In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Whether you believe in the BTC ETF-CME basis narrative revelation, the BTC miner distribution, the dormant wallet sale or derisking ahead of CPI+FOMC, BTC+ETH suffered from large downward selling pressure.

Lows of 66k, 3.45k; Funds started to unwind protection and buy upside.

2) Recent bullish ETF inflow has been challenged on face value, with CME Short future interest also rising, suggesting a large proportion used as part of a Basis trade for Tradfi funds.

CPI+FOMC derisking has added pressure on top of other negative flows.

Hedges saved accounts.

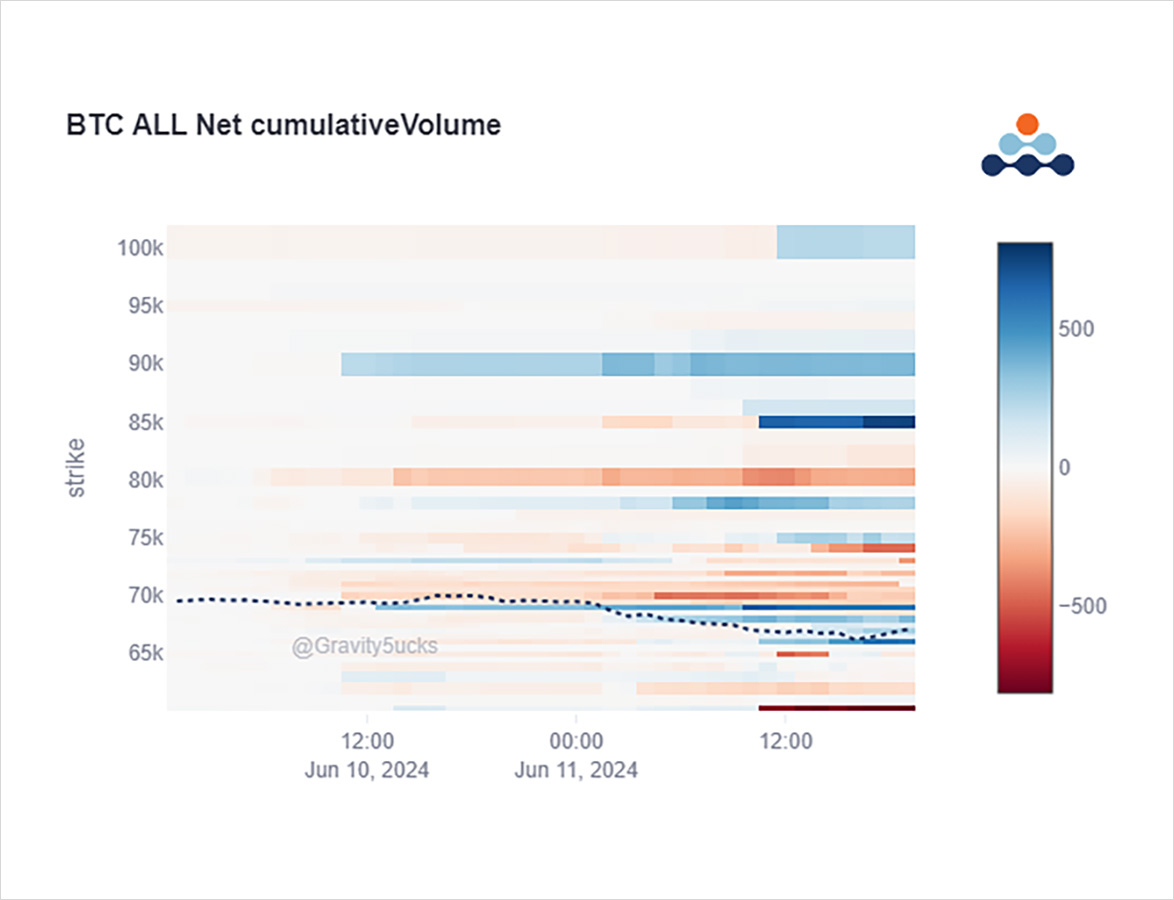

3) As BTC fell <67k, some of those hedges started to be unwound in June, and additional upside was added via a Dec Risk-Reversal (buying the 85k Call, selling the 60k Put), plus Sep Calls+Dec Call spread.

