A New Era For Crypto

Bitcoin is making headlines as it eyes a potential breakthrough beyond $100,000. Institutional interest continues to drive momentum, with global players like Japan’ Metaplanet joining the Bitcoin-buying spree initiated by MicroStrategy, now holding over 331,000 BTC. Meanwhile, the Nasdaq has listed options on BlackRock’s Bitcoin spot ETF(IBIT), leading to a surge in speculative activity and call buying. With regulatory shifts and institutional backing gaining traction, Bitcoin remains

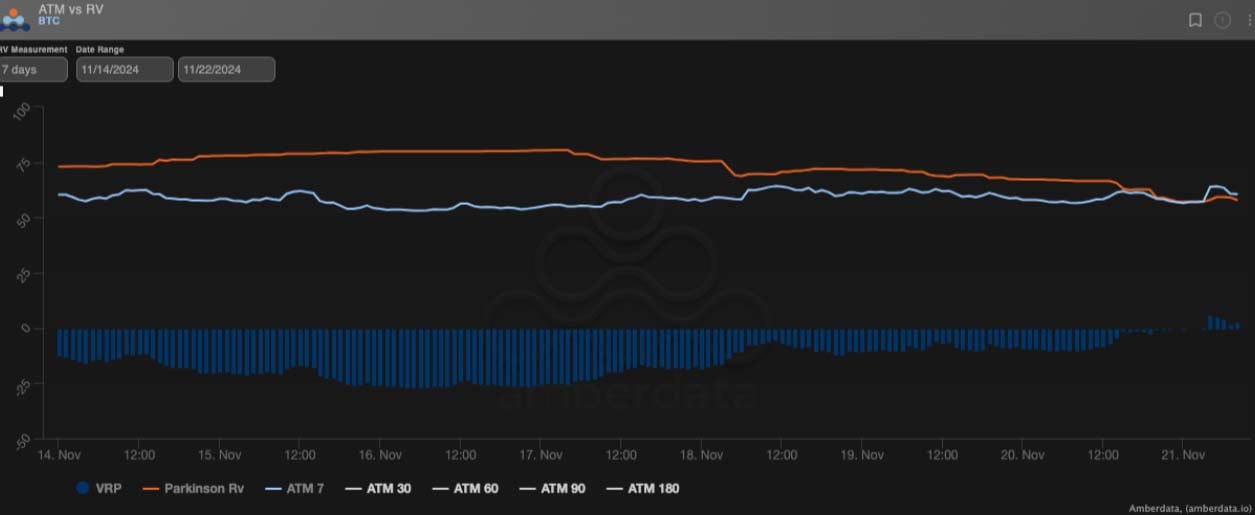

Gamma Has Been Good Value

Crypto markets are buzzing with elevated realized volatility but it does seem to have peaked in the near-term, as intraday ranges have been narrowing despite breaking higher in spot. While implied volatility had dipped slightly in shorter expiries, gamma still offers value and front end has bounced on the break above 95k. Until realized volatility settles and a clearer range forms, fading front-end volatility seems premature, especially as the big 100k level is approaching.

