BTC Established Range Sub $100k

ETH and BTC both briefly broke key thresholds – $4,000 and $100,000 respectively – before pulling back, keeping markets range-bound as we head into the holiday period in 2 weeks. But change is in the air: President-elect Donald Trump’s pro-crypto SEC pick, Paul Atkins, and a crypto-friendly Commerce Secretary candidate promise more supportive U.S. regulation. As institutional interest grows, BTC eyeing $100,000+ and ETH reaching new highs look increasingly likely. Still, short-term macro uncertainties-lingering inflation worries, global tensions, and potential tariffs—mean volatility remains part of the picture. FOMC next week is likely to deliver a rate cut but that is largely priced in.

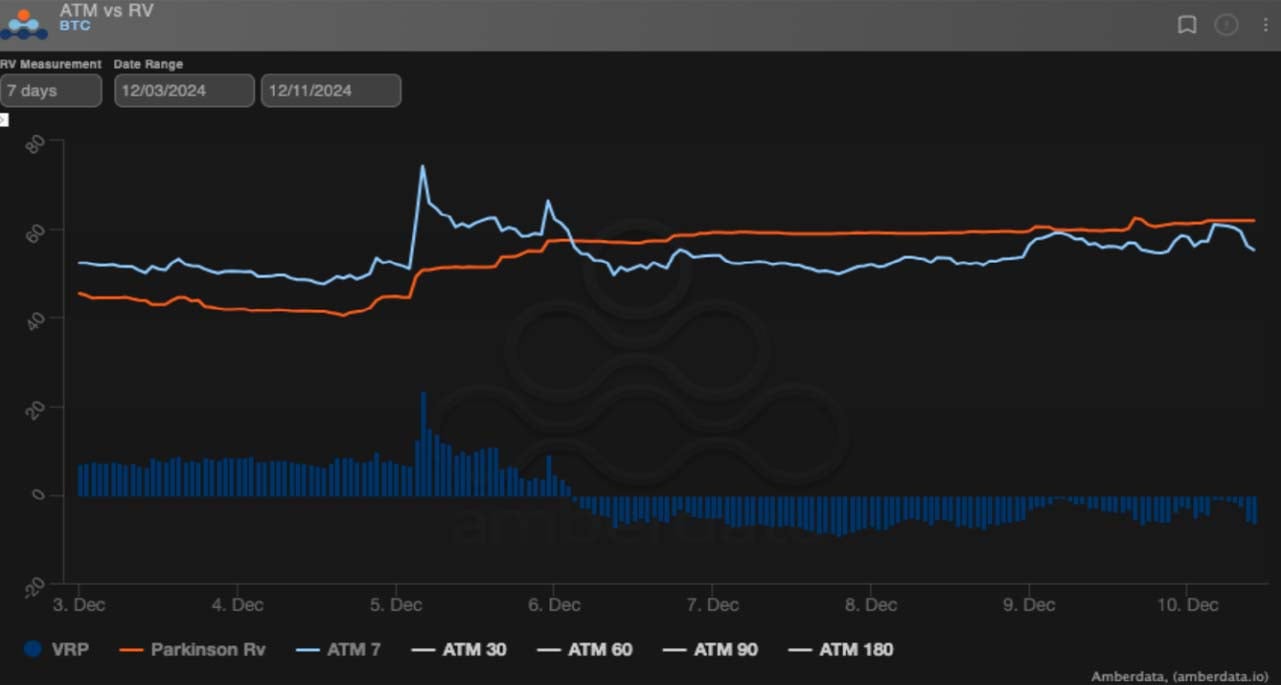

IV Not Keeping Pace With RV

BTC’s break past $100K triggered a spike in realized volatility, pushing both BTC and ETH into the 60s. While front-end implied vols firmed slightly, options sellers took profits, slowing the climb. BTC carry dipped negative, ETH carry stayed mildly positive, and price action consistently broke implied ranges. Intraday volatility soared, and a choppy market is solidifying an 85K–105K trading corridor for the rest of the year it seems.

