In this week’s edition of Option Flows, Tony Stewart is commenting on the recent rally to around $40k.

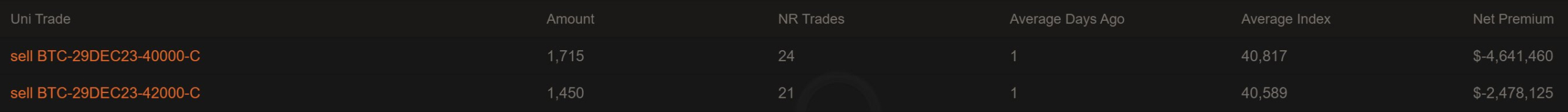

The breach >40k did not catapult IV higher as some hoped but resulted in the opposite, as long-held 40k+42k Dec Calls crystalized exits, spot 40.7k, gifting dealers Gamma.

Exposure not rolled.

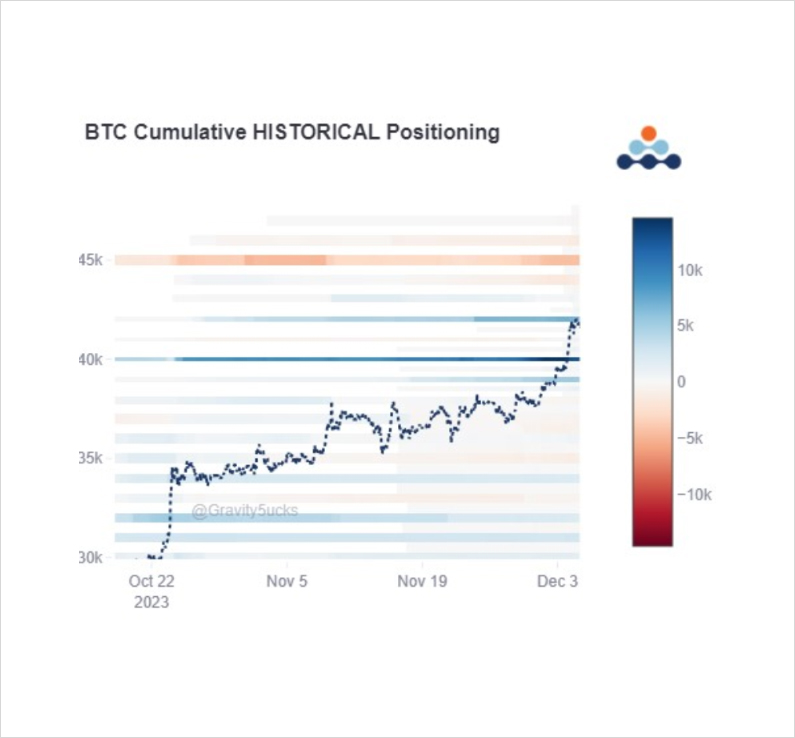

But as BTC >41k, Jan42k Call rolled to Jun60k Call and Sep40k Dec45k Dec50k bought.

