View on market

Bitcoin’s 4-hour chart shows a bullish trend, rebounding strongly past multiple resistance levels, suggesting further price increases.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying price rises.

You may consider taking this trade if you expect the BTC price to rise as the technical setup has turned bullish.

Trade Structure

(OTM Call) Buy 1x BTC-08NOV24-$63,000-C @ $6,678

(OTM Call) Sell 1x BTC-08NOV24-$65,000-C @ $5,919

Target: Spot level > $65,000

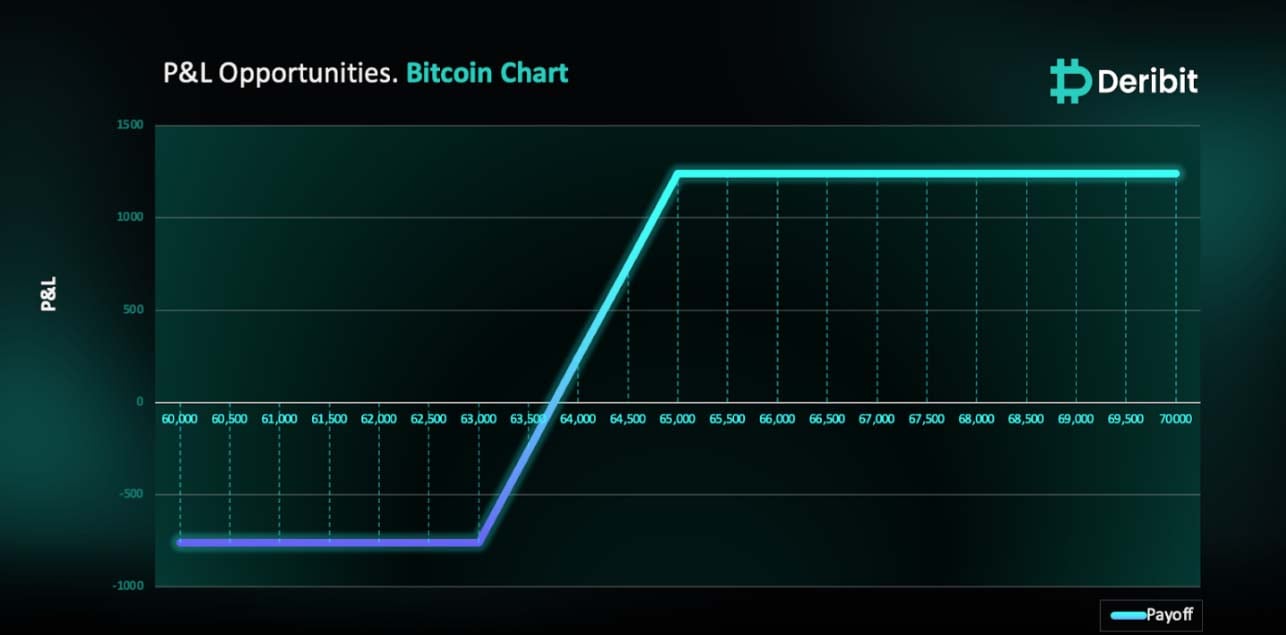

Payouts

Maximum Profit: $1,241/BTC

Debit of Strategy: $759/BTC

Why are we taking this trade?

Upon examining the 4-hour price chart of Bitcoin (BTC), we’ve observed a strong rebound following the decline on August 5th. Notably, BTC has breached several supply zones. I anticipated that BTC would climb to the next resistance level at $62,000 in my yesterday’s insights, which has also been surpassed. As a result, the trend is now bullish after breaking through two resistance levels, as shown in the attached price chart. We can therefore expect the price to continue trading higher with the increased institutional flows, reinstating a bullish market environment.

US Elections are to be held on 5th Nov 2024, hence 8th Nov expiry is therefore the Election’s expiry.

Traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $63,000) and simultaneously sell a Call option at a higher strike price (e.g., $65,000).

If the price of BTC is at or above $65,000, when the options expire on November 8th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $759.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)