As BTC bounced off the brief 66k low, Fast money scooped upside June Calls.

4) ETH failed in relative volumes to signify the same flows, with only minor buying of Straddles and upside flicking the switch at all.

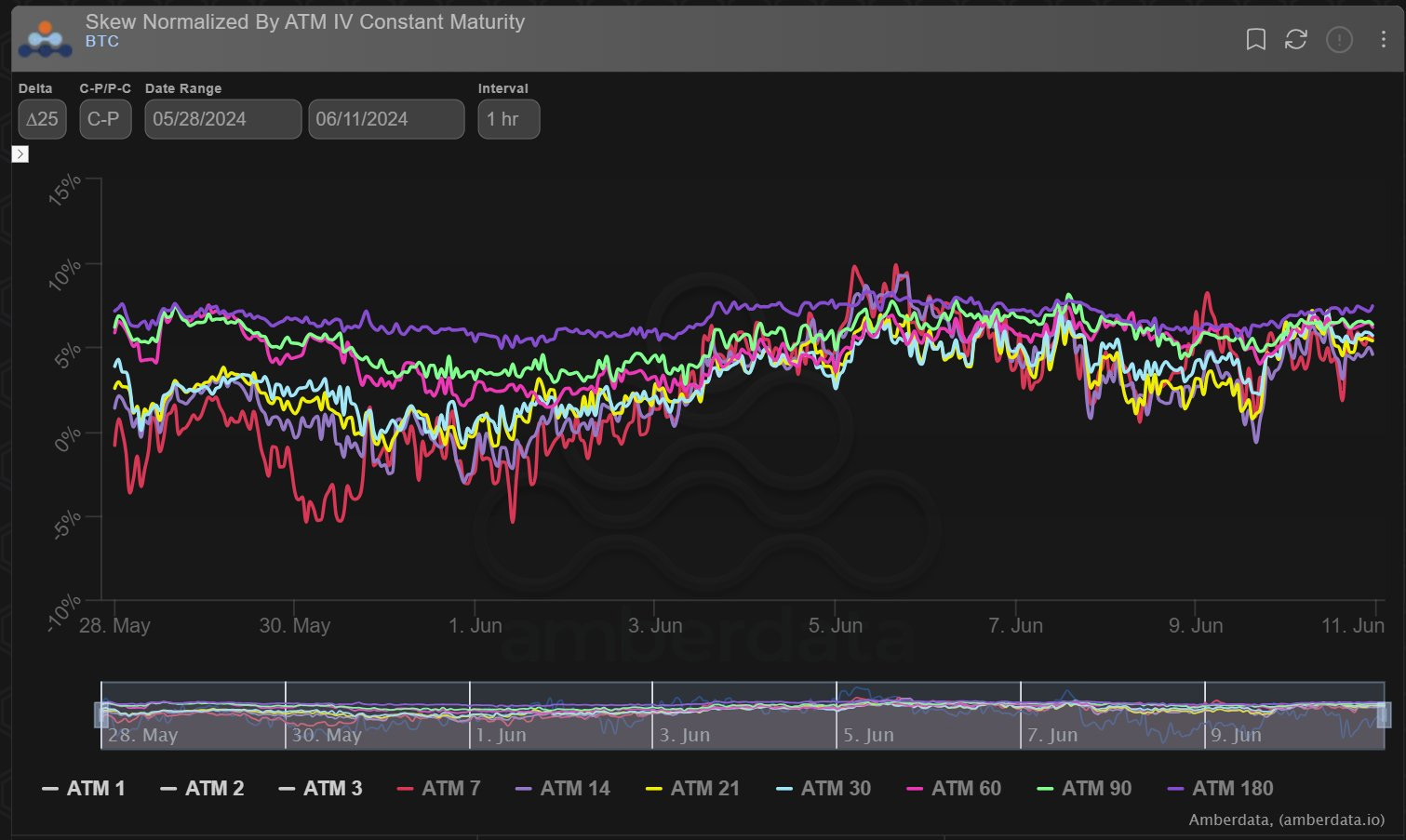

Dvols also barely budged on BTC or ETH, unmoved by the volatility at 53%, 64% respectively.

Only <14d maturities reacted; Gamma was attainable.

View Twitter thread.

AUTHOR(S)