Crypto Recovery Aided by Macro Forces

BTC bounced back decisively from below 60k, suggesting reduced short-term risks. What managed to turn the bearish tide around was the combination of the FOMC, QRA, and US NFP outcomes.

We also saw a return of net inflows in the BTC spot ETFs across the board. Even GBTC saw positive inflows.

ETH lagged behind due to regulatory concerns and delayed ETFs in the US. Another element not supporting the bullish price action in ETH was the tepid debut of HK’s spot ETFs.

The lack of clear narratives in crypto is also making macro play a bigger role and increasing correlations between crypto and other risk assets.

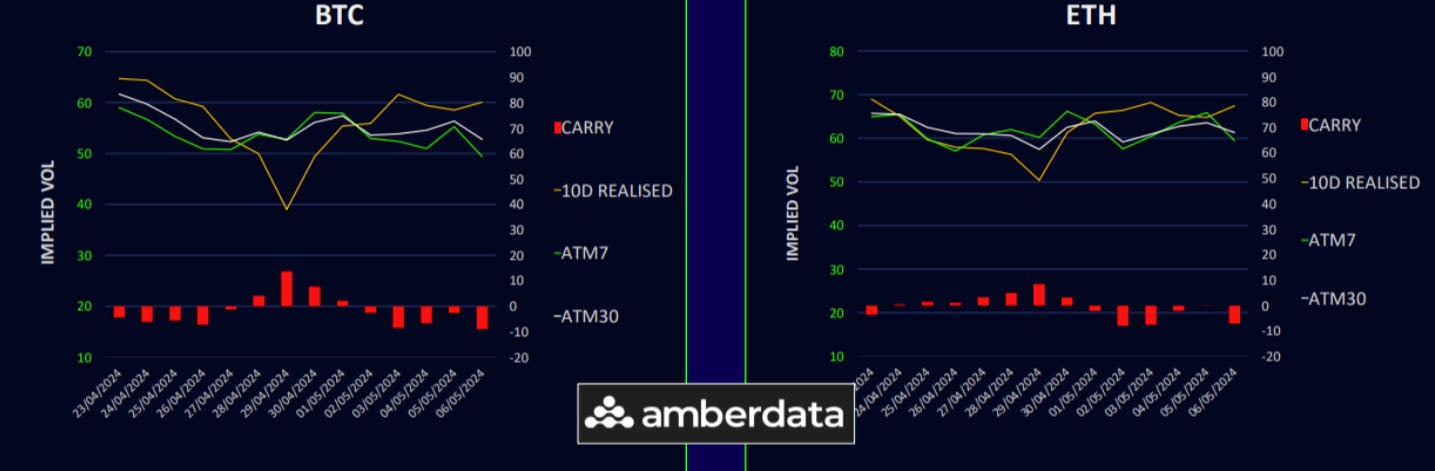

Realized Vol Bounces Back

Realized volatility increased last week following the breakdown below key support and a V-shaped reversal. Positive macro developments helped to kick in the realized vol, while implied volatility remained stable. With little macro news this week, volatility may drift lower. Spot prices staying within a range may see limited options activity. Long calendars are a favourable trade, especially for ETH.

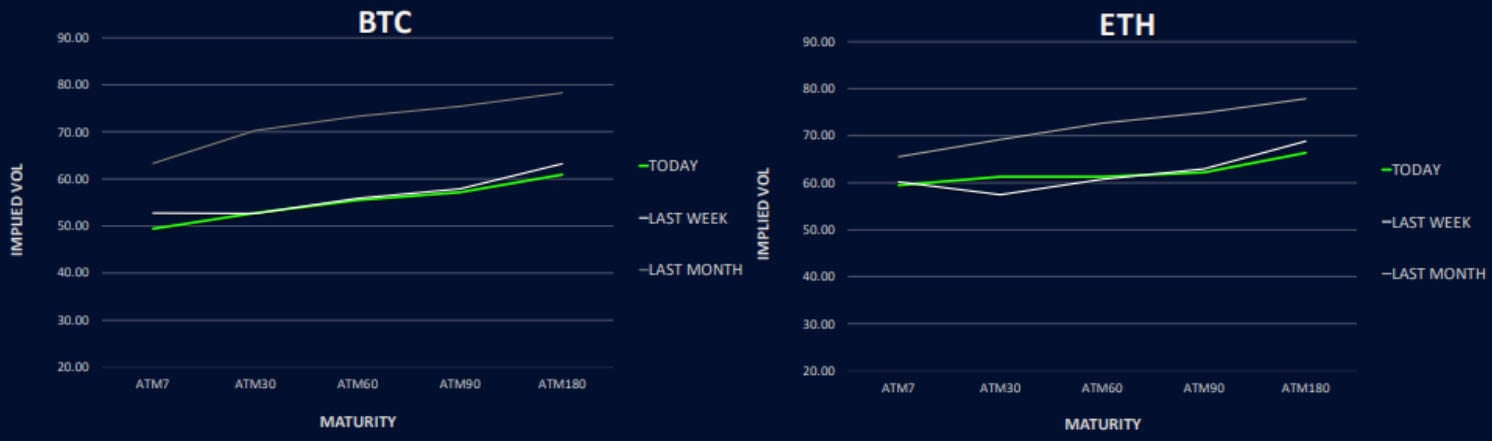

Small Moves in Term Structure

BTC and ETH term structures saw minor shifts in volatility, with slight changes across the curve. Weekly volatility and long-term vols decreased while mid-term held a small bid. Calls remained generally bid across both curves.