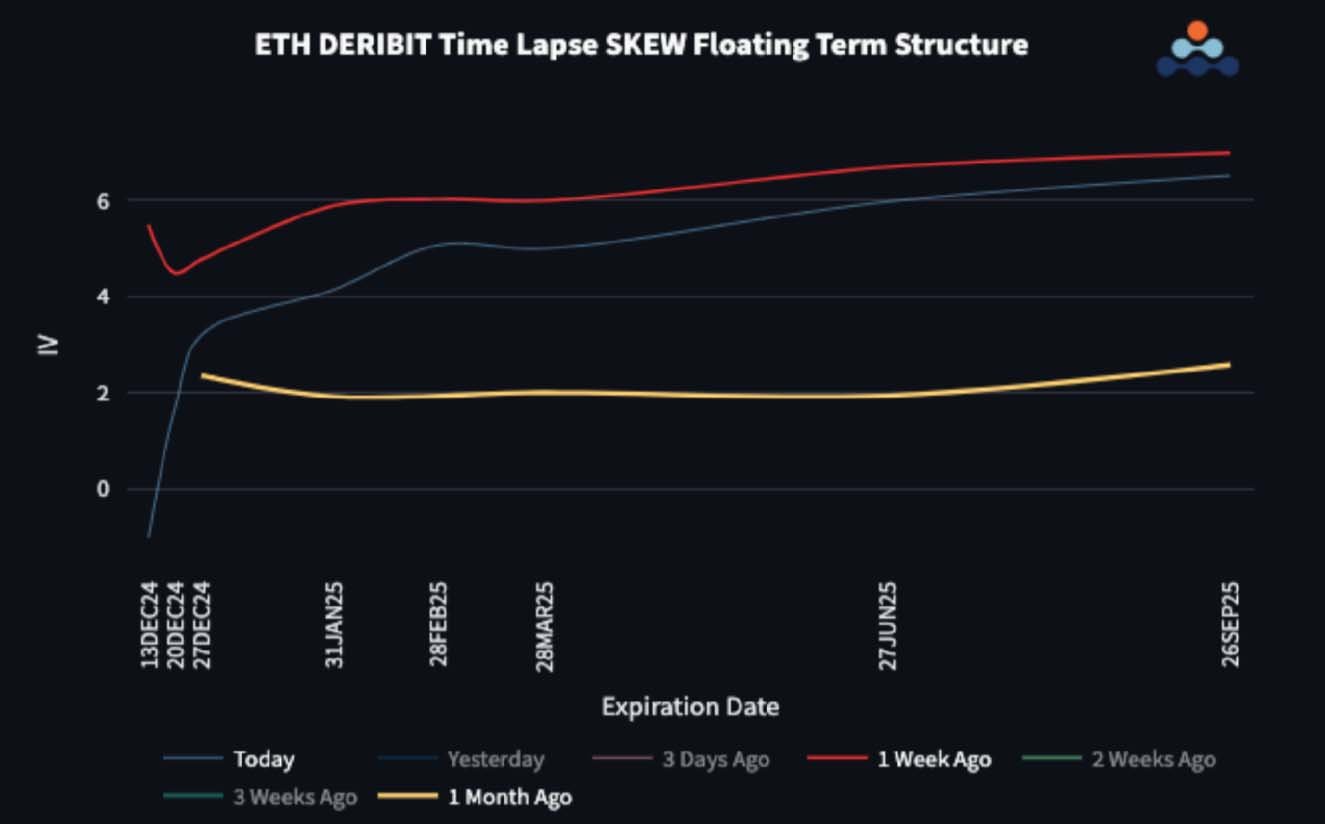

Front-End Call Premium Smashed Lower

Skew term structures are back in contango as front-end call premiums drop. January 2025 call skew remains strong, signalling the market expects consolidation to end by December. Bears eyeing a slide toward 85-90K can now capitalize on bearish risk reversals in early 2025 as a hedge. On-chain data shows long-term holders taking profits, hinting that weaker hands must still need to be flushed out. With funding rates high, speculative interest remains elevated.

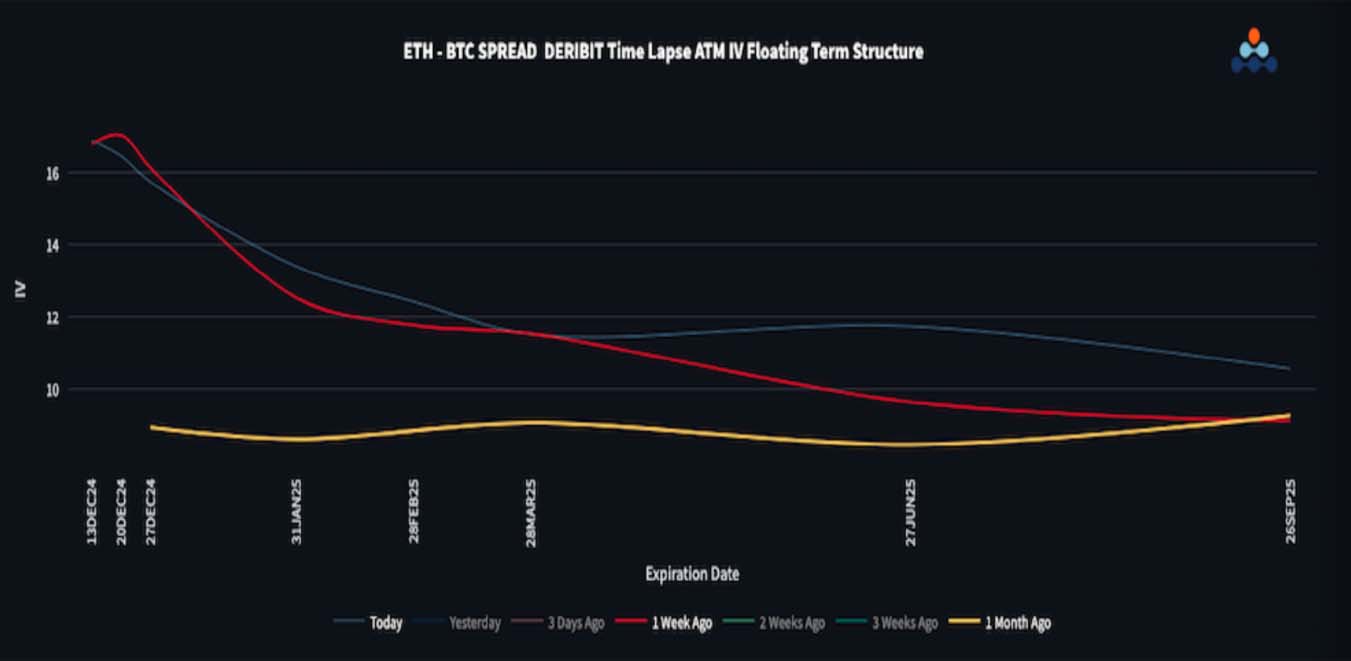

ETH/BTC Spot All Over The Place

ETH/BTC initially broke above 0.04, only to tumble back into its downtrend. ETH’s volatility premium over BTC stayed high despite some convergence in realized vols, reflecting fears of a big ETH catch- up move toward its 4,800 ATH. But as ETH failed to hold $4,000, skew flattened, suggesting the market’s bullish bets have cooled…for now.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)