Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

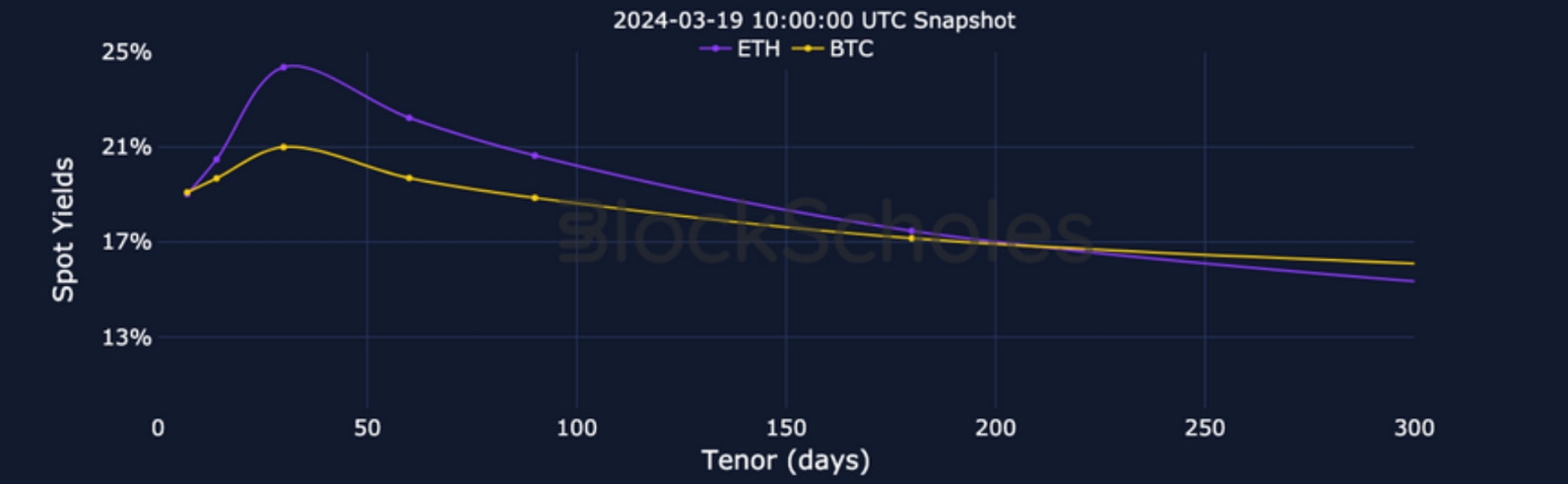

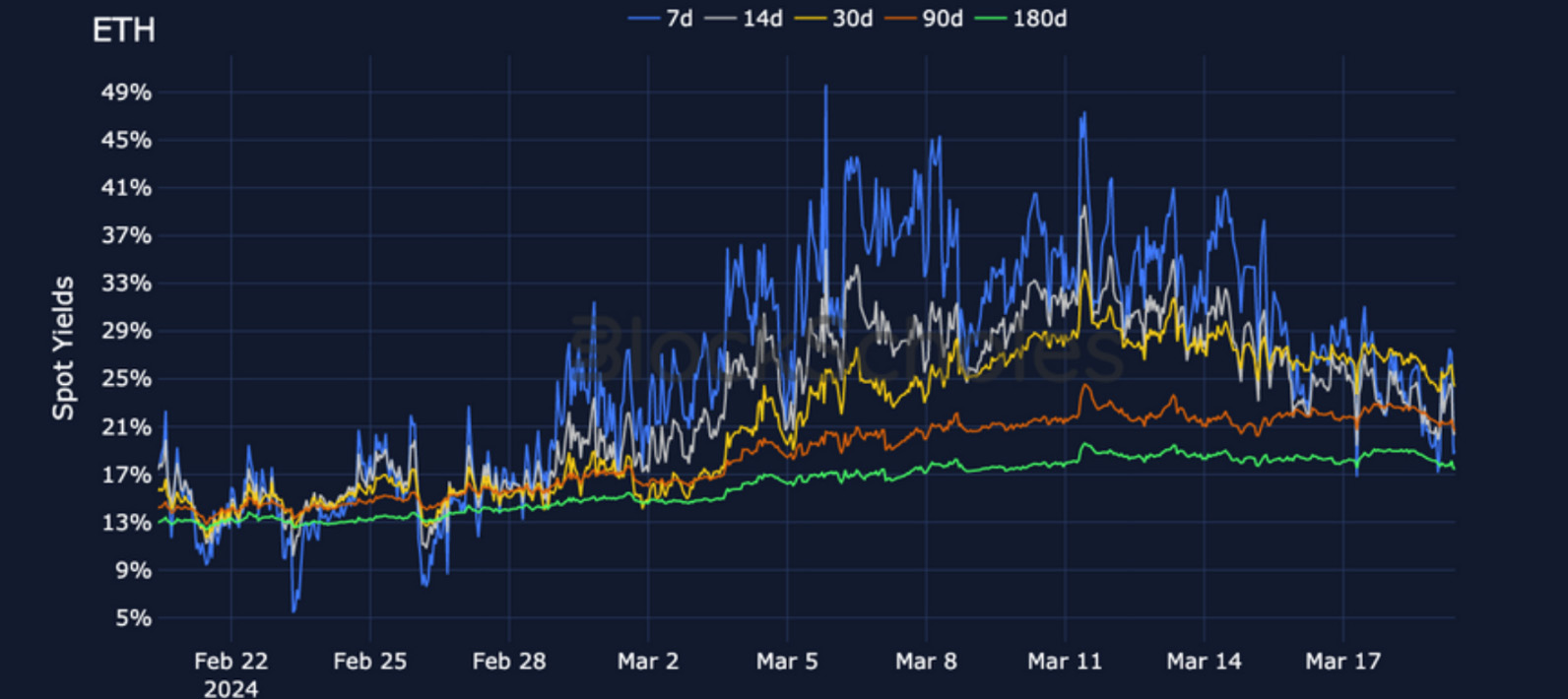

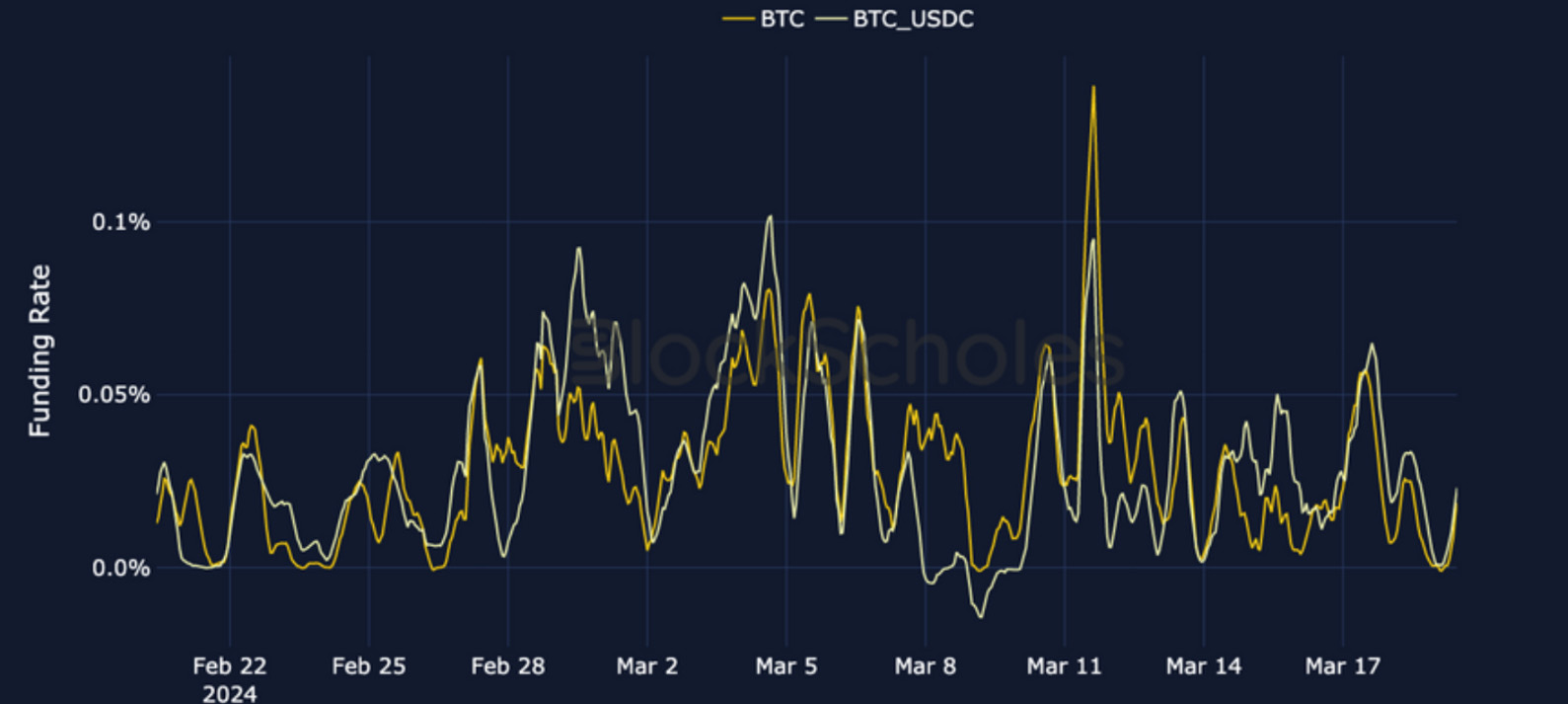

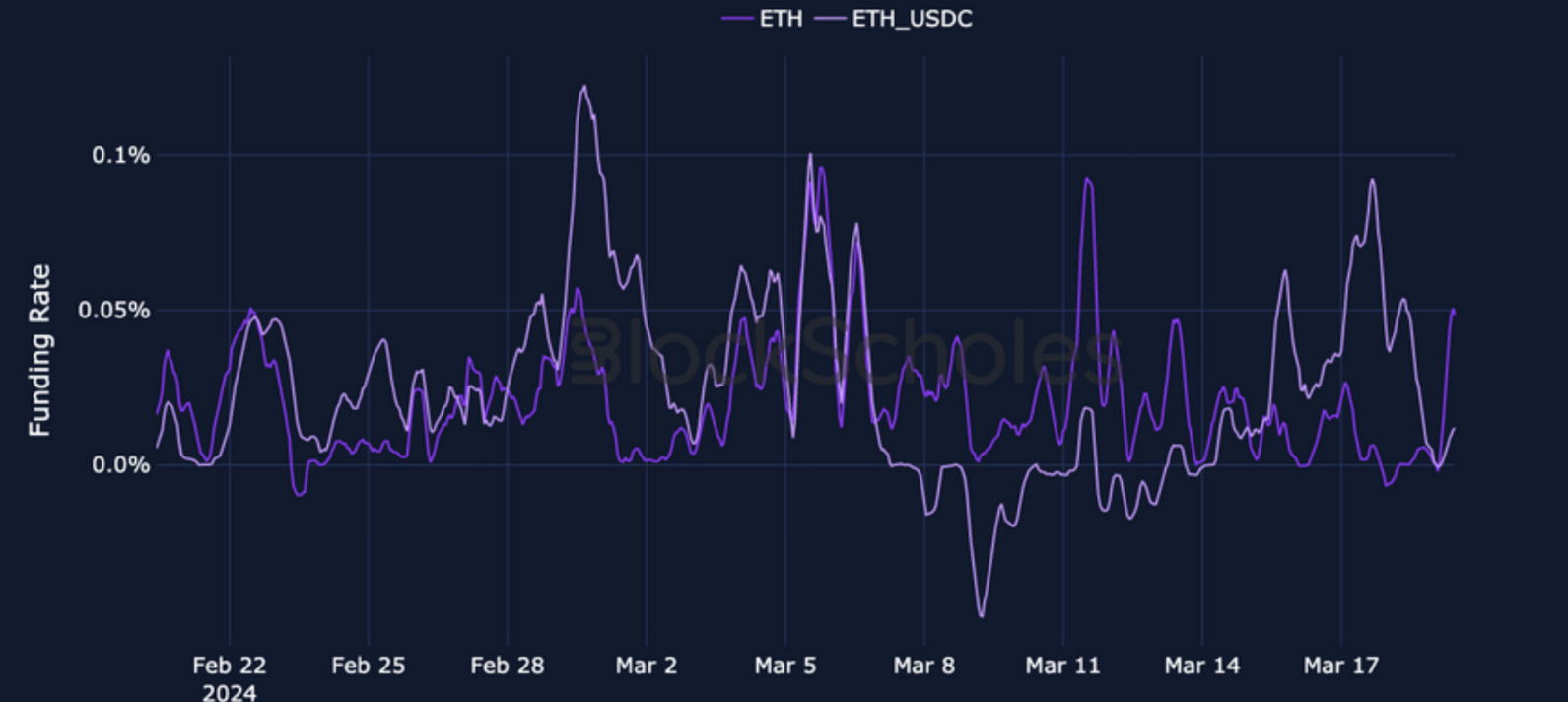

We previously observed increased demand for downside protection, indicating that the market may be positioning itself against any potential retrace. Following a rally to all-time high levels, the market has pulled back. Short-dated tenors show a significant decrease in spot yields for BTC and ETH, signalling a shift in near-term market sentiment. Funding rates, although positive, have cooled from their monthly highs, indicating reduced demand for leveraged long exposure. Fluctuations in BTC and ETH’s ATM vols suggest ongoing market uncertainty. Additionally, the 25-Delta Risk Reversal has shifted towards puts at short-dated tenors, indicating a bearish sentiment that is more pronounced in ETH than BTC.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – a significant fall in spot yields at short-dated tenors indicates a shift in market sentiment in the near term.

ETH ANNUALISED YIELDS – a similar fall in yields can be observed in ETH, though not as sharp as the fall in BTC.

Perpetual Swap Funding Rate

BTC FUNDING RATE – although positive, funding has cooled since reaching monthly highs, indicating less demand for leveraged long exposure.

ETH FUNDING RATE – contrary to last week, funding in USDC-margined contracts are positive, whilst token-margined contracts remain low.

