View on market

Altcoins, including MATIC, are rallying due to bullish sentiment and potential European Central Bank rate cuts. Technically, MATIC shows strong support at $0.69, suggesting a Call Ratio strategy for traders.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if your perspective aligns with a bullish outlook on Polygon.

Trade Structure

(OTM Call) Buy 1x MATIC_USDC-14JUN24-$0.76-C @ $0.0096

(OTM Call) Sell 2x MATIC_USDC-14JUN24-$0.90-C @ $0.0016

Target: Spot level < $0.9

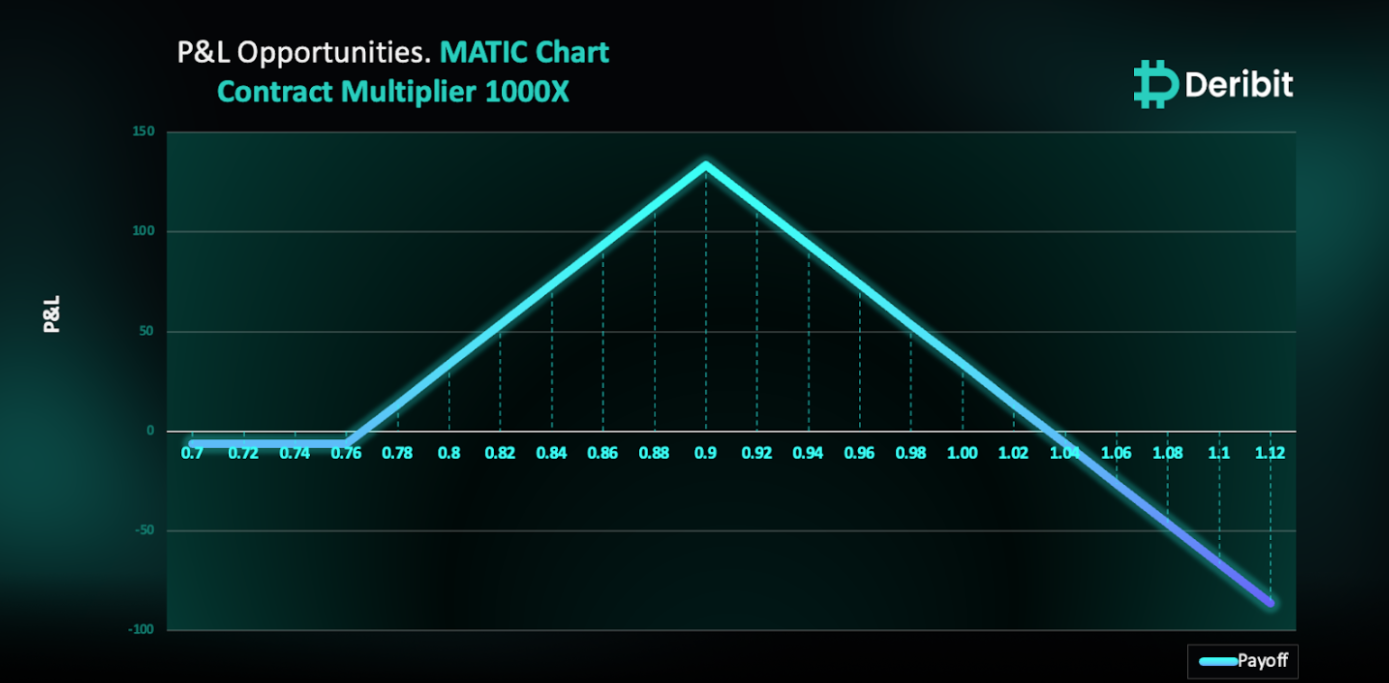

Payouts

Maximum Profit: $133.6/contract

Net Debit of Strategy: $6.4/contract

Why are we taking this trade?

As highlighted in my recent Insights, the altcoin market, including MATIC, is experiencing a notable rally driven by bullish sentiment across the entire crypto ecosystem. The SEC has instructed potential spot Ethereum ETF issuers to submit their amended S-1 forms by Friday. However, it may take some more time for these forms to become effective and for the new financial product to start trading.

Additionally, the wider markets are anticipating a rate cut by the European Central Bank this week, which could be well-received by the market and potentially lead to a rally in altcoins, including MATIC.

From a technical perspective, Polygon (MATIC) is showing robust performance with no signs of weakness or rejection. The attached price chart of MATIC illustrates that the price has consistently respected the support level of $0.69 on multiple occasions. Therefore, traders might consider taking advantage of this opportunity by using a Call Ratio strategy.

To implement this strategy, traders can buy a higher strike Call option (e.g., $0.76) and simultaneously sell Calls in double quantity (2x) of a higher strike price (e.g., $0.90).

If MATIC price is at $0.90 when the options expire on June 14, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $6.4, losses beyond the initial debit are possible due to the position’s net short call exposure.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)