicated a bullish sentiment as long positions have paid consistently large values to short position holders.

ETH FUNDING RATE – has also reflected a positive sentiment, albeit less consistent and less extreme than in BTC’s market.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – posts yet another week between 30% and 50%, despite rising slightly during Monday’s confusion.

BTC 25-Delta Risk Reversal – has oscillated at the same, slightly pessimistic tilt at 1W and 1M tenors that it has for much of the past month.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – is priced slightly lower than BTC’s across the term structure, and did not report the same pickup on Monday.

ETH 25-Delta Risk Reversal – follows the path laid out by BTC’s smile, showing a slightly stronger tilt towards OTM puts at a 3M tenor.

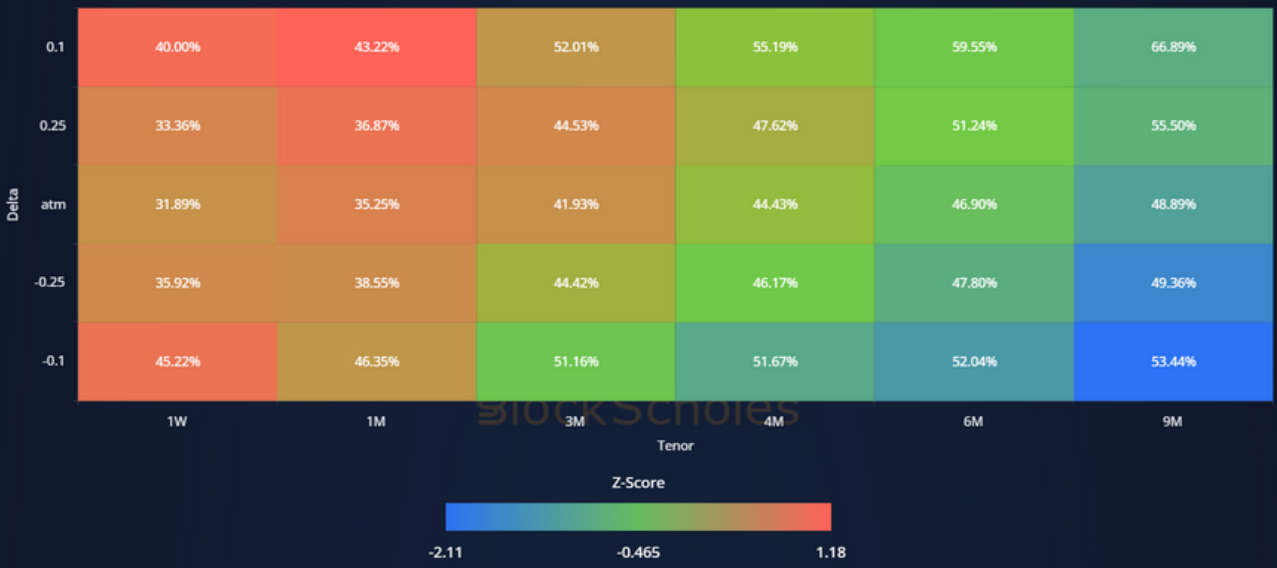

Volatility Surface

BTC IMPLIED VOL SURFACE – shows that implied volatility has increased most at shorter tenors, with a cooling strongest in longer-dated OTM puts.

ETH IMPLIED VOL SURFACE – displays a surface-wide cooling that, like BTC’s surface, is strongest in longer-dated downside protection.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