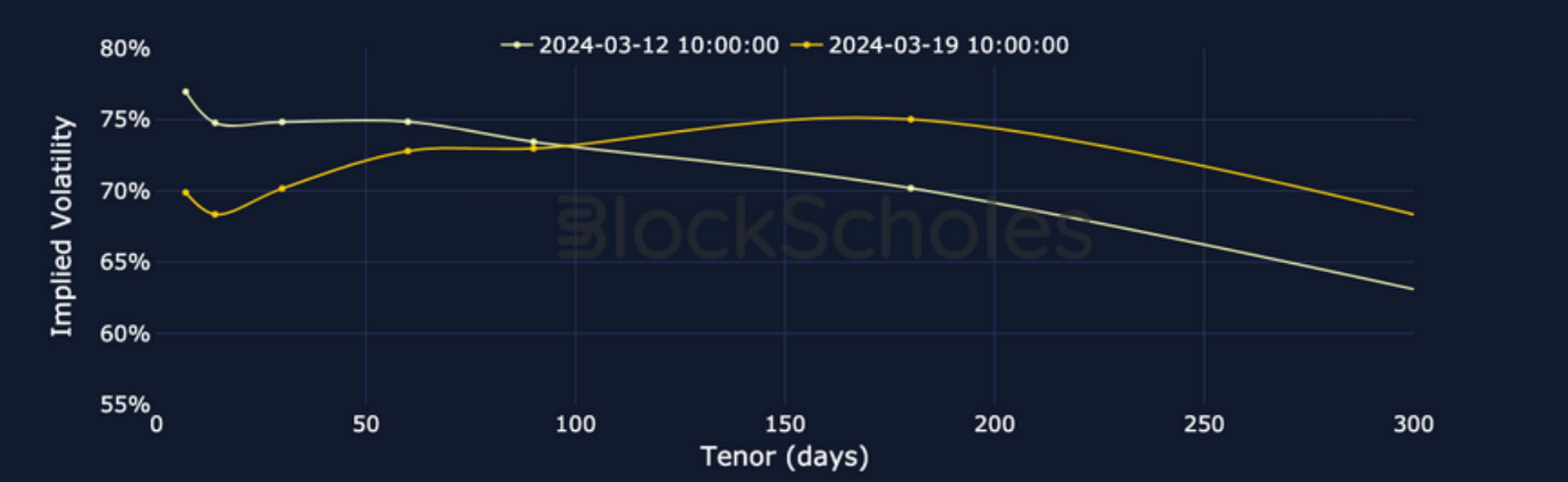

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has fluctuated between 65% and 80%, indicating a period of market uncertainty, paving the way for a shift in market sentiment.

BTC 25-Delta Risk Reversal – has shifted strongly towards puts at short- dated tenors, indicating increased bearish sentiment in the near-term.

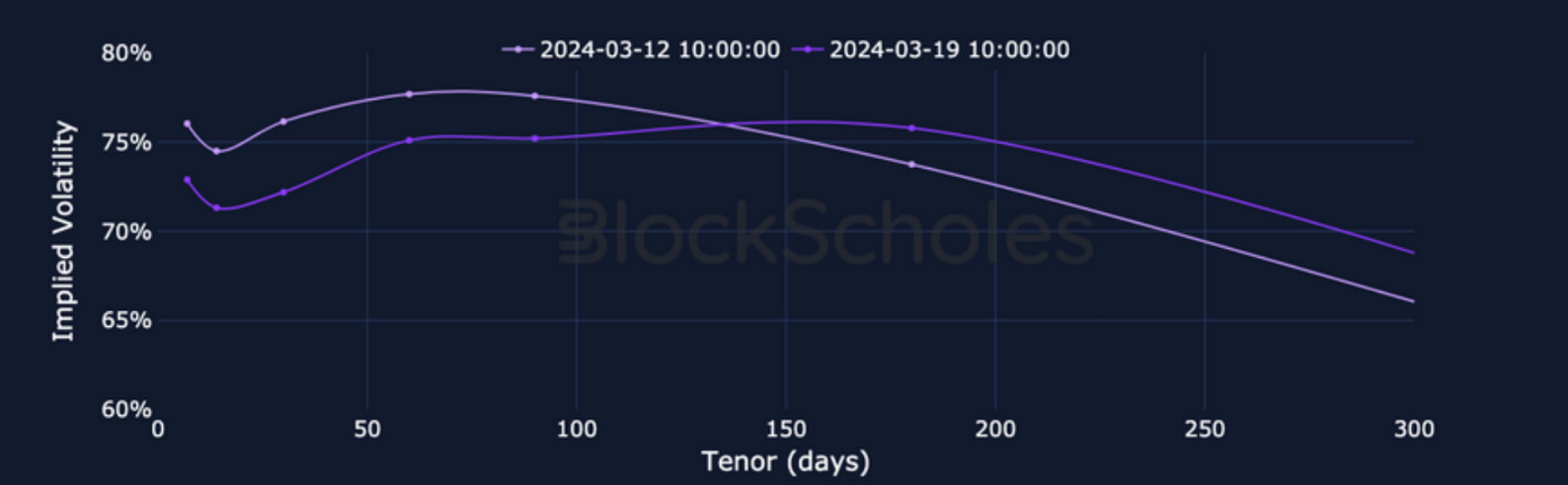

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – sees similar, but wider fluctuations compared to BTC as spot prices have fallen since touching above $4k.

ETH 25-Delta Risk Reversal – reflects far more bearish positioning when compared with BTC’s smiles at each tenor.

