Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

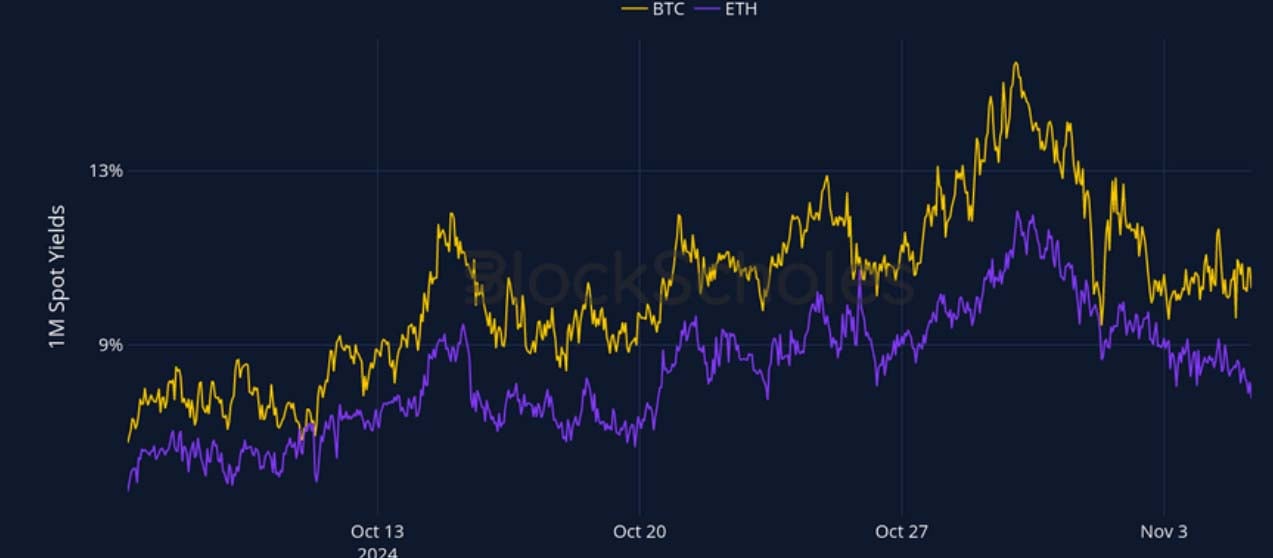

In the days leading up to the election we’ve observed a decline in both futures implied yields and perpetuals funding rates. With election-related uncertainty and recent spot price fluctuations, it’s clear that traders are now hesitant to pursue leveraged exposure in BTC and ETH as aggressively as they did last week, when the buildup of leverage was evident. This points to a reduced appetite for high-stakes directional bets, as BTC’s implied volatility remains elevated and continues to rise. Despite this, BTC’s volatility smiles keep signalling a bullish sentiment. In contrast, ETH’s implied volatility levels have slowed and moved sideways over recent days, with options’ skew reflecting a more bearish short-term sentiment. The spotlight therefore remains on BTC as the election cycle reaches its conclusion.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

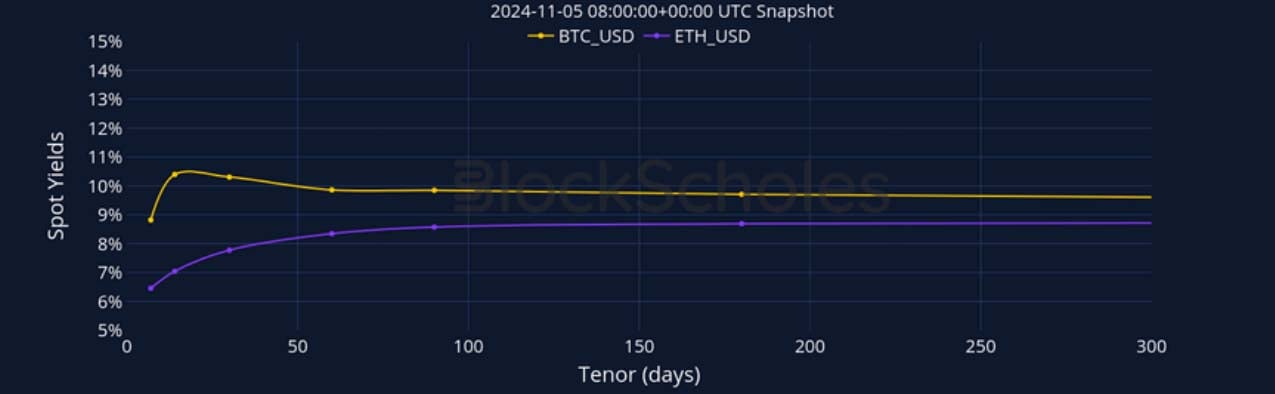

BTC ANNUALISED YIELDS – BTC’s yield term structure levels have dropped at the front end, now being slightly inverted from 14 days tenors onwards.