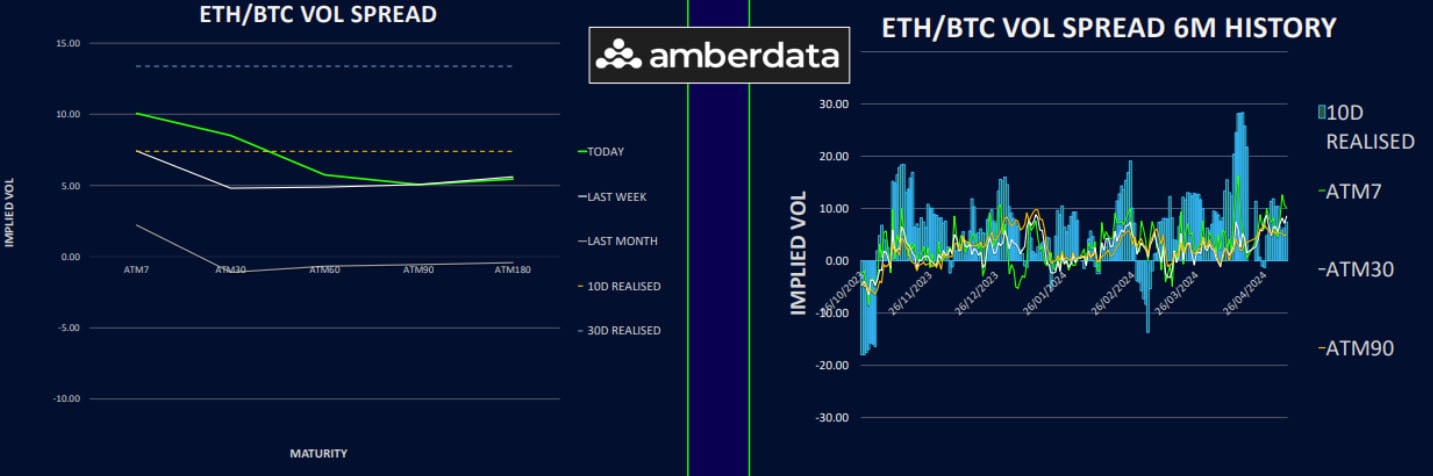

ETH/BTC Vol Spread Stretches Higher

The ETH/BTC vol spread widened, especially in the front end, aligning more with recent realized volatility spread. Longer maturities still maintain a premium but less so than the front end, with potential for further increases with ETH ETF decisions. ETH/BTC spot spread remains stable. Long calendars for ETH are favoured given the inverted vol spread term structure.

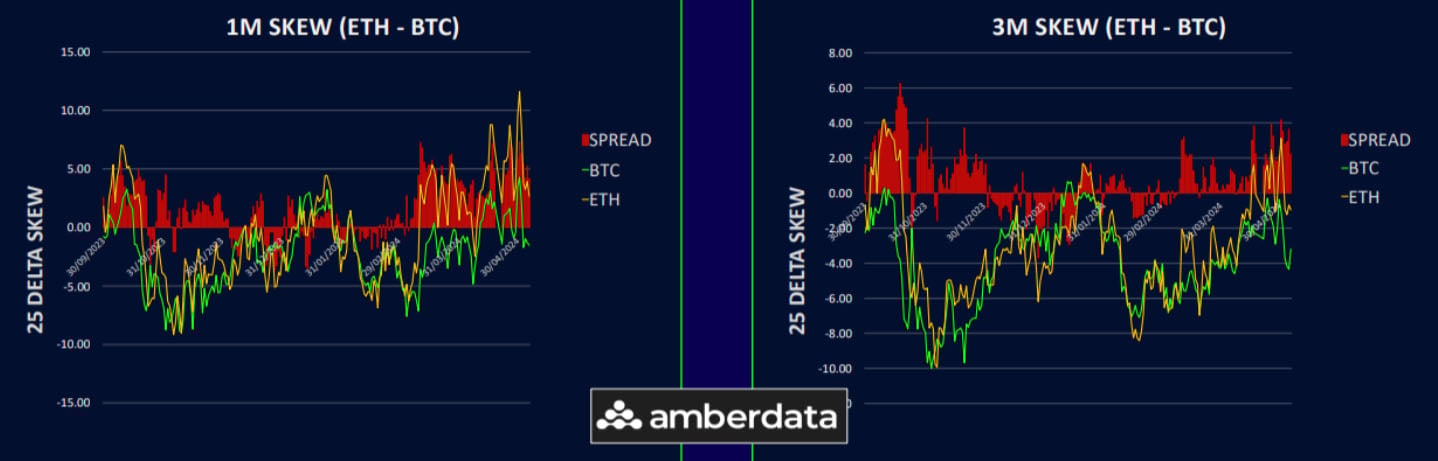

Put Skew Reverts from Extremes

Put skew reached extremes but reversed as spot prices recovered, leading to a shift from put to call premiums in BTC front end skew. ETH put skew also reversed but remains in put premium for front expiries. The movement in skew is symptomatic of speculative market behaviour as there is not enough structural hedging demand from sticky institutional capital like we see in Tradfi markets.

Option Flows And Dealer Gamma Positioning

BTC volumes remained steady, with put buying during the breakdown below 60k, followed by call buys focused on specific strikes, which are being funded with calls far OTM. ETH volumes increased, with notable options activity around ETF decision dates and buying in specific call strikes. Dealer gamma positions for BTC and ETH suggest limited impact unless prices approach key levels.

Strategy Compass: Where Does The Opportunity Lie?

Given the punting of SEC ETH ETF decisions into July, we would look at calendar spread that sell May and June options to own July to September options. The curve is still too flat in our view. Call calendars are preferred as they do you limited damage on a sharp drop in prices due to any disappointment.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)