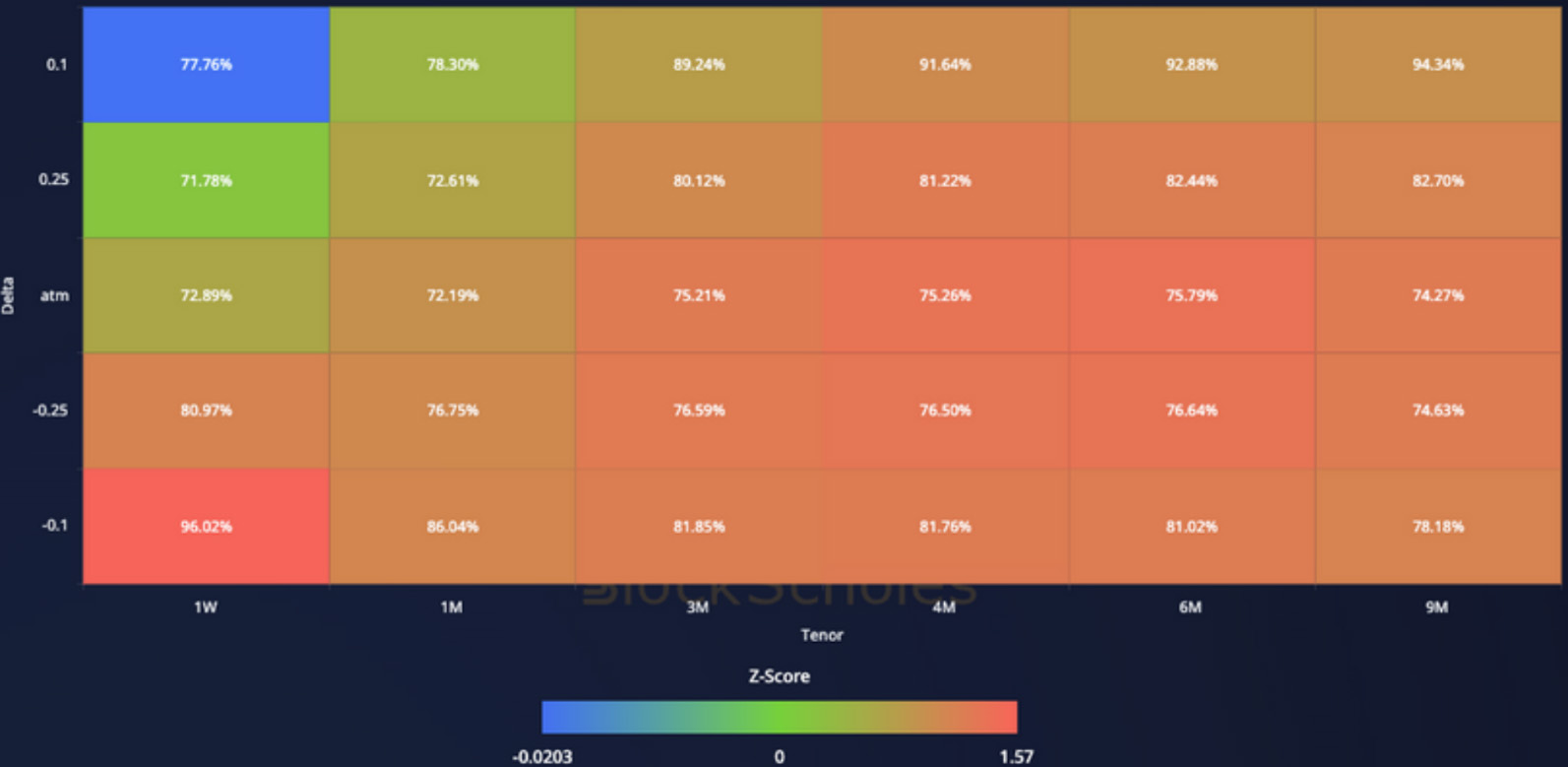

Volatility Surface

BTC IMPLIED VOL SURFACE – compared to last week, vol has fallen. Furthermore, back end vols outperform the front end, resulting in a disinversion of the term structure.

ETH IMPLIED VOL SURFACE – vol for OTM puts at a 1W tenor has risen significantly, indicating a strong shift towards negative put skew.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

