BTC Hits New All-Time Highs

Bitcoin continues soaring past $106,000, shattering records and drawing in billions of new capital. Top institutional players, like MicroStrategy, keep expanding their massive BTC holdings, reflecting confidence in its long-term growth. As Bitcoin’s appeal as “digital gold” rises, and central bank moves have little sway, the market looks primed for more upside ahead.

Bullish Price Action Amid Lower Vol

Volatility in Bitcoin has eased, even as it hit new all-time highs around $108K. While Ethereum remains more volatile, both assets show softer implied vols and opportunities for positive carry. With the market pushing toward $110K, there’s room for more upside during the holiday season as investors position ahead of the Trump inauguration on 20th January.

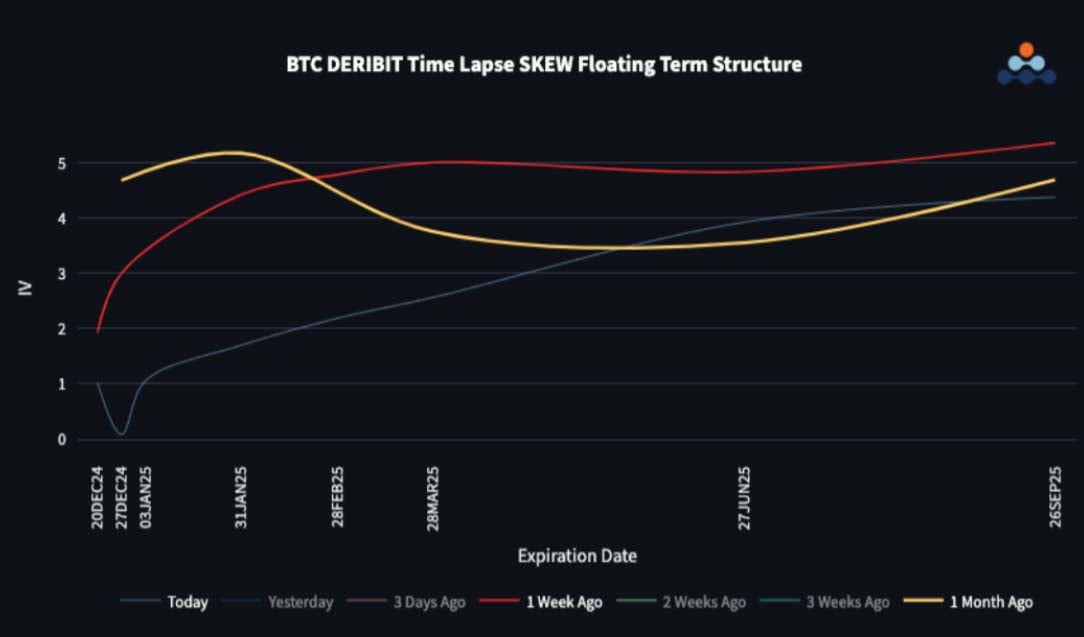

Skew Term Structures Shift Lower

The options market is settling into a steeper contango, with front-end skew moving closer to flat. Upside call interest is cooling off, replaced by strategic call spreads. Meanwhile, Feb25 put buying suggests traders are looking to lock in their gains and protect against any sudden turn early next year. This lack of extreme call skew is surprising after the spectacular run in Q4.

ETH/BTC Continues To Oscillate Violently

ETH/BTC spot action stays intense, testing long-standing downtrend resistance as Bitcoin still leads the charge. While short-term ETH volatility holds firm, longer expiries are losing some steam. With significant ETH upside buying for March, the stage is set for potential moves as political events and market leadership battles unfold in 2025.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)