View on market

There has not been much price movement after the halving and Bitcoin is facing tranches of resistance points, traders can short far out of the money calls for the current market.

Short Call

The proposed strategy is a Short Call. A short call strategy is one of the simple ways options traders can take bearish positions. It involves selling call options, or calls.

You might consider initiating this trade if you believe that BTC can face hurdles in price to move higher from the supply zones.

Trade Structure

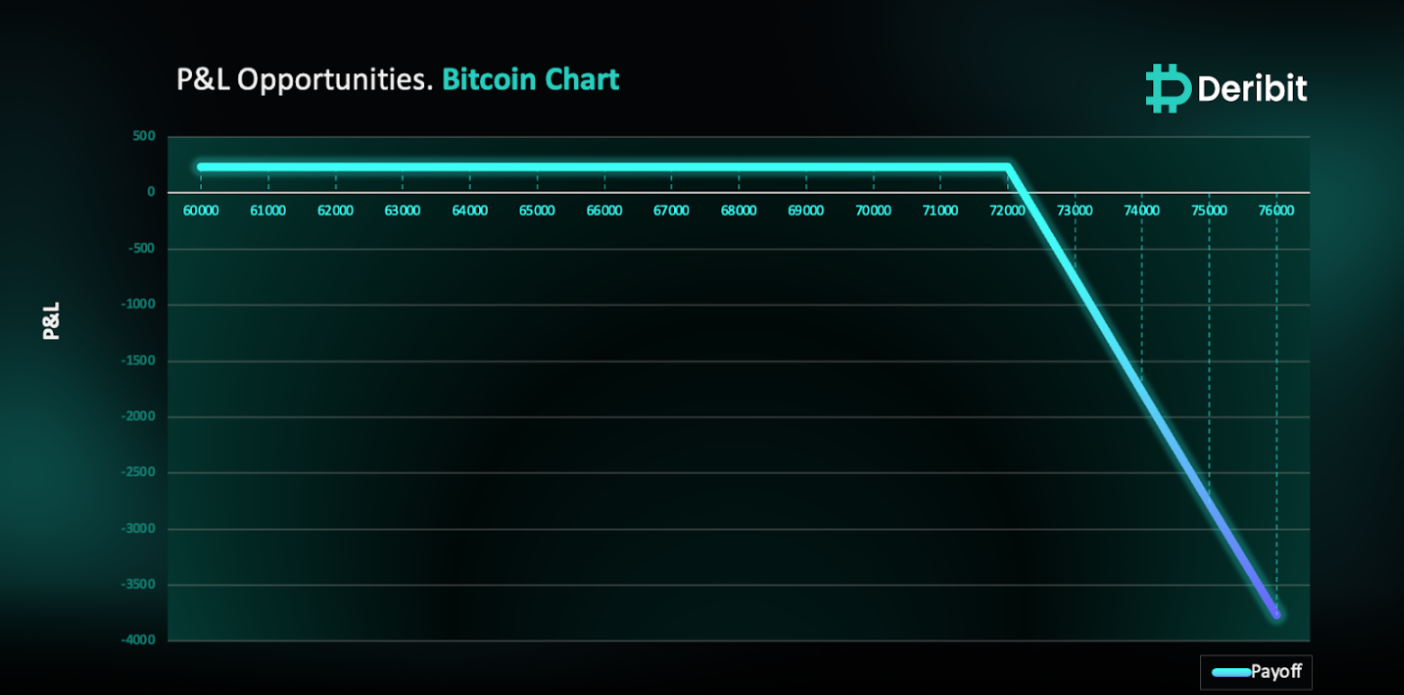

(OTM Call) Sell 1x BTC-26APR24-$72,000-C @ $230

Target: Spot level < $72,000

Payouts

Maximum Profit: $230/BTC

Why are we taking this trade?

Even with the significant Bitcoin Halving event, Bitcoin’s price has held steady, hovering between the $64,000 to $65,000 range, slightly up from Friday’s $63,000 mark. The flows in Bitcoin ETFs indicate ongoing weakness and diminished investor’s interest. Examining the 4-hour BTC price chart, we can identify several supply zones that could impede BTC’s upward momentum.

Hence traders can take advantage of the tranches of resistance points in BTC by shorting far OTM Call, eg., $72,000

It’s important to note that a sudden surge in volatility leading to a substantial upward movement wouldn’t be advantageous due to the position’s short call exposure.

How to take this trade on Deribit?

Step 1: Go to Bitcoin Options

Step 2: Select Expiry, Strike and execute your order.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)