Healthy Pullback In BTC

The crypto market took a hit, with over $400 million in Bitcoin and Ethereum liquidations. Despite the pullback, BTC remains strong above $90,000 and ETH above $3,300 – both well above previous resistance levels. Volatility is high, driven by overbought conditions due to speculative leverage.

This has led to far more aggressive profit-taking but also a cascade of forced selling by late comers. In the grand scheme of things, this is just a healthy pullback in an overextended move, and optimism over pro-crypto policies expected from Trump next year should cap the downside above key levels.

Crypto Volatility Trends Shifting

BTC realized vol has dropped to 50, while ETH holds firmer at 70. Implied vol is flat for BTC but climbing for ETH, with BTC carry positive by 10 vols, and ETH near neutral. ETH’s price range has been wider, frequently testing implied moves. For now, the market lacks equilibrium, making it too soon to bet against further volatility in my view.

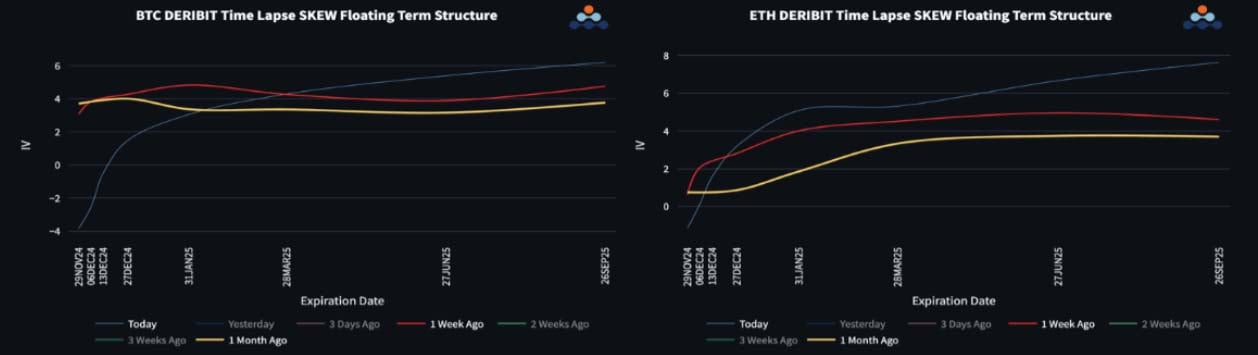

Skew Term Structures Steepen

BTC skew term structures steepened this week, with front-end skew flipping from +4 to -4 as investors hedge gains after BTC’s pullback near 100k. ETH call skew softened short-term but remains strong for January upside and beyond. Current skew curves suggest this dip is a correction within a broader bull trend.

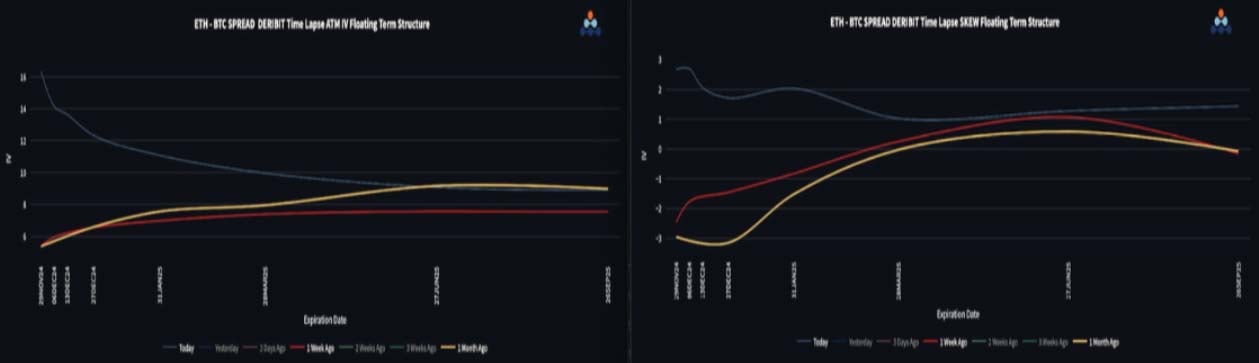

ETH/BTC Bounces Again

ETH/BTC saw a weekend bounce as ETH rallied, but failure to break $3,500 leaves the move unconvincing. ETH vol surged relative to BTC, widening the front-end vol spread to 15 vols, while the back-end rose slightly to 9 vols. Skew term structures now favor ETH, indicating traders are less worried about an ETH dip compared to a BTC decline.

We used the pop in ETH vol and relative resilience in spot to increase our hedge on ETH slightly this week.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)