ETH ANNUALISED YIELDS – ETH’s yield curve has re-steepened like BTC’s, with a decline at the shorter end.

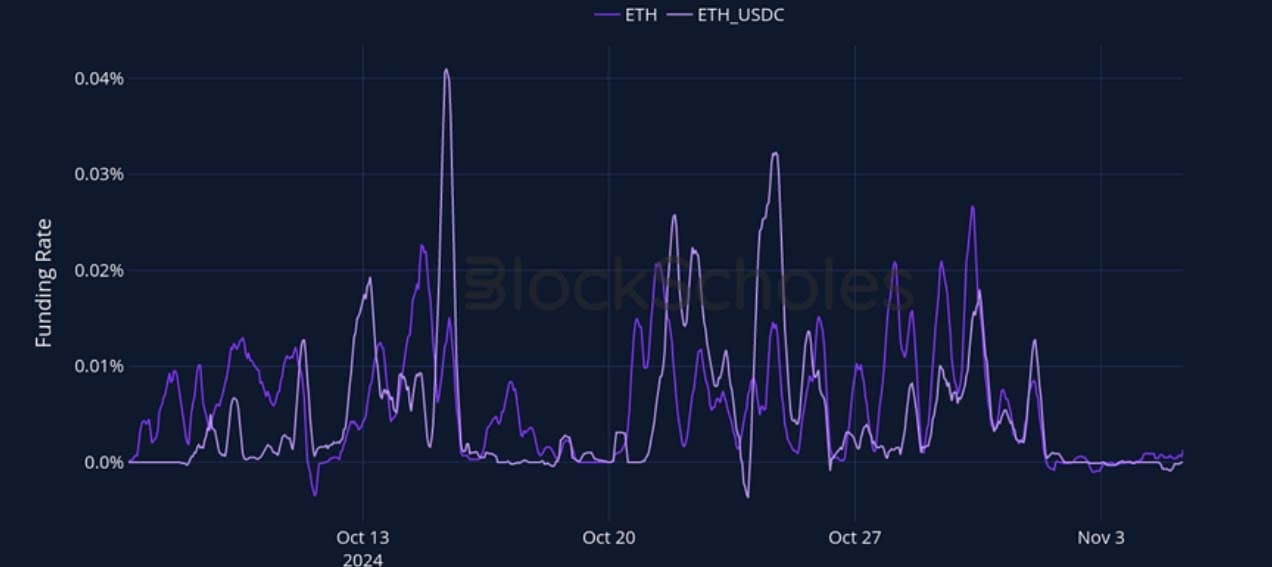

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC’s perpetual funding rates dip negative just days before the election, and after a prolonged bullish period.

ETH FUNDING RATE – ETH’s funding rate mirrors BTC’s recent movements, though ETH’s rates did not drop as negative and remain largely neutral.