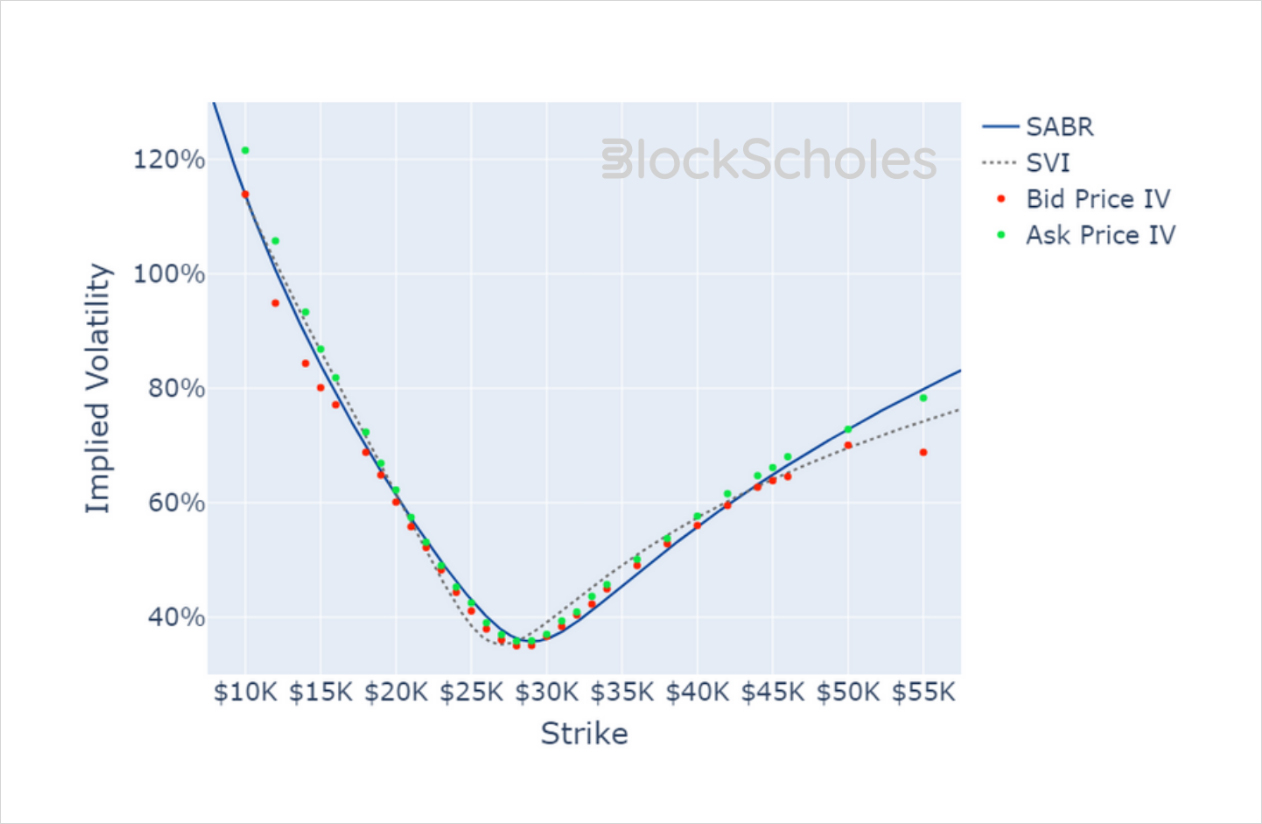

BTC SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

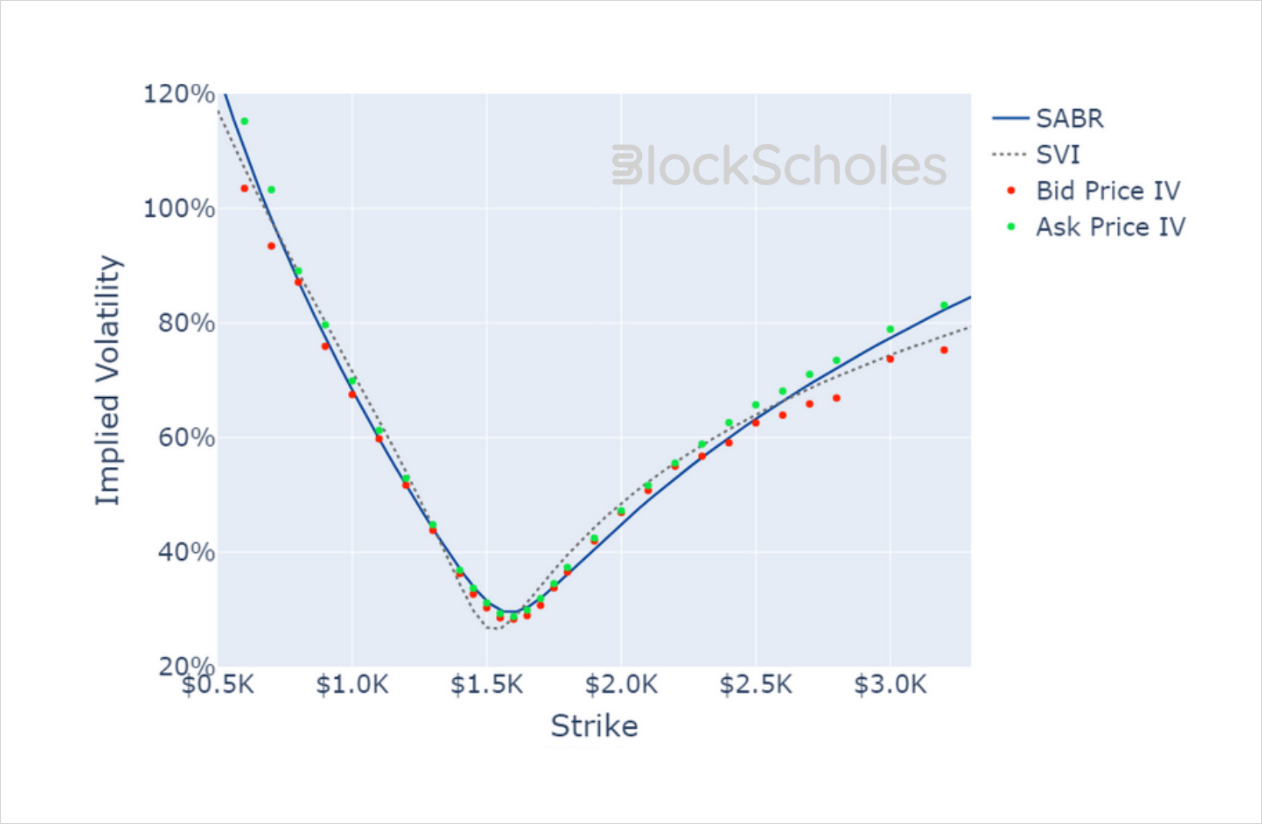

