View on market

Joe Biden’s withdrawal from the election and endorsement of Kamala Harris boosts Donald Trump’s chances, amid his pro-crypto stance and favorable U.S. political developments. The crypto market remains bullish, driven by successful Bitcoin and Ethereum ETF launches and strong technical patterns for Bitcoin.

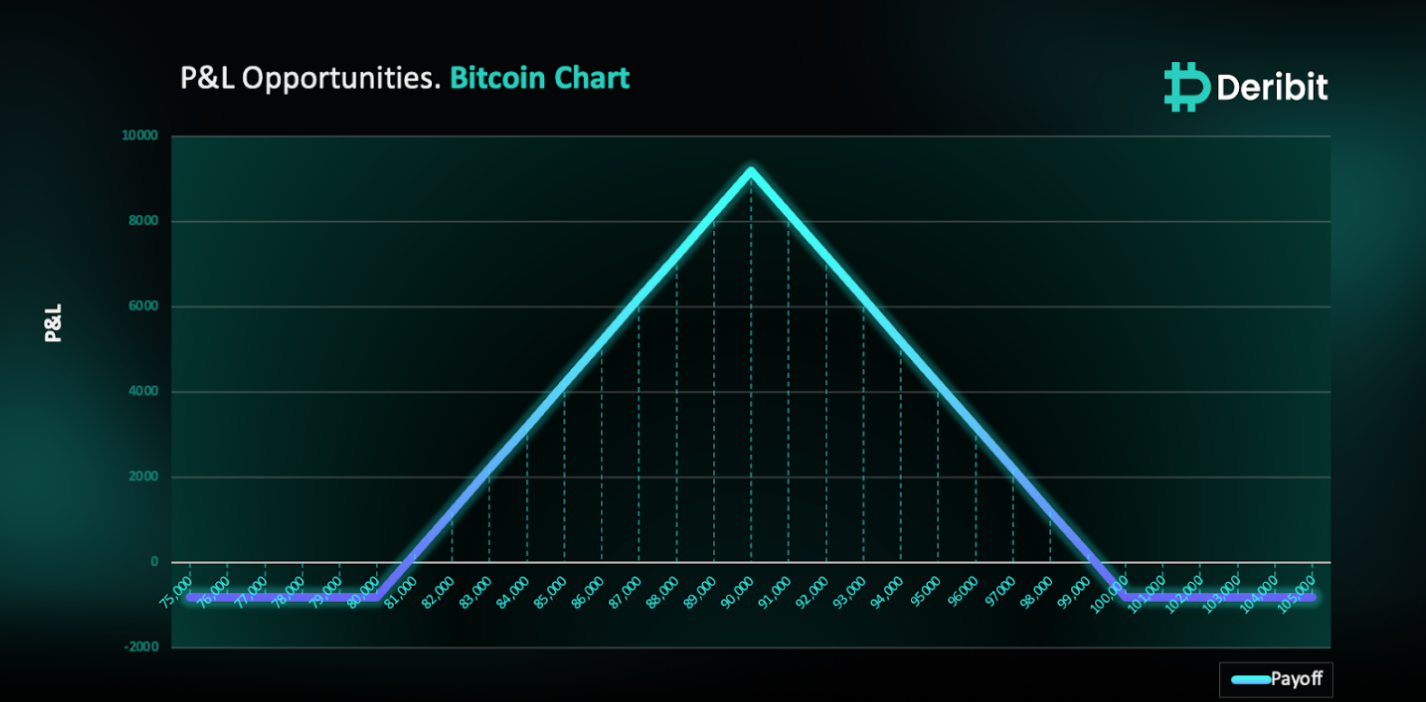

Call Butterfly Spread

The proposed strategy is a Call Butterfly Spread strategy. A Butterfly Spread with Calls is a three-part strategy that is created by buying one Call at a lower strike price, selling two Calls with a higher strike price and buying one Call with an even higher strike price.

You can consider executing this strategy if you are anticipating a bullish environment to continue for BTC.

Trade Structure

(OTM Call) Buy 1x BTC-08NOV24-$80,000-C @ $5,640

(OTM Call) Sell 2x BTC-08NOV24-$90,000-C @ $3,615

(OTM Call) Buy 1x BTC-08NOV24-$100,000-C @ $2,393

Target: Spot level = $90,000

Payouts

Maximum Profit: $9,197BTC

Debit of Strategy: $803/BTC

Why are we taking this trade?

Biden’s Withdrawal and Endorsement of Harris Shifts Election Dynamics

Incumbent U.S. President Joe Biden’s decision to withdraw from the election race and endorse Vice President Kamala Harris has significantly impacted the political landscape. Harris, who is currently trailing Biden in popularity polls, faces an uphill battle against Donald Trump, whose chances of returning to the White House have been bolstered by these developments (Source: The BLOCK).

Trump’s Positive Shift on Cryptocurrency

In the first half of 2024, Trump adopted a more favorable stance on cryptocurrency. In mid-July, he emphasized the importance of the United States leading the cryptocurrency industry, aiming to surpass China. This aligns with Ohio Senator Vance’s pro-crypto stance and his efforts to amend the Financial Innovation and Technology for the 21st Century Act (FIT21) to benefit the crypto sector.

Bullish Sentiment in the Crypto Market

The recent launch of Bitcoin and Ethereum ETFs has been hailed as highly successful, further fueling bullish sentiment in the crypto industry. On a technical front, Bitcoin broke out from a higher time frame supply zone at $67,300 after the formation of a flag and pole pattern. Although there were some retracements, they were confined to the pivot/demand zone responsible for breaking the mentioned supply zone. As a result, Bitcoin remains bullish.With political developments in the U.S. increasingly favoring the crypto industry, the bullish trend for Bitcoin is likely to continue.

For traders, looking to capitalize on this analysis in BTC, implementing a Call Butterfly Spread strategy could be advantageous. US Elections are to be held on 5th Nov 2024, hence 8th Nov expiry is therefore the Election’s Expiry.

To execute this approach, traders can purchase a Call option (e.g., $80,000) while simultaneously selling double the quantity of Calls at a higher strike price (e.g., $90,000) and buying a Call at an even higher strike price (e.g., $100,000).

If the BTC price is at $90,000 when the options expire on November 8th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $803.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)