ETH Holds Onto Gains Post ETF Approval

ETH has rallied close to $4,000, fuelled by speculative flows around the ETH ETF, expected to start trading in 4-6 weeks. This approval has improved ETH’s outlook, but a breakout above $4,100 will likely require more clarity on official trading dates and inflow data. Additionally, Trump’s recent support for crypto alongside strong risk-on in the equity markets should help drive further dip buying on any setbacks, also signalling the potential start of another strong ALTs season.

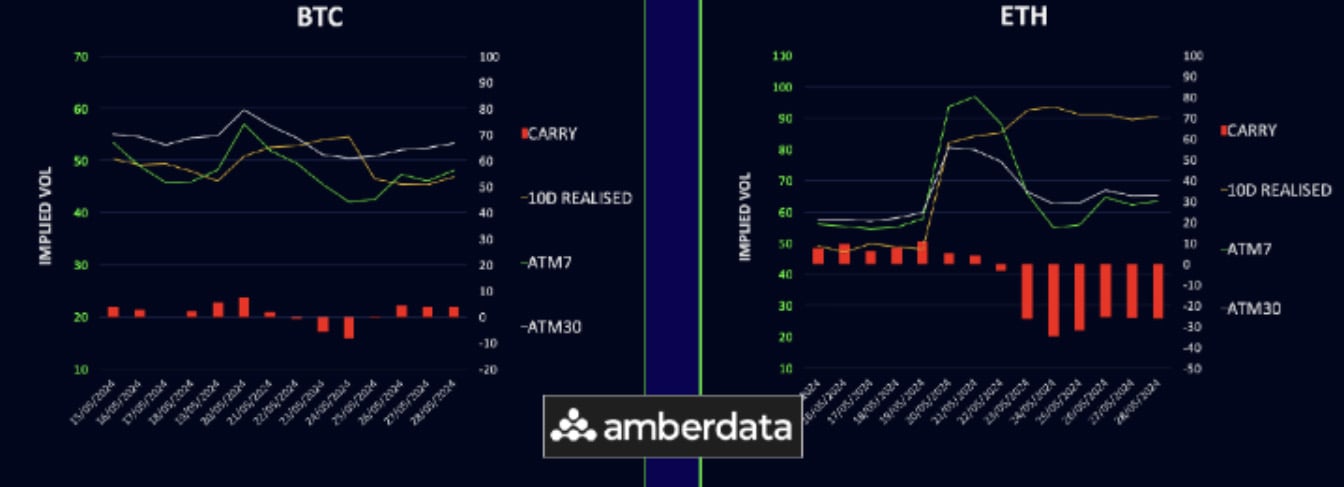

Realized Vol Calms Down

Crypto market volatility has settled, with BTC at 45 and ETH at 90 for 10-day realized vol. Implied volatilities have dropped post-ETH ETF approval. The market anticipates a rise when trading begins in 4-6 weeks, but for now, we’re in a holding pattern around $4,000. BTC carry is still slightly positive and selling gamma here has been the safer options for THETA hungry vol traders, while the ETH implied vol suggests the options market predicts a calmer period ahead, selling gamma may be riskier once the inflows start rolling in.

Term Structures Back Into Contango

BTC options term structure has dropped, especially in June, while ETH’s term structure shifted back into contango after the ETF approval. Weekly ETH vol dropped 20 points, but calls remain in demand, indicating expected inflows may drive ETH higher in the coming months.

ETH/BTC Vol Spread Resets Lower

The ETH/BTC vol spread has decreased but remains high compared to recent history, suggesting ETH may lead in the near future. The spot spread is approaching 0.06, a key resistance level. If ALT season gains momentum

Divergence in Skew Moves

BTC skew saw a slight increase in put premiums in the front-end, while call premiums remain in the rest of the curve. ETH skew is firmly in call premiums across the curve, with traders anticipating future upside following the ETF approval. Expect ETH call skew to trade higher than BTC call skew as the market narrative has shifted.

Option Flows And Dealer Gamma Positioning

BTC option volumes increased 20% to $9.35Bn, with notable activity in May 69k straddles and call spreads. ETH volumes surged 220% to $11.5Bn following the ETF approval, with significant call spread purchases and put selling. BTC dealer gamma is neutral near 70k, while ETH dealer gamma remains positive between 3600-4100, poised for potential market shifts with new inflows.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)