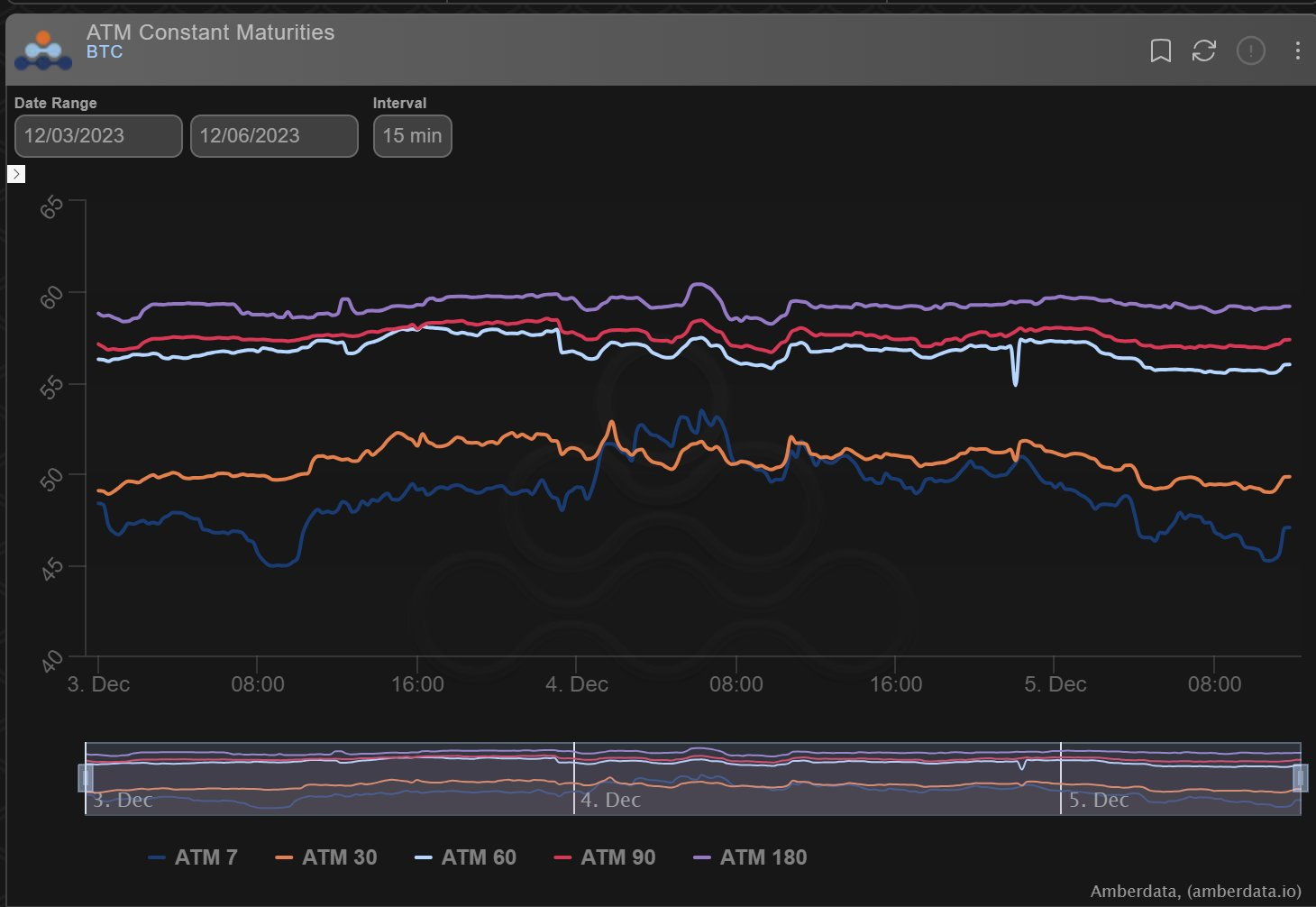

2) The Vol path to 40k was not as Longs had wished.

A fairly constant Vol with frequent Spot pull-backs dashed hopes of explosive IV reactions.

These long-held 40+42k Calls probably brought frustration in their expected performance and when 40k was breached, 3k+ ($7.5m) purged.

3) There was no sign of rolling exposure from these exits.

But as Spot rallied strongly towards 42k, Funds took advantage of dampened IV to buy Sep40k, Dec45k + Dec50k Calls x2k, and another to TP the Jan 42k Calls but to maintain hopium by rolling up and out to the Jun60k Call.

4) While Spot was following the plan hitting and challenging the 69k-15.5k 50% fib at 42250, Vega IV refused to join the party, only near-term Gamma reacting to any degree at all.

Confirms a well-telegraphed, expected, risk-managed move.

Flow now two-way.

Bullish position bias.

View Twitter thread.

AUTHOR(S)