Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Continued positivity around the prospects of multiple trade deals between the US and its partners has helped US equities advance for five consecutive sessions. BTC, which had rallied even before its US counterparts, has ascended alongside them, buoyed by additional drivers: strong spot ETF inflows as well as regulatory advancements. However, derivatives markets are still relatively subdued. BTC volatility trades low and steep with short-dated smiles skewed neutral and funding rates remain close to zero after some negative spikes. For ETH, funding rates are negative and futures implied yields remain below BTC’s across the term structure.

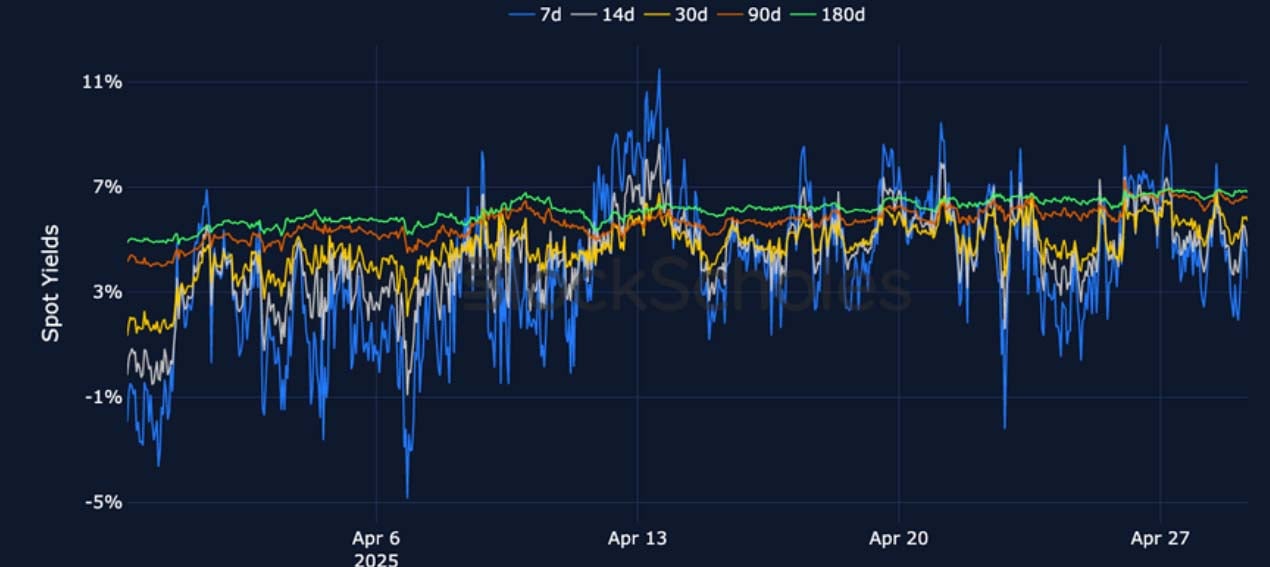

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

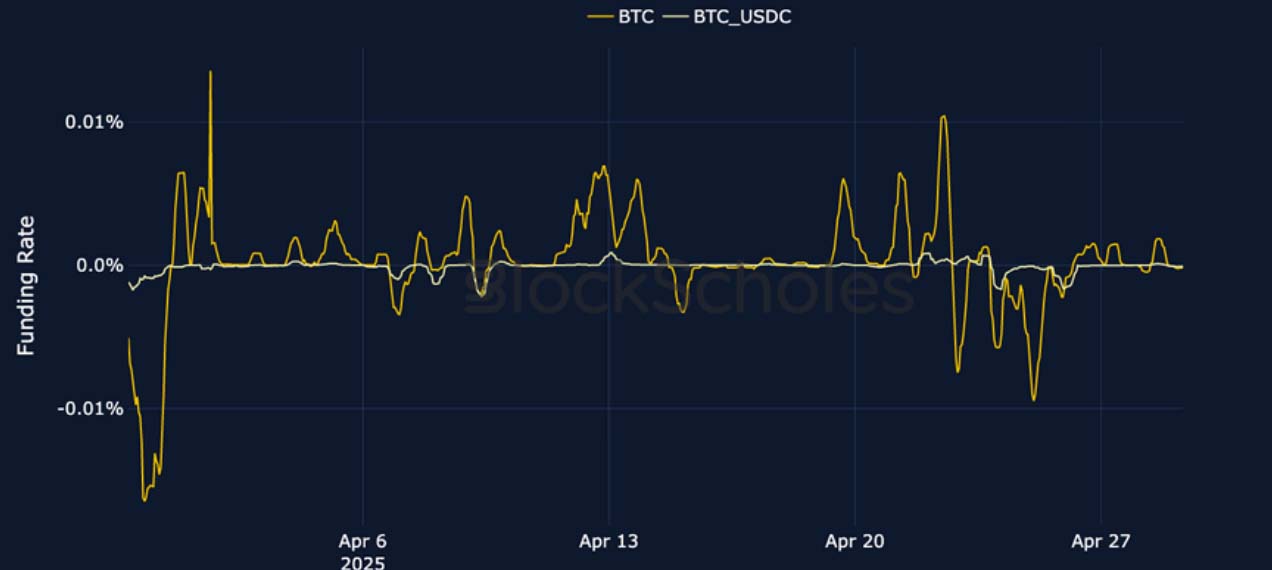

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates have ranged close to zero after the spot rally was met with strong spikes negative.

ETH FUNDING RATE – Funding rates remain negative and low as ETH spot price ranges sideways.

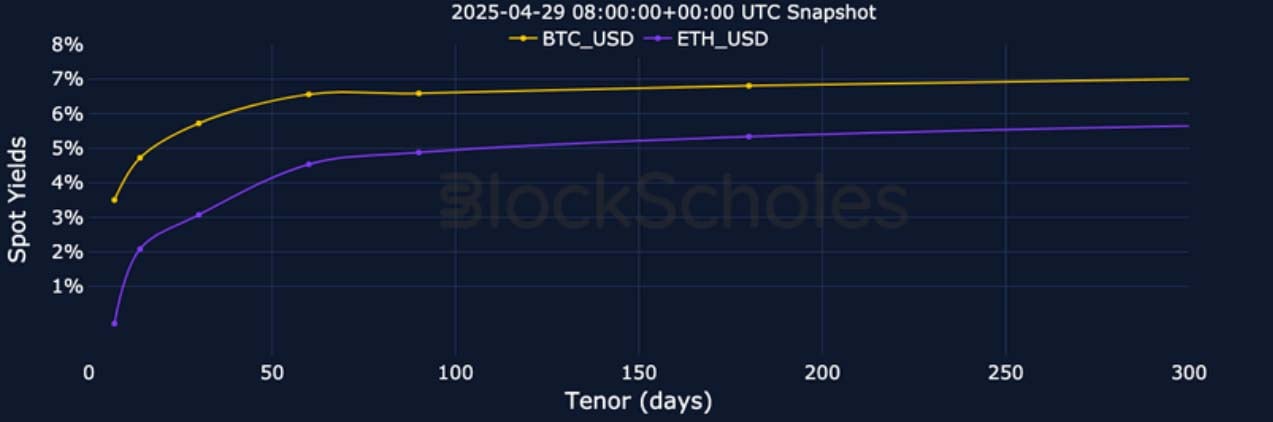

Futures Implied Yields

BTC Futures Implied Yields – Longer-dated futures yields continue to trend upward while shorter maturities remain reactive to spot moves.

ETH Futures Implied Yields – Remain noticeably below BTC’s across the term structure, echoing less bullish sentiment for ETH from perps and options.