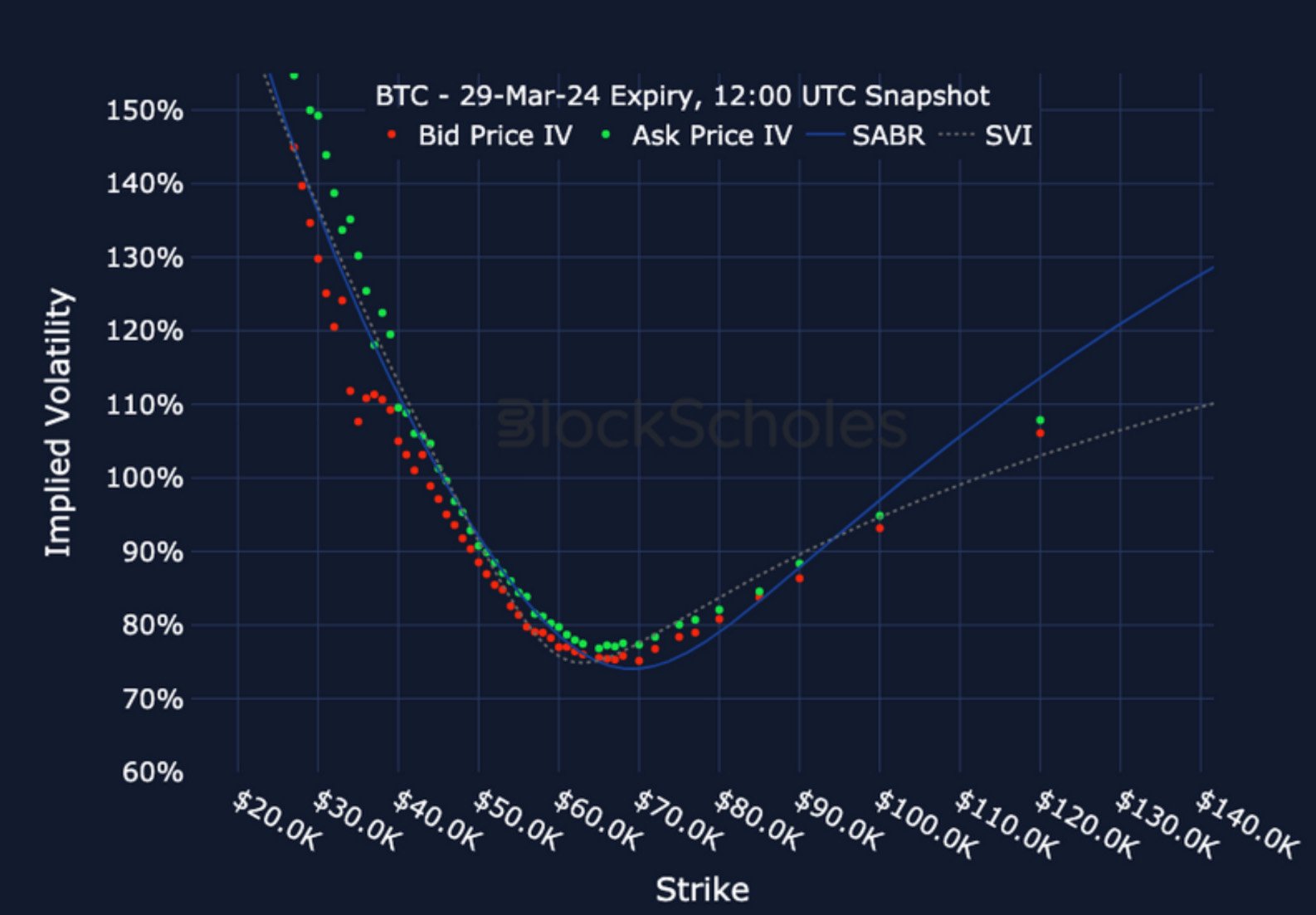

Volatility Smiles

BTC SMILE CALIBRATIONS – 29-Mar-2024 Expiry, 12:00 UTC Snapshot.