BTC Options

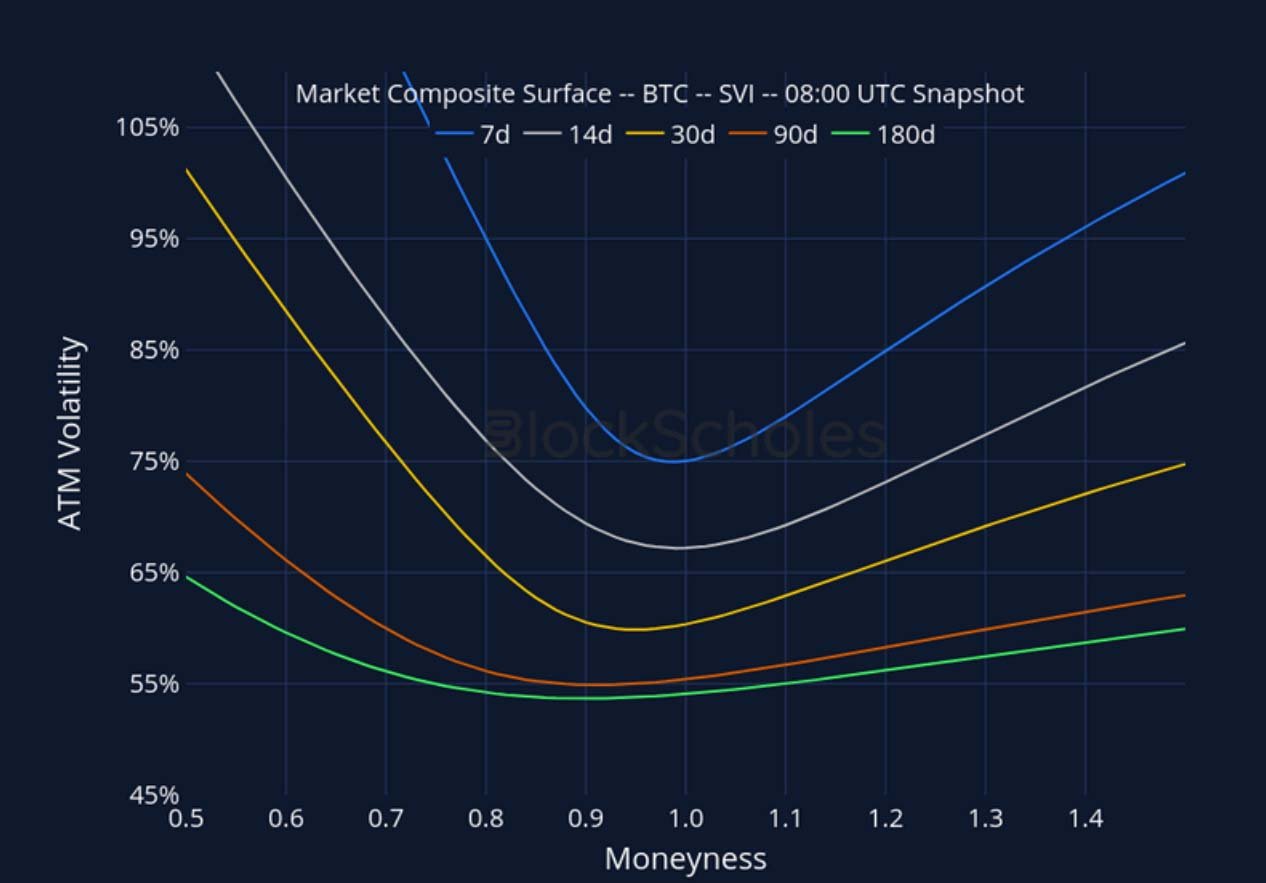

BTC SVI ATM IMPLIED VOLATILITY – The term structure of volatility remains inverted and shows growing levels across tenors, especially at the front end.