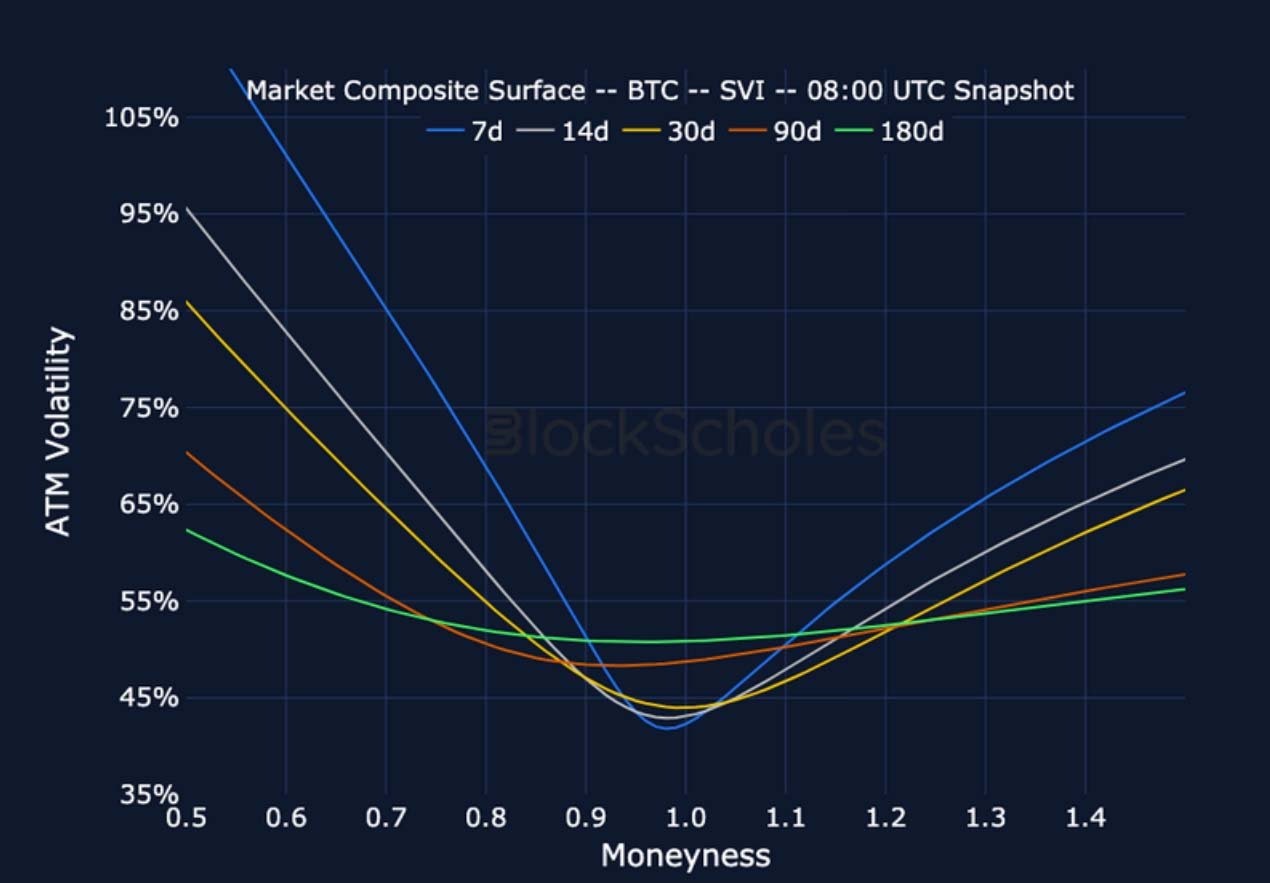

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – In contrast to ETH’s high and flat volatility term structure, BTC volatility trades low and steep.

BTC 25-Delta Risk Reversal – Longer-dated volatility smiles are skewed towards OTM calls, while shorter-dated smiles have recovered to neutral.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Volatility at all tenors trades in a tight 64%-68% range.

ETH 25-Delta Risk Reversal – A rally in short-term sentiment has abated, as skews at all tenors trade in a tight range around neutral.

