In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

The Trump SR expansion timed on a Sunday caught many afk.

Immediate reaction was to cover shorts and buy Calls.

But what Trump says and Trump+Congress can do are different.

Belief was more tempered than the Spot reaction.

So Calls>95k were sold, and Put protection was bought.

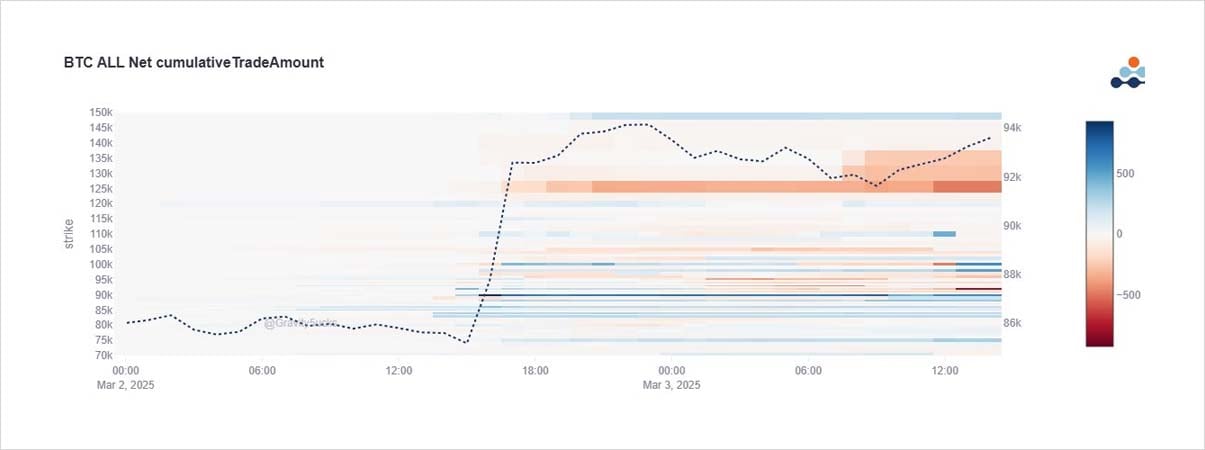

2) Chart shows blue in the 83-90k range, initially as Calls, then some Puts in the same Strikes later.

Calls in the 95-110k area were 2way with some short-covering, TPing, and adjustment of strategies.

But taking consideration of volumes, option flows fell short of Spot fervor.

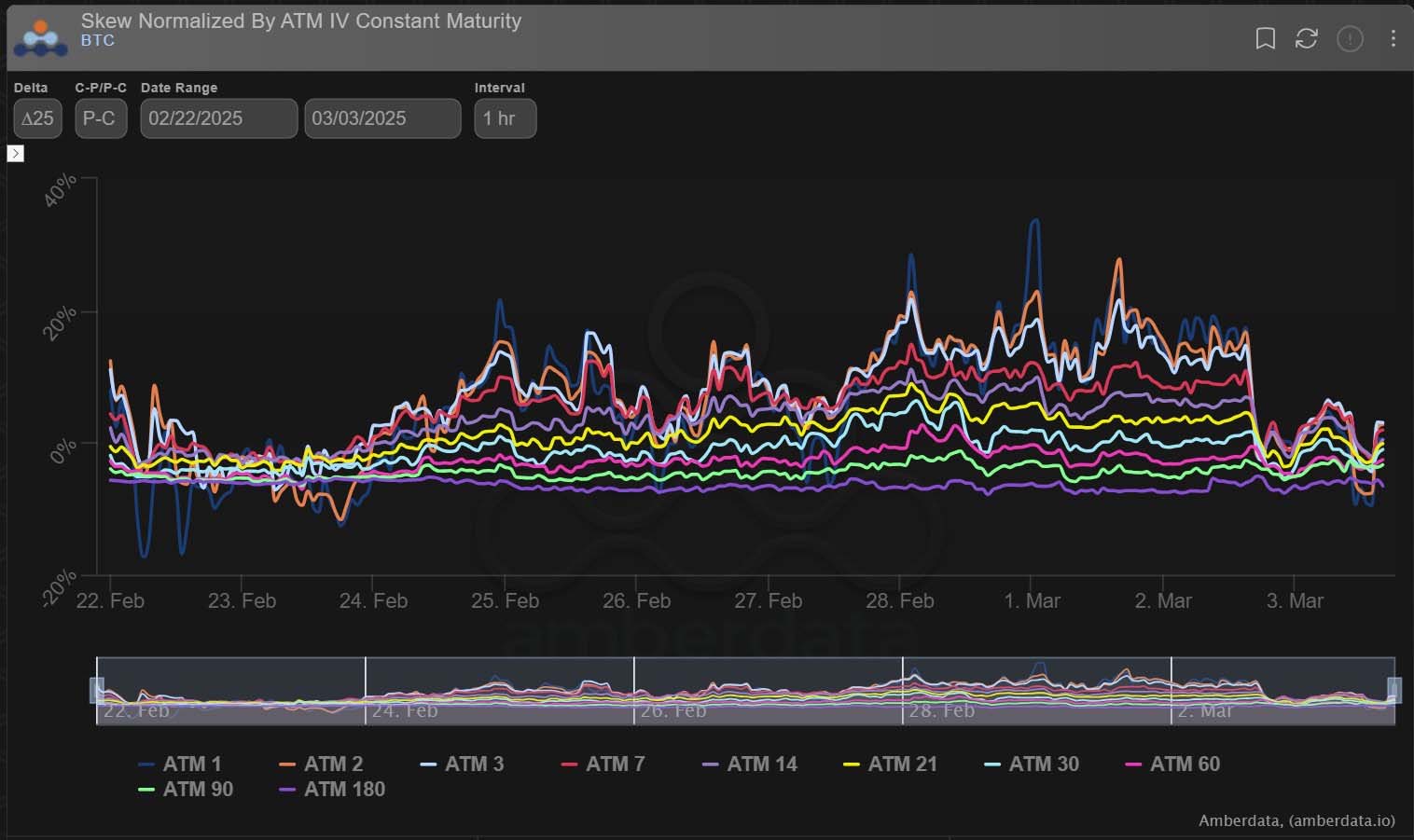

3) With Gamma being discounted for a benign weekend, shorts were forced to cover, and opportunities were plenty for fresh buying.

Fronts naturally reacted as soon as flows started lifting offers and engines defensively pulled back; with even some firmness in Vega upside.

4) After a week where demand for Puts was the game as Spot dumped, the Trump Social post flipped the Skew, and focus was initially on Calls.

Today a reality check on what might actually be feasible with Congress has resulted in a Spot retrace and Puts starting to twitch again.

View X thread.

AUTHOR(S)