View on market

I’ve highlighted a bullish stance on ETH and MATIC due to recent crypto developments and whale accumulation. Technically, MATIC’s retracement to the $0.69 demand zone presents a Call Spread strategy opportunity attractive for traders.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying stock and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying stock rises in price.

You may consider taking this trade if you are bullish on Matic.

Trade Structure

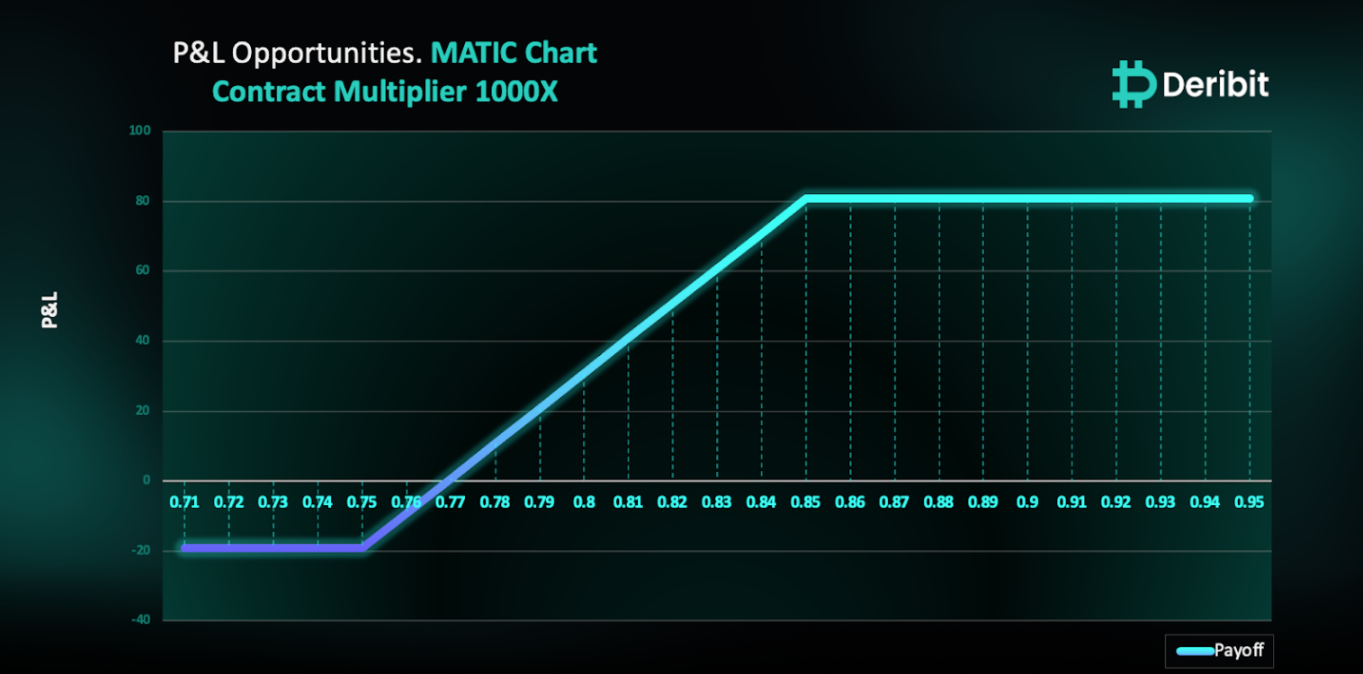

(OTM Call) Buy 1x MATIC_USDC-28JUN24-$0.75-C @ $0.0335

(OTM Call) Sell 1x MATIC_USDC-28JUN24-$0.85-C @ $0.0143

Target: Spot level > $0.85

Payouts

Maximum Profit: $80.8/contract

Net Debit of Strategy: $19.2/contract

Why are we taking this trade?

I’ve been emphasizing my bullish outlook on ETH and altcoins like MATIC, as several indicators suggest a positive trend due to recent developments in the crypto space. The world’s largest asset manager has updated its S-1 registration statement after the U.S. Securities and Exchange Commission approved 19b-4 forms for eight Ethereum ETFs, including BlackRock’s proposed iShares Ethereum Trust, paving the way for trading to begin.

Whales have been accumulating altcoins like MATIC, which plays a crucial role as a scaling solution for Ethereum. Technically, as shown in the attached 4-hour price chart of MATIC, the price is retracing back to the demand zone at $0.69. We’ve observed significant bullish candles emerging from this base, suggesting a similar reaction might occur again. Therefore, traders can capitalize on this demand zone by employing a Call Spread strategy.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $0.75) and simultaneously sell a Call option at a higher strike price (e.g., $0.85).

If MATIC price reaches $0.85 when the options expire on June 28th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $19.2.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)