Volatility by Exchange

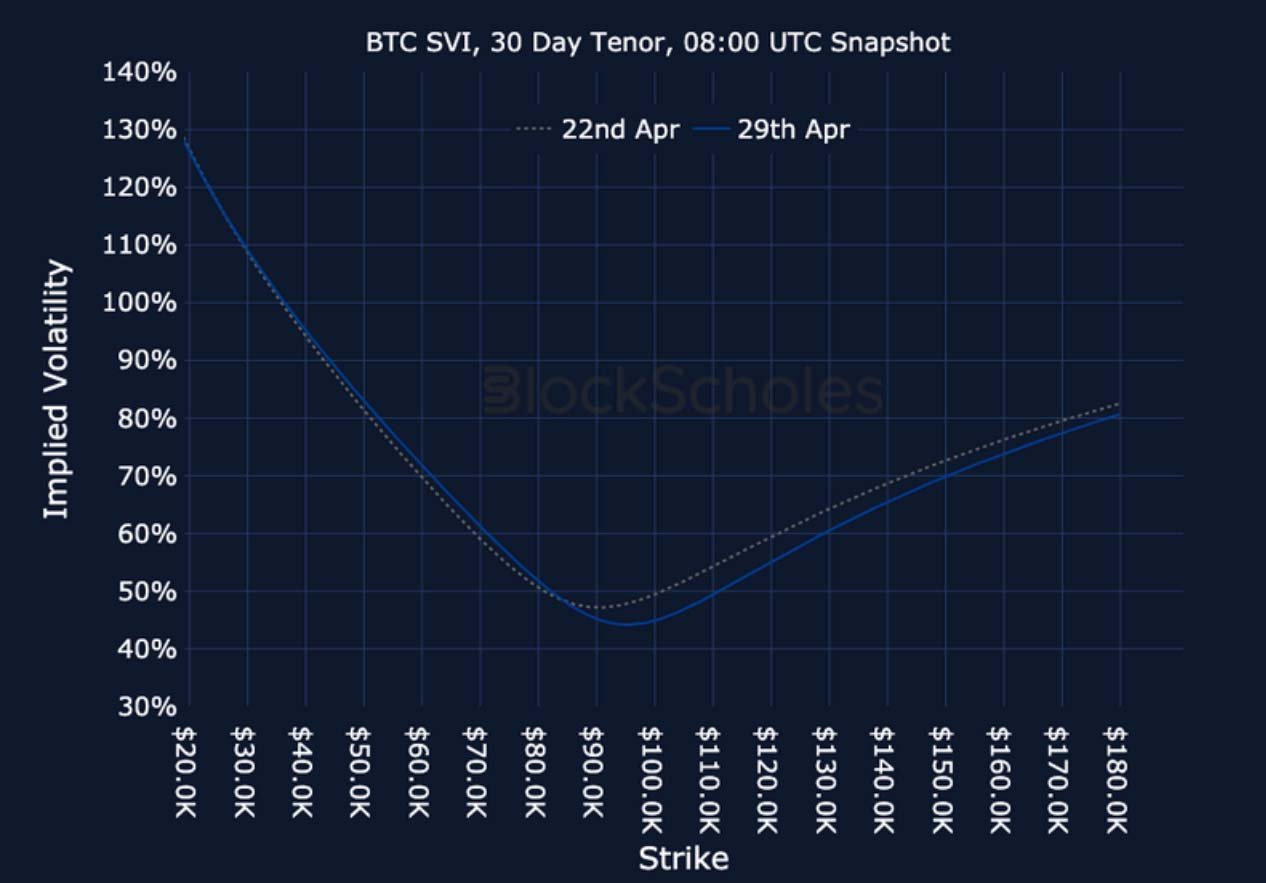

BTC, 1-MONTH TENOR, SVI CALIBRATION

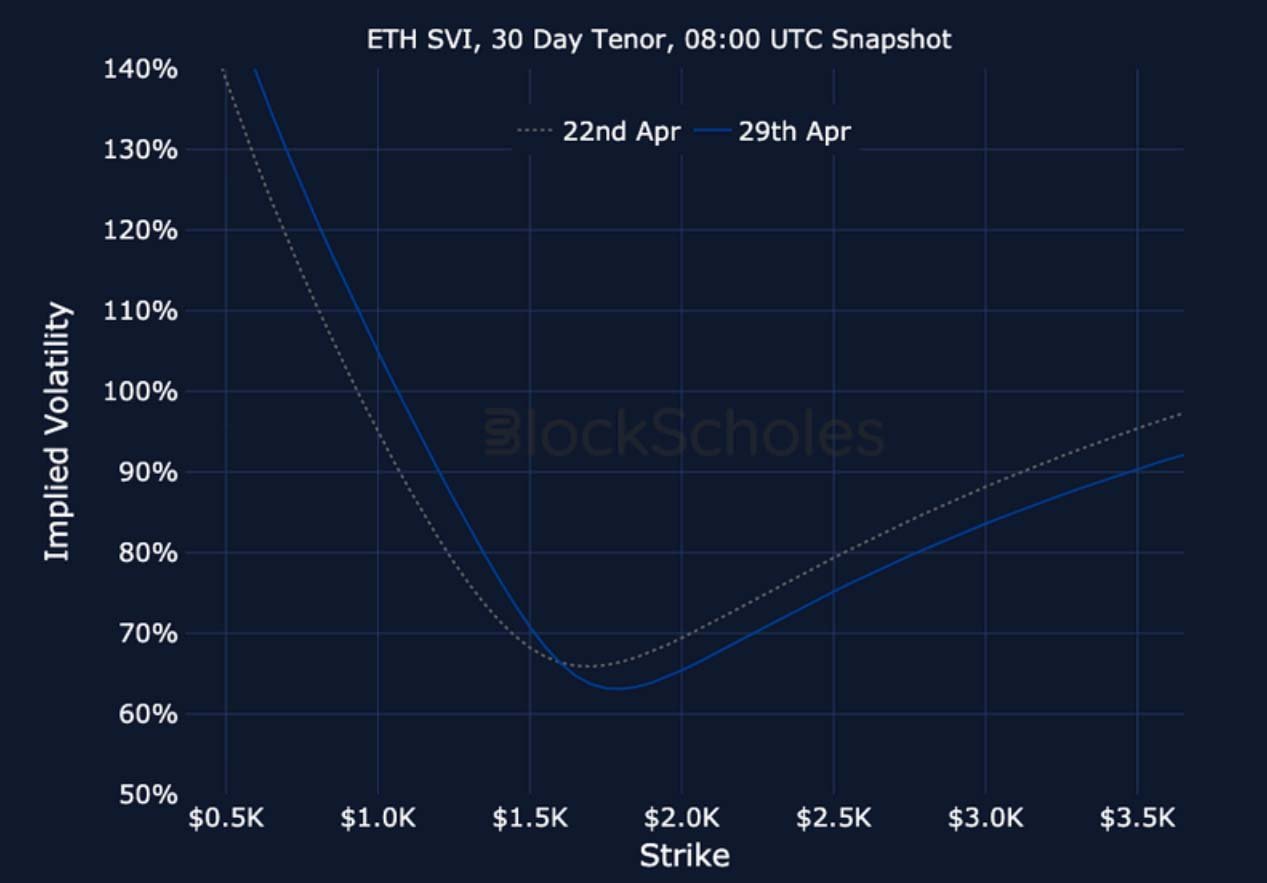