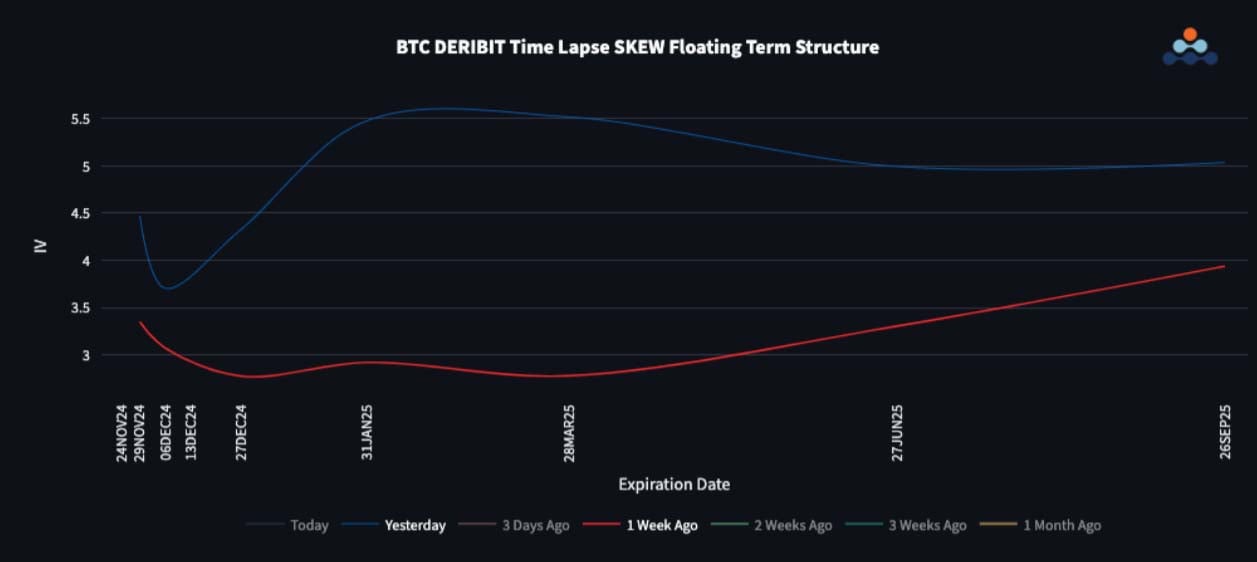

Skew Term Structures Roles Reversed

BTC’s skew curve flattened to just 4-5 vols across the term structure, reflecting its dominance over ETH. While Ethereum saw its call skew soften in the front, longer-dated options for 2025 indicate lingering optimism. For now, Bitcoin remains the standout performer, cementing its leadership in the market.

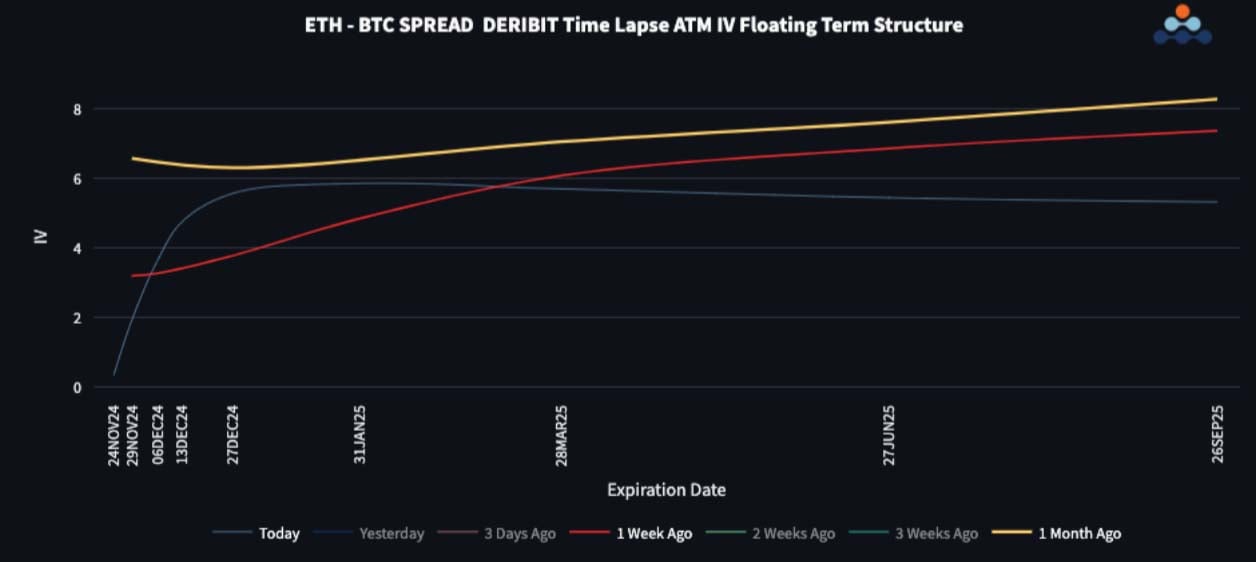

ETH/BTC Back At Local Lows

BTC demand continues to surge, pushing ETC/BTC spot to local lows and positioning Bitcoin near its highs. ETH holds support at 3000 but lacks the same buying momentum. Volatility spreads reflect this trend, with ETH vol fading against BTC. Front-end spread now sits near flat vol, while long-end spreads hold at 5.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)