In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Yesterday’s powerful bounce seemed to be underparticipated, with little fast money or funds contributing with Call buys.

Outlier was a continuation purchase of Mar 120k Calls.

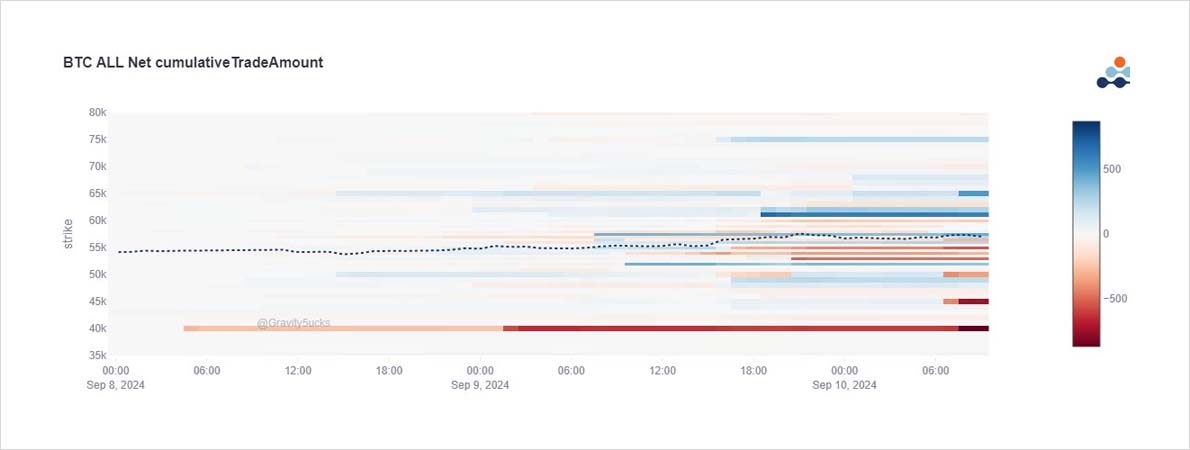

But European hour trades are more robust: selling of 40-50k Puts across tenors & 1-3day Calls bought.

2) A mixture of Fund sales of Sep 50k, Oct 50k, Nov 45k, Dec 40k, and risk-reversals (selling Put, buying Call) have hit the tape in European hours this morning; total close to 2k Puts sold.

In addition, 1-3day 57-59k Calls bought ahead of the Presidential debate & US inflation.

3) These Put sales could be a combination of several factors (in no material order):

