In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

A wild day.

Tariff threats plunge crypto markets.

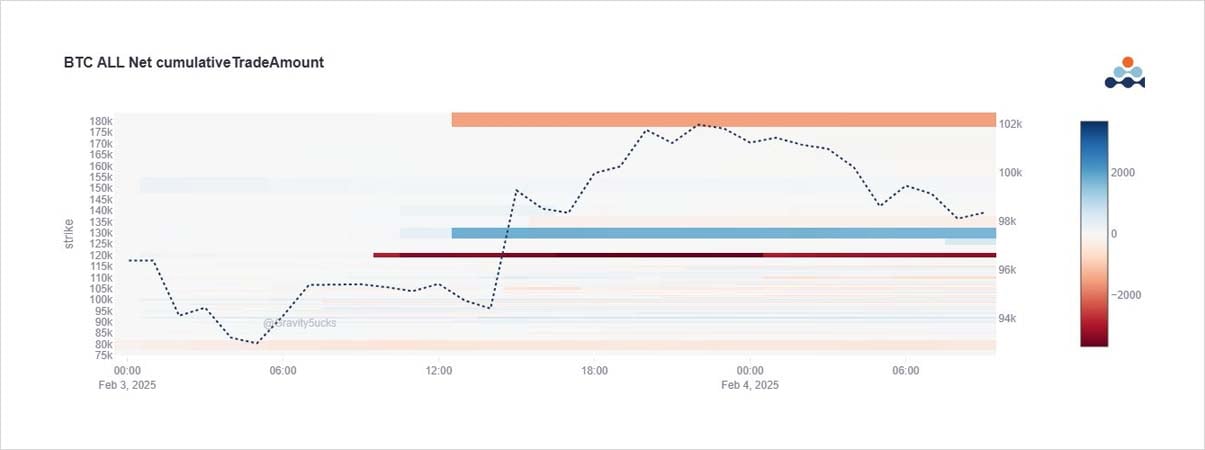

Blue-sky Mar110+120k Calls dumped.

Some rolled to April+June.

Jun 180k Calls rolled down to 130k Strike.

On US open, Feb+Mar 100-105k Calls lifted on DSOB.

Huge CB premium upon US mediation and Sachs Crypto plans awaited later.

2) A long of Mar 120k Calls dumped 3k into the market as hopes of success within Q1 diminished.

Similar action with a long of Mar 110k Calls, but rolled to Jun 120k Calls.

Jun 130-180k Call spread bought 1.5k, maybe a shift lower of 180k Call longs.

Feb+Mar 100-110k Calls bought.

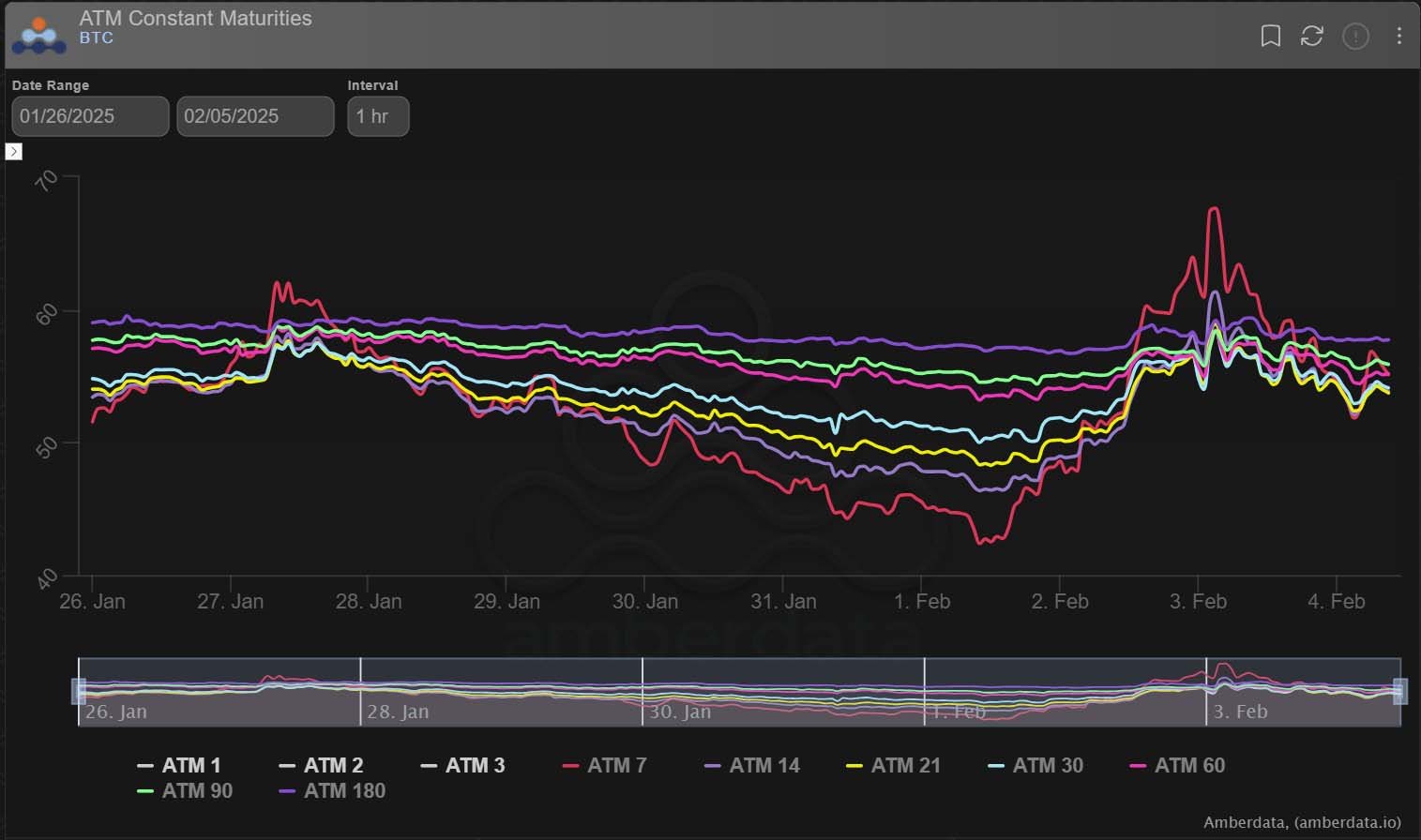

3) Gamma maturities naturally pumped, although much was an initial MM reset to avoid selling cheap, as the APAC session was devoid of any material trades.

Mar peaked 4% higher before the Mar 120k Call seller gifted Gamma to a few large desks.

IVs drifted back despite the huge RV.

View X thread.

AUTHOR(S)