In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

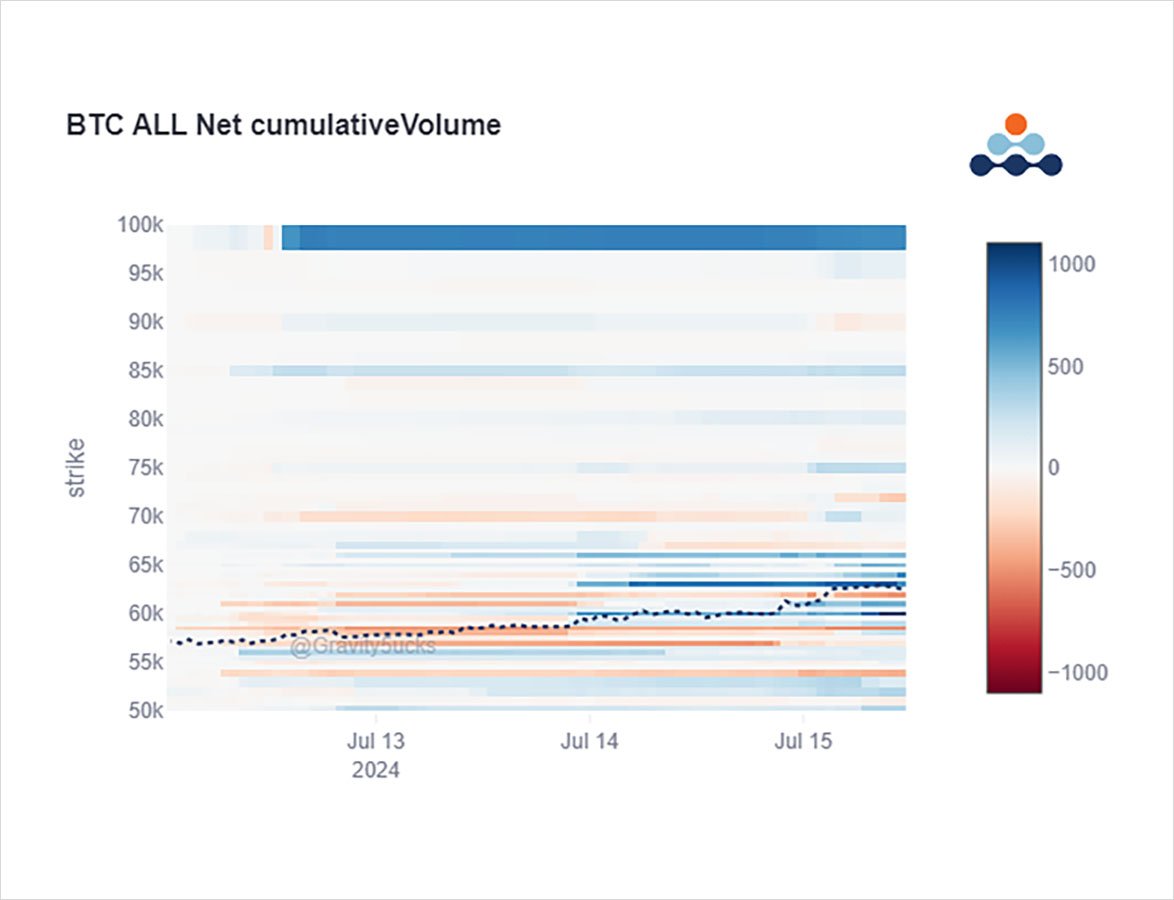

An aggressive seller of BTC Dec 100k Calls on Friday ran into a large buyer that then started lifting offers until 1k were accumulated.

The Trump wknd strength ignited fast money July 63k Call buyers and breach >60k.

Today, absence of German BTC sales +MtGox squeezed BTC >63k.

2) Dec upside continues to be the place for large Funds to express EoY exposure, either via naked OTM Calls, Vol or convexity plays.

On the bounce, existing Fund hedges remain in Sep, but some short Calls were covered in July; and additional buying post Trump assassination bid.