ETH SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

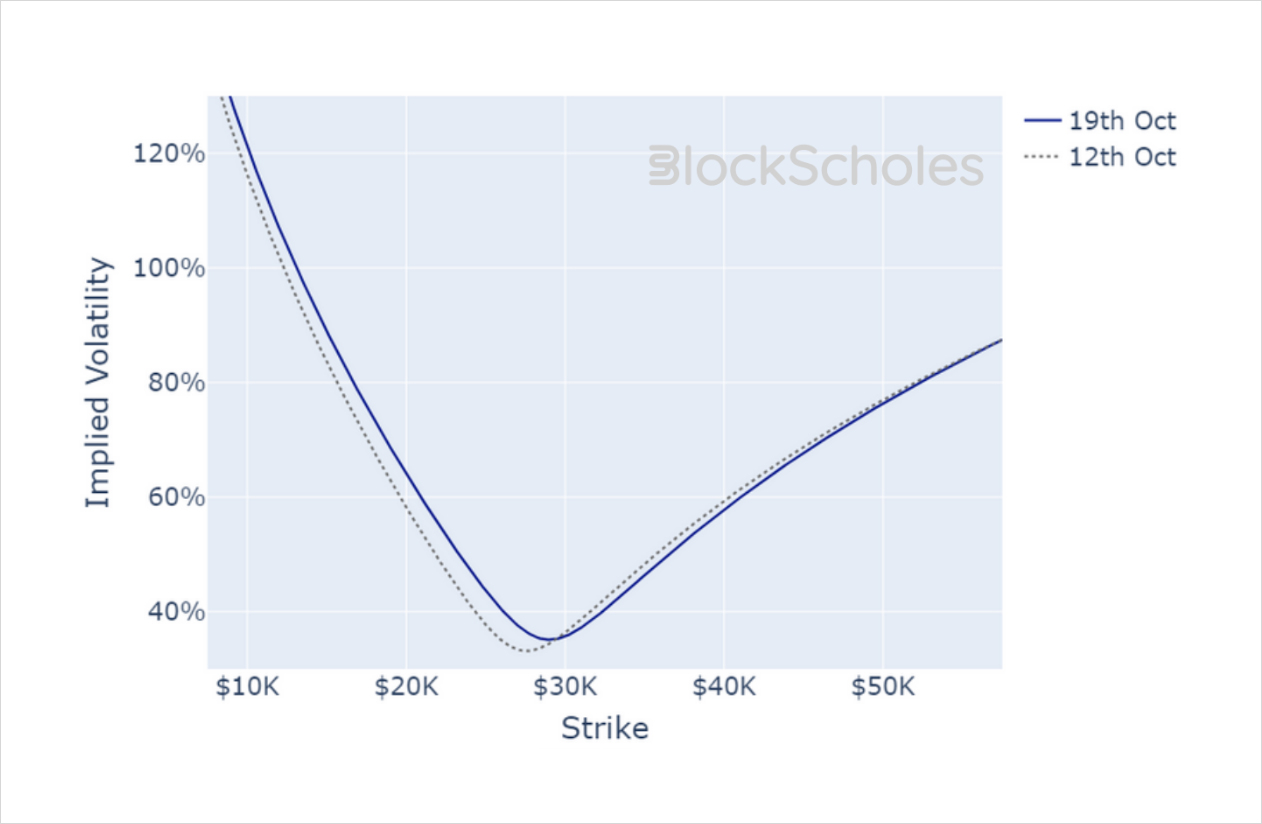

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)