a) Spot lows have been reached or lower concerns

b) dumping of protection

c) selling of vol ahead of the debate

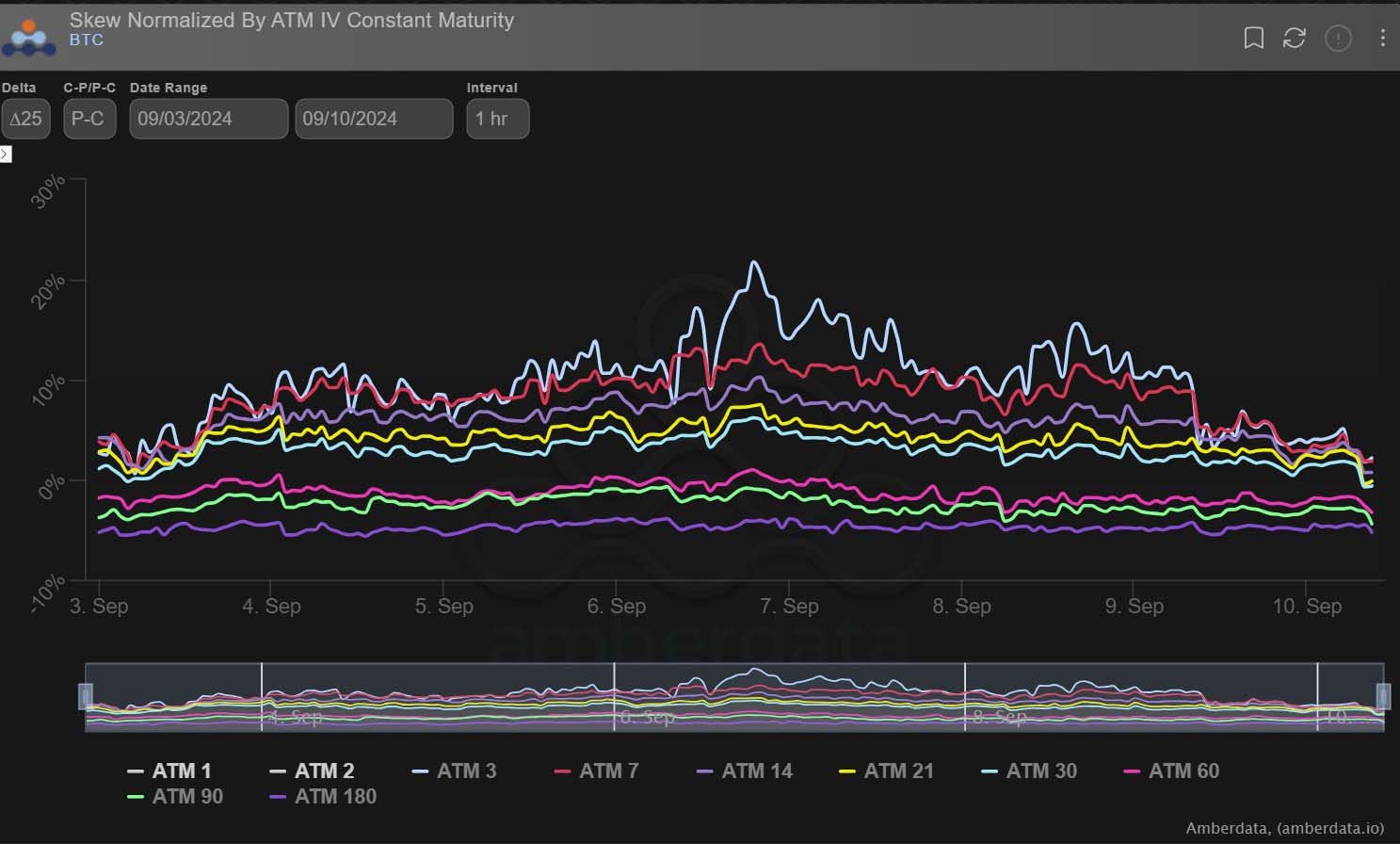

d) selling of elevated Put Skew (which has been heightened on the Spot sell-off).

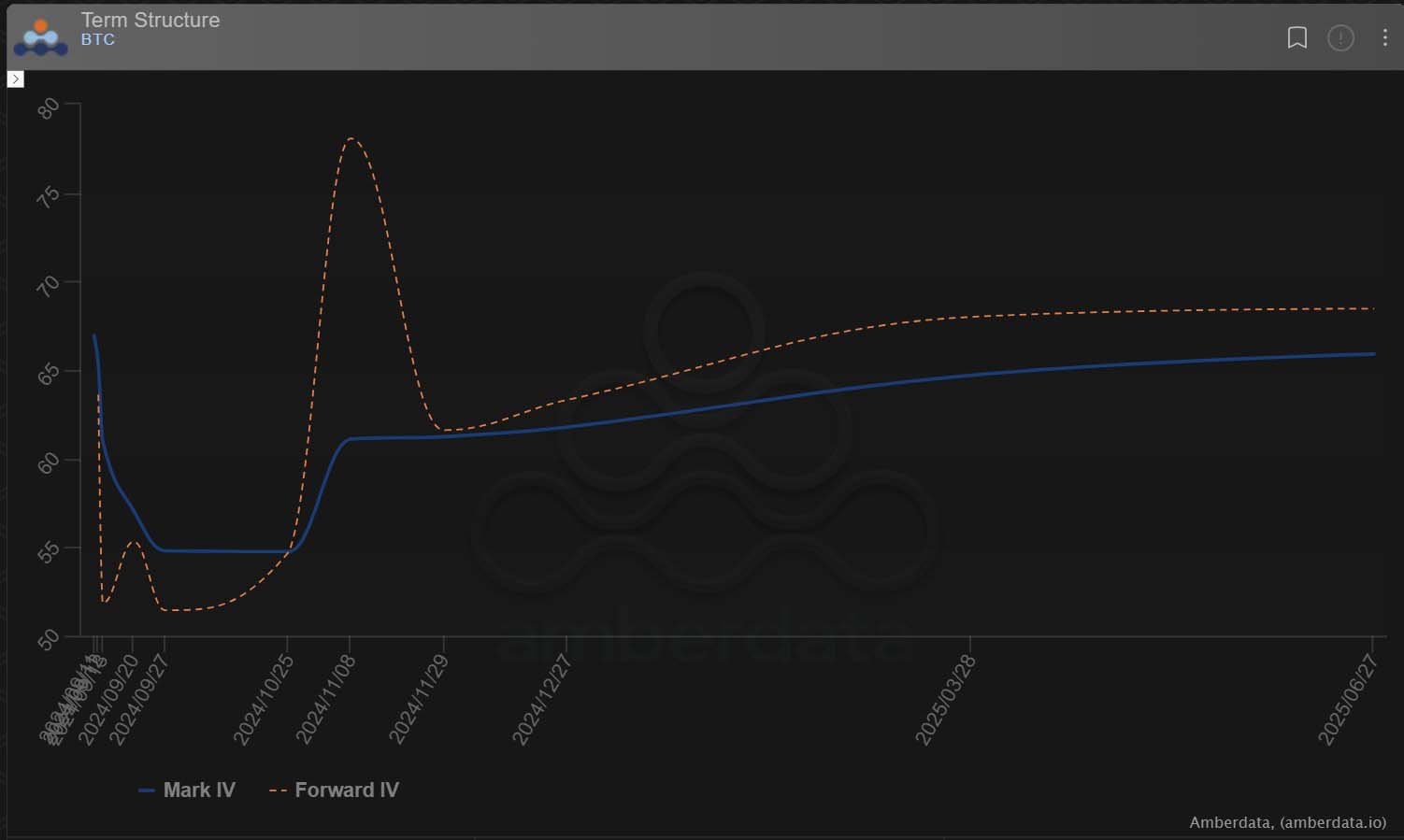

4) The BTC curve now has 2 clear ‘bumps’.

a) The Nov8+ expiry relating to the election period.

b) The near-dated expiries probably relating to the Trump-Harris debate later today, and/or US inflation numbers over the next couple days.

Both have manifested by targetted demand.

View Twitter thread.

AUTHOR(S)