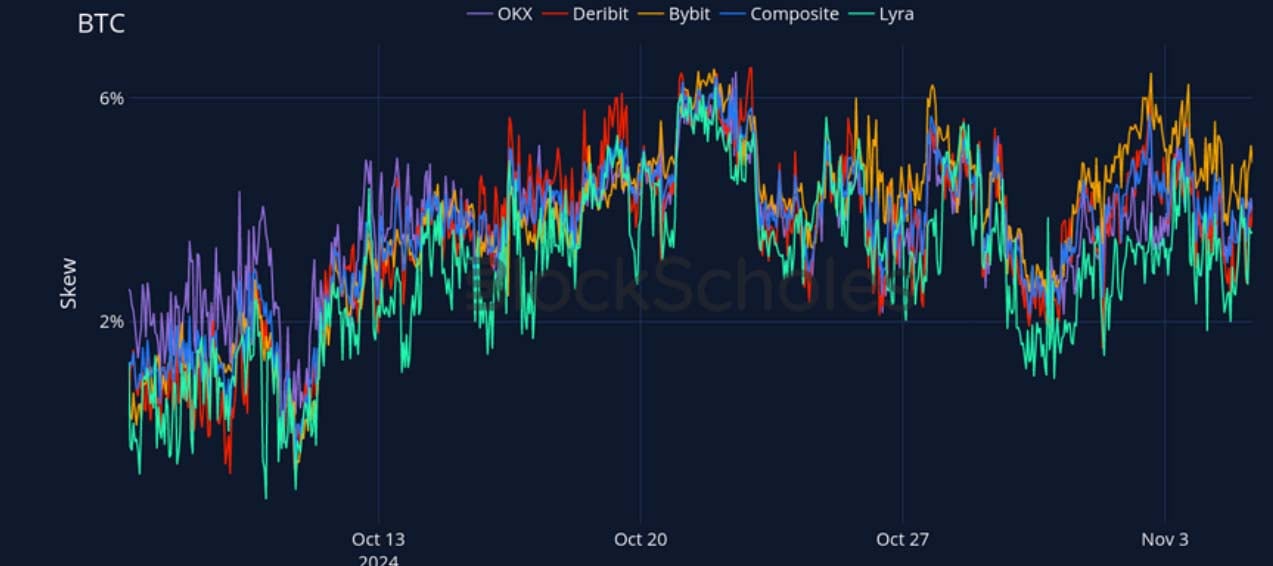

BTC 25-Delta Risk Reversal – Skew levels are positive across all tenors, indicating a stronger bullish sentiment in the long term.

ETH Options

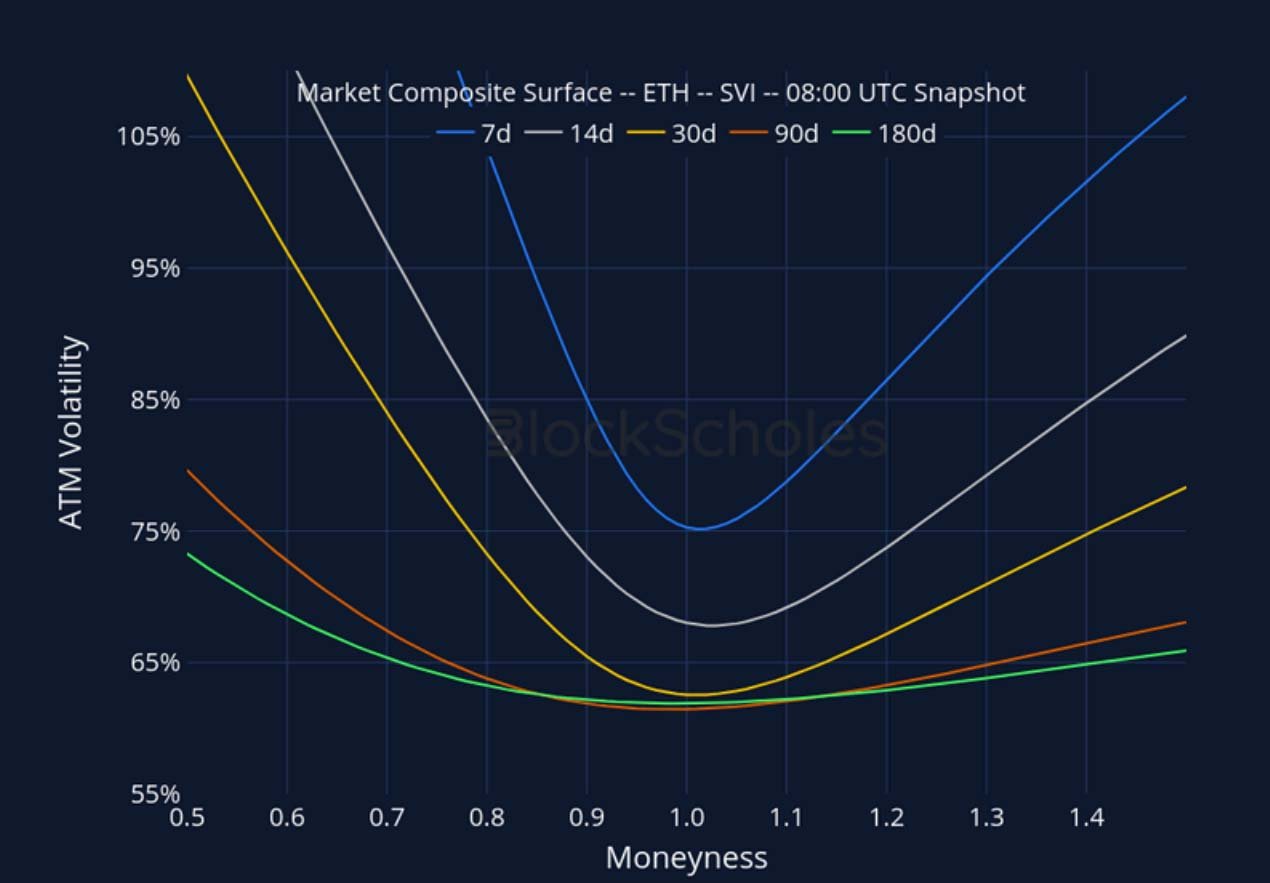

ETH SVI ATM IMPLIED VOLATILITY – ETH’s implied volatility term structure remains heavily inverted, though levels are not rising as fast as BTC’s.