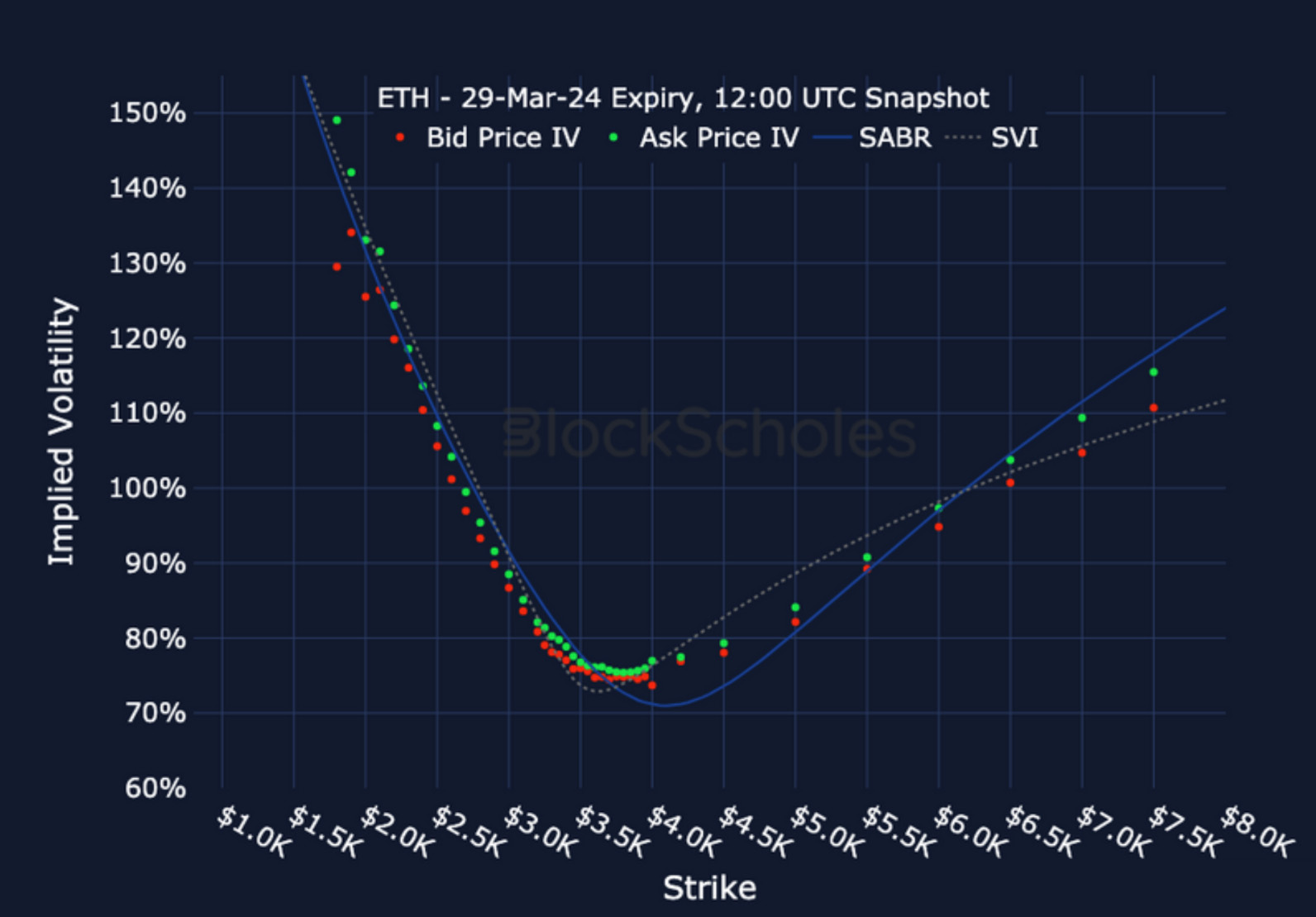

ETH SMILE CALIBRATIONS – 29-Mar-2024 Expiry, 12:00 UTC Snapshot.