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

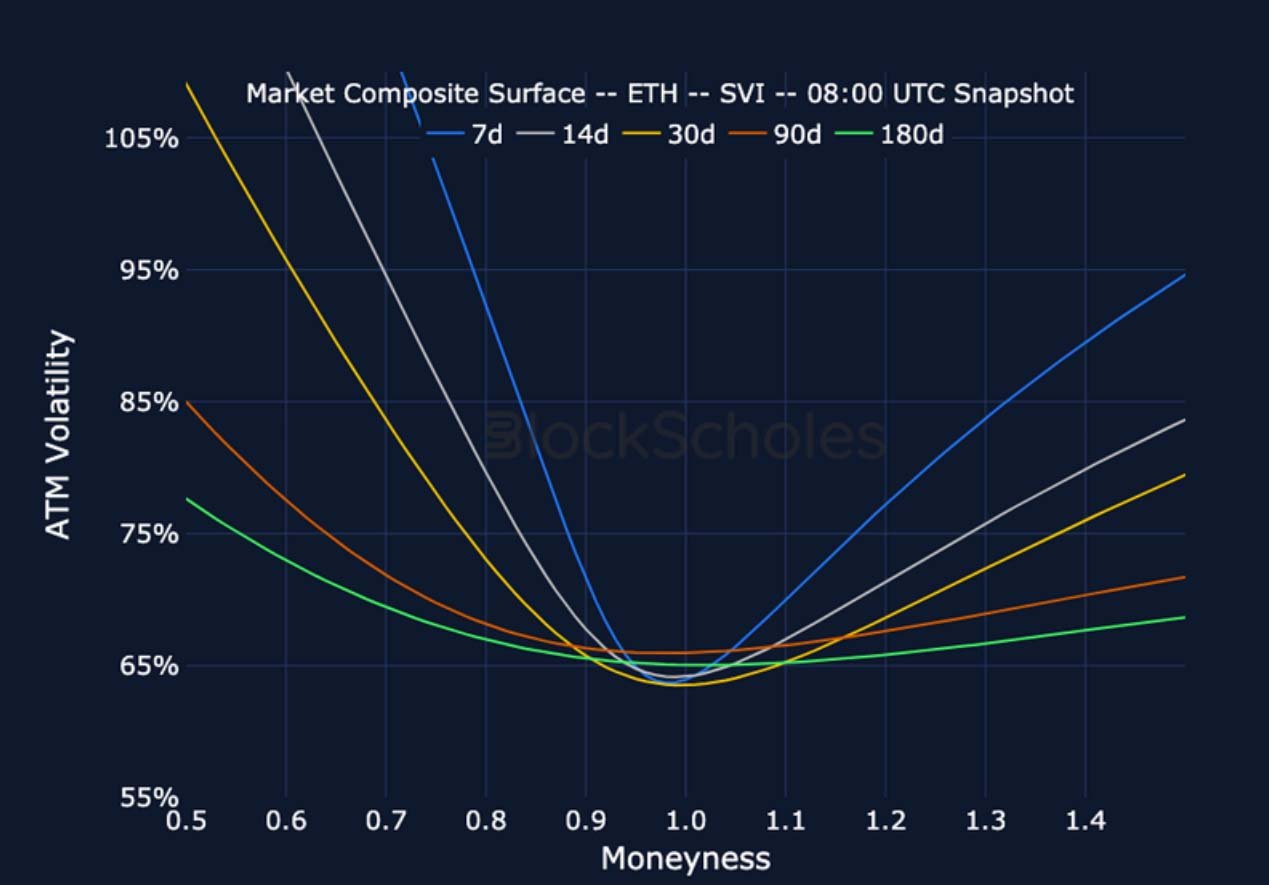

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

