View on market

Polygon Labs’ ISO 27001 certification and increasing whale addresses signal bullish activity for MATIC, with technical indicators and positive market sentiment suggesting a potential price rise toward $0.9. Traders might capitalize on this with a Call Ratio Spread strategy.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if your perspective aligns with a bullish outlook on Polygon.

Trade Structure

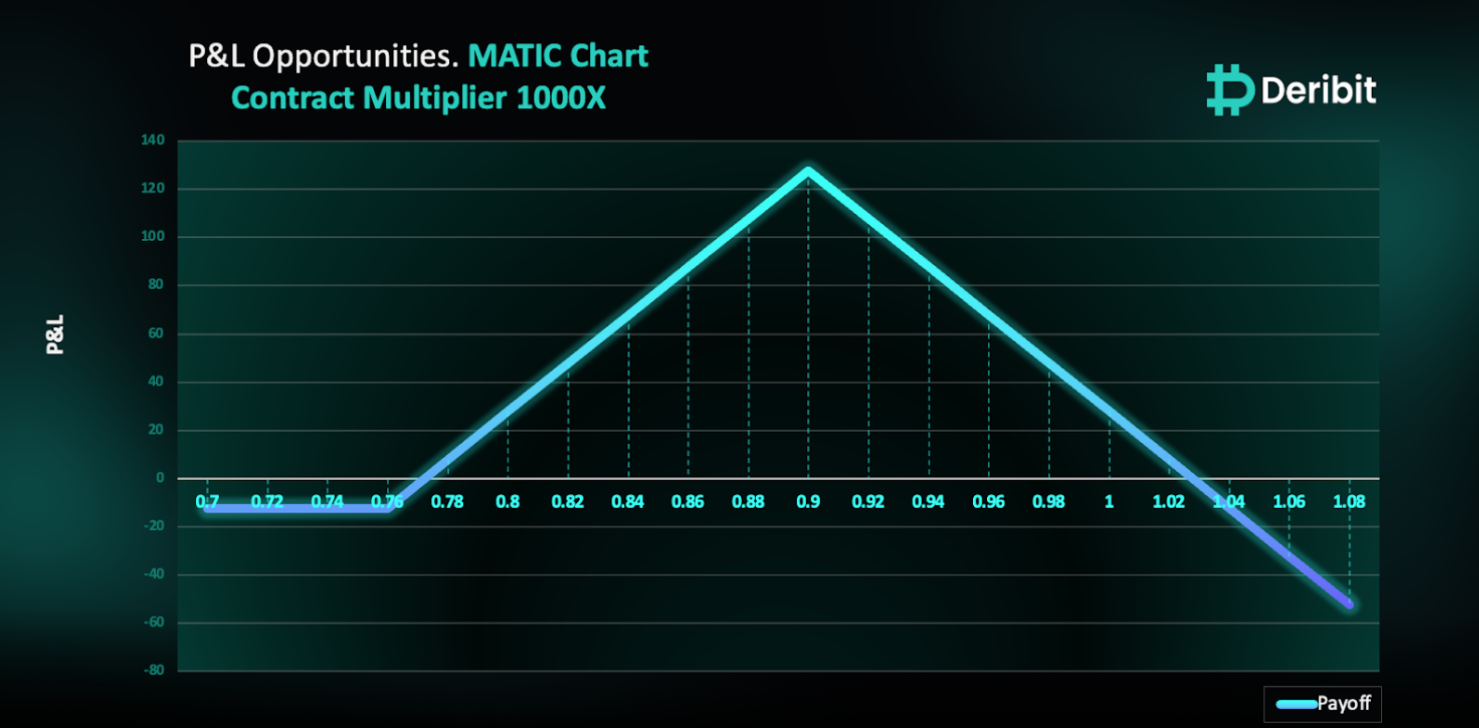

(OTM Call) Buy 1x MATIC_USDC-7JUN24-$0.76-C @ $0.0158

(OTM Call) Sell 2x MATIC_USDC-7JUN24-$0.90-C @ $0.0018

Target: Spot level < $0.9

Payouts

Maximum Profit: $127.8/contract

Net Debit of Strategy: $12.2/contract

Why are we taking this trade?

In my recent Insight, I highlighted a bullish outlook for Polygon, with several indicators suggesting the trend is likely to continue at much faster pace. Here are the 5 key reasons:

1) ISO 27001 Certification

Polygon Labs has recently been awarded the ISO 27001 certification, the gold standard for compliance in information security management systems. This certification indicates that Polygon has met stringent requirements for establishing, implementing, maintaining, and continually improving its information security management systems.

2) Increasing Whale Addresses

The number of whale addresses holding MATIC, a leading Layer 2 (L2) token, is on the rise. Analyzing the token’s movements on a 1-day chart confirms the gradual re-emergence of bullish activity in MATIC.

3) Positive Chaikin Money Flow (CMF)

MATIC’s Chaikin Money Flow (CMF) value stands at 0.12. This indicator measures the buying and selling pressure behind an asset’s price movement. A positive value like this suggests that more money is flowing into the asset on up days than on down days, indicating that buyers are in control and contributing to the bullish sentiment.

4) Technical Analysis: MACD Indicator

From a technical perspective, MATIC’s Moving Average Convergence Divergence (MACD) indicator shows the MACD line poised to cross above the zero line. When this happens, it suggests a shift in momentum from bearish (downward) to bullish (upward). This indicates that the moving average is catching up to the current price, suggesting a potential upward trajectory.

5) Polygon’s Role and Recent Developments

Polygon is a Layer-2 scaling solution for Ethereum, and its native cryptocurrency, MATIC, is used for governance, fee payment, and staking on the Polygon network. Polygon operates its own proof-of-stake blockchain, which runs parallel to Ethereum as a sidechain. With the approval of ETH ETFs, the entire crypto space is experiencing a bullish trend.

If this upward trajectory continues and the bulls remain in control, MATIC’s value could rise toward $0.9. Traders might consider capitalizing on this opportunity using a Call Ratio Spread strategy to maximize potential gains from the bullish momentum.

To implement this strategy, traders can buy a higher strike Call option (e.g., $0.76) and simultaneously sell Calls in double quantity (2x) of a higher strike price (e.g., $0.9).

If Polygon price is at $0.9 when the options expire on June 7th, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $12.2, losses beyond the initial debit are possible due to the position’s net short Call exposure.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)