Historical SABR Volatility Smiles

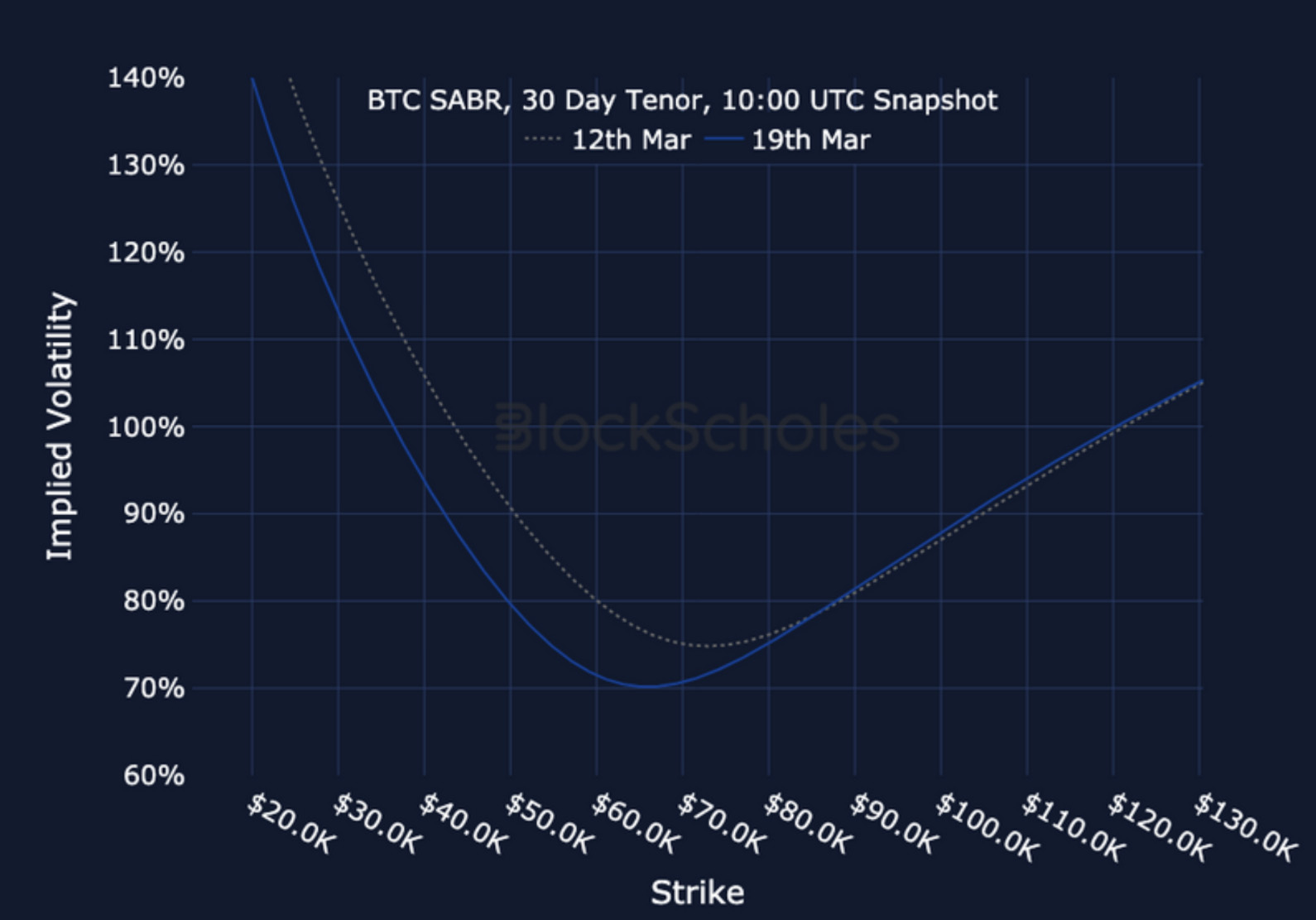

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

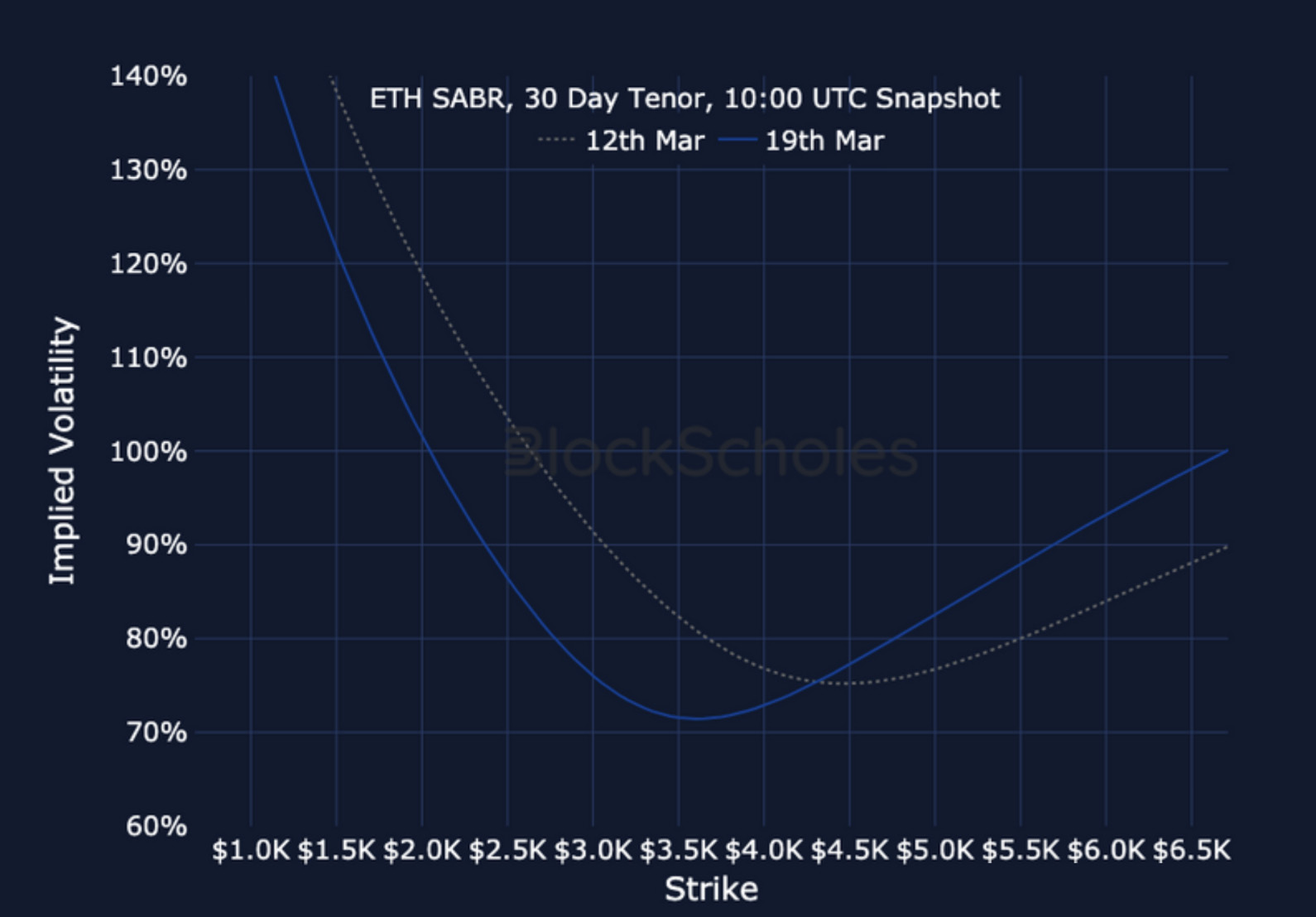

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)