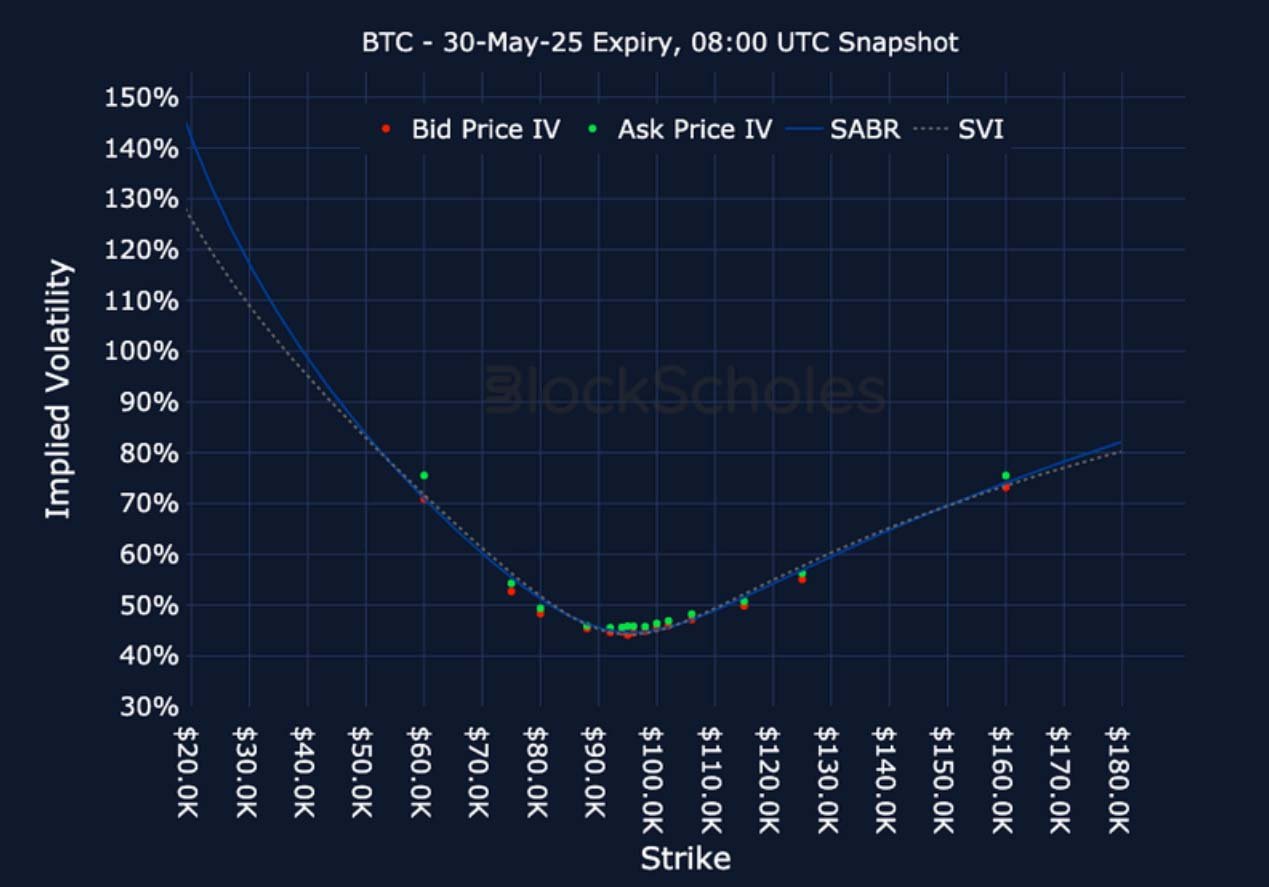

Listed Expiry Volatility Smiles

BTC 30-MAY EXPIRY – 9:00 UTC Snapshot.

ETH 30-MAY EXPIRY – 9:00 UTC Snapshot.