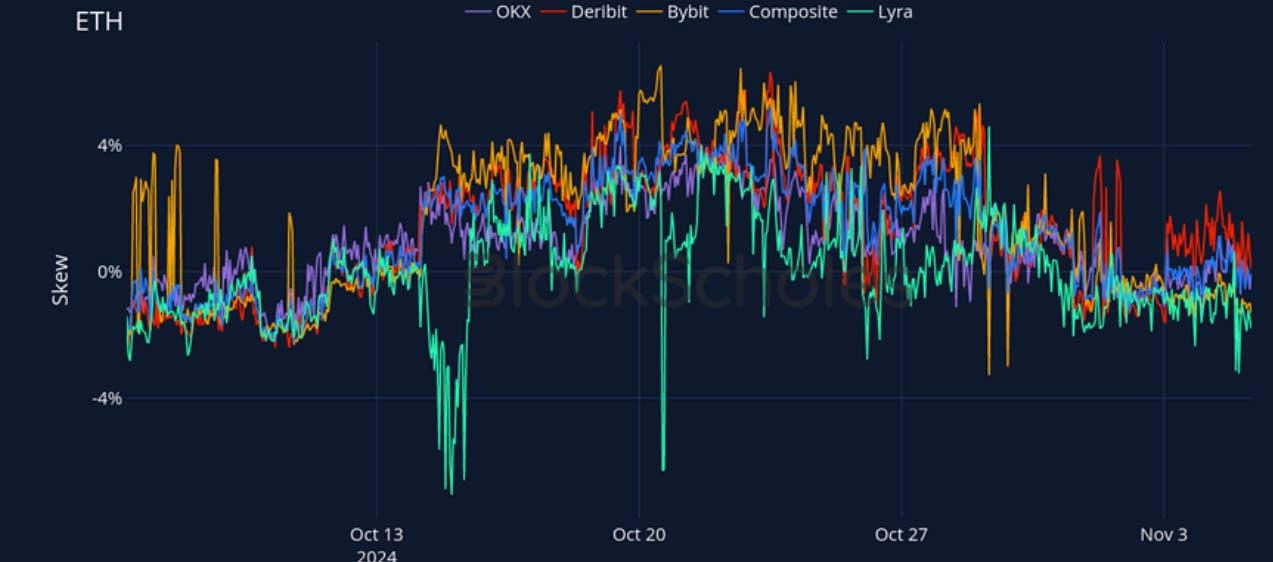

ETH 25-Delta Risk Reversal – ETH’s volatility smiles now indicate demand for downside exposure in the short term, while longer tenors remain more bullish.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

