View on market

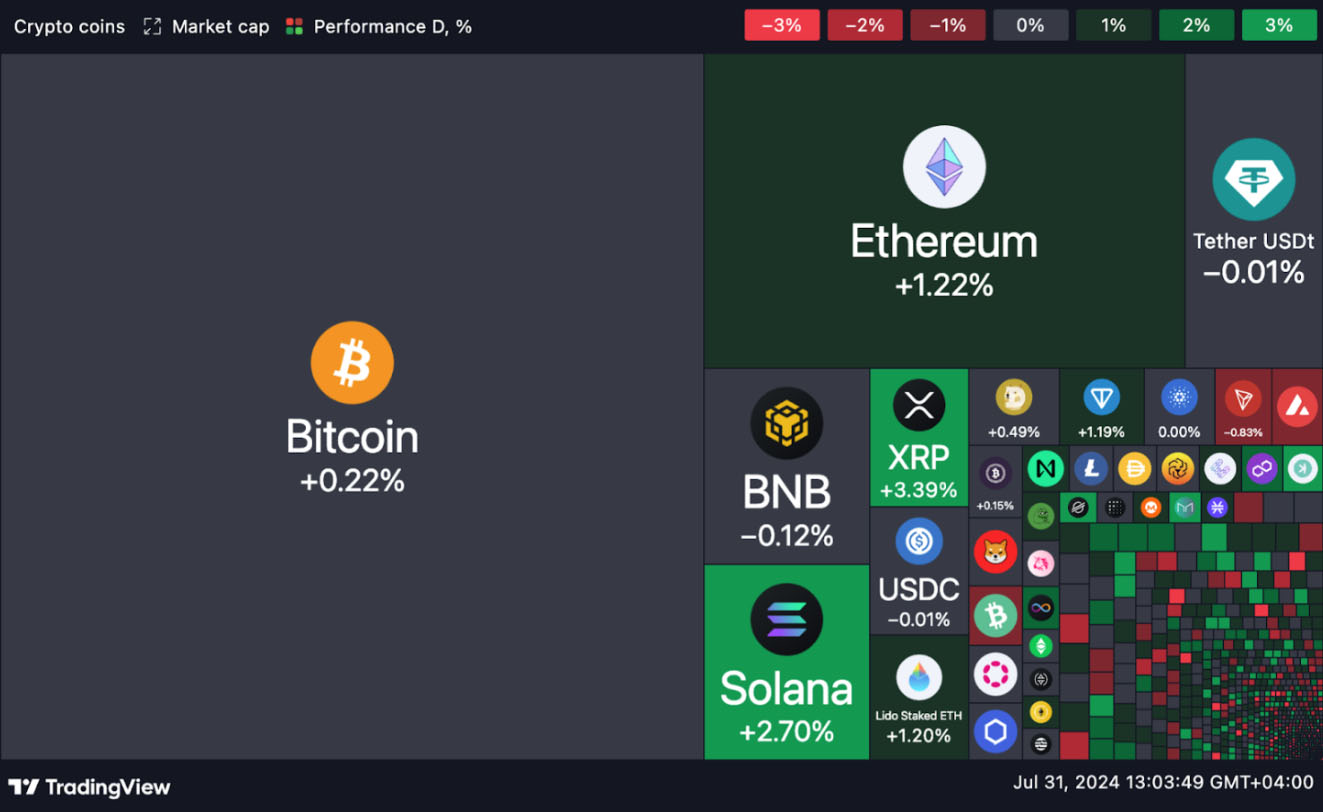

US spot Ethereum ETFs saw $33.7 million in net inflows, ending a negative flow streak. ETH has outperformed BTC in market cap and may break through a key supply zone.

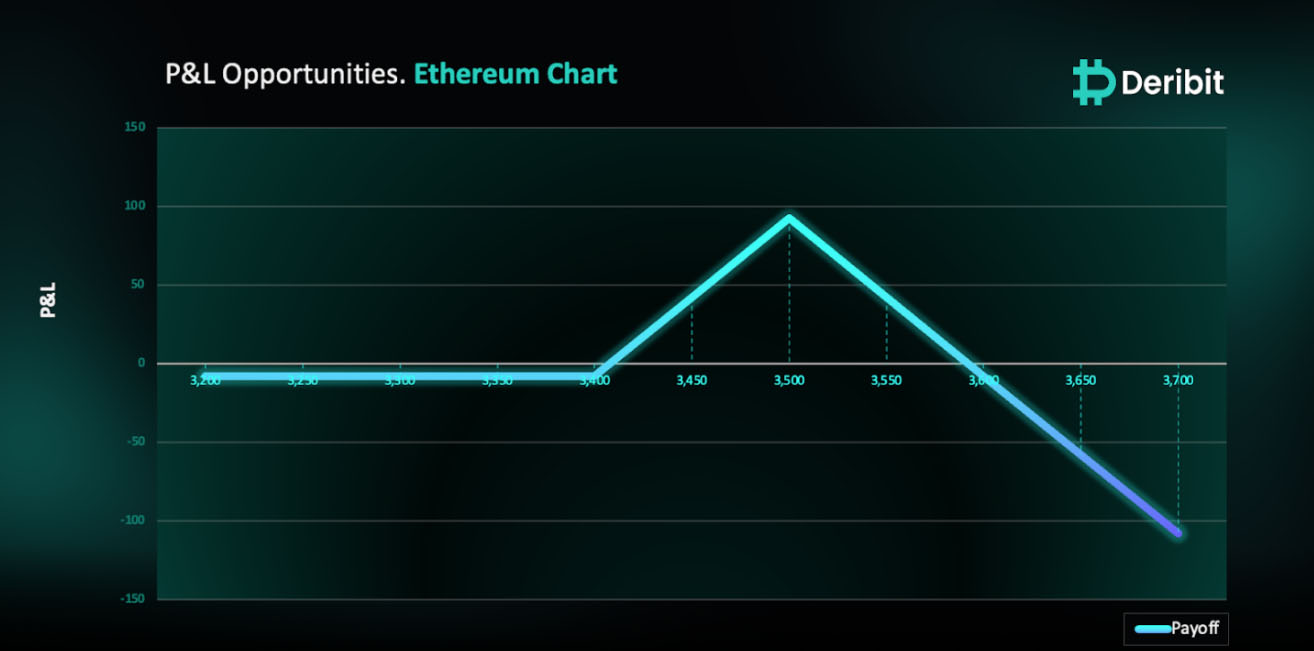

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are eyeing bullish trends in ETH.

Trade Structure

(OTM Call) Buy 1x ETH-03AUG24-$3,400-C @ $28.15

(OTM Call) Sell 2x ETH-03AUG24-$3,500-C @ $10.27

Target: Spot level < $3,500

Payouts

Maximum Profit: $92.39/ETH

Net Debit of Strategy: $7.61/ETH

Why are we taking this trade?

US spot Ethereum ETFs experienced net inflows of $33.7 million, breaking a streak of negative flows (Source: Farside Investors).

When comparing ETH to BTC on a daily basis, Ethereum has outperformed in terms of market cap, as illustrated in the chart below.

From a technical perspective, as shown in the attached 2-hour price chart, Ethereum hasn’t exhibited significant retracements from the highlighted supply zone. Consequently, the price may rebound, and I anticipate this supply zone could potentially break.

Therefore, traders might consider deploying a call ratio strategy in ETH for 3rd August expiry.

To implement this strategy, traders can buy a Call option (e.g., $3,400) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $3,500).

If the price of ETH is at $3,500 when the options expire on August 3rd, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy is at a debit of $7.61, significant losses are possible due to the position’s net short Call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)