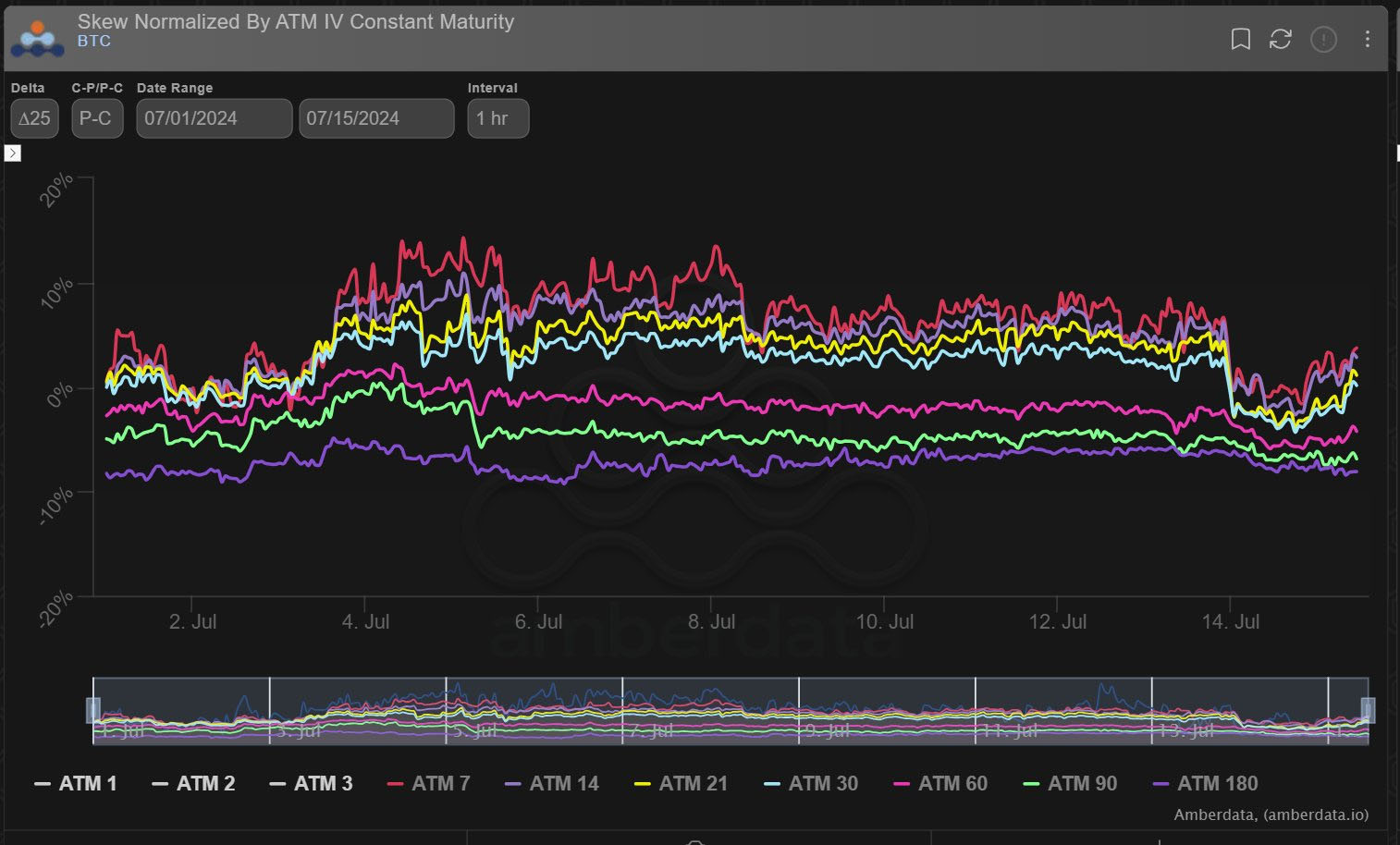

3) But with BTC at 63k, some small TPing of Calls across maturities were executed, and some Put buying in July+Aug hit the tape, taking advantage of a weakened Put Skew with Vols remaining firm due to Gamma demand.

View Twitter thread.

AUTHOR(S)