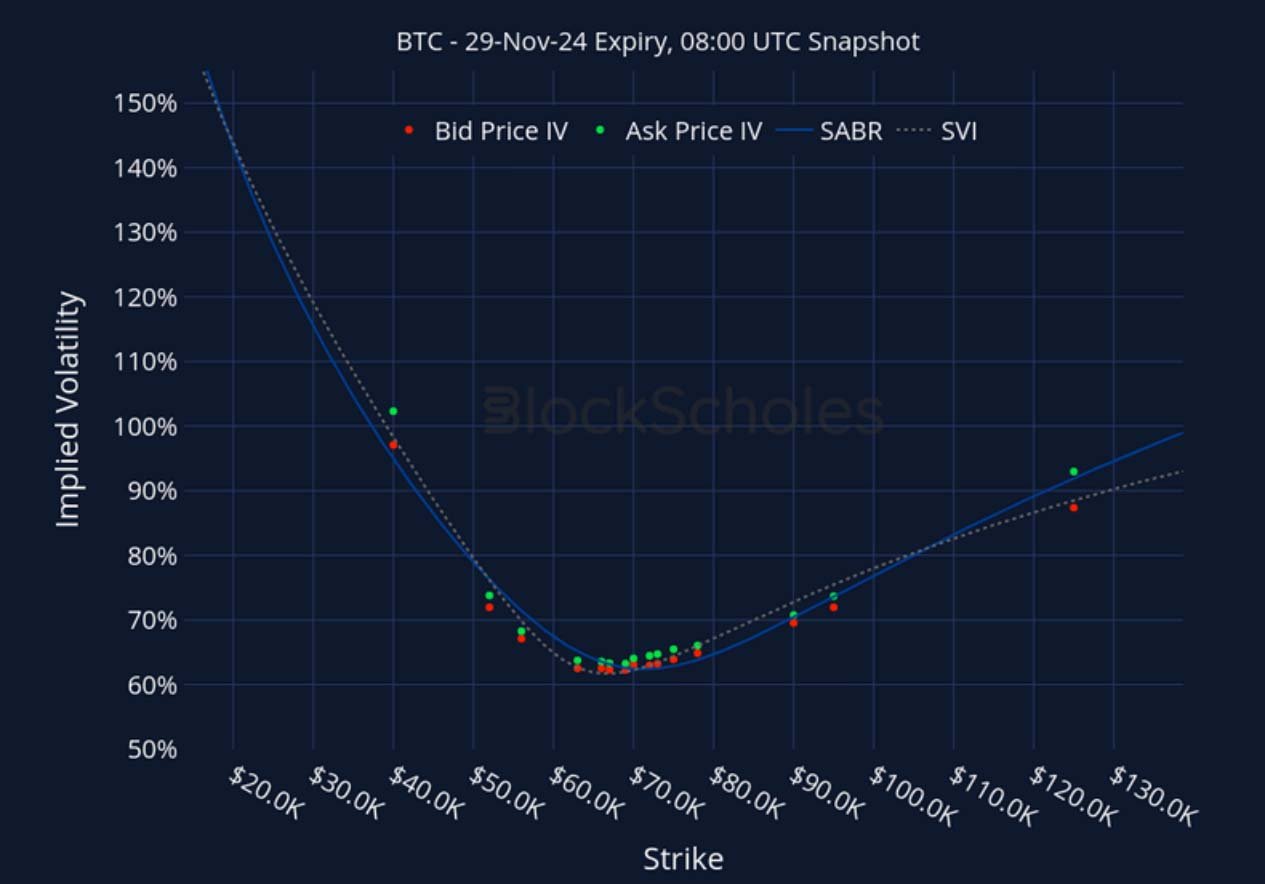

Listed Expiry Volatility Smiles

BTC 29-NOV EXPIRY – 8:00 UTC Snapshot.

ETH 29-NOV EXPIRY – 8:00 UTC Snapshot.