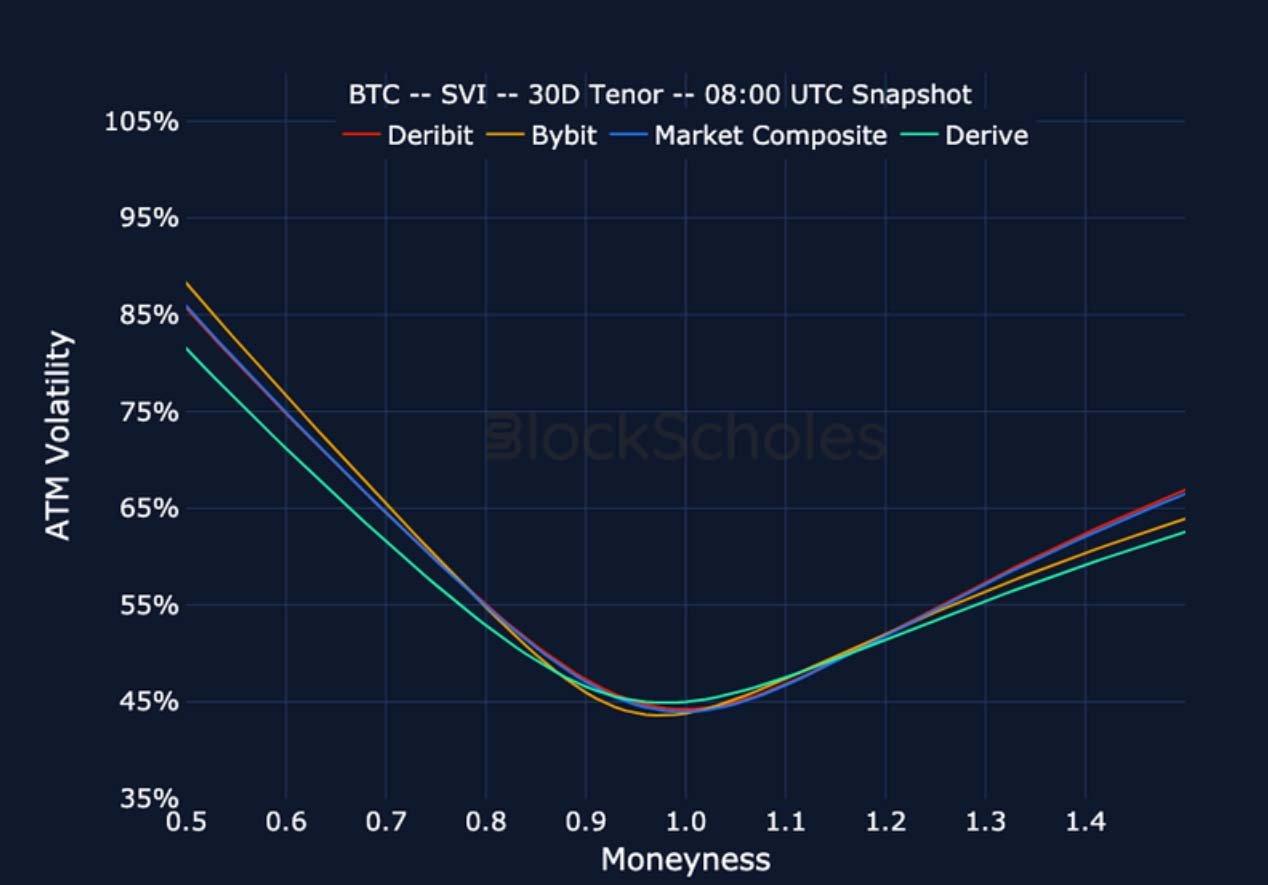

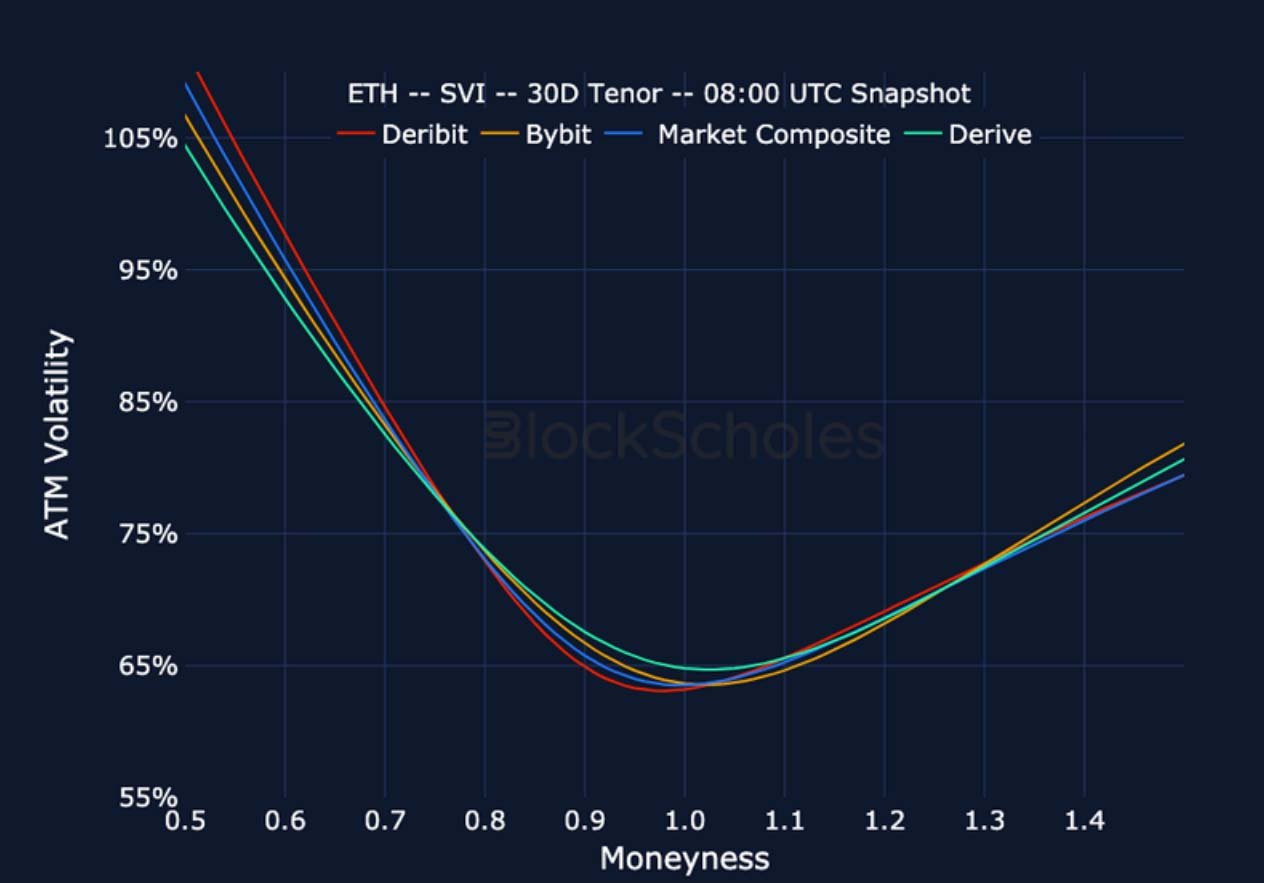

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)