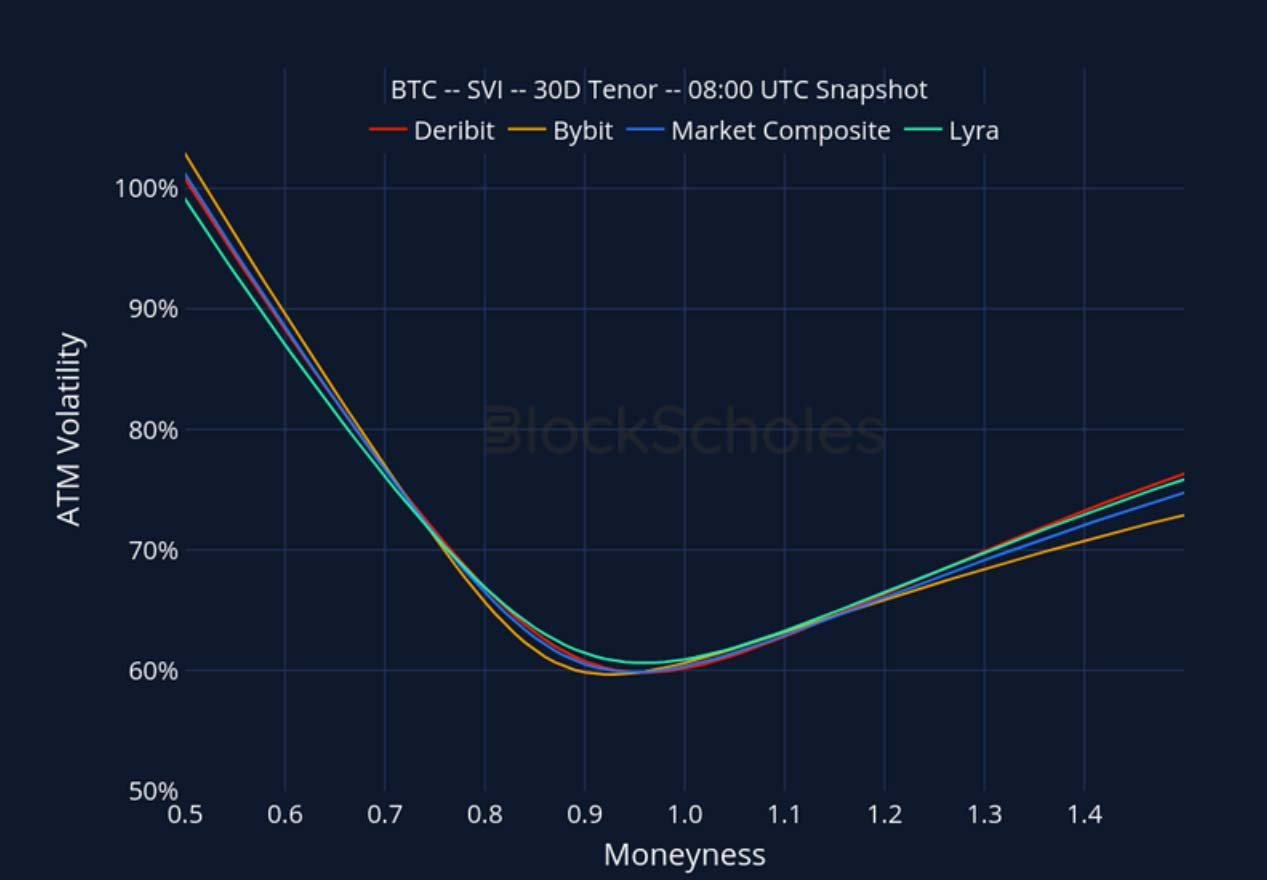

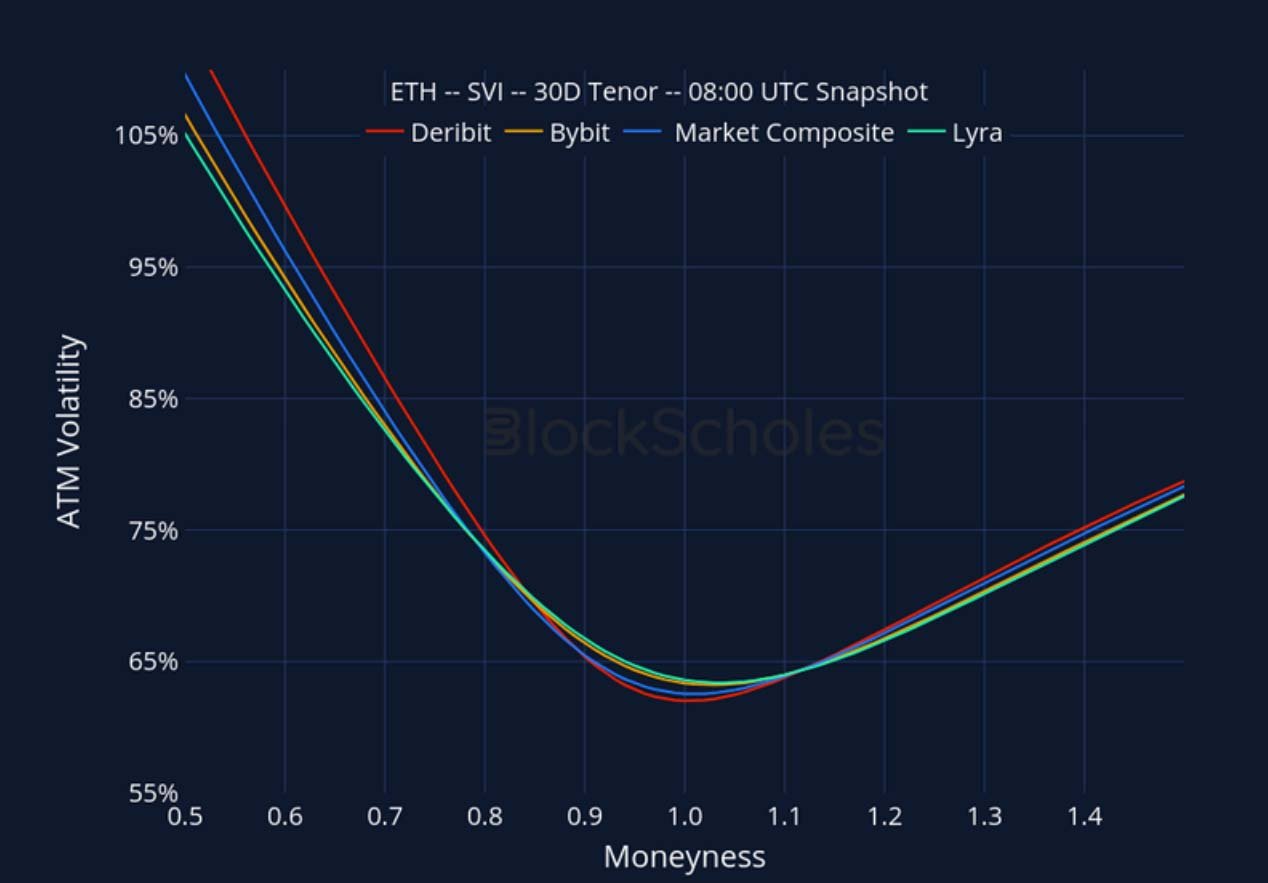

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

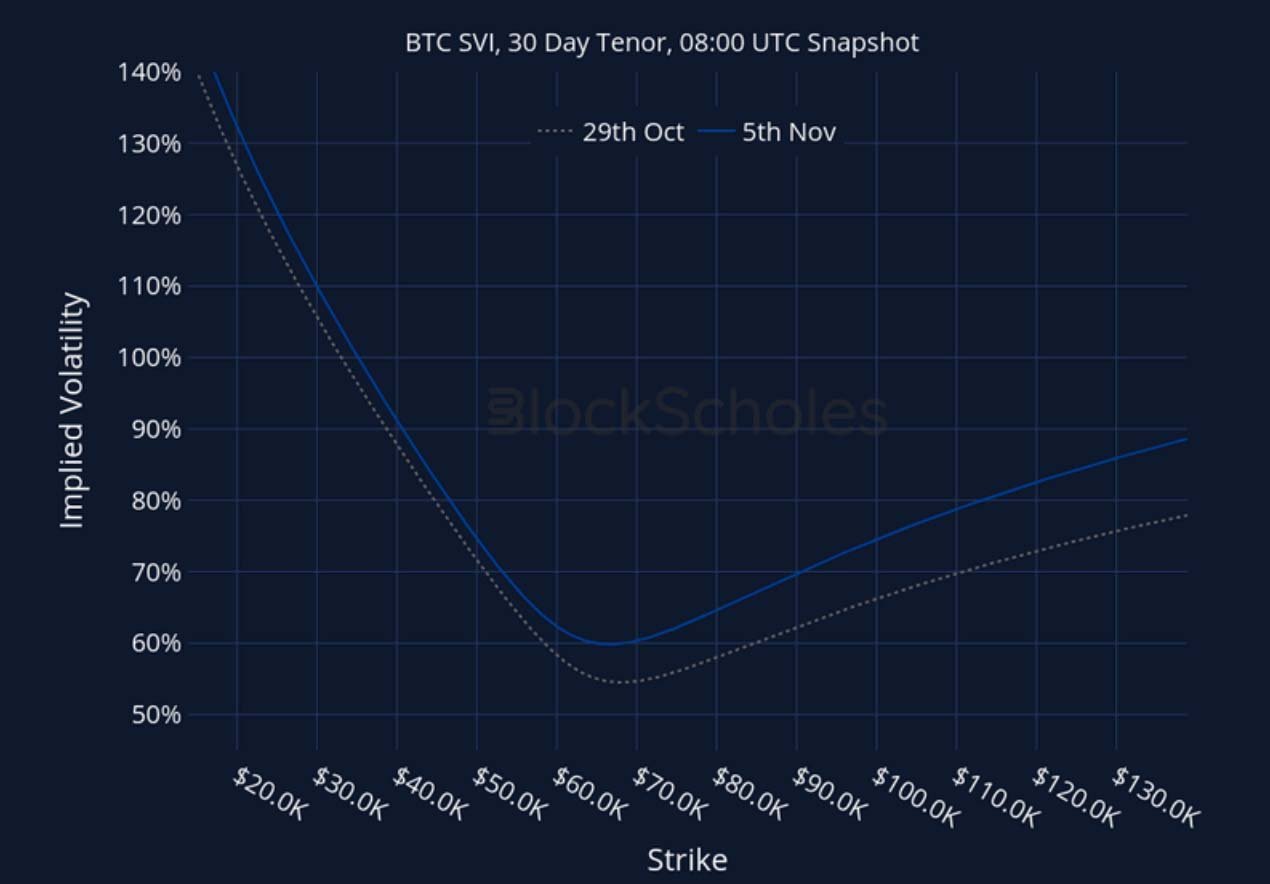

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)